Many people are interested and want to start investing in cryptocurrencies so the first thing they do is search the internet. Searching the web, you may find many sources of information on crypto. One of them is people on social media who are talking about cryptocurrencies and making predictions on the future price outcomes.

While some may be creating very helpful and educational content, most crypto influencers share misleading crypto investment advice and could cause you to lose all your investment money really fast.

That’s why in this article we are going to break down how crypto influencers operate, how they make money and how you can avoid investment mistakes that will cost you your life savings.

The goal of every crypto influencer is to get the maximum amount of views, shares and likes possible. Hence the loud and obnoxious headlines of their videos and posts. They are trying to attract as much attention as possible and the public buys into the bold statements. Some of their misleading content is: unrealistic price predictions, promoting trends that already peaked in popularity, promoting small coins without any fundamental value in them that can allegedly make you a fortune, etc.

The main takeaway here: never make investment decisions based only on attractive headlines made by influencers and always do your own research on the projects you invest in. If you ignore this and blindly buy into the hype of the crowd, then 9/10 times you are going to lose your money.

As a retail investor, you will always find a lot of content on the internet suggesting you to invest in a small unknown coin without any solid fundamentals, given a promise of making huge gains. Do not buy into such advertising without doing your own research on the project! Most of the projects will have no fundamental value or innovation to them, because most creators of such projects aim to make a quick large sum of money on a hot trend in the crypto world. The founders rarely have an intention of developing the project further after the launch and the initial cash-grab. Still they are able to sell the coin, using loud headlines communicated by influencers to the public that follows trends like a herd. The cryptocurrency world is extremely vulnerable to this mentality because much of the crowd is younger investors that don’t have much experience in the world. Do not be like them and do not fall for obnoxious marketing tactics. Always do your own research on the backbone of the project.

Paid cryptocurrencies reviews

Most of the promotional crypto content out there is paid for! Crypto firms and projects are paying anywhere from thousands to millions of dollars to various influencers, depending on their level of fame, to promote their coin. This is coming from someone who communicated with marketing teams of numerous projects during last year’s bullrun. Most of the time the projects lack fundamentals and they are advertised by social media personas not because they want to help you make money but because they were paid to speak about it.

You would think that high-tier celebrities with serious amounts of followers online would not engage in such fraudulent activities but you are wrong. They do so actively! Kim Kardashian, one of the most famous TV stars who has more than 300 million followers on Instagram, which is about 4% of the world population, was not above accepting money to promote poor crypto projects to her fans. She got paid to encourage her fans to buy a 1 month old token that didn’t even have a published whitepaper. The project had no real innovation or use-case in the real world and on top of that it was a coin that had the word “Ethereum” in its name even though it was not actually associated with the legitimate Ethereum project. Soon after the advertising campaign, the price of the coin plummeted and never rose again, leaving investors with a lot of money lost.

Kim Kardashian was not the only famous influencer who promoted untrustworthy crypto projects. On the list are: Floyd Mayweather, one of the highest paid athletes, Jake Paul, Dave Portnoy, etc.

You have to always be careful when reading promotional content on cryptocurrency projects. When investing, you have to believe in the future of the project regardless of anyone’s positive or negative opinion on it.

Affiliate programs

If you surfed the internet in search of crypto trading or investing advice you for sure stumbled upon many traders-influencers who post their huge gains that they made very quickly. Such misleading content attracts a lot of beginners who want to make immense wealth in very little time. Alongside these unrealistic results, influencers make sure to provide referral links to an exchange that they are paid to promote on their social media. Their followers could use such a link to get a discount on their trading fees once they register an account on the exchange. So the influencer’s strategy here is to post screenshots of his crazy 1000% gains on a single trade and try to lure as many newbies in as possible to register their own account on the exchange. The more new users sign up and start trading the more money the influencer and the exchange earn from commissions and fees. That’s why oftentimes the pictures that they post are not even real – the screenshots can be of an accidental big win or of a gain made while paper-trading, aka not using real money. A random big winning trade is achieved through being lucky and using very high leverage. Executing trades with leverage is borrowing additional crypto from an exchange to open a bigger position than you can afford to with your own money, which amplifies both your wins and losses. Trading and investing is a ruthless game with very strict rules to it, so not knowing the fatal risks of trading with leverage will lead an amateur to lose all of his deposit. The bottom line is a social media persona will do anything to earn a commission off of his referral link and will go to big lengths to sell it to an unsuspecting newcomer.

