Q1 2025 Market Report This report will cover all the...

Ever since the collapses of $LUNA, 3 Arrows Capital, Celsius and FTX, the crypto market has been in a slow downfall, with the total market cap falling -75% from the all-time high of $3.07T in November 2021, to the most recent low of $0.72T in November 2022.

In 2023, the crypto market has slowly been recovering from the large drop in 2022, and the most significant growth can be seen in the most recent period. In the past month, the crypto market has experienced a 40%+ increase in overall market cap, driven by several major news headlines, macroeconomic factors and new liquidity sources.

This blog post will explore the recent price movements, previous indicators for the start of a bull market, and insights from experts to provide a comprehensive view of when we could potentially see a new bull market – or answer whether we are already in it.

In the past month we’ve seen significant developments both in the traditional and crypto markets. Here are some of the top headlines which pushed the market to exponential growth in this period:

8 to 10 Bitcoin Spot ETF filings are currently in front of the SEC’s commision, signifying growing interests within large financial corporations to acquire Bitcoin. The news about the Bitcoin Spot ETF had the biggest impact on the market, resulting in a steady rise in Bitcoin’s price.

Large financial institutions, like Blackrock, Fidelity, Valkyrie, Invesco and Bitwise filed for the Bitcoin Spot ETF. Furthermore, the world’s leading asset manager (with $9T AUM), BlackRock, is confident the SEC will approve their filing by January 2024.

Furthermore, BlackRock has also filed for an Ethereum Spot ETF with Nasdaq. This move shows a never-seen-before growing interest from the once-crypto-skeptical conglomerate corporation.

This filing could also indicate that BlackRock is not just interested in the “store of value” aspect of crypto (Bitcoin), but also in the technological developments (Ethereum) and how they will impact the future of finance.

Furthermore, BlackRock has also filed for an Ethereum Spot ETF with Nasdaq. This move shows a never-seen-before growing interest from the once-crypto-skeptical conglomerate corporation.

This filing could also indicate that BlackRock is not just interested in the “store of value” aspect of crypto (Bitcoin), but also in the technological developments (Ethereum) and how they will impact the future of finance.

The United Kingdom’s central bank, the Bank of England (BOE), has released a plan to govern the stablecoin crypto market through rules released by the UK government in early November.

According to the UK government’s proposal, regulations for fiat-backed stablecoins will begin in early 2024. The Bank of England (BOE) will regulate stablecoins while the Financial Conduct Authority will govern the larger crypto market.

UK Prime Minister Rishi Sunak had announced that he wants the nation to become a crypto hub, maintaining that introducing clear rules for digital assets and crypto firms falls within the UK’s goals.

The notorious FTX founder, Sam Bankman-Fried, has been found guilty on all 7 charges including defrauding customers, money laundering and campaign finance offenses.

Sam is facing a maximum sentence of 115 years in prison after evidence proved that he defrauded customers for over $8Bn through FTX’s sister company, Alameda Research.

Although peculiar, this can be seen as positive news, as all punishment of bad players helps improve the integrity of the crypto industry.

On the 31st of October, the Federal Reserve decided to pause interest rate hikes for the second consecutive meeting, after also pausing them in September.

For the majority of 2022, the Federal Reserve has been aggressively raising interest rates to try to put a halt on inflation. They raised interest rates for more than 10 consecutive meetings from March 2022 to 2023.

The rates are still scheduled to stay between 5.25% and 5.50% in the wake of the consecutive hike pause. Furthermore, the US economy has defied predictions of an imminent slowdown by demonstrating its resilience.

All of the above mentioned headlines have been the main catalysts for the growing crypto prices the past few weeks.

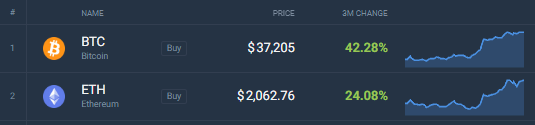

In the past 3 months, Bitcoin has seen a steady growth of 42%+ and is sitting at $37,210 at the time of writing, while the highest price Bitcoin reached in this period was $38,000.

