Debunking The Most Common Crypto Misconceptions in 2024 Cryptocurrency and blockchain technology...

After a strong surge in Q1 and a relatively quiet Q2, the cryptocurrency market in the third quarter experienced a somewhat bearish trend. This quarter was marked with some positive news, including Ripple’s and Grayscale’s victories against the SEC, which hold significant importance for the cryptocurrency market. Also, with a few modest developments and a noticeable increase in security incidents.

The leading cryptocurrency in the market by market cap, Bitcoin, saw a price decline from $30,000 to $27,000 (-11.37%) in this quarter, while the second-largest cryptocurrency, Ethereum, dropped from $1,900 to $1,670 (-13.6%). Generally, the other altcoins in the top 50, experienced a decline of over 30%, with a few exceptions. During the third quarter of 2023, the average daily trading volume amounted to $39.1 billion, marking an 11.5% decrease when compared to the preceding second quarter.

The total market capitalization of cryptocurrencies has decreased from $1.19 trillion to $1.08 trillion, marking a decrease of 9%. The market was generally in steady sideways action in the first part of the quarter, with a drop in mid August. Some of the possible factors for the Market decline are Rising U.S. bond yields, regulatory uncertainty, exhaustion of BTC spot ETF excitement, and long liquidations games by the big players. Long liquidation games by big players involve deliberately causing significant price drops in the cryptocurrency market to force smaller investors/traders to sell their long positions at a loss, enabling the big players like Exchanges and Whales to profit from buying at lower prices.

The leading cryptocurrency in the market by market cap, Bitcoin, saw a price decline from $30,000 to $27,000 in this quarter. With the excitement of Bitcoin NFTs decreasing in this quarter, and with Bitcoin spot ETFs anticipation news excitement started to cool down from its peak, Bitcoin price declined by 11%. Despite Grayscale’s legal victory over the SEC, in which the SEC rejected their spot Bitcoin ETF application, and Grayscale subsequently sued them for that rejection, this win, which increased the likelihood of approval, couldn’t push the price of Bitcoin beyond $28,000. With a highly anticipated Bitcoin halving on the way next year, BTC has held 27k area in this quarter.

Crypto-asset | Quarterly market cap change |

|---|---|

Bitcoin (BTC) | -11.3% |

Ethereum (ETH) | -13.65% |

Tether (USDT) | -0.55% |

BNB (BNB) | -11.87% |

XRP (XRP) | +11% |

Ether, with a 13.6% quarterly decrease, continues to follow the path of Bitcoin. With news of the first futures ETFs coming to the U.S. soon, interest in Ether still remains high. Staked ETH grew by 17% in Q3 2023.

Tether‘s market cap remained nearly unchanged, with only a slight 0.15% correction, solidifying its position as the undisputed leader among stablecoins.

Despite regulatory challenges and attacks on Binance exchange, Binance’s native cryptocurrency BNB has maintained its position in the top 5 cryptocurrencies, with an 11% loss in market cap.

In Q3, XRP entered the top 5 cryptocurrencies after securing a victory in the SEC lawsuit, as a U.S. judge ruled that XRP is not a security. This marked a significant triumph for the cryptocurrency and the overall crypto market, causing XRP to surge by 48% at the start of the quarter. However, it later retracted by 25.2%, following the broader market, and after many short-term traders sold the news.

Learn more about Veli strategies here.

On July 13th, Ripple Labs achieved a significant victory in its legal battle with the SEC regarding the XRP cryptocurrency. A U.S. judge ruled that Ripple Labs did not breach federal securities laws by selling XRP on public exchanges, marking a landmark win for the cryptocurrency sector. This decision had an immediate impact on XRP’s value, causing it to surge by 48% later in the day. However, it’s worth noting that XRP’s price has since retreated by more than 25.2%.

Curve Finance encountered a significant security breach on July 30th when hackers executed a reentrancy attack, which had ripple effects throughout the DeFi (Decentralized Finance) community. The attackers specifically targeted stable pools on Curve Finance that were implemented using the Vyper programming language. This attack resulted in losses exceeding $61 million. Fortunately, a week later, approximately 70% of the funds affected by the breach were successfully recovered. An ongoing investigation is actively addressing the remaining funds to restore them and ensure the security of the DeFi ecosystem.

Worldcoin, a cryptocurrency project founded by OpenAI CEO Sam Altman, launched its token on 14th August. At the heart of the project lies its primary feature known as the “World ID,” which the company characterizes as a kind of “digital passport.” This digital identity verification tool serves the purpose of confirming the authenticity of its user as a genuine human rather than an AI bot. Subsequently, several countries have initiated investigations into Worldcoin due to their concerns about safety and privacy issues.

In August 2023, PayPal launched its new stablecoin, PYUSD; a cryptocurrency fully backed by US dollar deposits, short-term US treasuries and similar cash equivalents. PayPal entering the blockchain space with its new stablecoin could bring crypto closer into the mainstream.Despite high expectations, PYUSD had a modest adoption with $148m circulation in Q3.

Grayscale achieved a significant win against the SEC, marking a crucial turning point for the U.S.’s first Bitcoin spot ETF. The D.C. Circuit handed down a ruling favoring Grayscale in the lawsuit challenging the SEC’s rejection of Grayscale Bitcoin Trust’s conversion into an ETF.

Roughly 16 trillion Pepe tokens, equivalent to $15 million, were illicitly transferred to several crypto exchanges, including OKX, Binance, Kucoin, and Bybit, where they were subsequently sold. This unauthorized transfer and sale of tokens were orchestrated by three PEPE team members, who took the tokens from the project’s multisig wallet, then proceeded to liquidate them on various crypto exchanges before deleting their social accounts.

SEC delays decision on spot bitcoin exchange-traded funds. SEC filings dated Aug. 31 indicated the agency would give itself until mid-October to make decisions on several applications. But another extension could be possible, experts say.

FTX has been granted court approval to sell its cryptocurrency assets to repay customers in U.S. dollars. Under the approved plan, the bankrupt crypto exchange will be permitted to sell up to $100 million in cryptocurrency per week. Additionally, the exchange can enter into hedging and staking agreements to reduce the risk of price volatility and earn passive income on more mainstream crypto assets such as bitcoin and ether.

During the third quarter of 2023, equities faced their most challenging period in over a decade, with bond prices also plummeting. This downturn was driven by global central banks either raising interest rates or signaling their intent to do so. In particular, the S&P 500 experienced a 4.9% decline in September, marking its worst month of the year.

Although headline inflation saw a decrease due to lower energy prices, core inflation remained high, with second-round effects continuing to impact the United States, the Eurozone, and the UK. The Federal Reserve initially raised rates in the third quarter and maintained them, but comments from Fed policymakers strongly suggested that another rate hike should be expected before the year’s end. Additionally, the dot plot, a data chart released following the September meeting, revealed a higher median rate projection for 2024. With many European countries already in recession, the U.S. could be the next in line which could have a big impact on the markets, but everything is still uncertain.

US indices for Q3 2023 (29 September 2023)

Inflation is showing signs of potential slowing down, but we’re witnessing a growing disparity among different regions. According to the current projection, global inflation is expected to reach 7.0% in 2023 and then decrease to 4.7% in 2024. This moderation is largely attributed to reduced economic growth and more restrictive monetary policies, which are helping to alleviate global inflationary pressures. Although, the new warzones opening in the world still can push inflation up in the coming months and the course of the inflation is still very uncertain.

Continued issues in labor markets are causing prices in the services sector to rise. Inflationary pressures in services are staying high due to low unemployment in major economies and ongoing wage growth. Moreover, the demand for services remains robust, contributing to further increases in prices. It’s expected that these inflationary pressures in the services sector will ease in 2024 as central banks implement tighter monetary policies and economic growth slows, which is likely to limit discretionary spending. Nonetheless, the persistent, underlying challenges in labor markets will persist and continue to exert pressure on the services sector in the long term.

Fluctuations in commodity prices have the potential to reignite inflationary pressures from the supply side. As we approach the end of the year, there’s a growing concern about increased supply risks in the commodity markets, which could contribute to greater price volatility and further inflationary pressures.

Additionally, the energy sector is also facing elevated supply risks, and these risks could result in higher energy prices in the fourth quarter of 2023. Import-dependent regions, especially in Europe and Asia, are particularly vulnerable to these energy supply disruptions, which may worsen the inflationary challenges.

From a risk perspective, the cryptocurrency markets have undergone significant changes since the previous year. Volatility, correlations with traditional equities, and correlations among the top 30 tokens have all decreased noticeably.

One notable factor influencing price movements in this quarter has been news related to regulatory developments in the United States. The actions taken by the U.S. Securities and Exchange Commission (SEC) have played a prominent role in shaping the market. There have been instances of regulatory enforcement actions, such as those involving Coinbase and Binance, followed by legal rulings in the U.S. Furthermore, the anticipation surrounding regulatory filings for spot exchange-traded funds (ETFs) by major global asset management companies has introduced a considerable amount of market activity concerning potential approval dates.

The excitement surrounding the possibility of a spot ETF approval is justified, as it signifies a significant step in the eyes of the SEC. The introduction of a highly liquid U.S.-based spot product holds the potential to further legitimize and stabilize the cryptocurrency market.

