Veli Won Best Startup Award by Plug and Play 🏆...

Cryptocurrency and blockchain technology continue to revolutionize industries and reshape the global economy through innovative solutions, such as decentralized finance and tokenized assets, and unparalleled transparency, thanks to blockchain technology. Despite their transformative potential, widespread adoption of this technology hinges on disputing the persistent misconceptions held by the general public.

In 2024, myths such as crypto being primarily used for illegal activities, lacking stability as a store of value, and operating in a regulatory vacuum still prevail. This blog post will tackle the most prominent crypto misconceptions by providing clarity and understanding to help bridge the gap between groundbreaking techand mainstream acceptance.

Cryptocurrencies have been associated with illegal activities, including money laundering, due to their pseudonymous nature and the difficulty of tracing transactions back to individuals. High-profile cases and media coverage have highlighted instances where cryptocurrencies were used to facilitate drug trafficking, ransomware attacks, and other illicit activities. This perception is reinforced by the decentralized and borderless characteristics of cryptocurrencies, which can make them attractive to those seeking to bypass traditional financial regulations and oversight.

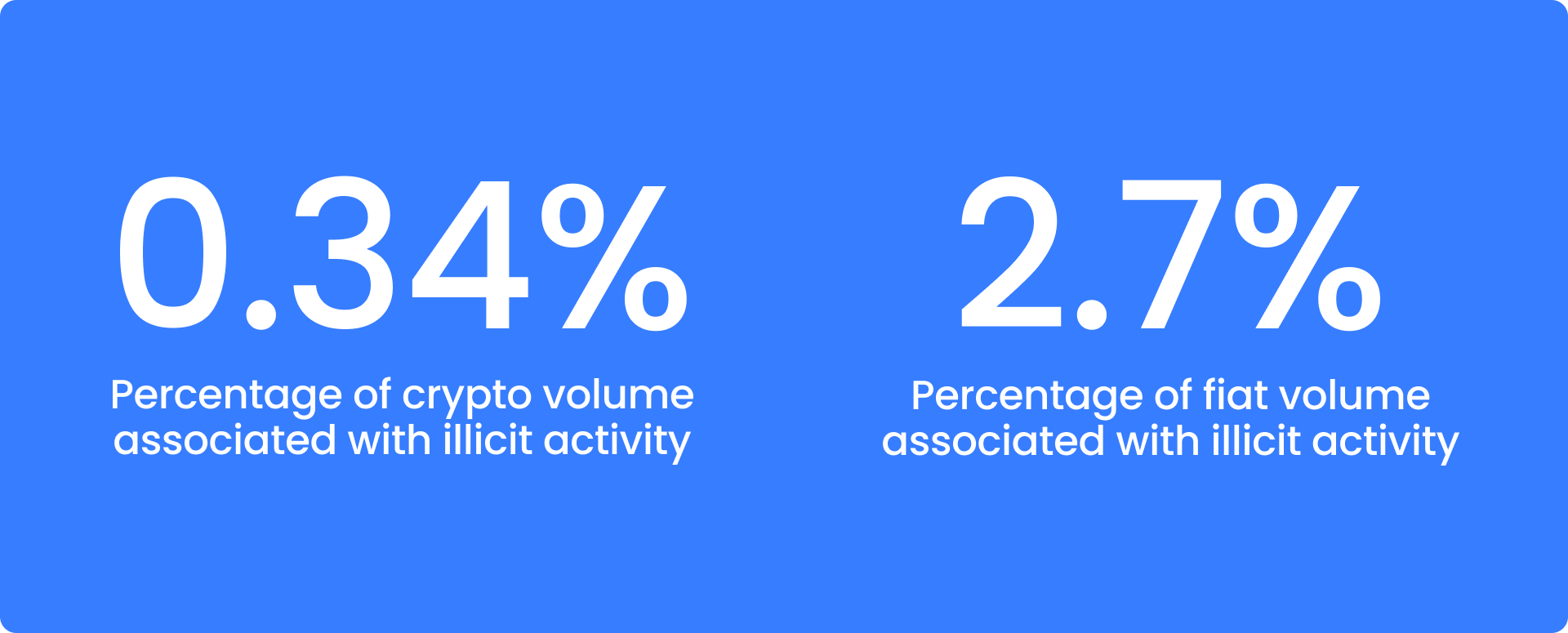

It is important to note that traditional currencies are still used far more extensively for criminal activities. Thanks to a report by Chainalysis, it was found that 2023 saw a significant drop in value received by illicit cryptocurrency addresses, to a total of $24.2 billion, compared to $39.6 billion in 2022. In addition to the reduction in absolute value of illicit activity, our estimate for the share of all crypto transaction volume associated with illicit activity also fell, to 0.34% from 0.42% in 2022. These numbers are further supported by Eurpol.