Ethereum followed Bitcoin in a similar manner but slightly underperformed it, with a growth of 24%+, and a current price of $2,060. The highest price Ethereum reached in this period was $2,135.

Furthermore, Bitcoin and Ethereum are both testing their resistance levels, situated between $38.000 – $40.000 for Bitcoin and $2150 for Ethereum.

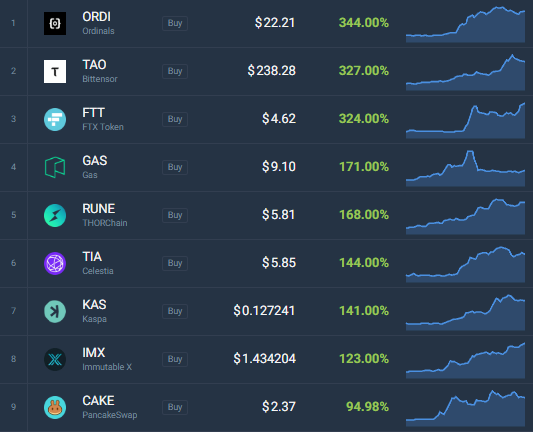

In the past month, we’ve seen 3 altcoins with returns of over 300% during that period – Ordinals $ORDI (344%), BitTensor $TAO (326%) and FTX Token $FTT (325%).

Other top altcoins leading the “Top Gainers” list are Gas $GAS (172%), Kaspa $KAS (140%), Celestia $TIA (144%), THORChain $RUNE (168%) and ImmutableX $IMX (123%).

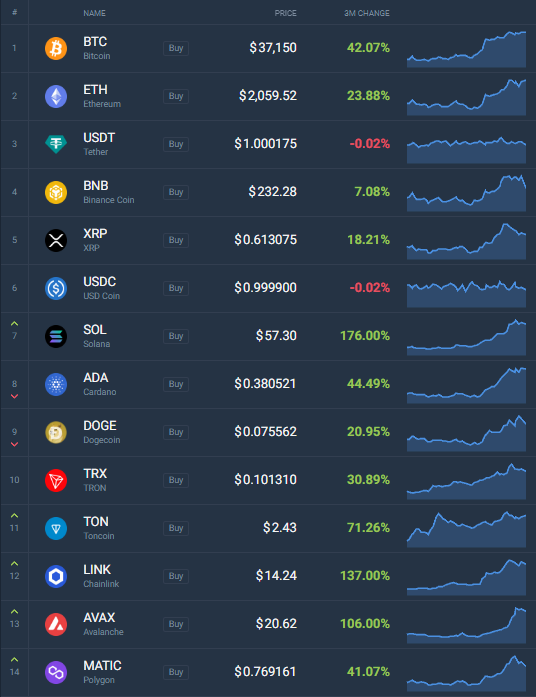

We have also seen significant growth for “Blue Chip” cryptocurrencies – the coins in the top 15 by market cap list – in the past 3 months.

BNB $BNB (7%), Ripple $XRP (18%), Solana $SOL (176%), Cardano $ADA (44%), Avalanche $AVAX (106%), Chainlink $LINK (137%), Polygon $MATIC (41%).

Due to the exuberant price growth of some cryptocurrencies, there is a debate in the crypto community whether we are already in the bull market, or are still waiting for the big wave of new influx to start. Let’s dive into some factors and insights so we can form a clearer answer on the topic.

Even though euphoria is flooding social media and crypto outlets, we should still keep in mind that we are far from the old all-time highs of Q4 2021.

The crypto market cap is down around -55% from the old all-time high, meaning that we are halfway to getting back to the old market top. This is a significant increase from the low of -75% from all-time high during Q4 2022, but it is still a large retracement that will need an improved macroeconomic landscape if we want to return to previous highs.

Bitcoin and Ethereum are respectively down from their all-time high by -47% and -60%. Although top altcoins have seen significant growth the previous month, they are still far from their previous highs:

BNB $BNB (-65% from ATH), Ripple $XRP (-84% from ATH), Solana $SOL (-77% from ATH), Cardano $ADA (-88% from ATH), Avalanche $AVAX (-85% from ATH), Chainlink $LINK (-75% from ATH), Polygon $MATIC (-71% from ATH).

