Debunking The Most Common Crypto Misconceptions in 2024 Cryptocurrency and...

The year 2023 ended with positive sentiment in the crypto markets as Bitcoin closed 8 consecutive green weekly candles in December. This price action was mainly due to growing speculation of a Bitcoin ETF approval, which was finally confirmed on the 10th of January when the SEC approved all 11 Spot Bitcoin ETFs.

With the new year starting off with one of the biggest Bitcoin headlines in the cryptocurrency’s history, 2024 is poised to be a prosperous year for cryptocurrencies, but the positive news doesn’t stop there; In this blog post, we will go over the most anticipated events for investors in 2024 that will shake up the crypto market.

Due to new advancements in the regulation and financial sector, 2024 is setting itself as the first ever year of comprehensive institutional adoption of cryptocurrencies. The main turning point for institutional adoption has been the approval of 11 Spot Bitcoin ETFs by the US SEC on the 11th of January, kicking off the year with positive news for crypto.

The ETF approvals were crucial for introducing institutional investors, such as insurance companies and pension funds to Bitcoin. These investors who have previously not been interested in engaging with crypto now have a safe and secure way of doing so. This is also true for European institutional investors who will, thanks to the new MiCA regulation, also have a safer and more secure experience interacting with crypto.

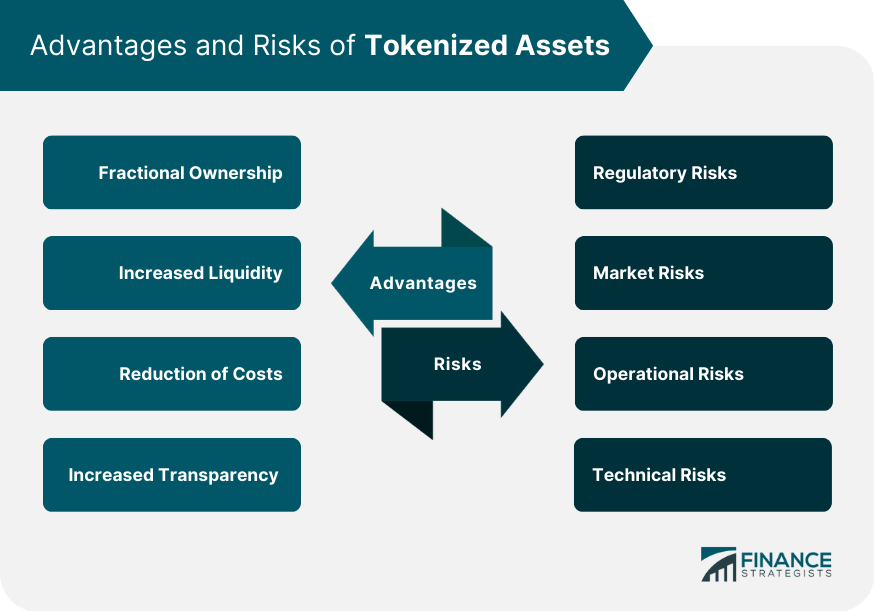

In 2024, the growth of tokenization markets is also expected to be seen, a sector directly connected to the traditional financial markets dominated by institutional investors. More and more experts, such as Blackrock’s CEO, Larry Fink, are speaking on the potential of tokenization to impact financial markets by facilitating more transparent and efficient transactions.

Advantages and Risks of Tokenized Assets, by Finance Strategists

For more information on tokenization, read our recent blog post “Complete Guide to Tokenization”.

