Debunking The Most Common Crypto Misconceptions in 2024 Cryptocurrency and...

Investors, both individual and institutional alike have understood the importance of exchange-traded funds (ETFs) ever since they were initially launched. Rather than having to purchase stock in multiple individual companies, you can invest even relatively small amounts in a variety of stocks through exchange-traded funds. For example, ETFs that track the S&P 500 index, dynamically follow the top 500 publicly traded American companies, and they are the most popular ETFs with the most assets under management.

Besides the diversification, ETFs give investors more flexibility, lower fees, more tax efficiency and immediate and automatic dividend reinvestments. In the crypto world there are no such things as ETFs, which is why we at Veli have decided to create Veli Strategies.

In this blog post, we will cover everything you need to know about Veli Strategies and how you can get started with them, whether you are an individual investor or a financial advisor that wants to invest in Veli Strategies on behalf of their clients.

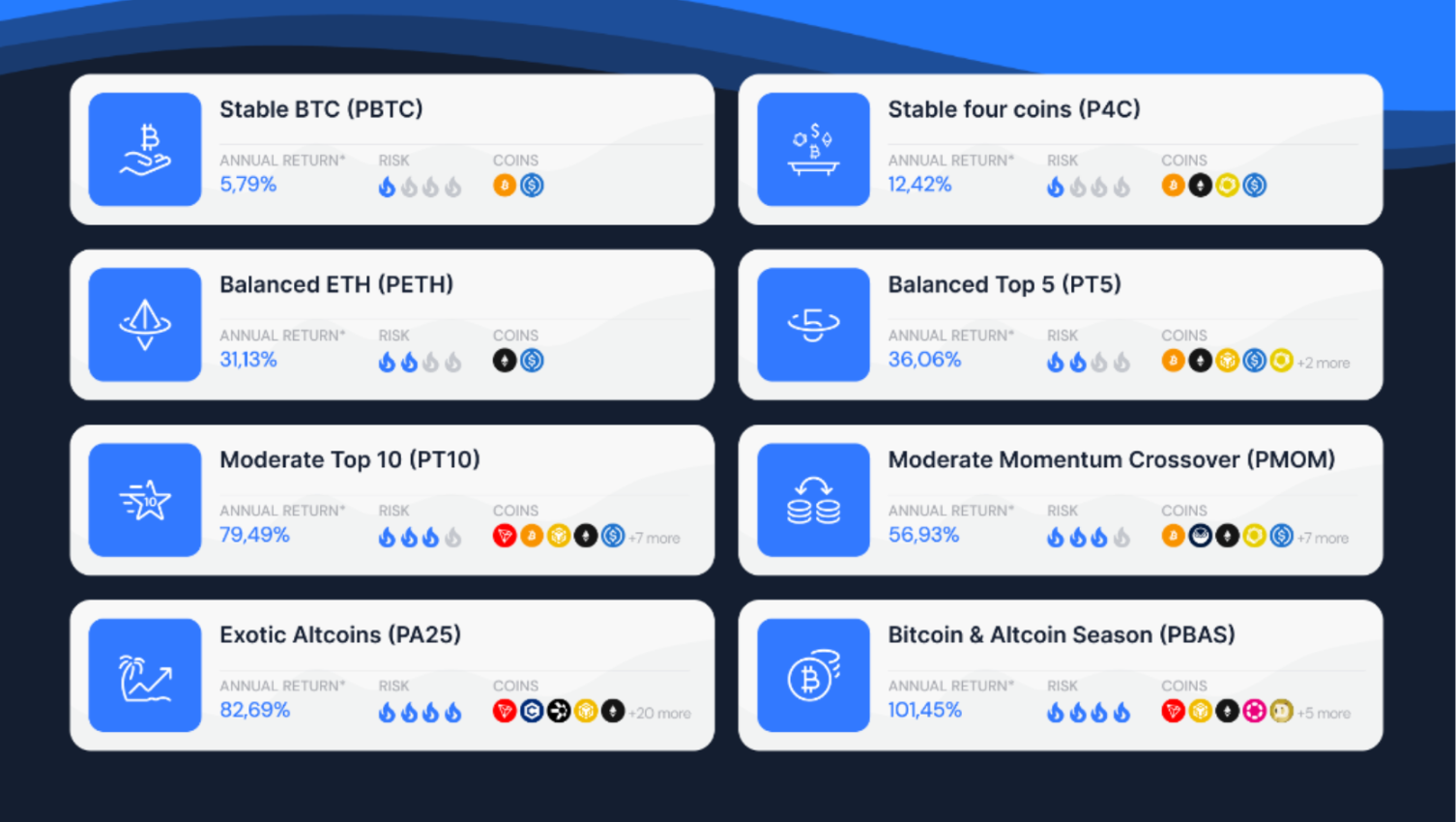

Veli Strategies are representing a mix of different cryptocurrencies, stablecoins and tokenized assets. Our strategies have been created by PhDs in Quantitative Finance and back tested from 2017. Each strategy represents a carefully selected collection of coins, with its own risk and return profile. There are 2 different types of strategies – Smart and Passive; we will explain the difference in more detail in this post.

Each strategy has a specific methodology on how its assets are balanced; Let’s take for example our Stable BTC strategy; this is a conservative strategy that allocates 10% into Bitcoin $BTC and 90% into the stablecoin $USDC. Each month the strategy rebalances to keep the 10/90 ratio, which means that Bitcoin $BTC is automatically bought when the price is lower, and sold for $USDC when the price is higher.

The reason why our Strategies are so desired is because they benefit both individual investors and financial advisors.

Individual cryptocurrency investors can invest in already created and backtested diversified portfolios in one click through our Strategies, instead of having to purchase individual coins separately. Moreover, with automated rebalancing, investors always have exposure to the top coins, instead of staying long term in coins which might not perform so well.

Furthermore, investors don’t need to have a PhD in Finance or spend countless hours analyzing charts and trying to buy crypto at specific times or prices, as wih Veli strategies it is all done automatically. That way we are lowering the barrier of entry for everyone that wants to get into crypto.

Financial advisors, on the other hand, can invest in crypto Strategies and manage their client’s assets through our Financial Advisor Portal. Instead of constructing a new portfolio for each client separately, advisors can easily invest in pre-constructed Strategies with different risk and return profiles.

If you are a Financial Advisor or Wealth Manager and you are interested in including crypto in your clients’ portfolios, you can contact us through the form on this webpage.

