Veli Won Best Startup Award by Plug and Play 🏆...

This report will cover all the shifts that the general Crypto market, and some of its most important players, experienced during Q4 2024. Here’s everything you need to know about the most recent quarter in crypto, from raw data and analyses, to novel projects and regulatory news.

Q4 marked a massive acceleration of the market, with the total cryptocurrency market capitalization reaching an ATH of $3.908t! This echoed towards the top 5 cryptocurrencies of course, all of which experienced a rise during this quarter.

This rise was driven following Donald Trump’s presidential win amid the hopes of a friendly approach toward digital currencies, supported with an increased SPOT ETFs inflows, which sparked a crypto market rally.

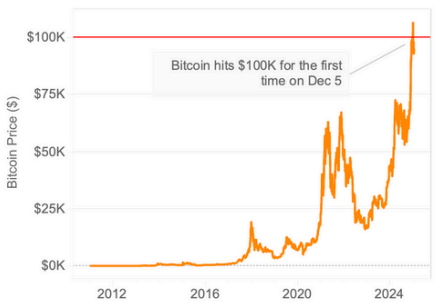

Throughout Q4, the world’s leading cryptocurrency experienced a price increase of approximately 47% (71% at its peak), rising from $63,275 to $93,339. Bitcoin’s highest price during the quarter was $108,469, reached on December 17th, marking the highest value in its history.