A major bull-market catalyst that every investor is waiting on is the Bitcoin halving – the event that reduces Bitcoin inflation by 50%. The next halving, planned for April 2024, will reduce Bitcoin’s inflation from 1.88% to 0.94%.

The first Bitcoin halving was in November 2012, and a new all-time high was reached 368 days after the event. The second Bitcoin halving was in July 2016, and a new all-time high was reached 527 days after the event. The third Bitcoin halving was in May 2020, and a new all-time high was reached 548 days after the event.

If we are following the historical halving data (which doesn’t guarantee 100% accuracy, and is not always correct), we could assume that the next Bitcoin ATH should happen between April 2025 (at the earliest) and October 2025 (at the latest), with the most probable period for a bull market peak being July – August 2025.

With the next Bitcoin halving about 5 months away, it’s a good opportunity to explore and consider growing your portfolio before the potential market movements.

If you need help to get started and bridge the knowledge gap, you can always book a free call with a personal crypto mentor at https://veli.io/mentor/, or simply invest in Veli Strategies that automatically track top coins and rebalance each month, through the Veli app https://linktr.ee/veli.io/. You can take a quiz in the Veli app, add your starting capital, risk level and investment goals to get the perfect strategy for you.

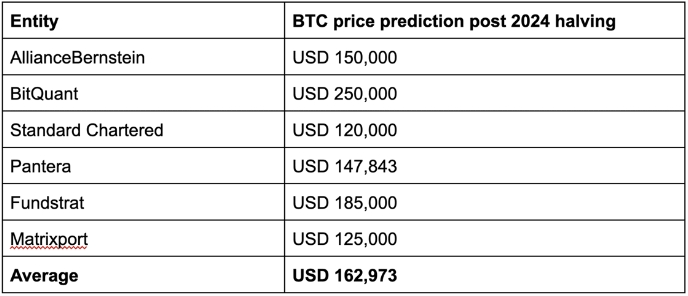

Institutional investors and asset managers have already started writing down their predictions for Bitcoin post-halving – the event that is seen as the early catalyst for the bull market.

Standard Chartered and MatrixPort are on the more conservative side, and are predicting a price of $120.000 – $125.000 per Bitcoin, while AllianceBernstein and Pantera are predicting a price of $147.000 – $150.000 per Bitcoin. More generous estimates of Fundstrat and BitQuant predict a price of $185.000 and $250.000, respectively, for a single coin.

The average of all of these predictions can be calculated to $162.000 per Bitcoin, post 2024 halving.

As the Spot Bitcoin ETF will be one of the major catalysts for the rise of Bitcoin’s price, it is crucial to follow the approval deadlines. Below you can find the deadline dates for the approval of the Spot Bitcoin ETF for all of the Issuers:

The past month has witnessed a resurgence in the overall market cap, fueled by major players entering the crypto space, regulatory developments, and the crypto community’s evolving dynamics.

Notable events include the surge in Bitcoin (and Ethereum) ETF filings, the Bank of England’s exploration of stablecoins as a form of payment and he decision by the Federal Reserve to pause interest rate hikes

In terms of top gainers, altcoins like Ordinals ($ORDI), THORChain ($RUNE), and GAS ($GAS) have substantially outperformed the rest of the market. Blue-chip cryptocurrencies, including Solana ($SOL), Avalanche ($AVAX), Chainlink ($LINK), and Polygon ($MATIC), have also displayed considerable growth.

Through historical price movements and data, although not always accurate, a prediction could be made that the next Bitcoin all-time high will be reached between April and October 2025, with a price per Bitcoin of $120.000 – $250.000.

A more specific estimate would assume the reaching of a new Bitcoin all-time high in July-August 2025 with a price of $162.000 per Bitcoin, predicted by some of the largest financial institutions and asset managers in the world.

Veli is Going for the MiCA License! A new era...