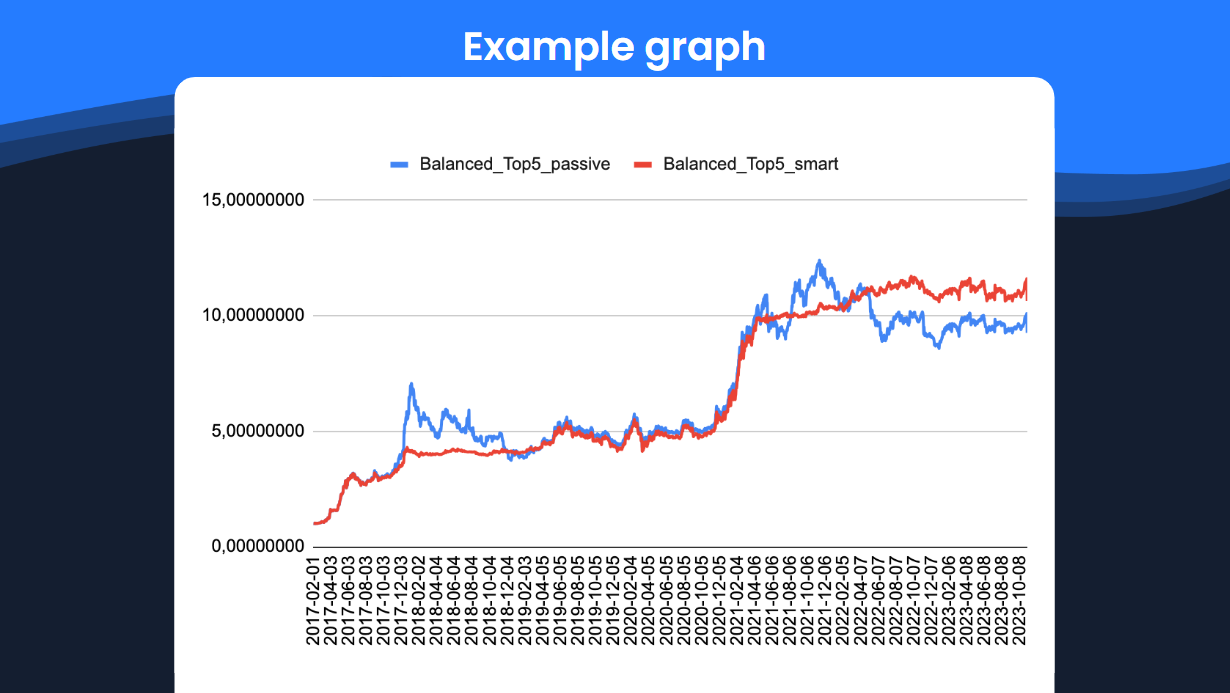

As mentioned earlier, most Veli Strategies have a “Smart” and a “Passive” type of the strategy, to give all investors their preferred investment option.

Passive Strategies go up and down with the market. Historically, passive indices have been outperforming most active strategies. Even if they experienced a drop in the short run, in the long run investors were still able to make attractive returns.

Smart Strategies attempt to enter the market when prices are low and exit the market when prices are high, thereby locking in profits and preventing big drops during the bear market. They use a set of indicators to determine the right moment to enter the market, over a prolonged period of time. The same goes for exiting the market, as Smart Strategies exit into a mix of stablecoins gradually.

The goal of our Smart Strategies is to give inexperienced investors a way to generate attractive returns while minimizing the potential losses, by automatically buying when prices are low and selling when prices are high, thereby mimicking the way professional investors invest.

As you can see, Smart Strategies might not ride the bull market wave all the way to the top, but they also don’t experience significant drops during the bear market.

