When contemplating an investment opportunity you should take into consideration the following:

● Unsolicited contact. Contact was made out of the blue by phone call or on social media or by email or by text message regarding the investment opportunity. No legitimate advisor/broker will approach you by cold calling or cold texting these days. If that is the case, you are strongly advised to end communication immediately.

● Firm’s registration with the financial supervisory authority. Always check whether the firm is actually registered with financial supervisory authority depending on your country of residence. If the firm is not registered with the financial supervisory authority, also if the firm is registered with some exotic jurisdiction referred to as an offshore jurisdiction, then it is most likely a fraudulent firm.

● Warning lists and negative reviews. Always check whether the firm is on the warning list issued by the financial supervisory authority in your country of residence and to google “company name” and “scam/fraud” for any warnings or negative reviews. If you find that the firm in question is listed or that there are negative reviews talking about scams, it is highly recommended to discontinue engagement with the firm.

● Unknown product. If you do not understand the product that you are going to invest into, avoid it. Never hand your money over if you do not fully comprehend how and why you would get very high profits promised to you. In case of investment scam, you most likely be offered to invest into novel and complex products, related to cryptocurrency or foreign exchange.

● Unknown partners. If the firm claims that they are business partners with other trading platforms, and they do not provide any proof to it or the provided proof seems illegitimate, it is advised to discontinue engagement with such firm. Nowadays the majority of trading platforms have no partnerships with brokerage firms, thus if a firm claims to be in partnership with a trading platform, most likely it is a scam.

● Investment advice. Do not take investment advice from an unknown third party. Only take investment advice from your long time known banker/financial advisor/lawyer or anyone that you know for a longer period of time and have built trust or at the very minimum call your trusted banker/financial advisor/lawyer or anyone that you know and trust to get their opinion on the opportunity at hand.

● Pressure to make a decision. You are pressured to make a quick decision to invest, grounding it a lifetime opportunity, promising you bonuses or other benefits (e.g. time-limited offers: you either invest now or you will miss the chance). In such a case you are strongly recommended to discontinue engagement with the firm.

● Unrealistic returns. You will be offered a high or even unrealistic return on your investment. A general rule is that if the promised profits sound too good to be true, then most likely it is a scam.

● Downplaying of the risk. In case the risk of losing your investment is downplayed (e.g. incurrence of loss is non-existent), you are advised to discontinue engagement with the firm.

● Withdrawal taxes. You are asked to invest more or to pay taxes you have to allegedly pay for the fake profits received.

● Download of software. Never install any type of software on your computer for the purpose of the investment, this includes the software facilitating the remote control of your computer, such as: Anydesk, TeamViewer, ConnectWise Control etc. The scammers may get access to your banking information, meaning that they would make payments using your card or even directly from your bank account, register you on multiple service providers and trade on your behalf.

● Unknown websites. Never register on any websites suggested to you. If you do so, check the website on which you are registering (i.e., who is the owner of the website, what services available at the website etc.). You should avoid situations where you are required to answer certain questions and you are provided with the answers beforehand. You should not use any prepared answers by other persons, you should provide answers based on your knowledge.

● Unknown apps. Avoid downloading dubiously looking crypto trading apps suggested to you.

● Power of Attorney. Never provide Power of Attorney to any third person to manage any account for you.

● Unknown recipient of your investment funds. Never transfer funds to a firm other than you are investing with. If you are directed to transfer funds to a firm with a different name, it is a major red flag and you are strongly recommended to discontinue investment immediately.

● Instructions on communication. If a firm is commanding or directing you to say certain things to another trading platform (beneficiary of your funds), that is a major red flag and you should discontinue the engagement with such firm immediately. Firms may request you to say that you are performing the trading all by yourself or that you never allowed any remote access to your computer.

● Threats. If you refuse to make deposits and firms are threatening that they are going to take a legal action against you, because you owe them commission fees or taxes, do not deposit any funds but instead report the firm to your local law enforcement authorities.

● Target of other scams. In order to facilitate the crimes, fraudulent firms are sharing your personal data to related firms or unrelated ones. As a result, you may become the target of other fraudsters. Thus,if you have already become a victim of a scam, you are likely to be contacted again by a related or unrelated entity, which may be promising to help you to recover your lost funds or offer new investment opportunities.

If you believe that you happened to invest with a fraudulent firm, then discontinue transferring your funds immediately and seek legal advice.

Are you not sure whether the investment opportunity in crypto assets is legitimate?

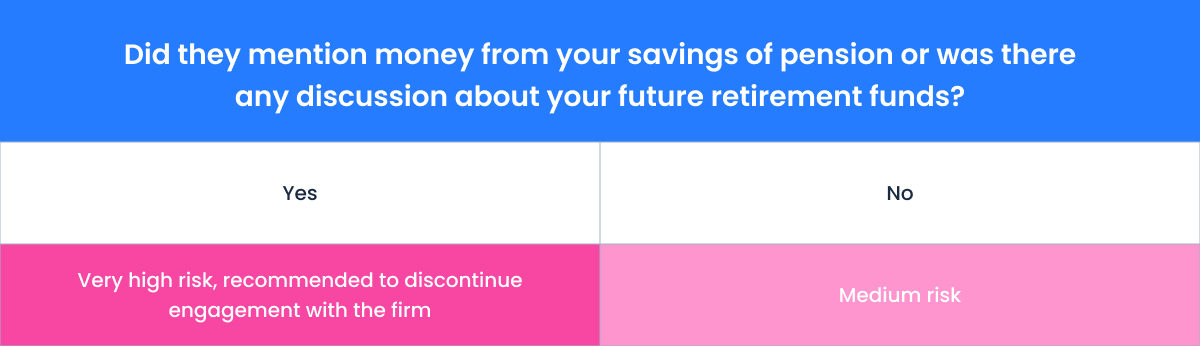

Investment opportunity checklist. If you collect 2 (or more) high risks or 1 very high risk, then it is recommended to discontinue an engagement with the firm.