In Q3 2023, global equities faced their toughest period in a decade, with central banks raising rates. Inflation remains uneven across regions, and the labor market is driving up service prices. Commodity price fluctuations pose inflationary risks. Meanwhile, the cryptocurrency market experienced some turbulence, with Bitcoin’s solid year-to-date performance, lower volatility, and regulatory developments influencing prices. The anticipation of spot ETFs signals potential market legitimacy. The economic landscape is evolving with dynamic risk factors and ongoing central bank actions. As the global economy is still very vulnerable and uncertain, with a possibility of the U.S. getting into a recession, markets are still uncertain and very speculative.

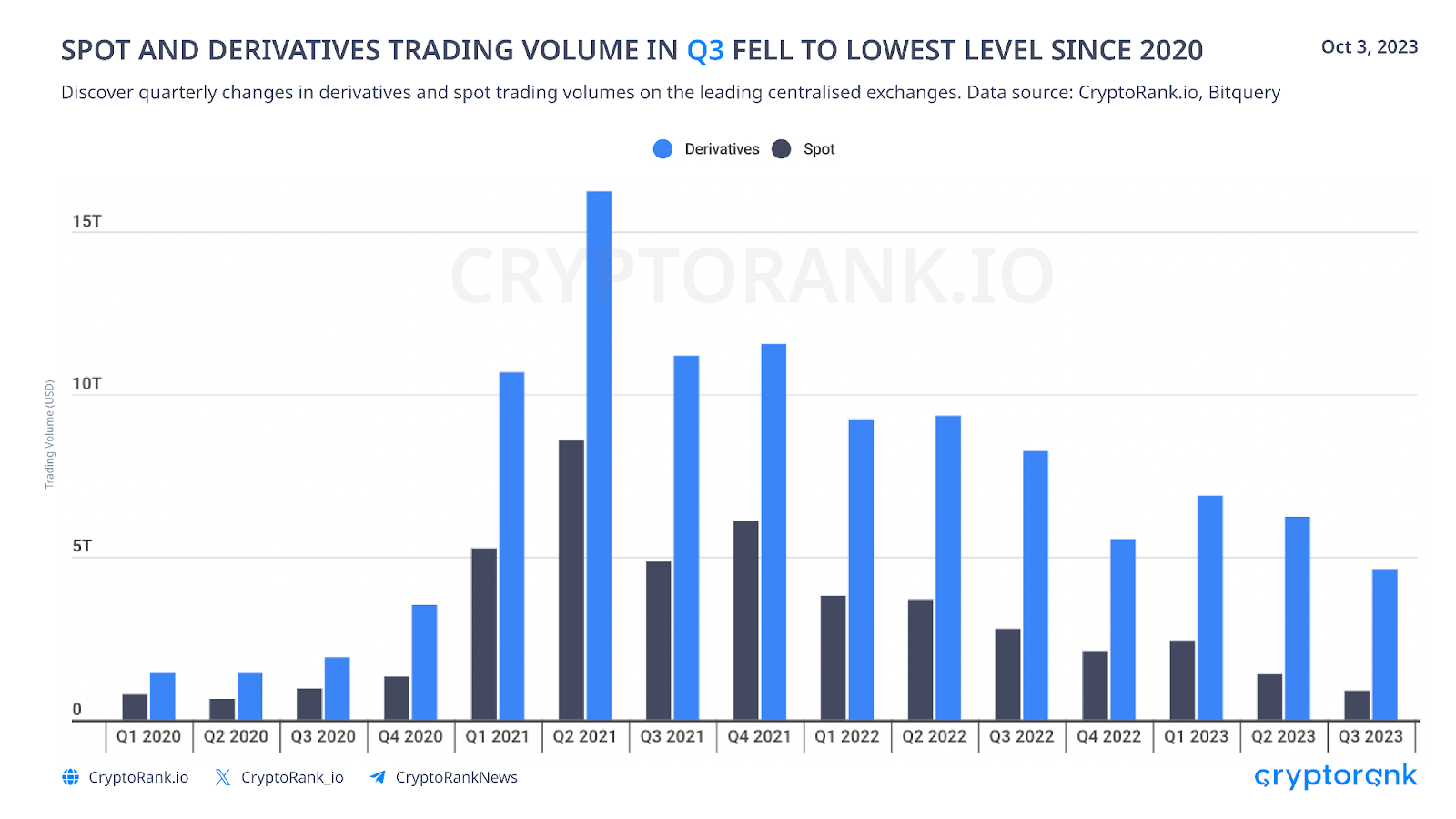

Starting from the beginning of 2023, we’ve observed a consistent decline in trading volumes on exchanges. This reduction in trading activity has been accompanied by a decrease in market volatility, which, in turn, has impacted the potential for profitability. A notable consequence of this trend is that numerous assets have been stuck in a relatively tight trading range for an extended duration. This prolonged period has contributed to a waning interest among market participants in actively trading crypto assets.