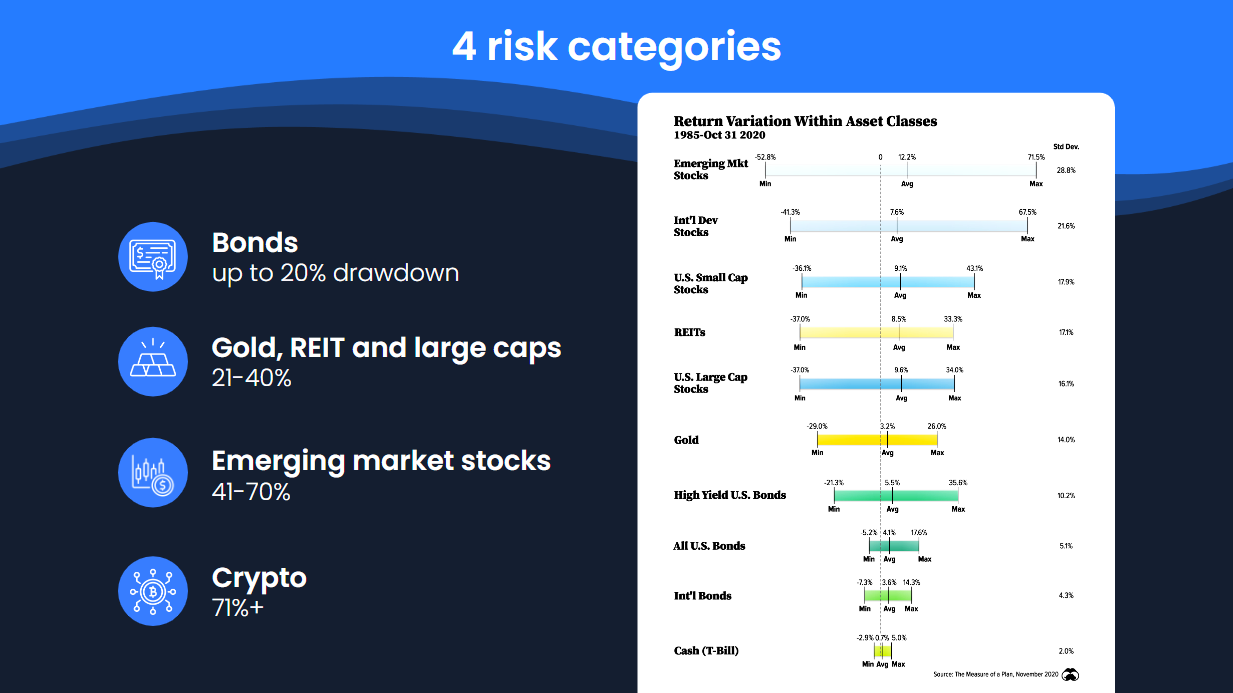

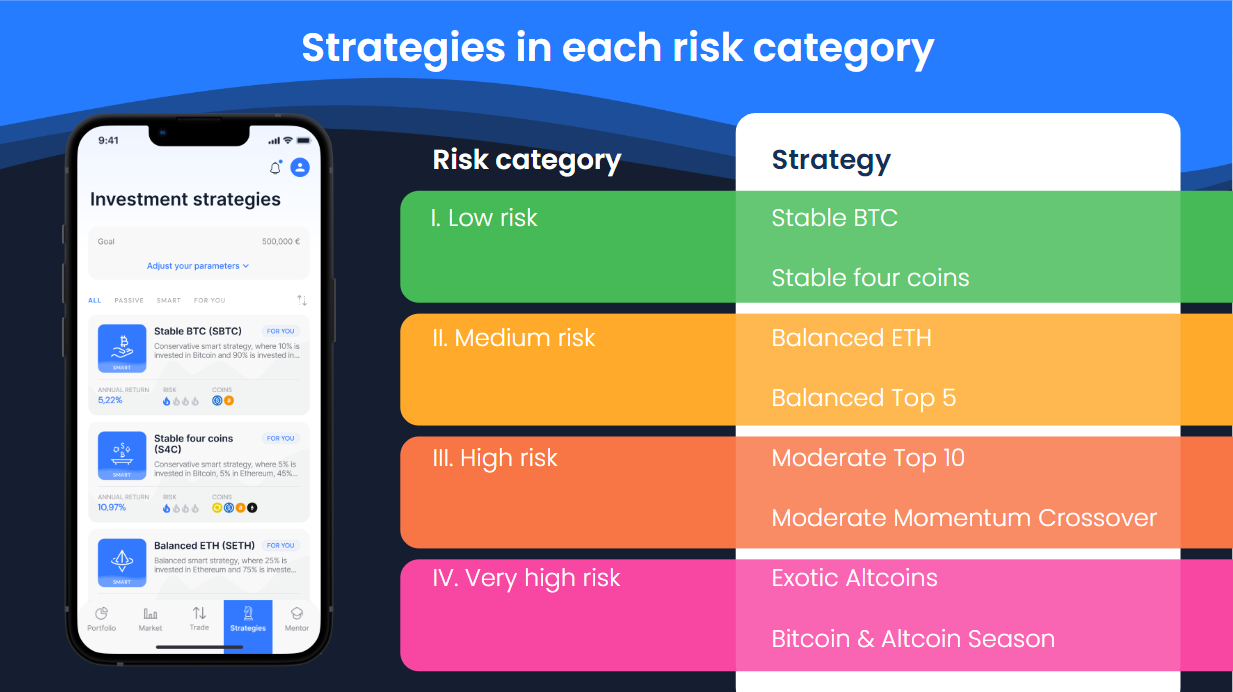

Veli Strategies have 4 risk categories, determined to mimic the traditional financial instruments risks and have been based on the maximum drawdown:

Strategies with the lowest risk, such as Stable BTC and Stable 4 Coins have historically also shown the lowest returns, while strategies with the highest risk, such as Exotic Altcoins and Bitcoin & Altcoin Season have historically shown the highest returns.

By balancing between stable assets and volatile cryptocurrencies, each strategy offers a unique risk and return profile.

When researching all of the potential investment assets for our Strategies, we defined our investment universe as the top 50 cryptocurrencies by market cap, stablecoins and also Pax Gold, the gold-pegged token.

Whenever a new cryptocurrency enters the top 50 market cap, we check if it’s available through our white label liquidity provider and then add it to our investment universe.

We also have a selection criteria through which we filter out tokens that we don’t want to include in our strategies, such as memecoins (except in the Exotic Altcoins Strategy, where we also include coins like Dogecoin $DOGE).

