Debunking The Most Common Crypto Misconceptions in 2024 Cryptocurrency and...

Did you know that while 90% of Financial Advisors receive inquiries about cryptocurrencies from their clients, only 15% end up investing in them. This is because learning about cryptocurrencies, constructing and managing multiple different portfolios for clients is complicated and takes time. Furthermore, for traditional financial advisors to get into cryptocurrencies, they would need to create their own platform for digital assets, taking away time from their core business.

We decided to fix these issues and simplify the process of onboarding traditional financial advisors to the crypto world by launching the Veli Financial Advisor Portal, a web platform where financial advisors can easily onboard their clients and seamlessly manage their digital assets. Through our financial advisor platform, we plan to position ourselves as the “Interactive Brokers” of the new tokenized economy. In this blog post, we will share the top 4 reasons why financial advisors use our new platform.

While our competitors only offer cryptocurrency investments on their platforms, we focused on bringing 3 different categories of products on our Financial Advisor Portal. Thanks to our wide range of assets, financial advisors and their clients have the ability of investing in cryptocurrencies, Veli Strategies and tokenized assets.

All the digital assets on the Veli Financial Advisor Portal are stored on secure cold wallets with Fireblocks, one of the largest insured crypto custodians, so you can rest assured your client’s assets are safe and sound.

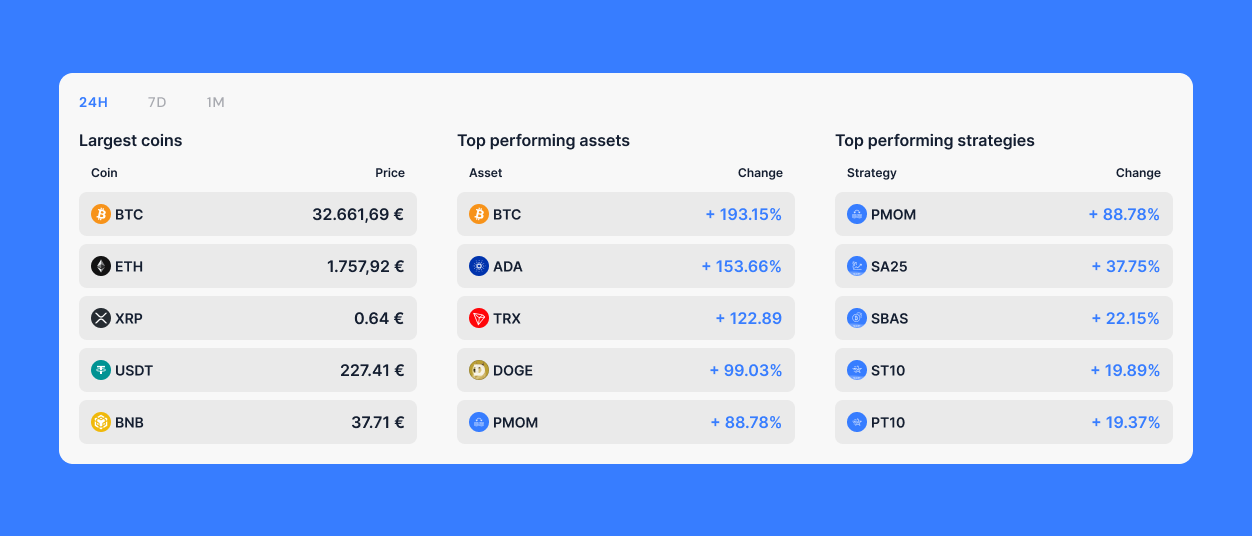

Serving as the core for any digital asset platform, Cryptocurrencies are also a staple on the Veli Financial Advisor Portal. On our platform you can invest in 100+ different cryptocurrencies, a number which frequently grows as we are constantly adding more coins and tokens to the platform.

Veli Strategies are pre-made cryptocurrency portfolios that represent a mix of different cryptocurrencies. Each strategy represents a carefully selected collection of coins, with its own risk and return profile. Our strategies have been created by PhD’s in Quantitative Finance and back tested since 2017 to optimize the performance of the strategy. Furthermore, there are 2 different types of strategies – Smart and Passive – each with their respective advantages. While Passive strategies go up and down with the market, Smart strategies attempt to enter the market when prices are low and exit the market when prices are high.