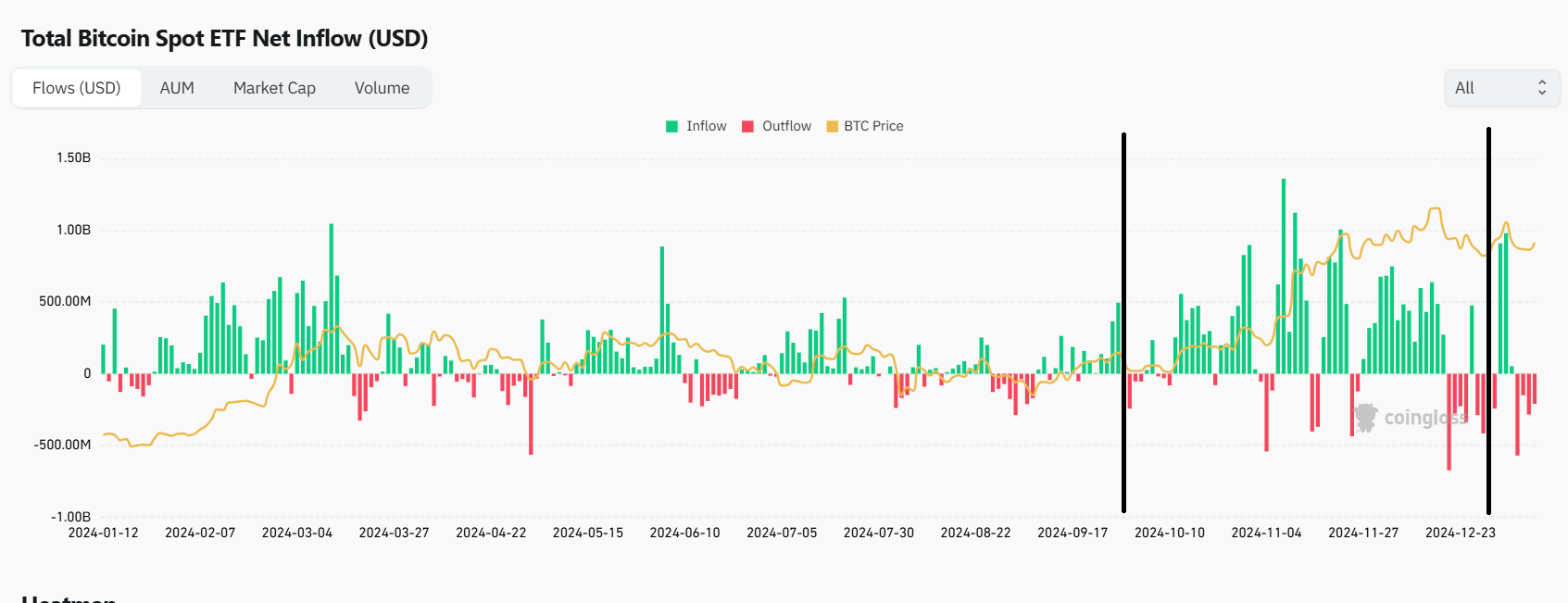

Bitcoin SPOT ETFs

Bitcoin Spot ETFs experienced massive inflows of approximately $21.174 billion in Q4 2024, marking their highest quarter for inflows! IBIT maintained its position as the leader by assets under management (AUM) of $56.23b, followed by FBTC ($20.54b) and GBTC ($20.46b). The majority of inflows this quarter were once again attributed to IBIT which now holds 559.56k BTC (2.66% of the total Bitcoin supply).

The runner-up saw a slightly smaller increase compared to Bitcoin, with a price rise of approximately 32.3%, starting the quarter at $2,520 and ending at $3,335. The peak price during this quarter was $4,108, which still fell short of the previous all-time high from November 2021.

Ripple wound up being the biggest gainer of the top 5, closing the quarter with 310,9% rise, going from $0.508 to $2.08. At the peak of the price in this quarter, XPR was priced at $2.9. Which is an astonishing 477% rise in this quarter compared to the peak. The rise was credited to the positive developments around its legal battles and Donald Trump winning the U.S. presidential elections.

Binance’s BNB showed steady price growth among the top five cryptocurrencies, with an approximate 23.7% increase, rising from $567 to $702 by the end of the quarter. The highest price BNB reached during this period was $793.

Solana also experienced steady growth, with its price rising from $152 to $189, marking a 24% increase for $SOL. The peak price during the quarter reached $264.

Bitcoin surpassed $100K on December 5, 2024, after Donald Trump’s presidential win sparked a crypto rally. His pro-crypto promises, including a national Bitcoin reserve and tax-free crypto transactions, fueled optimism. While momentum slowed by year-end, Bitcoin more than doubled in value.

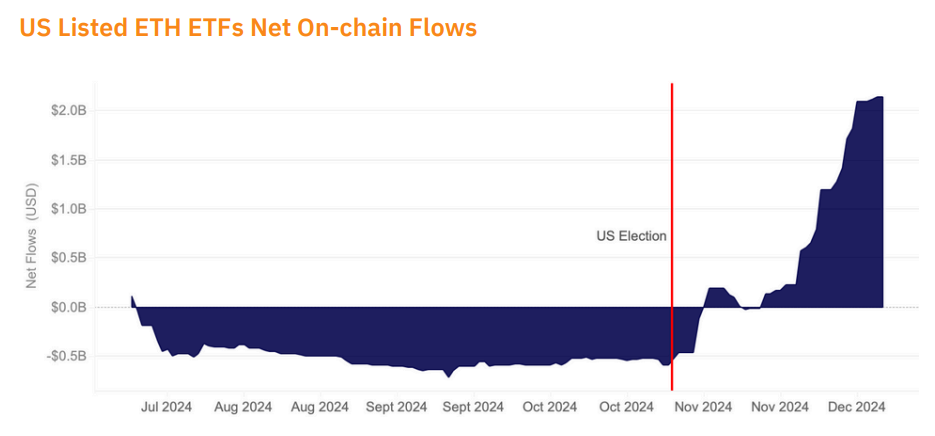

Net inflows into spot ETH ETFs turned positive in Q4, supported by broader price gains after the U.S. election and ETH-specific drivers. Regulatory clarity in the U.S. could significantly benefit ETH, which has faced challenges due to uncertainty. The outgoing SEC commission has penalized firms offering ETH staking and has yet to officially define whether ETH is a security or commodity.