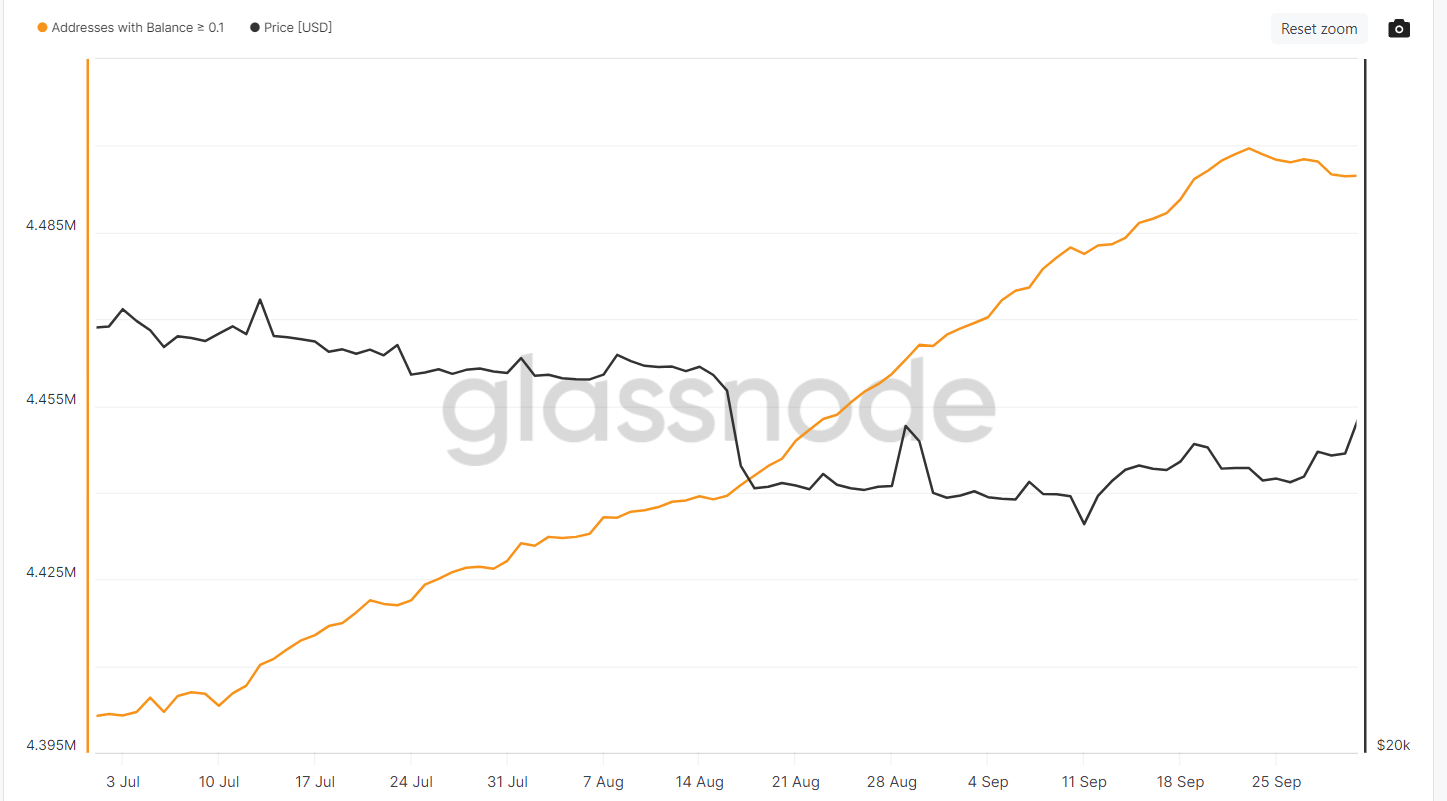

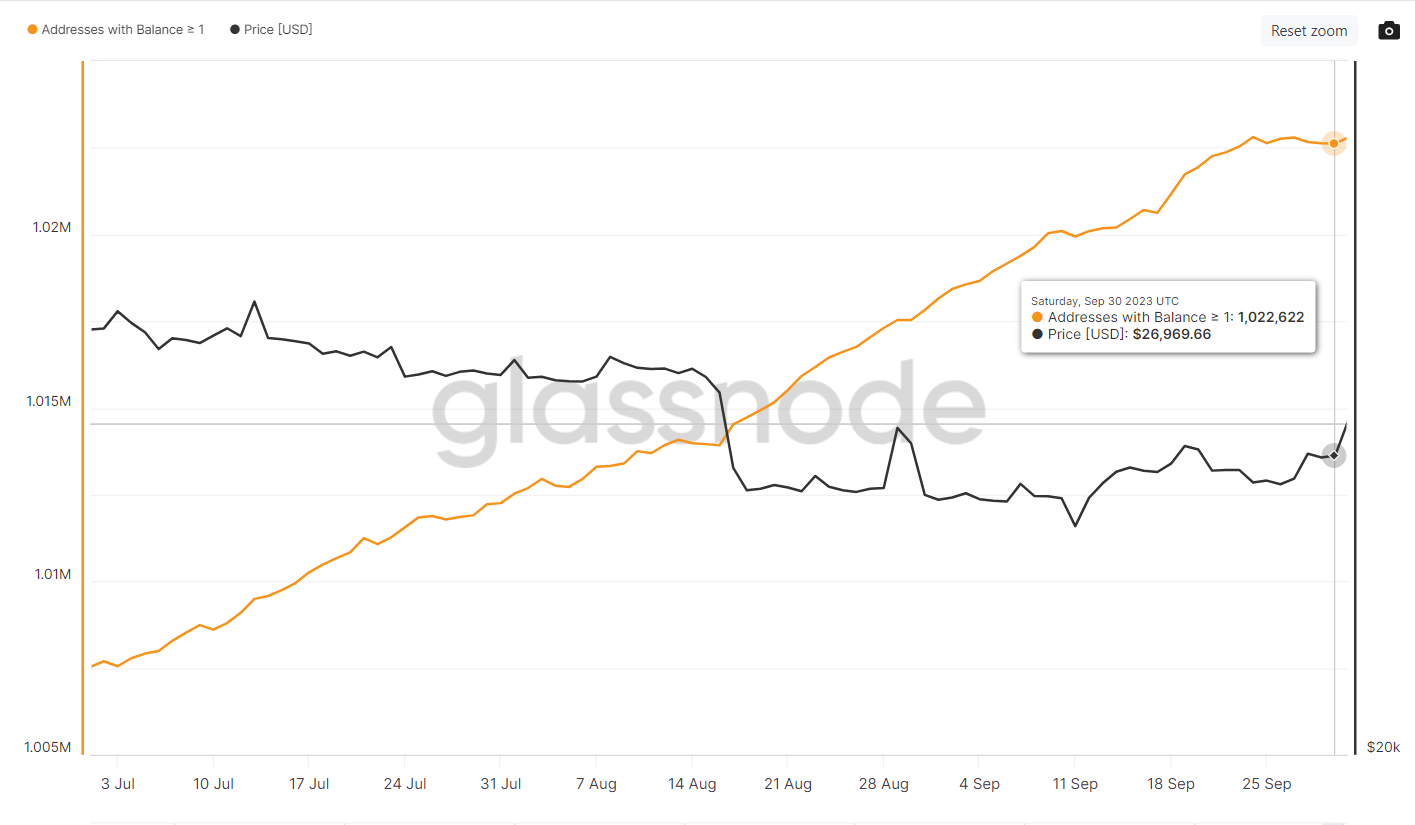

The number of addresses with balances ≥ 0.1 and ≥ 1 BTC (retail) has continued to grow, suggesting that retail is still buying Bitcoin and accumulating in the Q3. The number of addresses with balances ≥ 0.1 raised from 4.39m to 4.94m, and ≥ 1 from 1.006m to 1.022m.