To learn more about Veli Strategies, read our blog post titled “Comprehensive Overview of Veli Strategies”.

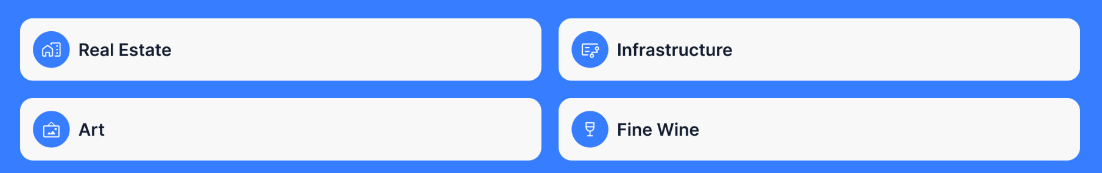

Tokenization is the process with which real-world assets are turned into digital tokens on the blockchain, through smart contracts. The on-chain digital token now represents the ownership rights of the owner in the underlying real-world asset. Through this process, any real-world asset, physical or non-physical, can be turned into a token on the blockchain.

Thanks to the Veli Financial Advisor Portal, financial advisors and their clients now have the ability to invest in various types of assets and deals that are not traded on stock exchanges and that were previously illiquid, such as private equity, real estate, art, luxury goods and even fine wine!

To learn more about tokenization and how we positioned ourselves to be at the forefront of the tokenization revolution, read our blog post titled “Complete Guide to Tokenization”.

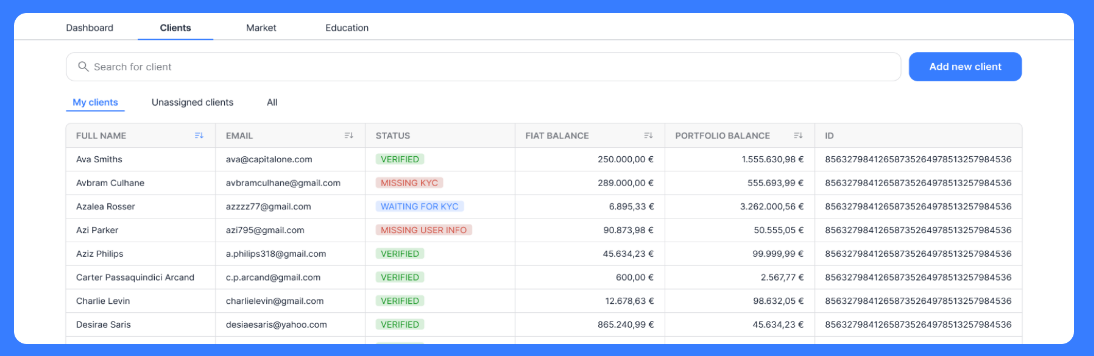

One of the biggest pain points for financial advisors are the confusing and complex client onboarding processes on different platforms, taking time away from the advisor’s primary business – managing his client’s portfolio. The Veli Financial Advisor Portal takes on a simplified approach when it comes to client onboarding.