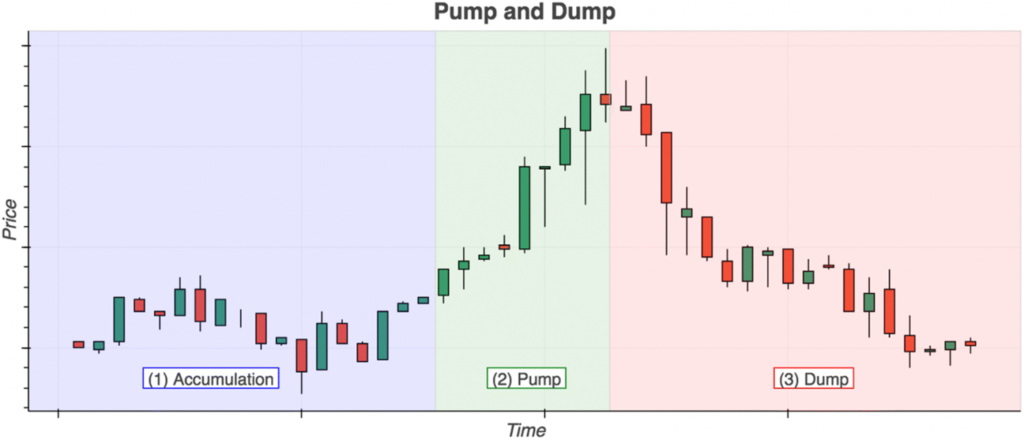

Pumping and dumping coins

Another strategy of earning money for an influencer is to promote coins after buying into them. Often you will see a crypto account talking about how great a project is and that a specific coin is going to be the next 10x gain for anyone who buys it right now. The strategy for the influencer here is to buy or receive that specific coin onto his wallet before he advertises it to the public, so once he hypes it up and the price goes up he can sell it for a profit. In the Stock Market this century-old scheme is called a “Pump and Dump” and it is illegal. One will go to jail for it but not in the crypto world. There is no concrete legislation yet that outlaws pumping and dumping coins on the cryptocurrency markets.