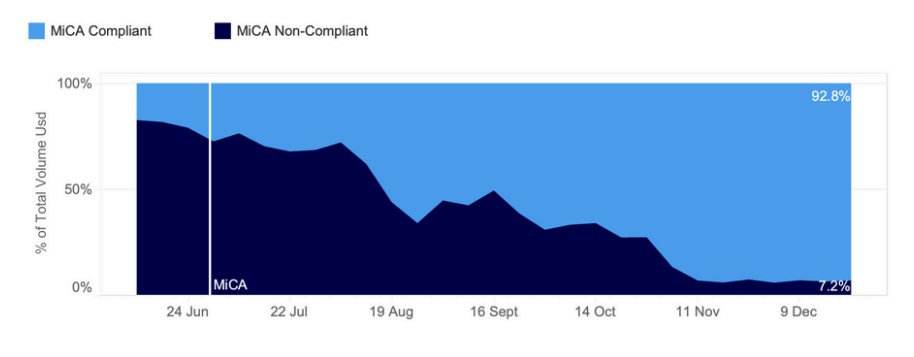

Since the EU’s MiCA crypto regulation took effect in June, the European stablecoin market has seen a resurgence. MiCA-compliant EUR-backed stablecoins like Circle’s EURC, Société Générale’s EURCV, and Banking Circle’s EURI now dominate 93% of the euro stablecoin market, up from 20%. In contrast, non-compliant EUR stablecoins have faced declining demand and delistings. In November, Tether announced it would discontinue its EUR-backed stablecoin, EURT, but plans to stay active in Europe through investments in Malta-licensed StabIR and Netherlands-regulated Quantoz.

Donald Trump wins US Presidential Elections on November 5. President Trump’s administration signaled strong support for cryptocurrencies. Plans were announced to create a strategic national reserve of Bitcoin and to appoint pro-crypto individuals to key regulatory positions, such as the SEC. These moves generated optimism for a more crypto-friendly regulatory environment in the U.S., influencing market dynamics and investor sentiment.

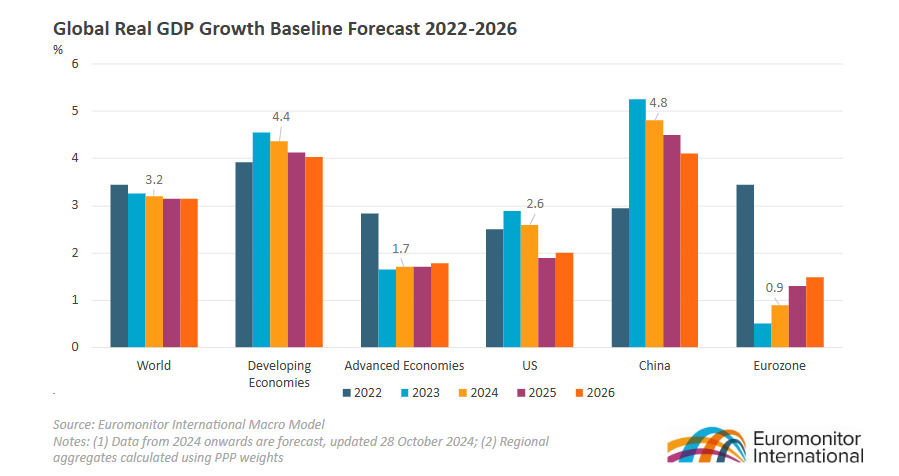

In the fourth quarter of 2024, the global economy exhibited steady growth, with real GDP increasing by approximately 3.2%, maintaining this rate into 2025. This growth, while stable, remained below pre-pandemic levels, reflecting the lingering effects of earlier economic disruptions

Throughout 2024, central banks in major economies began easing monetary policies in response to moderating inflation. For instance, the European Central Bank (ECB) reduced rates three times during the year, aiming for neutrality by 2025.

Similarly, the U.S. Federal Reserve implemented two rate cuts, totaling 75 basis points by November 2024. These adjustments were designed to support economic activity amid easing inflationary pressures.

Lower interest rates in the U.S. and Europe (due to Fed and ECB rate cuts) created a more favorable environment for risk-on assets, including cryptocurrencies.

Regional Economic Performance:

United States: The U.S. economy demonstrated resilience, with real GDP growth projected at 2.6% for 2024. However, a slowdown to 1.9% is expected in 2025, influenced by the lagging effects of high interest rates and a potentially weakening labor market.

Eurozone: The Eurozone continued its gradual recovery from the 2023 economic downturn. Growth is expected to improve in 2025, supported by falling interest rates and the economy emerging from stagnation. Nevertheless, challenges persist, particularly in Germany, which faced declining investment and weak exports.

China: China’s economy struggled to meet its official growth target of 5% annually, hindered by a sluggish property sector, weak domestic demand, and sluggish exports. Real GDP growth is forecasted to soften from 4.8% in 2024 to 4.5% in 2025.