Bitcoin: Number of Addresses with Balance ≥ 0.1

Bitcoin: Number of Addresses with Balance ≥ 1

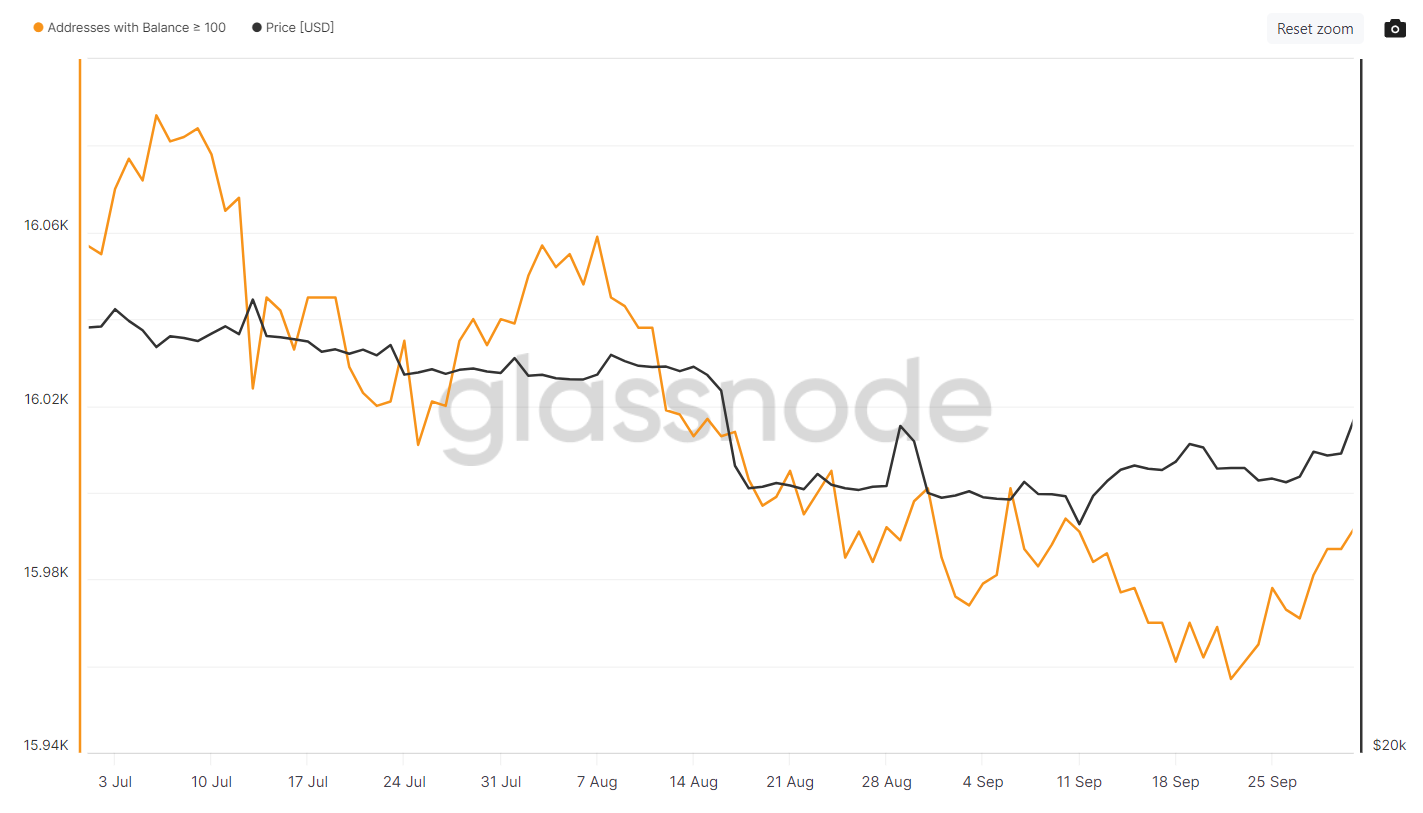

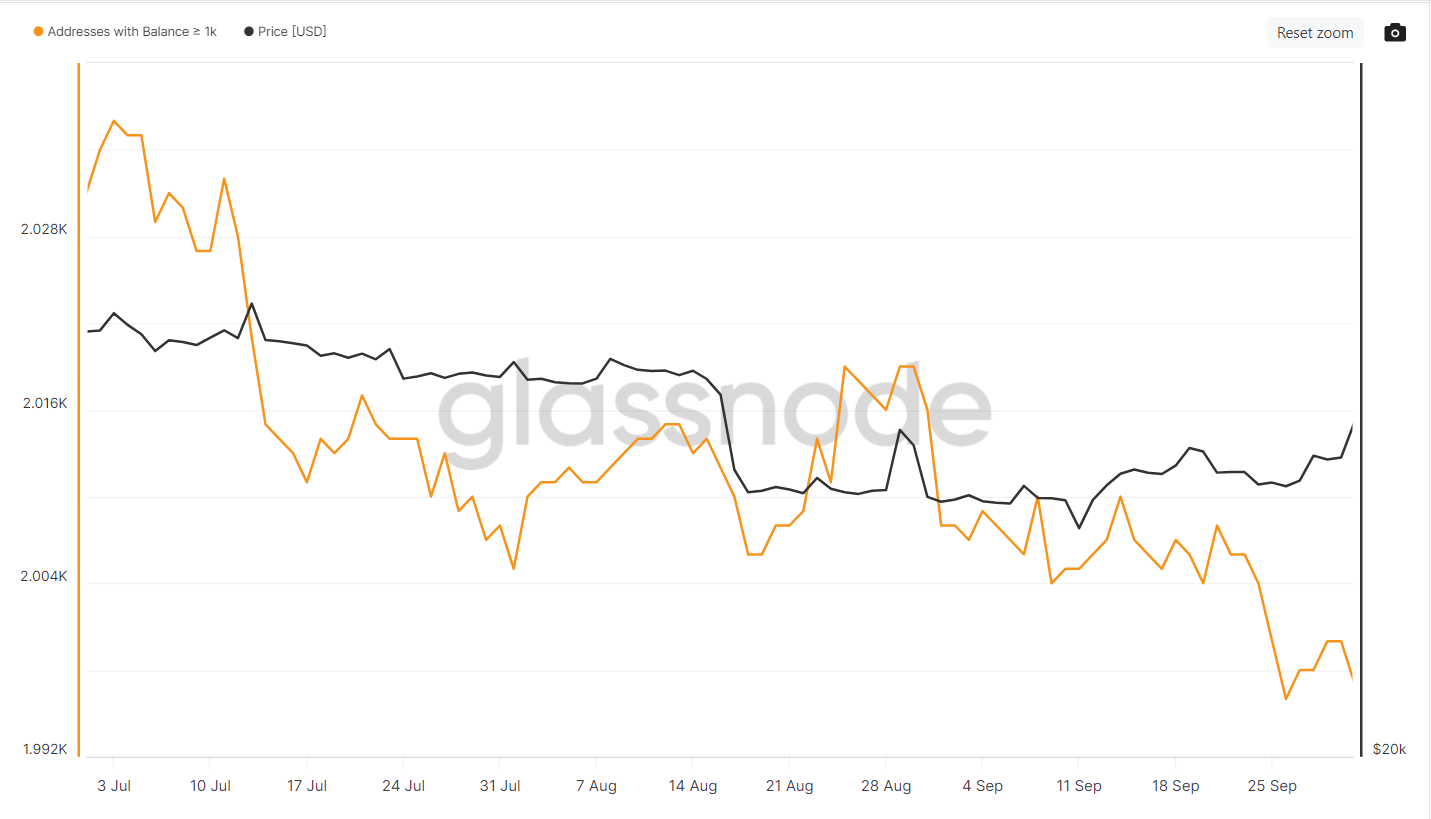

The number of Addresses with Balance ≥ 100 and ≥ 1k BTC has continued to shrink in the Q3. Addresses with Balance ≥ 100 were shrinking during this quarter with a small twist in the last few days. The number of addresses shrank from 16,057 to 15,987. The number of Addresses with Balance ≥ 1k continues its downtrend since March 2022, which suggests that bigger whales didn’t start accumulating BTC yet and are still gradually selling. The number of addresses fell from 2150 to 2006.

Bitcoin: Number of Addresses with Balance ≥ 100

Bitcoin: Number of Addresses with Balance ≥ 1k

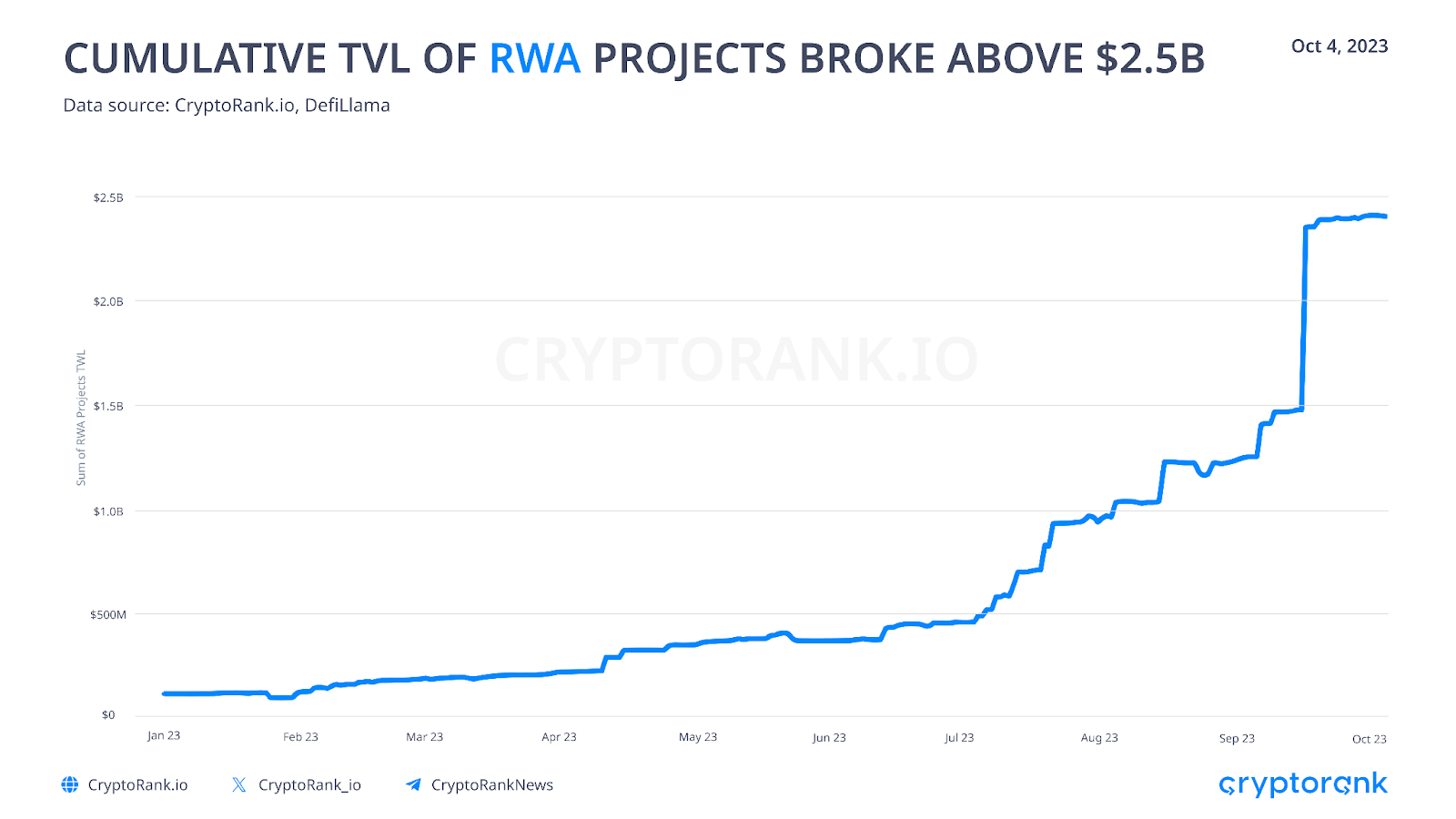

Despite the extended decline in decentralized finance (DeFi), there are emerging trends that give us hope for a possible comeback. In the first half of the year, we saw significant growth in Liquid Staking projects, establishing their dominance in the DeFi space. Currently, Liquid Staking projects continue to attract user interest, but the third quarter has witnessed even more substantial growth in Real World Asset (RWA) projects, signaling a new wave of expansion in the DeFi sector.

Real World Assets (RWA) is a rapidly expanding category within the crypto landscape, though it remains relatively small in scale. The concept of asset tokenization is not a novel trend, but it has garnered renewed attention, primarily because traditional crypto instruments have been associated with volatility and heightened risks. Protocol Maker is at the forefront of this movement, allocating a substantial portion of its earnings into stable cash flow assets such as Treasuries and various securities. Notable projects in this domain also include Frax, Canto, and several others. Our platform, Veli, has also entered the world of RWA through partnership with DAP Capital. You can find out more about that here. Our users can expect many interesting things from the tokenization world on our platform in the near future.

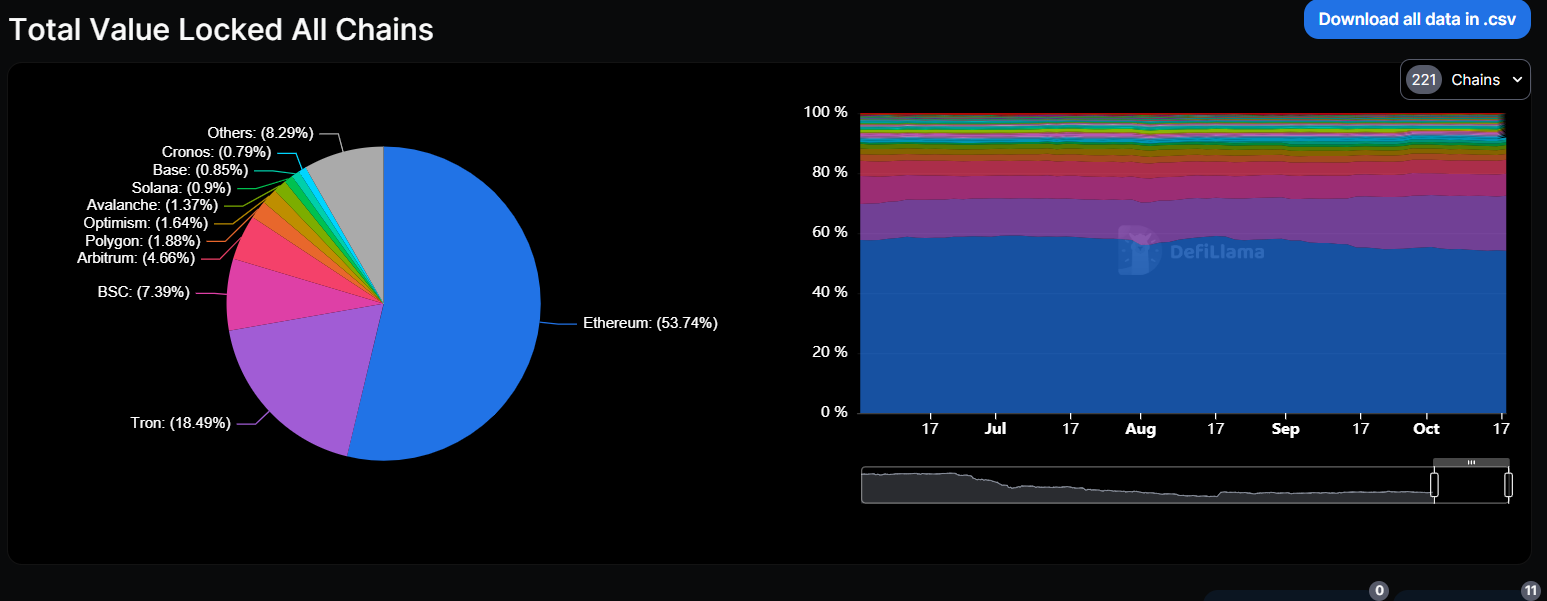

TVL in DeFi remains highly concentrated on Ethereum, which is dominating with 53.47%, followed by Tron, BNB and Arbitrum. Interest in Layer 2 blockchains has slightly decreased, resulting in a slower growth in TVL. Other blockchains, such as Solana, were also able to demonstrate growth in key indicators during the recovery of coin prices.