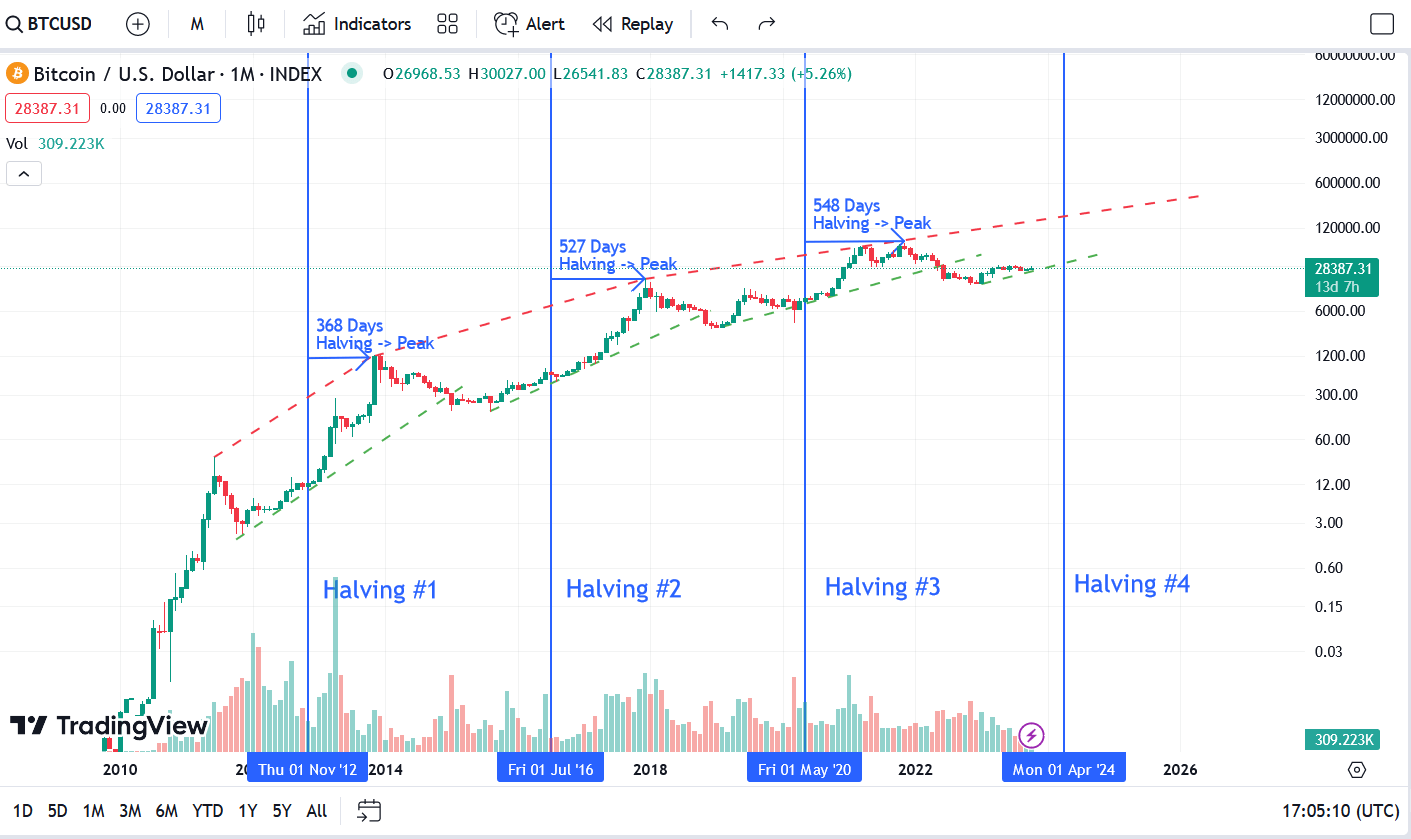

The Bitcoin halving is an event through which the reward for mining Bitcoin is cut in half. In more detail, the Bitcoin halving halves the mining reward for each block mined by half, meaning that it reduces the Bitcoin inflation by 50%.

This event occurs every four years, and the next one will be the 4th Bitcoin halving since the cryptocurrency’s inception (2008), with the previous three happening in 2012, 2016 and 2020. Through the next halving, planned for April 2024, the reward for each block mined will drop from the current 6.25 to 3.125 Bitcoin per block mined, meaning that the Bitcoin inflation will drop from 1.88% to 0.94%.

Advantages and Risks of Tokenized Assets, by Finance Strategists

The Bitcoin halving is one of the most important events in the cryptocurrency sphere, as it usually leads to positive price movements for Bitcoin and the entire ecosystem. If we look at historical data, Bitcoin halvings usually indicate the earliest start of an upcoming bull market; they have done so for all three of the previous halvings events.