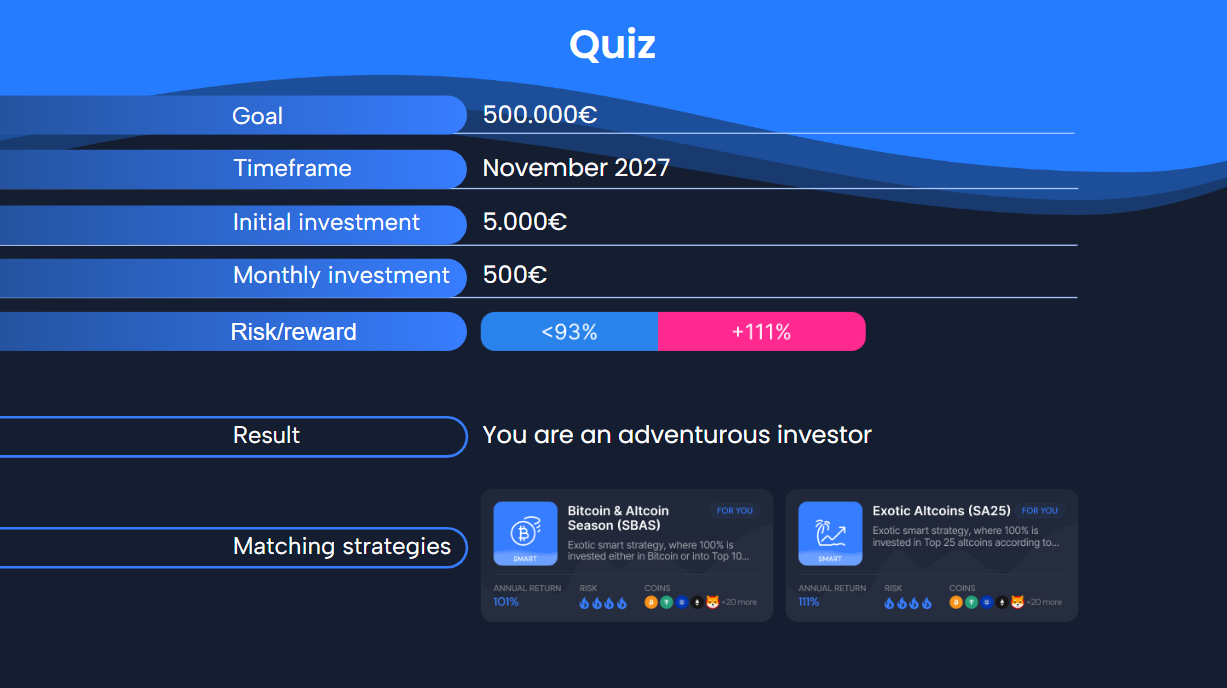

In order to make the Strategy onboarding process for new users as simple as possible, we implemented a Veli Strategy Quiz in our app.

The Strategy Quiz asks you what your financial goal is, the timeframe in which you want to achieve this goal and how much you are willing to invest, both in the beginning at one and on a monthly basis, to reach this goal. The quiz then asks you what your risk / return scenario best describes your annual investment expectations.

After answering these questions, you will see which strategies match your criteria and can help you achieve your financial goal. It is important to remember that these are not investment recommendations, the decision is fully up to the investors themselves.

If you need any help with the Veli Strategy Quiz, check out this support video on our YouTube channel.

Exchange traded funds have forever changed the world of traditional finance, by giving investors the ability to invest in ready-made diversified portfolios. We are revolutionizing the crypto investment world by taking the concept of ETFs and implementing it in the cryptocurrency markets, through our revolutionary Veli Strategies.

If you are an individual investor, you can invest in Veli Strategies right now through the Veli App, available on the Apple App Store and the Google Play Store.

If you are a financial advisor, wealth manager or financial advisory house and want to offer crypto to your clients, contact us using the form on this page.

For more information on Veli Strategies, check out the Strategies page on our website.

*Annualized returns are based on the period 02/2017-09/2023.

The market for crypto assets and the purchase of crypto assets constitute a high risk. Crypto assets are subject to high fluctuations in value, and there is no real underlying asset. Declines in value or a rapid, complete loss of the money spent are possible at any time. Past performance is not a reliable indicator of future performance.

Debunking The Most Common Crypto Misconceptions in 2024 Cryptocurrency and...

Veli Secures Investment from DSl Angel Investor Network We are...

How Veli Transformed Vezovišek & Partnerji Into a Digital Asset...