Steady GDP growth, especially in developed economies, increased investor confidence across all asset classes, including cryptocurrencies.

Global inflation experienced a significant decline, dropping from 6.5% in 2024 to an anticipated 3.8% in 2025. This downward trend was observed across various regions, with Europe’s inflation rate decreasing from 7.8% in 2023 to 4.2% in 2024. The reduction in inflation allowed central banks to adopt more accommodative monetary policies, fostering an environment conducive to economic growth.

Lower inflation improved overall economic stability, encouraging broader participation in digital asset investments.

Despite the slight upward revision, the overall trend remains downward, with inflation decelerating from 4.1% in 2023.

The macroeconomic conditions in Q4 2024 provided a mixed but overall positive environment for cryptocurrencies. Lower interest rates and inflation, coupled with GDP growth and institutional adoption, drove renewed market interest.

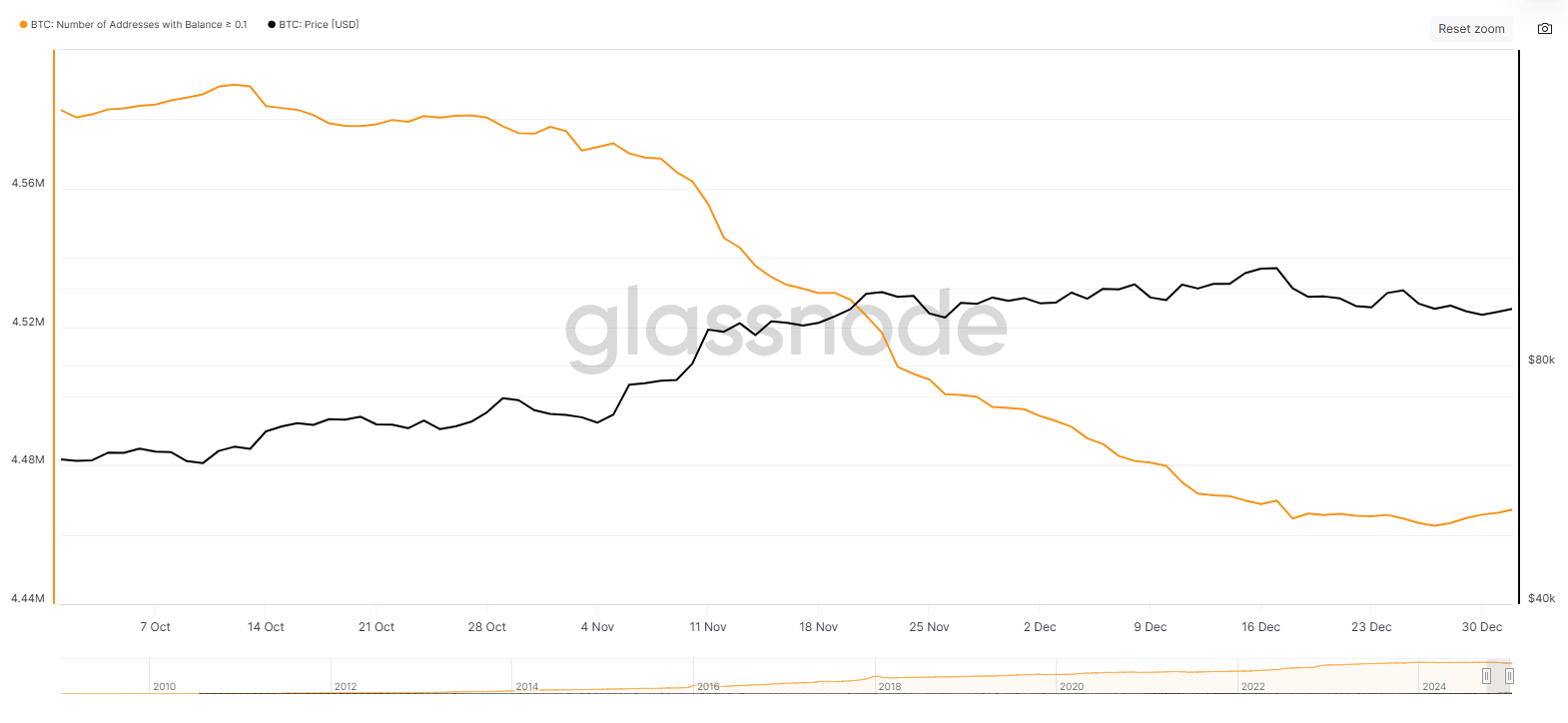

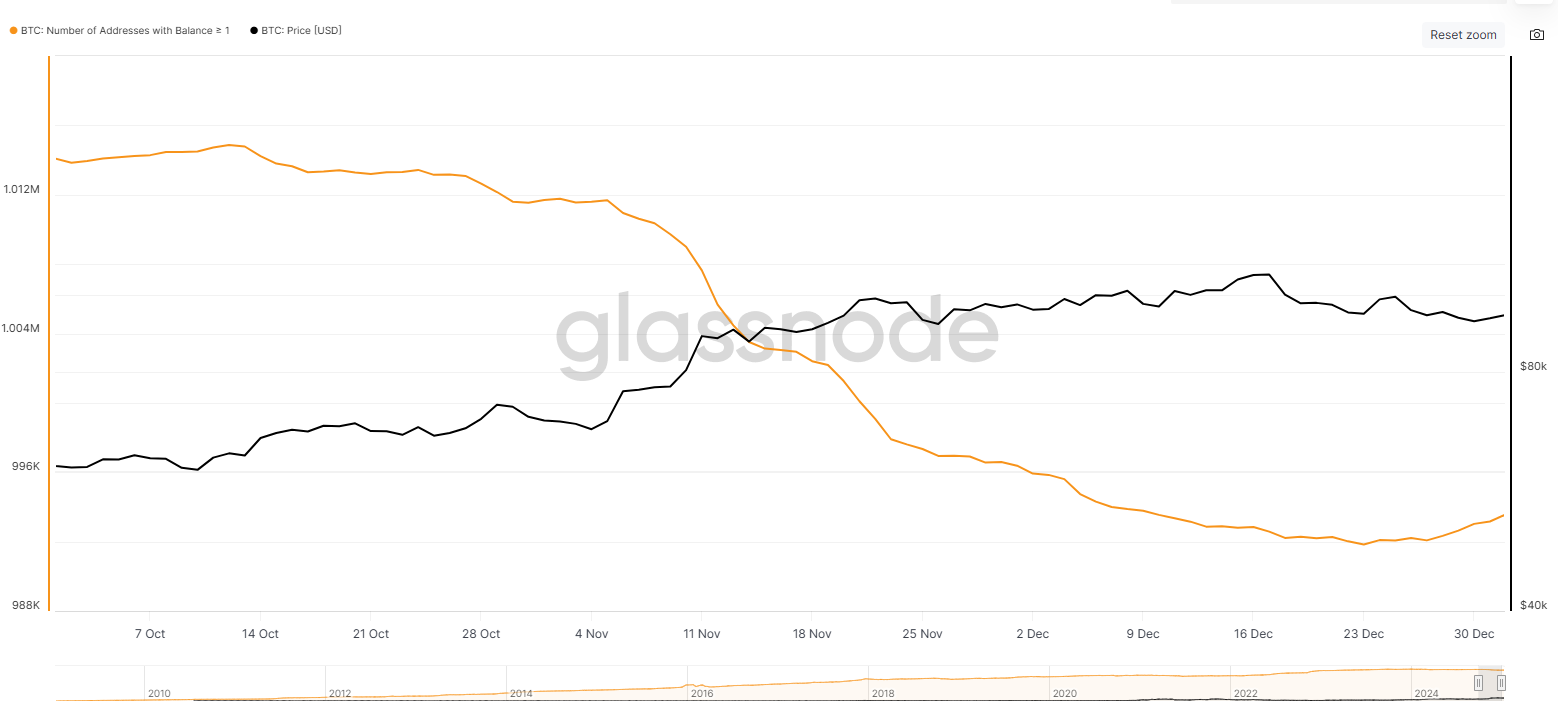