Compared to Fiat currencies, crypto is used much less, specifically 8 times more for illicit activities, as the UN estimates that ~$1.6 trillion, or 2.7% of global GDP, is used for illicit activity.

The criticism that cryptocurrencies are not a reliable store of value stems from their extreme volatility. Bitcoin, the most well-known cryptocurrency, has experienced significant price fluctuations, which undermine its stability as a store of value compared to traditional assets. This is also the case for altcoins – cryptocurrencies that are not Bitcoin – which often see even larger price drops.

While top cryptocurrencies remain volatile, it is important to make a distinction between speculative crypto tokens and more sophisticated digital assets with utility:

For example, stablecoins are specifically designed to maintain a stable value by being pegged to traditional assets like the US Dollar. Examples include USDT (Tether) and USDC (USD Coin). These stablecoins offer a reliable store of value, especially for individuals in countries experiencing high inflation. By holding stablecoins, these individuals can preserve the value of their money and even earn yield through various decentralized finance (DeFi) platforms, effectively beating inflation.

Furthermore, there are cryptocurrencies backed by real-world assets, which exhibit much less volatility. For instance, $PAXG (Paxos Gold) is a cryptocurrency backed by physical gold. Each token represents one fine troy ounce of gold held in secure, audited vaults.

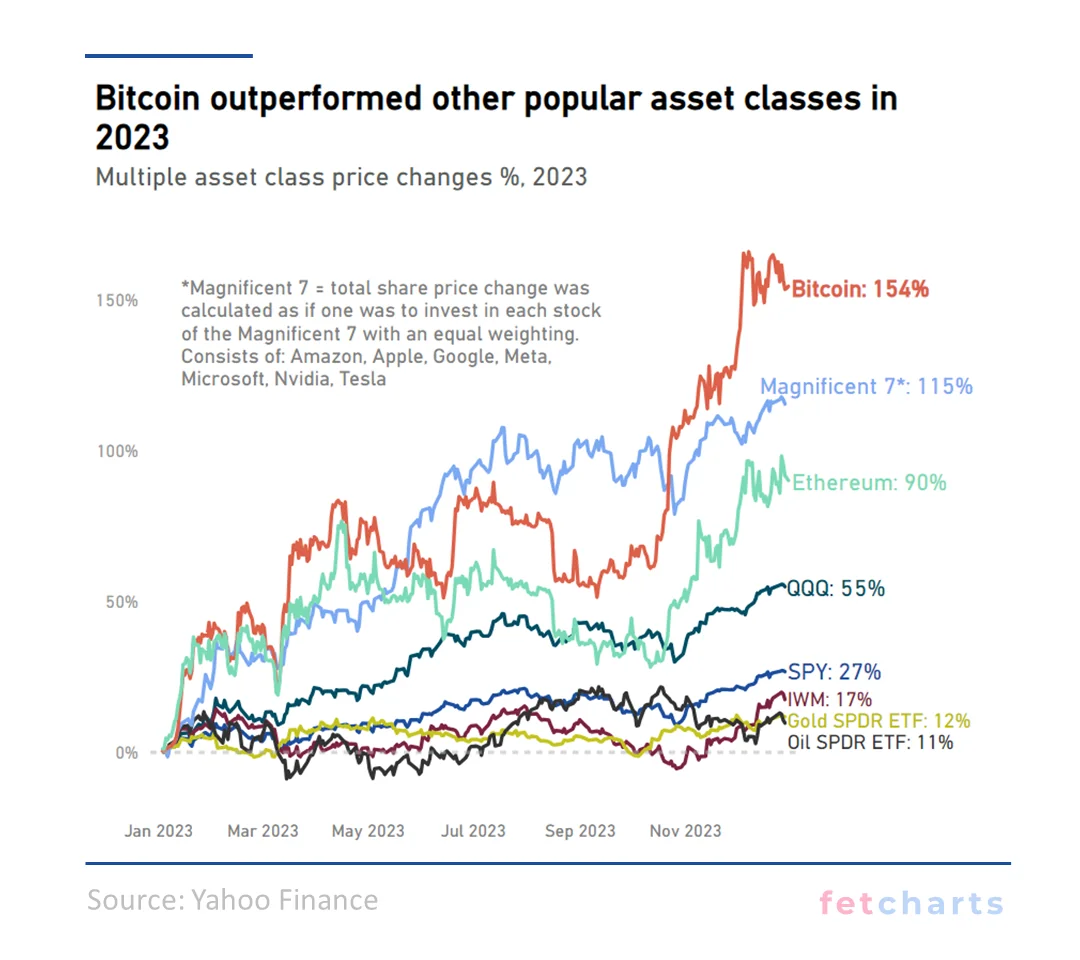

It is also true that, long term, Bitcoin is a great store of value and hedge against inflation, and has been the best performing in the past decade, even when compared to Stocks, ETFs and even Gold! Just in 2023, Bitcoin had better performance than any other asset class:

Skeptics argue that the rapid rise in the value of cryptocurrencies is indicative of a speculative bubble. They point to historical parallels such as the dot-com bubble and the housing market crash, where asset prices were driven to unsustainable levels by speculative investment.