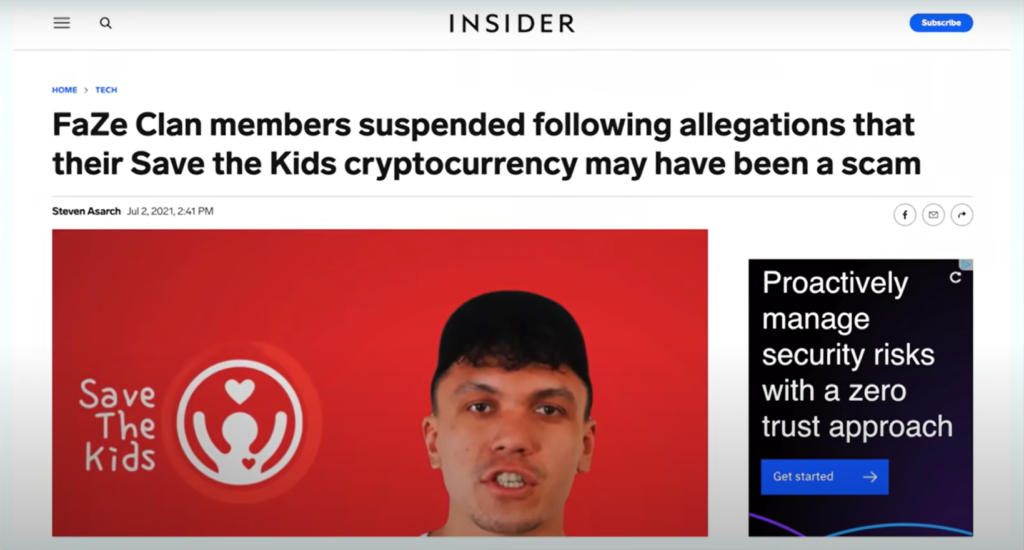

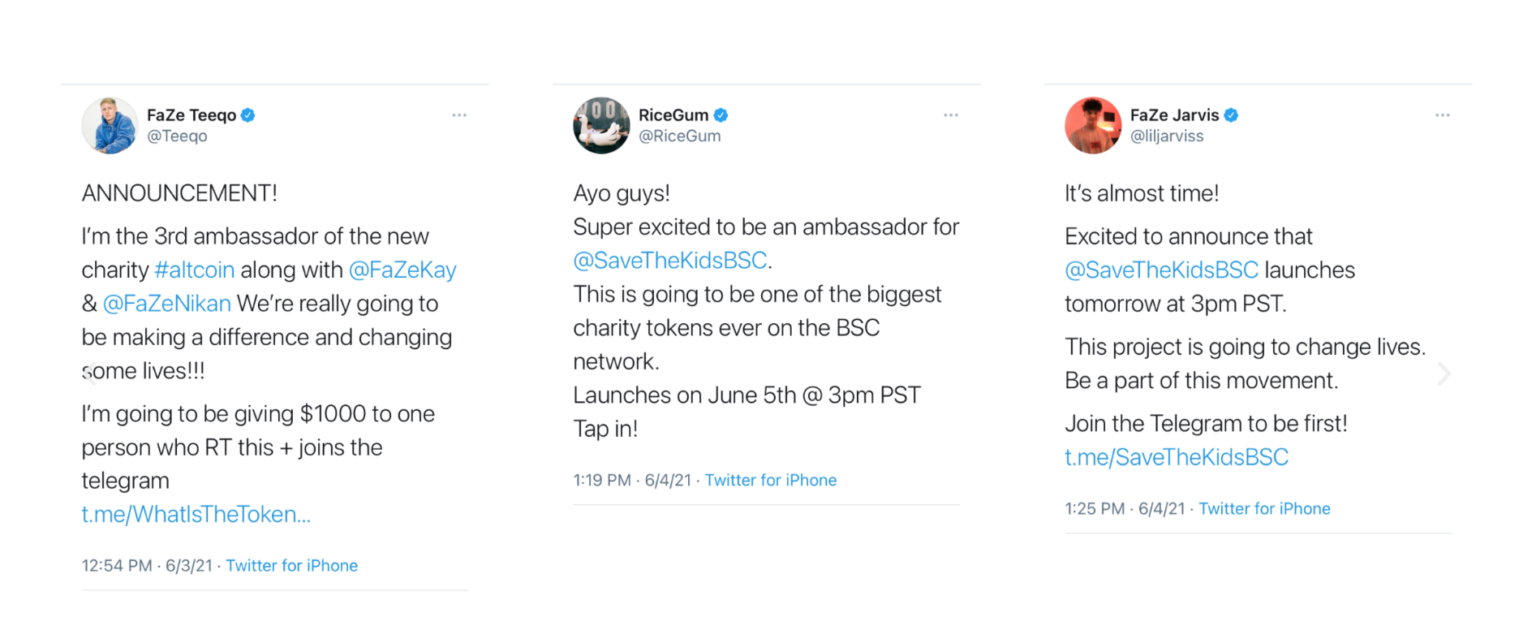

Nevertheless, it is a scam and one of the recent ones was a coin named “Save the Kids”.

The whole point of this project was to send a percentage of every transaction to a charity that helped provide children with food, but it didn’t really play out that way. Influencers involved, allocated a lot of the supply of the coin to their wallets, hyped up the coin on their social media and the followers started to buy in. Once the price rose, influencers sold off their lion shares of the coin at peak price to their fans, dumping its market price and making most investors lose their money. After that the creators of the project abandoned it and ran away with what they managed to cash out.

Some call this a “Pump and Dump”, some call it a “Rug Pull” but at the end of the day it is the same concept of extracting the larger portion of the market capitalisation of a coin against the buying pressure of the new-coming investors. So once again, we encourage you to only invest in proven and quality assets and to always do your own research on the project before putting your money in it.

General conclusion

In general, there are many ways for influencers to promote low quality projects for their personal gain, and tactics to trap you into investing in them. The three methods mentioned above are the most common types of influencer scams that you should be aware of. Our advice would be: always check every piece of information on social media and never blindly trust a person just because they are famous.

13 years have already passed since the creation of Bitcoin and the cryptocurrency market, so the participants are finally starting to mature. We had two bear markets in the past, with the third ongoing at the moment, and the people are starting to get more familiar with the market cycles and the corresponding price movements. There are now significant historical statistics and improved tools that can help us more accurately predict the future of crypto projects. This information is available to all people worldwide. Many are starting to embrace the long term investing journey with gradual gains, steering away from betting it all on one shady project. Many burning losses later the public is slowly turning to better quality digital assets with more solid fundamentals and teams behind them.

We encourage you to invest in high quality assets only using the money that you can afford to lose. You must also have a gameplan for your conquest of the market. Our application provides you with institutional-grade automated strategies that are suitable for all types of investors. We will make sure to lead you step by step through your investment journey as you outperform the strategy of simply buying and holding Bitcoin. Sign up to Veli Waiting List to get 0 trading fees in the 1st year and to be the first to know when we launch.