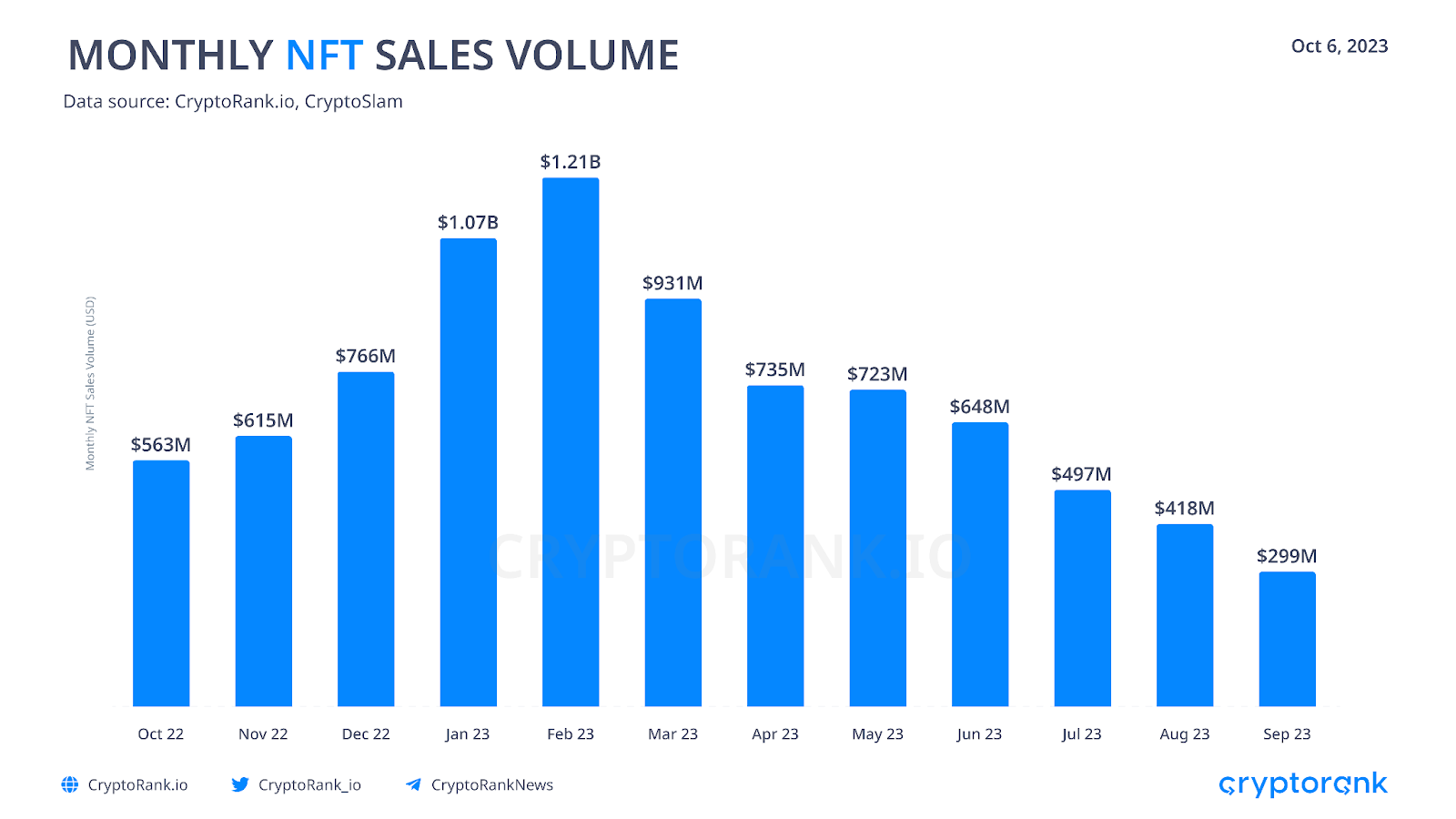

The NFT (Non-Fungible Token) market is presently facing significant challenges. Despite initial optimism at the start of the year, that enthusiasm has rapidly decreased. At the moment, NFT trading volumes are on par with those observed in early 2021, before the NFT boom began.

Ethereum continues to maintain its top position as the primary blockchain for NFT trading volume. While Polygon and Solana consistently compete for the second position, no blockchain, other than Ethereum, has succeeded in establishing itself as a definitive “hub for NFTs” thus far.

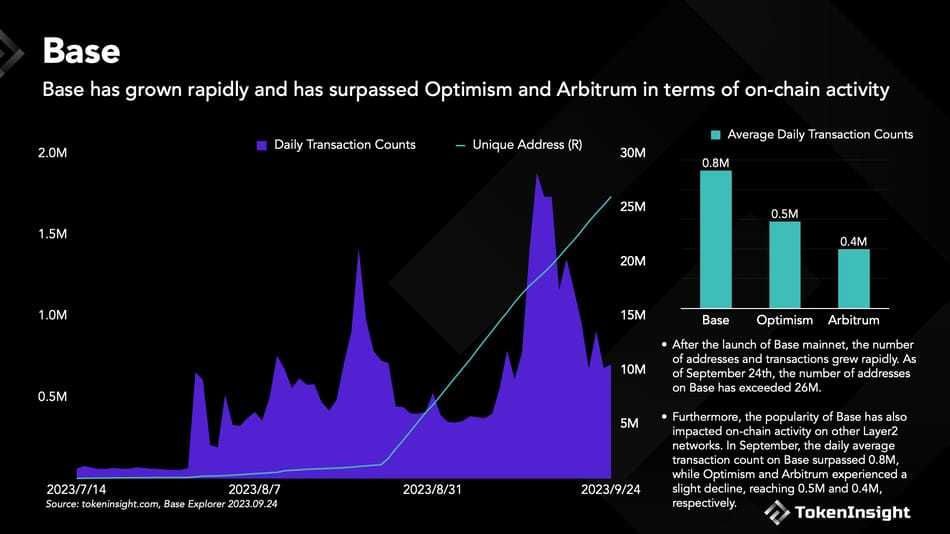

Following the successful launch of its Mainnet, Base has experienced remarkable growth, surpassing the on-chain activity of Layer 2 solutions like Optimism and Arbitrum.

An increasing number of projects are embracing the OP Stack to construct Layer 2 networks, and Base has emerged as a prominent leader in this space, garnering significant attention.

Since the introduction of the Base mainnet, there has been a rapid surge in both the number of traders and the volume of transactions. By September 24th, the number of unique user addresses on Base had exceeded 26 million. In September, the average daily transaction count on Base exceeded 0.8 million, while Optimism and Arbitrum experienced a decline with transaction counts of 0.5 million and 0.4 million, respectively.

By the end of Q3, the stablecoin market cap experienced a 2.5% decrease, falling from $128.5 billion to $124.3 billion.

During this timeframe, various stablecoins experienced notable fluctuations in their market capitalization. Notably, USDP, BUSD, and FRAX saw substantial drops of 50.7%, 43%, and 33.2%, respectively. In contrast, DAI and TUSD witnessed notable growth, with their market capitalizations increasing by 25.8% and 15%, respectively.

It’s worth mentioning that BUSD, a stablecoin issued by Paxos and promoted by Binance, faced a continuous decline in market capitalization. This was attributed to the mounting regulatory pressure on Binance by the U.S. government, and as a result, BUSD is set to phase out of use by 2024.

USD Coin (USDC) experienced significant losses, with its total value decreasing by $2.26 billion, representing an 8.3% decline.

Tether’s market cap remained nearly unchanged, with only a slight 0.15% correction, solidifying its position as the undisputed leader among stablecoins.

Based on the current mining rate, there’s approximately 6 months left before the next Bitcoin halving occurs, which suggests that the crypto market may experience a period of sideways trading before the next bull run begins. According to historical cycles, Bitcoin should have reached its bottom in November 2022 at around $16k per BTC. However, there’s still a chance for prices to quickly drop before the halving occurs. As for altcoins, they may experience sideways trading, but with a higher likelihood of dipping lower and reaching new lows before the halving and subsequent main bull run.

