Veli Won Best Startup Award by Plug and Play 🏆 Thanks to...

“When will crypto reach the bottom?” is a burning topic in many investors’ minds, especially since 2022 was less than ideal for crypto owners. Still, many of them believe in the cyclical nature of stock (and crypto) markets. So, the real question here is, “Has crypto hit bottom?” or is it about to?

Trying to predict price movements in such a volatile market is quite challenging. You’ll find divisive opinions on whether the price of Bitcoin (or any other crypto asset) will go up or down. Those who believe in the latter look for the crypto bottom, or the lowest price of an asset before it starts surging again. Therefore, we’ll explain what crypto bottom is and how to spot it below.

Table of contents

In short, the crypto bottom is the lowest point of the prevailing downtrend. This happens in cycles (roughly 4 years). The encouraging aspect is that each cycle thus far has reached a higher peak than the previous one, indicating a positive trend as cryptocurrency adoption continues to increase. As an investor, you want to prevent losses and acquire more coins for the same cost. To do that, you have to know when to enter. For this reason, it is vital to monitor bottoms to start investing near the cycle bottom. Once the price reaches the bottom, it typically starts surging, and this trend can continue for the next 2 years.

Several indicators can show whether or not a crypto asset has hit bottom. Here’s how and where to look for the crypto bottom signs.

In 2013, the total crypto market cap was $10.6 billion, only to drop to $5.5 “billion” after 12 months. If you examine the overall value of the cryptocurrency market, you’ll see that there are year-over-year fluctuations in these figures. However, regardless of what the digits might show, the overall trend is progressing in an upward fashion.

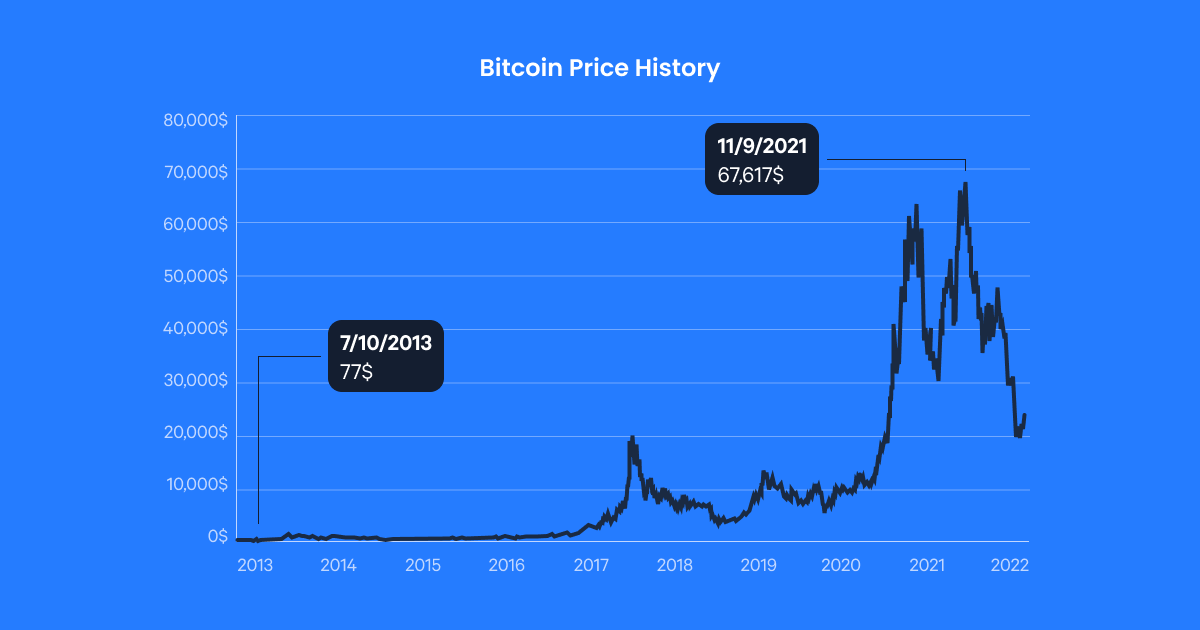

Accordingly, the cryptocurrencies’ value goes up as well. For example, looking at the bitcoin price history, we can notice in 2015, $171.51 was the lowest point, while the highest price was $495.56 for 1 BTC. In 2017, you could buy Bitcoin for $755.76 and sell it for $20,089. In 2022, the lowest price of Bitcoin was $15,599, while the top value reached $48,086! It may be worth considering the fact that the rate of increase is decreasing (from 500x, to 126x, and then to 21x…), which is noticeable and potentially significant.

Emotion is another key crypto bottom indicator. Most people buy when the overall trend is going up and when you can predominantly find positive news about crypto in the media outlets. Also, they sell when the market starts going down. The common denominator for both cycles is fear. Individuals typically adopt the so-called “herd mentality” in the bull market fearing they will miss out on an opportunity (FOMO) and lose their investment (panic) in the bear market.

So, a practical approach to this issue would be to stop thinking like the rest and, instead, start analyzing the market without relying on the decisions of others (at the very least, most of them). Theoretically, one should start buying when the price is down and sell when it hits an all-time high. This is the only way to truly attain a positive return on investment.

If you’re easily influenced by social media and news, the market sentiment can prevent you from recognizing the right moment to invest. It may result in missing the chance to buy when the price of an asset bottomed. Analyzing the crypto market and reading technical, fundamental and sentiment analysis can be challenging for beginners.

That’s one of the reasons that the Veli app was created in the first place. This platform analyzes the market for you and identifies the right moment to invest. The app’s goal is to purchase assets at or near their lowest price and sell them at or near their highest price, a strategy that is advantageous because it is not swayed by emotions or investors’ fear of losses, but instead relies purely on numerical analysis.