As we already mentioned, the safest and smartest way to invest is putting your funds into quality projects with long term potential. By that we mean investing in proven assets that have stood the test of time and will most likely survive this and the next bear markets. Longer investment horizon of 3+ years is always a good choice. History shows that the most profitable crypto portfolios were created by users who lost the passwords to their wallets and crypto has been sitting there, gaining value all these years. Another investment strategy that had some of the best historical results so far is Dollar-Cost-Averaging (DCA). Alternatively, a good passive income strategy with your crypto is staking or lending it.

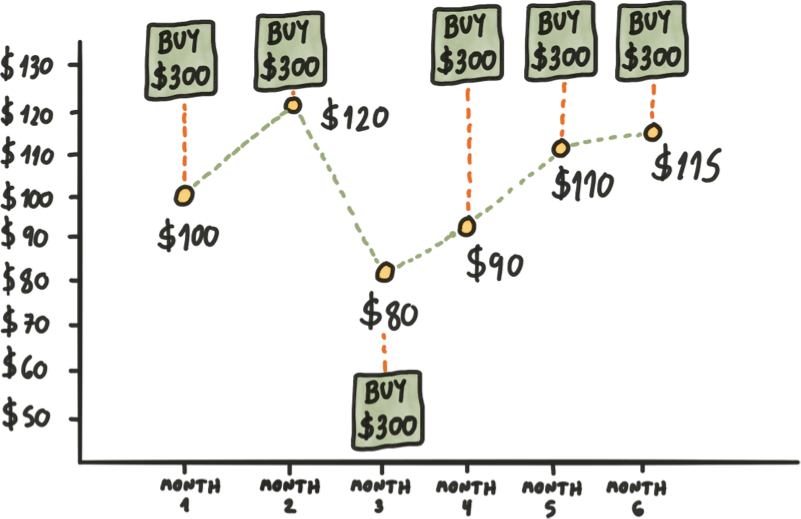

Dollar-Cost-Averaging

Dollar-Cost-Averaging is the one strategy that made the most millionaires in the crypto space. DCA is a strategy of investing small equal amounts of money repetitively in specified time intervals for a set period. For example, we can set our strategy to invest 100$ in Bitcoin every two weeks for 2 years, rather than investing the whole amount at once. Investing like that, we are buying our BTC at the average price of that whole 2 year period of buys and reducing our chances of purchasing it at its highs. Accumulating like this, we are protecting ourselves from some of the long term losses and we are gradually making profits as price goes back up.

Staking

Staking is a way of earning rewards for holding certain cryptocurrencies on a platform. Most of the cryptocurrency projects are now based on a Proof-of-Stake (POS) consensus mechanism. POS mechanism ensures that all the transactions are verified and secured without any third party interfering. If you choose to stake your coin, it becomes a part of this process as you help secure the blockchain that the coin belongs to. With delegating coins to secure the network, stakers are getting rewards for each transaction made on the network. Some of the yearly rewards could reach 10-25% of the investment. More casual staking reward rates are around 2-5% APY. So if you are a long term hodler or have some cash laying around, it’s always a good option to put it to work and earn some interest while holding coins. Don’t forget that some of the protocols have a vesting period for staking the coins which means staked crypto won’t be available for withdrawal before the vesting period runs out, or withdrawal will be possible with a penalty.

Crypto lending

Another method of earning high interest on your investment is lending your crypto. By lending your crypto, you are depositing a certain amount of your coins, on a crypto lending platform, that lends it out to borrowers in return for high interest payments. Payments are usually made in the same cryptocurrency used for lending and it’s usually compounded every day, week or month. To access a crypto loan, borrowers are required to deposit a crypto collateral. Overall, crypto lending is another good way to put your cryptocurrencies to work and earn good passive income.

One of our main objectives with Veli is to provide for a simple and effective investment journey into the world of digital assets of tomorrow. We want to enable anyone to start their crypto journey today, even if they don’t have any prior experience in the field.

Our platform is carefully designed to help you in every step. We provide extensive educational material and research that will save you hours of frustration. Read the articles on our website and get answers to your most burning questions!

Our application will have automated strategies built on cutting-edge institutional data that will invest your money in the most effective way. Choose the one you like the most based on your tolerance to risk. Sit back and enjoy your crypto learning journey with Veli! Sign up right now for our app-launch in November and enjoy the early access benefits.

Veli Unique Value Propositions: