Debunking The Most Common Crypto Misconceptions in 2024 Cryptocurrency and...

Veli has now achieved over $10M in assets under management following DAP Capital acquisition and client migration.

Following a long and fruitful collaboration between Veli and DAP Capital, today we are happy to announce our full merger, as the DAP Capital platform has now been rebranded into the Veli Tokenized Assets platform.

This pivotal step in our partnership implies that Veli has now achieved over $10 million in assets under management, combined from $3.6 million in crypto assets on Veli, and $7 million in tokenized assets on Veli Tokenized Assets (Formerly DAP Capital).

In connection to the acquisition, Stevan Radonjanin, the CEO of Veli, said: “We have been seeing rising demand for tokenized assets ever since the RWA boom in 2023. This acquisition is a testament to Veli’s core goal of creating the most comprehensive digital asset platform for financial advisors in Europe, offering not only cryptocurrencies, but also various real-world tokenized assets.”

The migration process from DAP Capital has already been handled seamlessly, ensuring minimal disruption to user’s access to the platform. User account details and assets have been securely transferred to Veli.

Users are able to log into the Veli mobile app with the same username that they used on DAP Capital.

In order to unlock all of the platform features, users will have to reset the password and complete the identity verification.

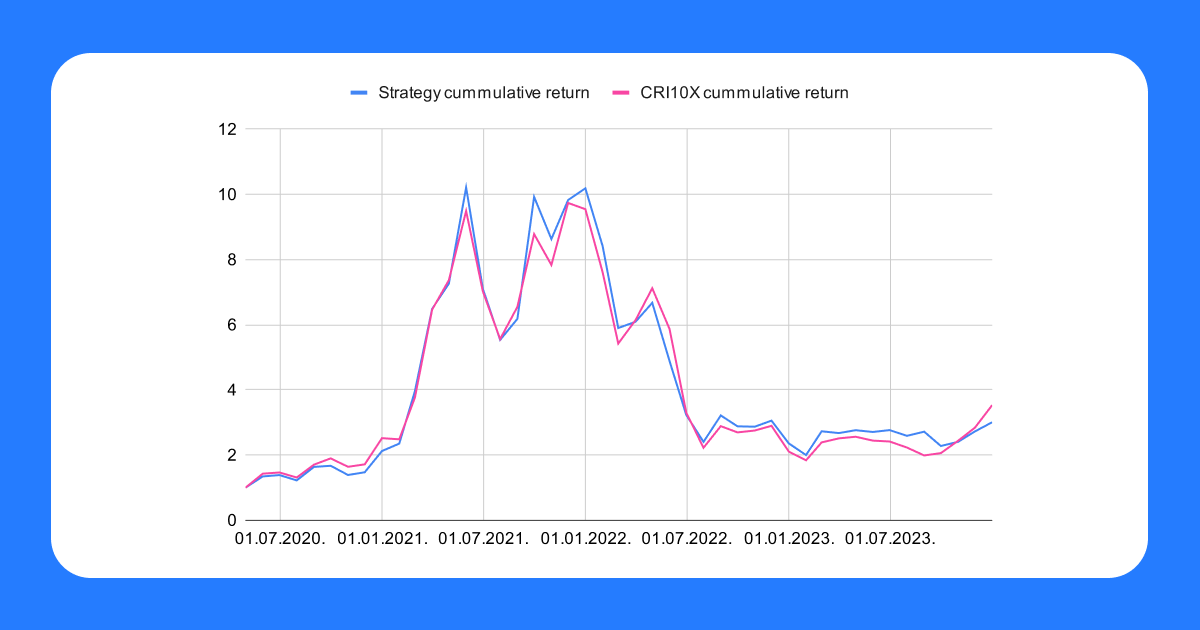

In order to match returns of DAP Capital’s CRI10X investment strategy, a nearly identical strategy was created on the Veli platform. Funds which were invested in CRI10X have been converted into the new strategy called Crypto Top 10 (CT10).

The strategy includes the Top 10 cryptocurrencies by market capitalization (excluding stablecoins and meme coins) with equal weights (10% each). The strategy’s weights are regularly rebalanced once a month, but can also be rebalanced immediately if the price of an asset rises or drops more than 25%.