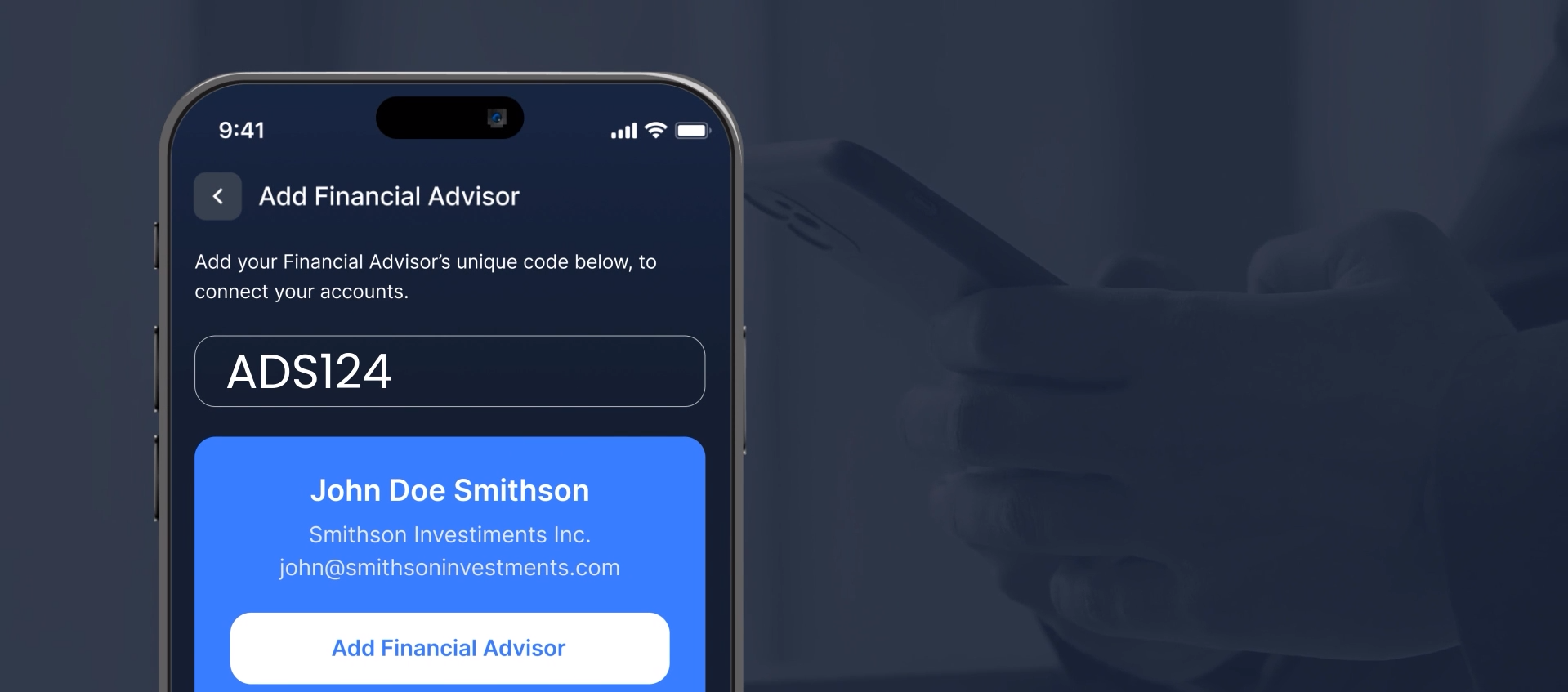

Financial advisors can simply onboard existing and new clients to the Veli Financial Advisor Platform using only the Veli mobile app. Adding a client is as simple as inputting their client account code into the Veli mobile app, after which the client can authorize you to manage their funds directly from the app.

As a company that embraces crypto and blockchain, we know more than anyone that getting into crypto with no knowledge or experience is hard, especially for Financial Advisors. From the technology to the financial aspect, there are way too many topics that one should have knowledge of before starting to invest in digital assets.

We decided to help Financial Advisors that want to get started with crypto by providing them all the resources needed on our Veli Financial Advisor Portal through our Educational page. In that section, financial advisors will be able to learn about the world of crypto through insightful yet simple video-based courses and lessons. The lessons will range from “Intro to Blockchain Technology” and “Investing in Crypto 101”, all the way to “Investing in Alternative Digital Assets” and “Crypto Regulation”.

Our goal is to provide enough educational resources so that any financial advisor, experienced or not, will gain enough knowledge to be able sail the crypto seas on their own while managing their client’s digital assets. Furthermore, alongside these valuable resources, financial advisors will also have industry experts on demand to help them with any questions that may arise as they are learning their way through our crypto crash course.

With a seamless onboarding process, a diverse range of digital assets secured by Fireblocks, and robust educational resources with expert-level support, the Veli Financial Advisor Portal stands out from the crowd of digital asset management platforms for Financial advisors, and emerges as the best solution for any financial advisor and advisory house looking to expand into digital assets.

To learn more about our platform and onboard your clients, visit the Veli Financial Advisor Portal.

Debunking The Most Common Crypto Misconceptions in 2024 Cryptocurrency and...

Veli Secures Investment from DSl Angel Investor Network We are...

How Veli Transformed Vezovišek & Partnerji Into a Digital Asset...