When we look at the monthly frame and take a longer-term view, we can observe that Bitcoin (BTC) is currently in neutral territory and slowly starting to enter the overbought territory. At present, the first significant resistance that needs to be overcomed is at around $31k. If BTC can surpass this level, then the next major resistance is at around $38k. Big downside supports are around $19k (previous all-time high), followed by $16k and $13.8k. Based on historical trends, BTC’s price may remain within the range of $19k-$38k until the next halving in April. Alternatively, the range could be wider, extending from $13.8k to $47k, but more likely in the $25k-$47k range.

BTC

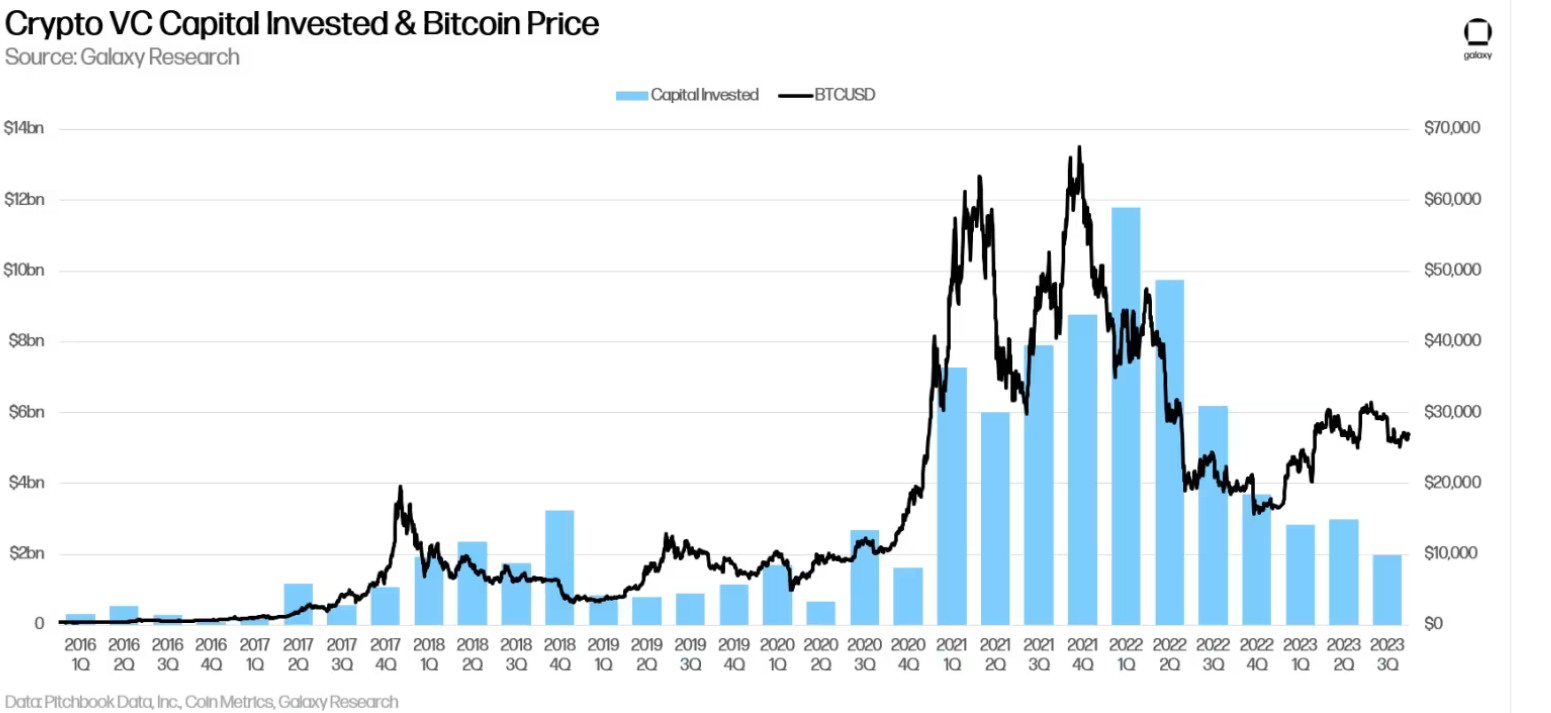

The cryptocurrency venture capital (VC) landscape has not yet reached its lowest point. Q3 marked the lowest quarter since Q4 2020 in terms of both the number of deals and the total capital invested.

In Q3 2023, the crypto and blockchain sector attracted $1.975 billion in investments, continuing a decline that began following the peak of $12 billion in Q1 2022. It’s worth noting that crypto and blockchain startups collectively raised less money over the past four quarters than they did in just Q1 2022 when the market was experiencing a bullish phase. Additionally, the number of deals reached a new low in this cycle, with only 376 deals recorded during the quarter.

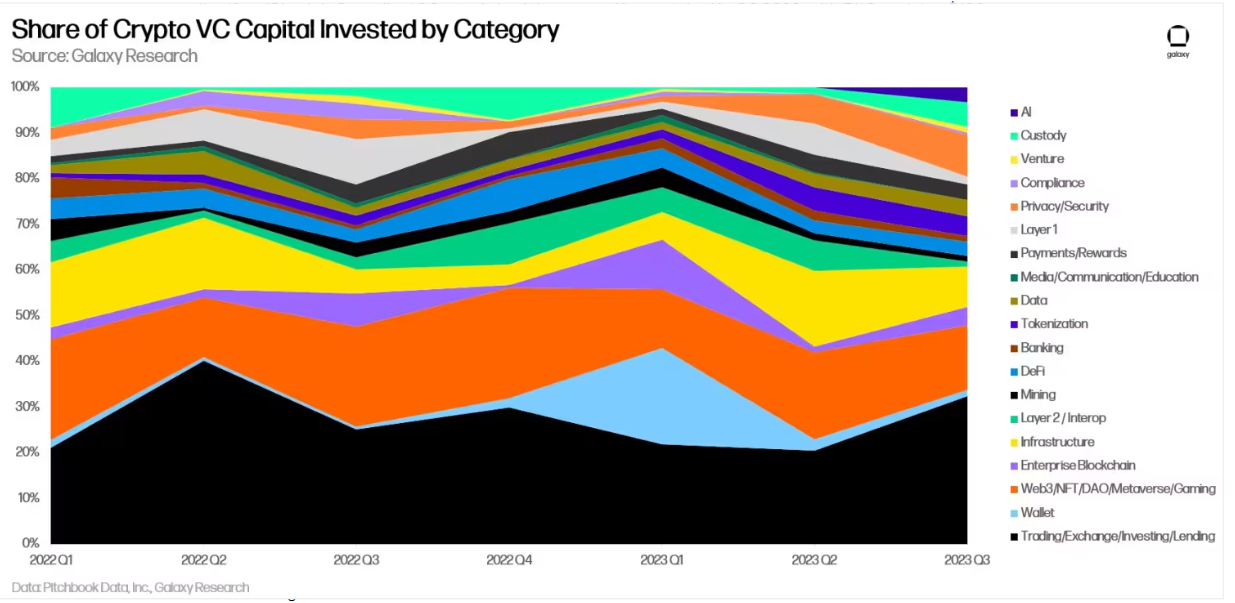

In terms of the number of deals, companies involved in developing products related to Web3 Gaming, NFTs (Non-Fungible Tokens), DAOs (Decentralized Autonomous Organizations), and the Metaverse maintained their leading position. They were followed by companies engaged in Trading, Exchanges, Investment, and Lending. Importantly, these trends have remained consistent and unchanged from what was observed in Q1 and Q2 of 2023.

For the third consecutive quarter, startups focused on Trading, Exchanges, Investments, and Lending secured the most substantial portion of venture capital funding, amassing a total of $611 million, accounting for 32.5% of all the venture capital investments made. Additionally, for the second consecutive quarter, Web3, NFTs, Gaming, DAOs, and Metaverse startups followed closely, securing the second-largest share of capital at $266.5 million, equivalent to 14.2% of the total venture capital investments for the quarter.

In Q3 2023, Haqqex, a digital asset exchange marketing itself as “Shariah Compliant,” raised $400 million, securing the largest deal. BitGo‘s Series C round raised $100 million, making it the second-largest deal of the quarter.

Moreover, a noteworthy development in Q3 2023 was the emergence of the AI category, where startups working on AI-related products raised over $60 million, making up 3.2% of all venture capital investments in the quarter.