If we continue with the same trend, we can expect more growth for Bitcoin in the period after April, marking the halving as one of the most anticipated crypto events for 2024.

On the 16th of November 2023, the world’s largest asset manager, BlackRock, filed for a Spot Ethereum exchange-traded fund (ETF). This decision continued BlackRock’s push towards blockchain adoption, as they had already filed for a Spot Bitcoin ETF three months prior in June, which was approved on the 11th of January. The SEC, for now, has not yet shown interest in approving an Ethereum ETF, as on the 24th of January they delayed their decision timeline to March 10th.

With 11 Spot Bitcoin ETFs approved and trading this month, crypto investors are now speculating on whether a Spot Ethereum ETF will launch this year. Experts are mainly optimistic on the topic, as some think an approval from the SEC could come as early as May this year.

Brett Tejpaul, head of Coinbase Institutional, said in a recent interview that there’s interest and enthusiasm for a spot Ethereum ETF from its clients and noted that a number of leaders said they would see value in that kind of a product coming to market.

“We anticipate a spot Ethereum ETF approval in May with an estimated 75% likelihood.” said Matt Kunke, research analyst at crypto market making firm GSR.

“I strongly believe that we’ll see the approval of a spot Ethereum ETF this year. Bitcoin and Ethereum are both listed and regulated futures on CME, and are likely considered pretty equal in the eyes of the SEC.” said Philippe Bekhazi, founder and CEO of institutional crypto trading platform XBTO.

Although BlackRock is the biggest, it is not the first institution that filed for an Ethereum ETF, as Ark and 21Shares have already done so. The first final decision deadline for the SEC on the spot Ethereum ETF application, from Ark and 21Shares, is on May 23.

The European Union’s Markets in Crypto Assets regulation (MiCA) is a draft legislation that seeks to establish a comprehensive legal framework for regulation of virtual assets within the European Union. Essentially, MiCA is bringing practices from the already present financial market regulations to the cryptocurrency space, as well as adding some new rules.

This regulation will mark the European Union as the first major jurisdiction in the world with a tailored and comprehensive crypto law. The key objectives of MiCA are to replace individual regulations with one unifying framework, to set clear rules for service providers in the crypto ecosystem, and to provide more certainty in the regulation of crypto assets where it is not covered by existing financial regulations already.

Here are some of the most significant key points when looking at what MiCA will impact:

MiCA will apply to the majority of web3 businesses, including custodial wallets, cryptocurrency exchanges, trading platforms, crypto advising firms and crypto portfolio managers. In terms of assets, MiCa will cover asset-referenced tokens, e-money tokens and utility tokens. In the majority of cases, MiCA will also apply to non-fungible tokens.

Although the European Parliament cast its definitive vote on the 20th of April 2023, the complete MiCA legislation will enter into force this year, with December set as the month when all of the final rules will take full effect.

In the case of interest rate cuts this year, which are now at their highest level since February 2001, risky assets, such as Bitcoin, Ethereum and other cryptocurrencies would become more attractive to individual and institutional investors alike. This shift in sentiment might lead the market to become more involved in Bitcoin and the crypto industry.

Federal Reserve, Chicago

Although some analysts predict lower rates in 2024, we must not rule out the possibility of a recession and an extensive period of monetary tightening by the Federal Reserve. Raised rates and unclear macroeconomic conditions would probably negatively impact the crypto markets.

With big shifts brought by institutional investors, technical advancements and legislative changes, 2024 seems to be a critical year for the advancement of digital assets, both for adoption and advancements.

Although the year has started off on the right foot, outside factors, such as geopolitical altercations and turmoil in the global financial markets, could negatively affect the growth of the crypto ecosystem this year on a wide scale.

Debunking The Most Common Crypto Misconceptions in 2024 Cryptocurrency and...

Veli Secures Investment from DSl Angel Investor Network We are...

How Veli Transformed Vezovišek & Partnerji Into a Digital Asset...