The dramatic price increases in cryptocurrencies, followed by significant corrections, suggest that many investors are motivated by the fear of missing out (FOMO) rather than fundamental value. This speculative behavior fuels concerns that the crypto market could experience a sharp downturn, resulting in substantial financial losses for investors.

This perspective overlooks several important nuances of financial markets and the unique characteristics of the cryptocurrency market. Firstly, all financial markets experience cycles of boom and bust. These market cycles are a natural part of economic activity, influenced by a variety of factors including investor sentiment, macroeconomic trends, and technological advancements.

The cryptocurrency market, being relatively young and less liquid compared to traditional markets, exhibits more pronounced cycles. Lower liquidity means that price deviations are more extreme, leading to higher volatility. This does not necessarily indicate a speculative bubble, but rather a nascent market maturing through its natural cycles.

The environmental impact of cryptocurrencies, particularly Bitcoin, has been a significant point of criticism. The process of mining Bitcoin, which involves solving complex mathematical problems to validate transactions and secure the network, consumes vast amounts of electricity. This energy-intensive process has led to concerns about the carbon footprint and overall sustainability of cryptocurrencies.

Firstly, the rise of proof-of-stake (PoS) blockchains significantly mitigates these concerns. Unlike the proof-of-work (PoW) mechanism used by Bitcoin, PoS does not rely on energy-intensive mining. Instead, it secures the network through validators who are chosen based on the number of coins they hold and are willing to “stake” as collateral. This method requires far less computational power and, consequently, much less energy. Leading cryptocurrencies like Ethereum, Binance Smart Chain (BNB), and Solana have adopted or are transitioning to PoS, showcasing the industry’s commitment to more sustainable practices.

Furthermore, the Bitcoin mining industry is increasingly turning to renewable energy sources, as a CryptoSlate report estimates that over 50% of all Bitcoin miners use renewable energy, significantly reducing their carbon footprint. Additionally, innovative uses for the residual energy generated from Bitcoin mining are emerging. For example, the heat produced by mining rigs can be repurposed for heating buildings or greenhouses, effectively utilizing energy that would otherwise be wasted.

The regulatory landscape for cryptocurrencies is still developing, leading to a perception that the market operates in a legal gray area. The lack of clear and consistent regulations across different jurisdictions creates uncertainty for investors and businesses operating in the crypto space. This regulatory ambiguity can also contribute to issues such as fraud, market manipulation, and inadequate consumer protection.

While regulatory clarity in the US is still developing, significant progress is being made. Spot Bitcoin and Ethereum ETFs have been launched (Ethereum ETFs announced, to be launched) in 2024, allowing retail and institutional investors access to cryptocurrencies without ever needing to open an exchange account, or interact with blockchain technology. Political candidates for the 2024 presidential election, including both Joe Biden and Donald Trump, are discussing cryptocurrency regulation, signaling a commitment to clearer guidelines. This indicates a growing recognition and commitment to developing a clearer regulatory framework for cryptocurrencies in the US.

In Europe, the regulatory landscape is much more advanced. By December 2024, the Markets in Crypto Assets (MiCA) law will come fully into power, providing a comprehensive regulatory framework for cryptocurrencies across all EU countries. MiCA will establish consistent regulations, ensuring that all EU member states operate under the same jurisdiction. This will significantly reduce regulatory ambiguity, enhance consumer protection, and foster a more secure and transparent market environment.

As more and more interest grows in the cryptocurrency space, so do the misconceptions and misinformation. Although the crypto sector is a nascent one, all the signs of it growing to be a leader in the financial space and going head-to-head with other asset classes are showing.

We at Veli are pioneering the future of institutional-grade cryptocurrency investing by creating our Veli Financial Advisor Portal. We have created a platform where financial advisors can onboard their clients and manage their digital assets, including cryptocurrencies, crypto strategies (ETF-like crypto funds), and tokenized assets.

We have already proven traction by partnering with the leading financial advisory firm in Slovenia, reaching $10M AUM, and receiving a grant from the Innovation Fund of the Republic of Serbia and an investment from Digital Serbia Initiative’s network of angel investors.

Reach out if you’d like to onboard your financial advisory entity, partner with Veli, or just want more information!

You can contact us through support@veli.io

Veli Partners with DEC Institute to Equip Finance Professionals for...

Inside the Mechanics of Crypto Indexes – How Are They...