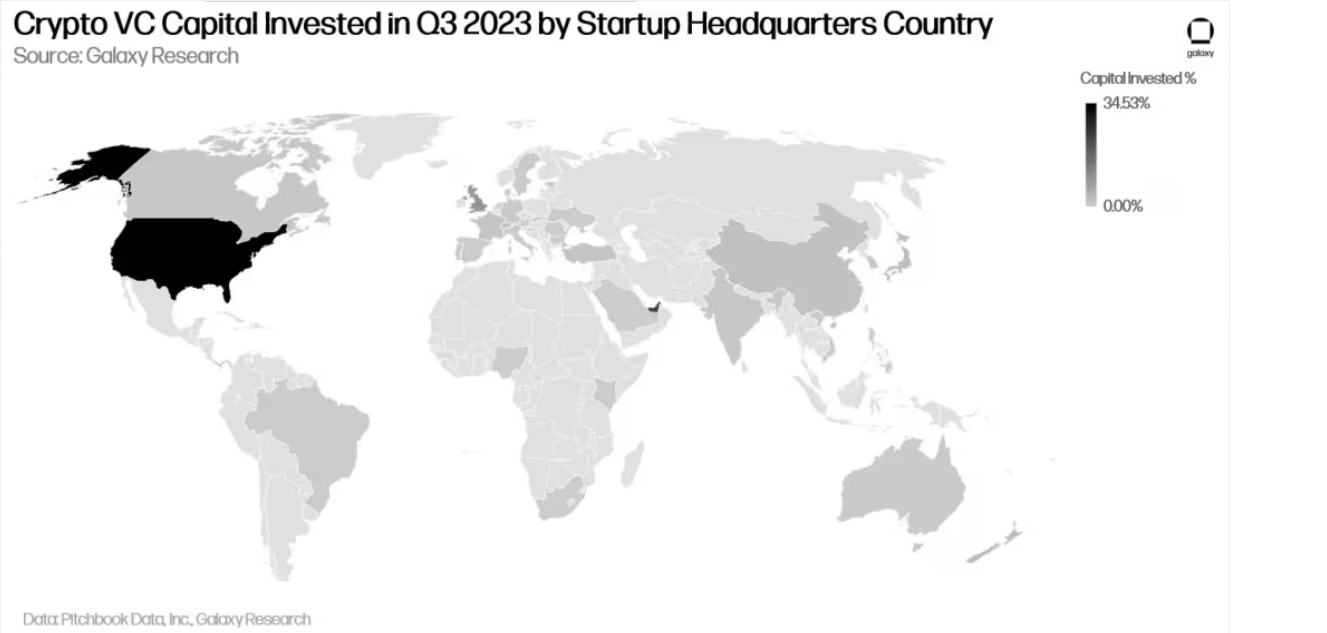

In Q3, the United States remained at the forefront in terms of the number of deals and the capital invested in the cryptocurrency industry.

U.S.-based companies continued to secure the lion’s share, accounting for 34.5% of all crypto VC investments in Q3 2023. Following closely were companies based in the United Arab Emirates, making up 23.5% of the total, followed by the United Kingdom at 9.5%, and Singapore at 6.2%. This indicates a growing global presence and impact of cryptocurrency startups headquartered in regulatory-friendly jurisdictions.

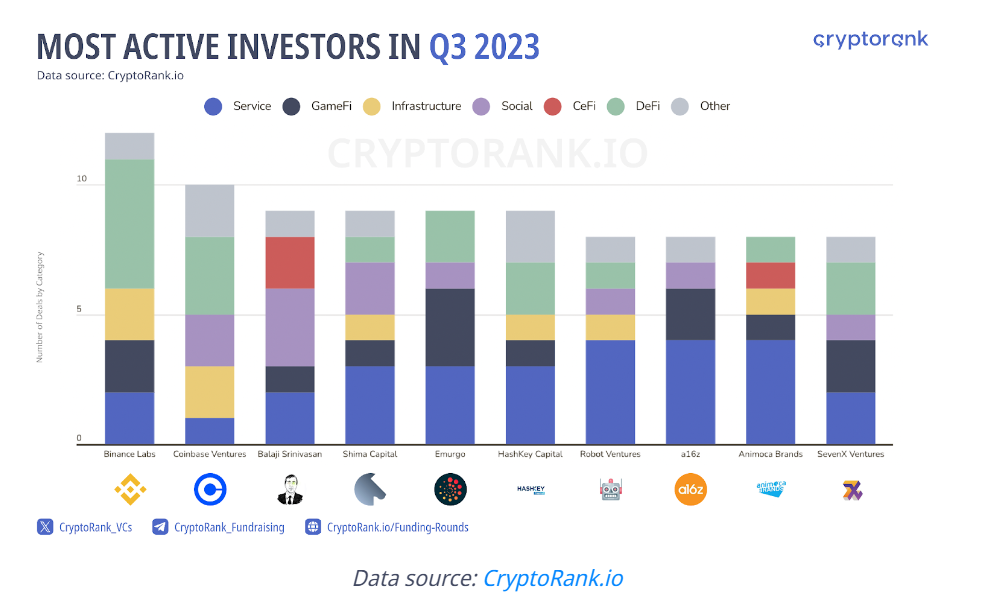

It’s worth highlighting that Binance Labs emerged as the most active investor in the quarter, displaying a strong presence in the cryptocurrency space. This fund showed its commitment by investing in 12 projects, with a significant focus on the DeFi (Decentralized Finance) sector. Following closely, Coinbase’s venture capital arm, along with the former Coinbase CTO Balaji Srinivasan, also made substantial and noteworthy investments in various projects. This underscores the active involvement of major players in the cryptocurrency industry in supporting and backing innovative blockchain projects.

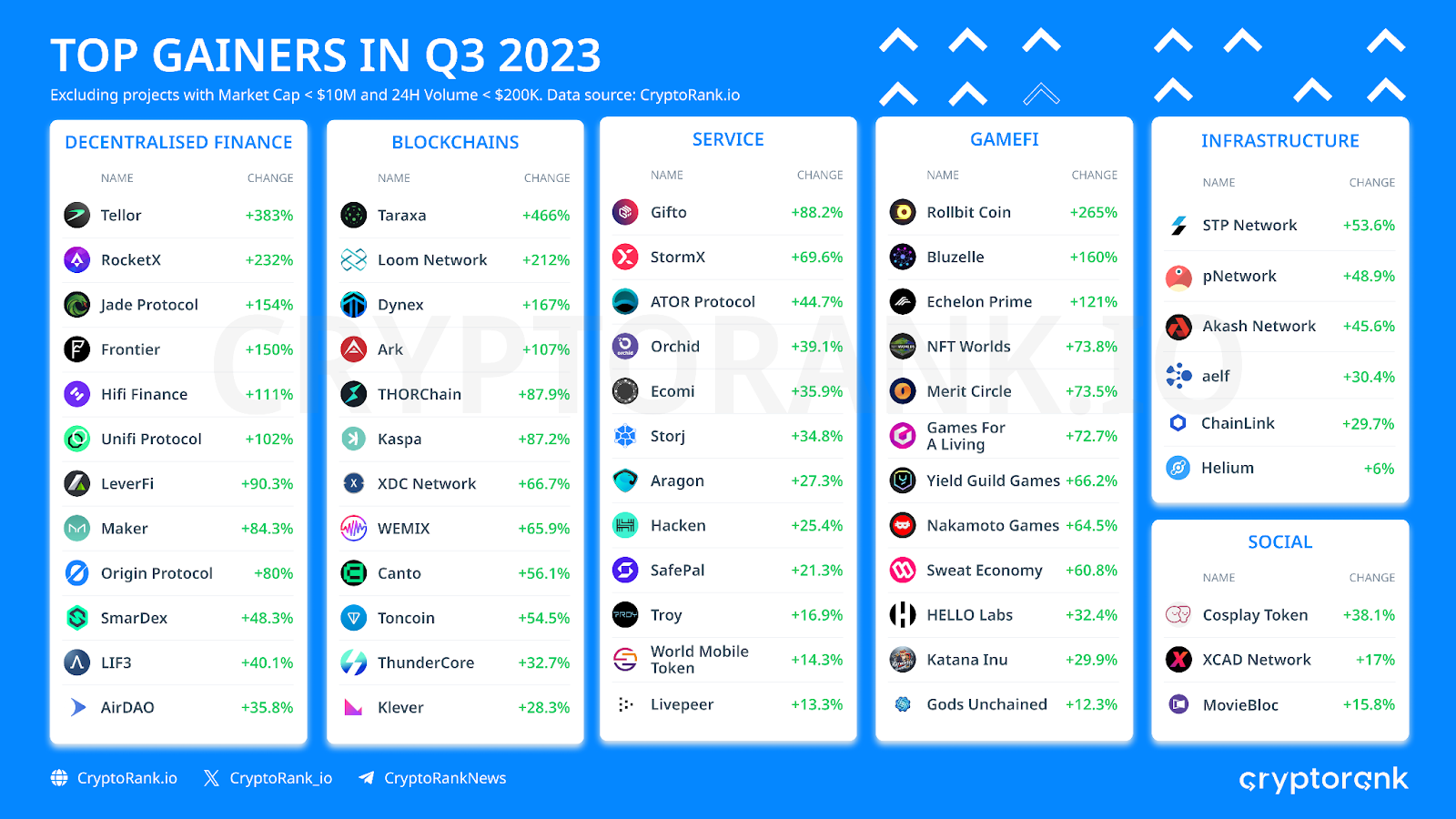

During the past quarter, several projects saw noteworthy success. One standout example is Solana, which faced a notable performance setback after the FTX incident. Despite the prevailing fear, uncertainty, and doubt (FUD), Solana managed to close the quarter with an impressive 27% increase in its price. Additionally, TON coin briefly surprised everyone by entering the top-10 cryptocurrencies list. This unexpected ascent was driven by a remarkable 47% price surge triggered by the news of Telegram app’s integration with web3 technology.

Among the list of gainers, you can find a diverse range of projects. However, there doesn’t seem to be a prevailing trend or overarching narrative that would drive the entire industry, similar to the DeFi boom in 2020-2021, the emergence of GameFi in 2021, or the buzz surrounding AI in the early part of 2023.