Past price movements are another critical aspect in determining the crypto bottom. For instance, consider the Bitcoin price drops in the past bear market years. From the peak price in 2013, BTC dropped 87% in the bear market period, which was the most significant price drop to date. From the next cycle peak in 2017, the price went down by 84%. From the most recent peak in 2021, the price yet again plummeted by 77% so far.

Probably the biggest loser in the entire crypto market is Luna. The South Korean-based cryptocurrency was tied to Terra, a stablecoin pegged to different fiat currencies. Luna and UST were delisted from major crypto exchanges worldwide. This event is significant as it still somewhat influences the entire crypto community and the investors’ behavior. Sources like CoinMarketCap can help you track the cryptocurrency price movements and find which crypto is the most down.

When it comes to the price fluctuations of cryptocurrencies, opinions are divided. On the one hand, many crypto experts believe that crypto has already hit the bottom and that the price will rise rapidly relatively soon.

On the other hand, experienced crypto investors believe that the price of Bitcoin could plunge to $5,000. As a result, it’s possible that other cryptocurrencies may continue to decrease in value, and noteworthy market shifts are not anticipated until the third or fourth quarters of 2023.

It is challenging to predict price movements, regardless of experience. Different sources will tell different stories. In reality, it is challenging to predict what will happen to Bitcoin in 2023 as this is the first time a bear market coincides with a wider global economic crisis. Therefore, we have analyzed 3 possible scenarios.

Some experts believe Bitcoin will suffer due to many macroeconomic factors. However, it’s not the first time this cryptocurrency has faced a price crisis. In 2017, Bitcoin hit a $19K top, only to drop to $3,5K (around 80% lower) a few months later. As a reminder, Bitcoin entered 2022 with a price above $40K.

On-chain data indicate Bitcoin has bottomed. The cryptocurrency has surpassed the realized price for short-term and long-term investors, as well as the average price. On the other hand, despite Bitcoin’s climb to $24k, we could see another bottom forming in 2023, following the FTX demise, which could continue to influence the market.

Alternatively, Bitcoin could potentially lose almost half of its current value, and it’s difficult to determine whether a drop to $10K is a realistic possibility. Nonetheless, there are several factors to consider that could potentially accelerate a downward price trend.

Holding BTC or any other cryptocurrencies may become less attractive to the broader masses once FED interest rates increase. However, many factors can push the price up or down.

The crash of the FTX exchange led to a chain event, which resulted in the instability of several related firms, now facing bankruptcy. Should these companies resist challenges and remain solvent, it may potentially be time to consider whether or not Bitcoin will bottom out.

Positive news surrounding crypto could trigger the Bitcoin price moving up. The end of the war or XRP winning the case against SEC would potentially push the BTC price upwards. According to Brad Garlinghouse, CEO of Ripple, this legal drama may end in the first half of 2023, possibly indicating a more positive trend in the future.

Regardless, a BTC price drop is nothing to be afraid of if you’re playing the long game.Investors who plan to hold onto their cryptocurrency for over a decade would probably welcome the chance to buy Bitcoin at $10K. This could present a favorable opportunity for investment, particularly since numerous investors, such as Scaramucci, anticipate that the price of Bitcoin will be between $50K and $100K by the end of 2023.

Bitcoin might also reach its bottom by dropping down to $7K. While this scenario would be far from ideal for those with skin in the game, it similarly wouldn’t (and shouldn’t) be enough to abandon ship. You’ll find a handful of experts that believe some crypto platforms’ liquidity problems will cause BTC’s price to drop significantly.

Many believe the world is headed to recession, which is expected to begin in the first half of 2023. In such a scenario, the GDP will start dropping, which could indicate a drop in productivity. Businesses might start closing rapidly, and the overall purchasing power could significantly decline. As a result, investors will look to reduce exposure to cryptocurrencies, i.e., riskier assets. In consequence, the price of BTC could drop to $7K.

Yet again, few believe it’ll come to that as the investors’ confidence in BTC, as well as other cryptos, remains high. After all, even if the pioneer of all crypto assets reaches the $7K bottom, it would be an ideal opportunity for newcomers to step in and potentially earn massive profits after the price rebound. It wouldn’t be the first time the crypto market would reward the most persistent individuals.

It is nearly impossible to confidently predict whether it’s the right time to get more involved with crypto. If you believe scenarios 2 and 3 are realistic, but you’re confident that BTC’s price will bounce to $30-40k by the end of 2023, you could go for DCA (Dollar Cost Average). In other words, instead of investing $1,000 in Bitcoin all at once, you can divide this amount into smaller, equal sums ($250, for example) and deposit at regular time intervals.

Because it’s difficult to predict the exact bottom, investing all at once is likely not the optimal approach. Alternatively, you can divide the investment amount and make purchases incrementally over the course of several months. Consequently, this technique can help you get a good average purchase price.

Alternatively, you can wait for Q2 2023 to end and see what happens. If Bitcoin’s price continues to drop, adding to existing long positions could be an ideal solution. Nevertheless, we advise you to conduct your own thorough research and analyze the market in more detail, before increasing your involvement in the fascinating yet volatile realm of cryptocurrencies.

If you struggle to follow the market because of your busy schedule and need an expert to talk to, join the Veli waitlist and book a free call with your crypto mentor.

Latest Articles

Veli Won Best Startup Award by Plug and Play 🏆 Thanks to...

Veli Partners with DEC Institute to Equip Finance Professionals for the Future...

Inside the Mechanics of Crypto Indexes – How Are They Actually Constructed...