The two strategies have performed very similarly, as can be seen in the chart below:

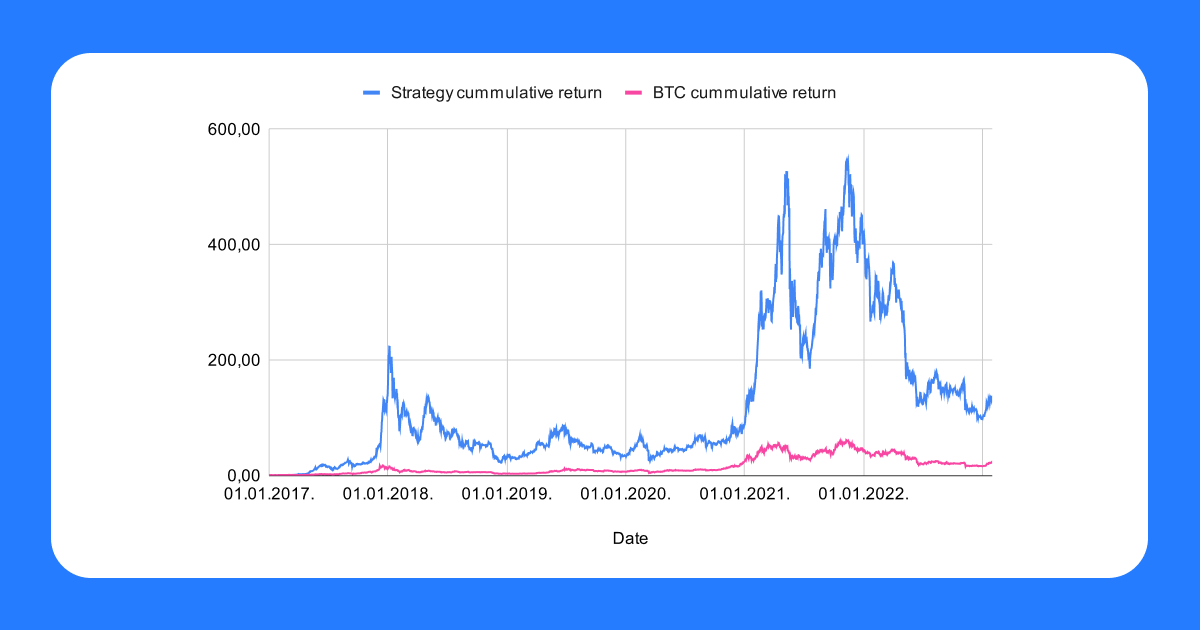

The new CT10 strategy has significantly outperformed Bitcoin’s performance in the previous 7 years:

The DAP Capital platform was never intended for investing in highly liquid instruments, such as cryptocurrencies, but rather into tokenized real-world assets. That is because the infrastructure of the platform was built in a way that users can only purchase a cryptocurrency strategy once a month and exit it once a month.

For a fast paced industry where prices can move more than 20% in a single day, such as the digital asset industry, a more efficient solution was needed.

This migration to Veli brings substantial benefits to all DAP Capital users, enabling them to buy and sell crypto instantly, as opposed to once a month.

With the Veli platform, investors are able to purchase a number of investment strategies, with different risk and return levels, as well as individual cryptocurrencies, such as Bitcoin and Ethereum.

Veli works with multiple liquidity providers to ensure that there is sufficient liquidity for all assets, as well as to enable buying and selling of cryptocurrencies at best possible prices. All assets are kept safely with Fireblocks, the largest and most reputable institutional digital asset custodian on the market.

In the last few months, we have proven significant traction for Veli by reaching the milestone of $10 million assets under management. We have partnered with several advisory houses, but we are not stopping there; as our goal is to become the Interactive Brokers of the new Tokenized economy, our primary focus in the next period will be growing our network of advisory houses, family offices and wealth managers and onboarding them onto the Veli platform.

The next project in our pipeline is Veli Strategies via API, a groundbreaking product through which we will be able to provide our investment Strategies to any digital asset investment platform. Once they integrate our API, they will be able to provide crypto investment strategies to their user base, without the hassle of developing their own strategies or having to send their users to another platform.

Our focus for the rest of the year will be the acquisition of necessary licenses to ensure compliance with the upcoming Markets in Crypto Assets (MiCA) regulation. We prioritize achieving full regulatory compliance in advance, in order to be able to serve both crypto clients and provide tokenization services going forward.

For any further information or questions, the Veli team is always available to you through support@veli.io.

Debunking The Most Common Crypto Misconceptions in 2024 Cryptocurrency and...

Veli Secures Investment from DSl Angel Investor Network We are...

How Veli Transformed Vezovišek & Partnerji Into a Digital Asset...