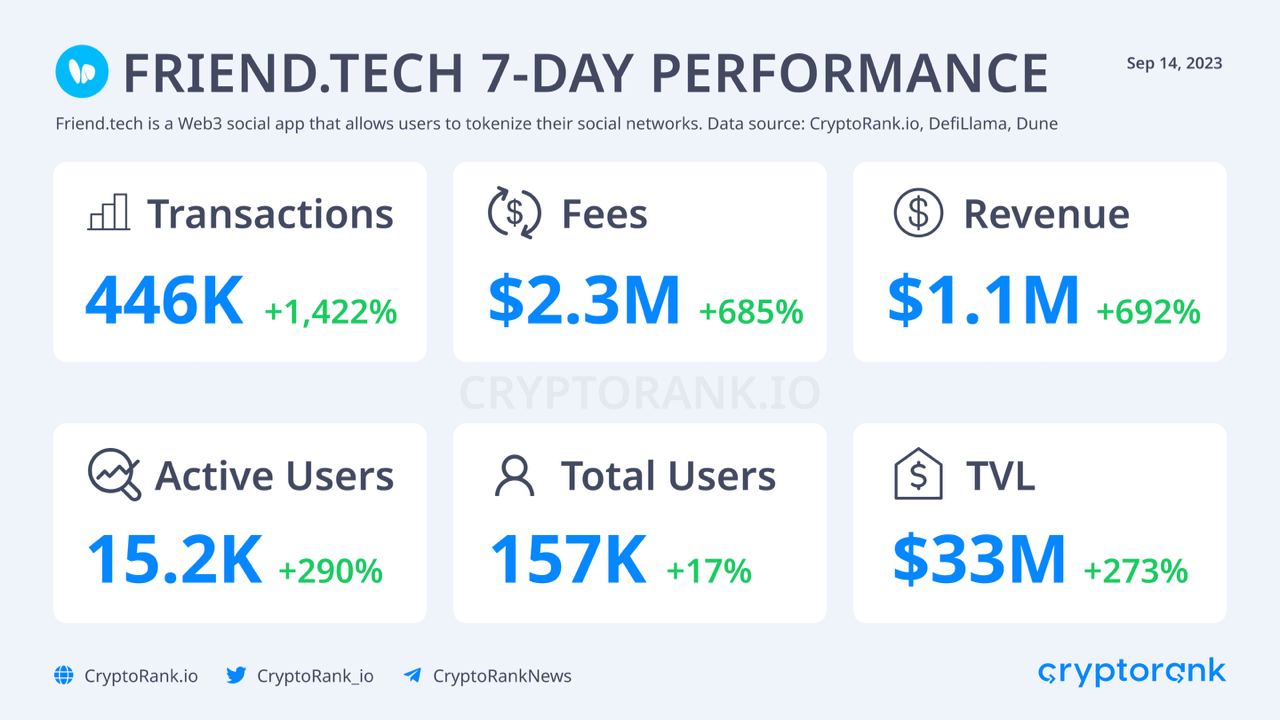

The launch of the Base blockchain was a truly remarkable event. Now, our attention turns towards the most intriguing application within the Base ecosystem, which is Friend.Tech, a SocialFi crypto project. SocialFi merges social media with decentralized finance (DeFi) on Web3 platforms. It empowers content creators, influencers, and users by providing control over their data, freedom of expression, and the opportunity to earn from their social media presence using cryptocurrencies and nonfungible tokens (NFTs).

Once you are inside the app, you can even generate invite codes, share with friends, and get points in the process. These points might be a step towards farming the Friend.tech airdrop. Regrettably, the predominant activity observed on Friend.Tech is driven by short term traders. Presently, this platform is primarily utilized for profit generation, with social interaction taking a backseat.

It’s worth noting that Friend.Tech set the trend for social applications, which subsequently led to the creation of fork clones on blockchains like Arbitrum, Avalanche, and others. While these clones offer greater convenience, they do not address the fundamental issue at hand: for the majority of users, they are merely a means to generate income within a frictionless market.

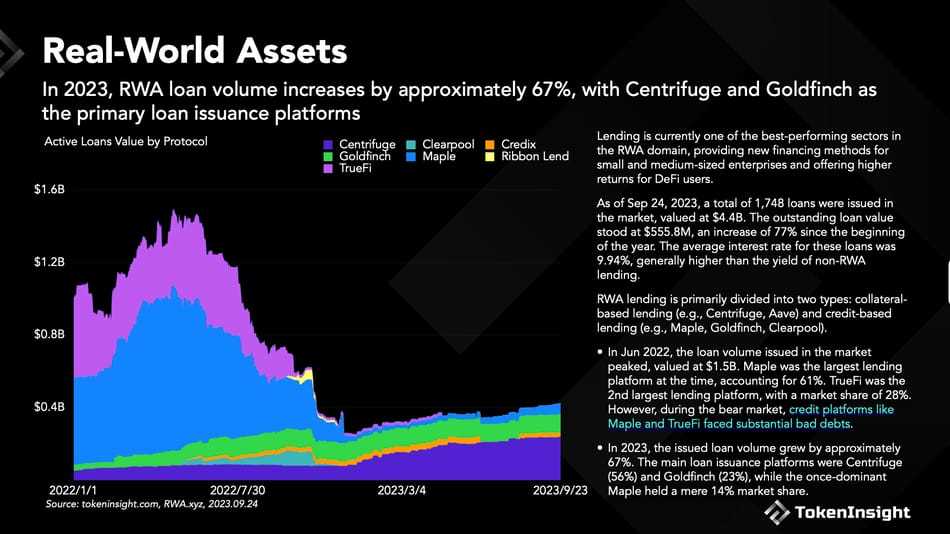

The market capitalization of the RWA (Real World Asset) sector experienced a substantial growth of around 60%. This growth was accompanied by a remarkable 77% increase in the issuance of RWA loans and an astounding surge of 452% in the market for tokenized US Treasury Bonds.

Lending has emerged as one of the top-performing sectors within the RWA landscape, introducing fresh avenues for financing small and medium-sized enterprises while delivering higher returns to DeFi enthusiasts. Lending in Real-World Asset (RWA) tokenization typically involves a process where digital tokens representing real-world assets are used as collateral for loans.

As of September 24, 2023, the market saw a total of 1,748 loans issued, with a combined value of $4.4 billion. The outstanding loan value reached $555.8 million, marking a substantial 77% increase since the year began. Notably, the average interest rate on these loans stood at 9.94%, generally surpassing the yields of non-RWA lending options.

In the backdrop of the Federal Reserve’s consistent interest rate hikes, U.S. government bond yields have become increasingly attractive. On-chain users are now presented with a new investment opportunity through tokenized treasury bonds. Presently, the average yield for on-chain tokenized government bonds is at 5.25%, whereas the yield for stablecoin lending on platforms like Aave V2 (Ethereum) falls within the range of 3.5% to 4.5%.

Kaspa is a relatively new Layer 1 project that aims to address some of the scalability issues associated with traditional blockchains like Bitcoin and Ethereum. Kaspa is the first blockDAG cryptocurrency (it’s not a traditional blockchain). Kaspa is unique in its ability to support high block rates while maintaining the level of security offered by proof-of-work environments. It provides instant transaction confirmation and a user-friendly developer experience. Kaspa’s current main net operates at 1 block per second (in comparison to Bitcoin, one block per 10 min). The transaction fee on Kaspa is 0.0001 KAS (0.00005$ at the current KAS price), which makes Kaspa one of the Layer 1 networks with the cheapest transaction fee out there (compared to Solana’s fee for example, 0.0002$). KAS price has been generally in an upward trend since its inception and showed strong growth, with already reaching $1b market cap. With a highly positive sentiment around it, it reminds of Solana in its early days, a new and advanced technology that could overtake the traditional blockchain projects.

At the moment, the crypto market is undergoing a consolidation phase and is trending downward, in anticipation of the next Bitcoin halving event scheduled for April 2024. Currently, the crypto market remains highly vulnerable, and many sectors are in jeopardy, experiencing significant losses. The two largest assets, Bitcoin and Ethereum, have displayed resilience despite a slight pullback following their strong performance in Q1. The sideways trading pattern may persist until the halving event, with a possible significant correction in this period. The overall macroeconomic situation remains uncertain, with ongoing global conflicts and unregulated inflation. With many European countries in recession, there is the possibility that the United States may also join them, potentially triggering a new wave of market despair.

The crypto sector is still in a correction phase, and many altcoins are approaching their all-time lows. However, some new sectors, such as RWA and SocialFi, have enjoyed a strong quarter. Venture capital activities continue to languish, and venture investors face a challenging fundraising environment.

There is some very positive news for the market, including legal victories for Ripple (XRP) and Grayscale against the SEC. These victories indicate that most cryptocurrencies are not considered securities and, thus, are not subject to securities regulations. Furthermore, the chances of a Bitcoin Spot ETF have improved significantly after Grayscale’s victory and are now almost certain. With the 2024 halving event on the horizon and the potential for BTC spot ETFs, the crypto market appears poised for a strong recovery in the coming year. However, until these developments materialize, the market may continue to experience further sideways action. As we approach the BTC halving, the chances of a price decline decrease, but a quick, significant dip in price before the market recovery is still highly possible due to macro economy changes or some bad event happening related to the crypto industry.

Latest Articles

Debunking The Most Common Crypto Misconceptions in 2024 Cryptocurrency and blockchain technology...

Veli Secures Investment from DSl Angel Investor Network We are thrilled to...

How Veli Transformed Vezovišek & Partnerji Into a Digital Asset Powerhouse Cryptocurrencies,...