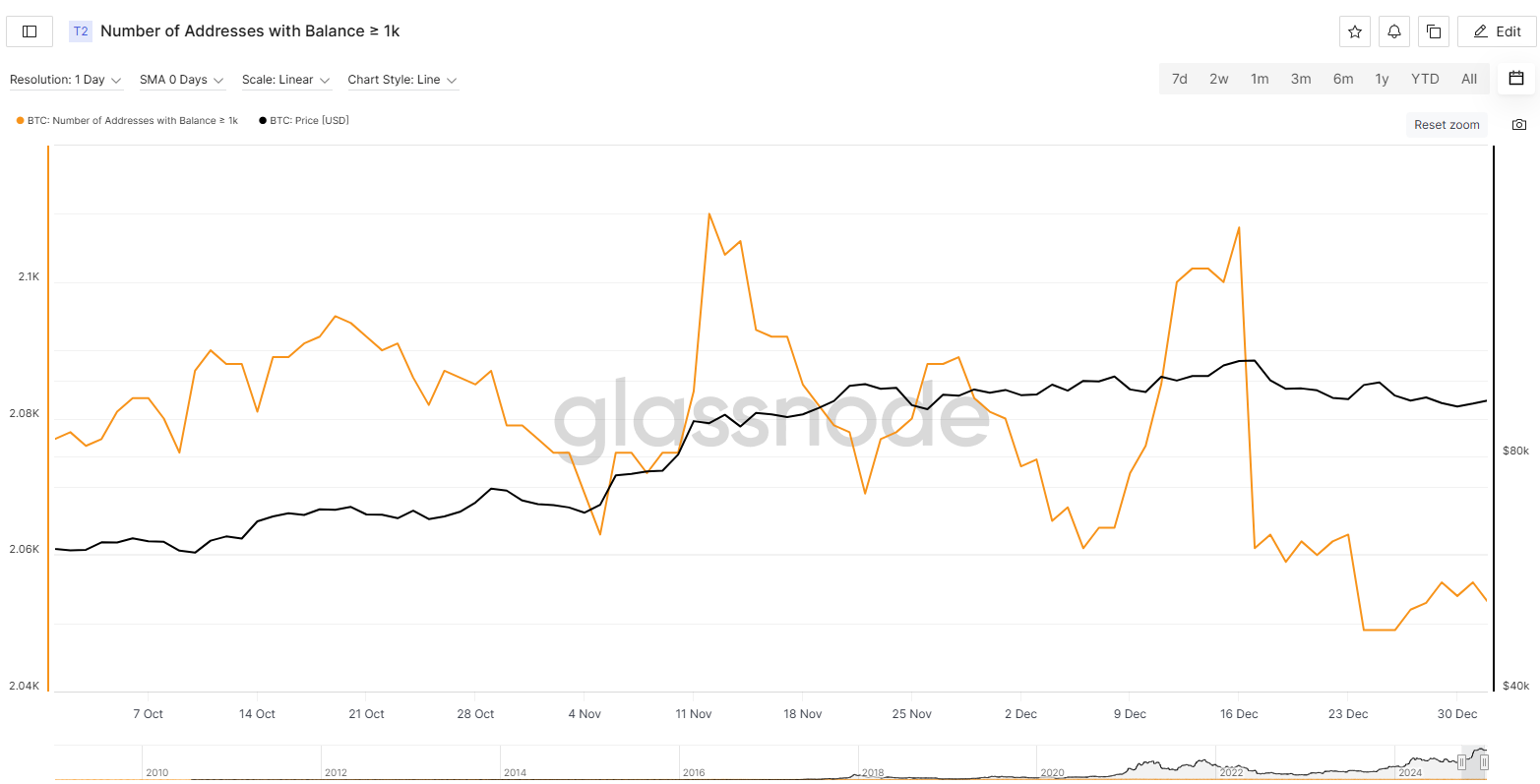

The number of addresses with balances of ≥ 0.1 BTC saw a slight decrease in Q4, as did those with balances of ≥ 1 BTC. This trend signals caution among retail investors after a big surge in BTC price, with short-term holders selling and taking some profits. The number of addresses with balances ≥ 0.1 BTC decreased from 4.58 million to 4.46 million, and those with balances ≥ 1 BTC decreased from 1.014 million to 993.16k.

Bitcoin: Number of Addresses with Balance ≥ 0.1

Bitcoin: Number of Addresses with Balance ≥ 1

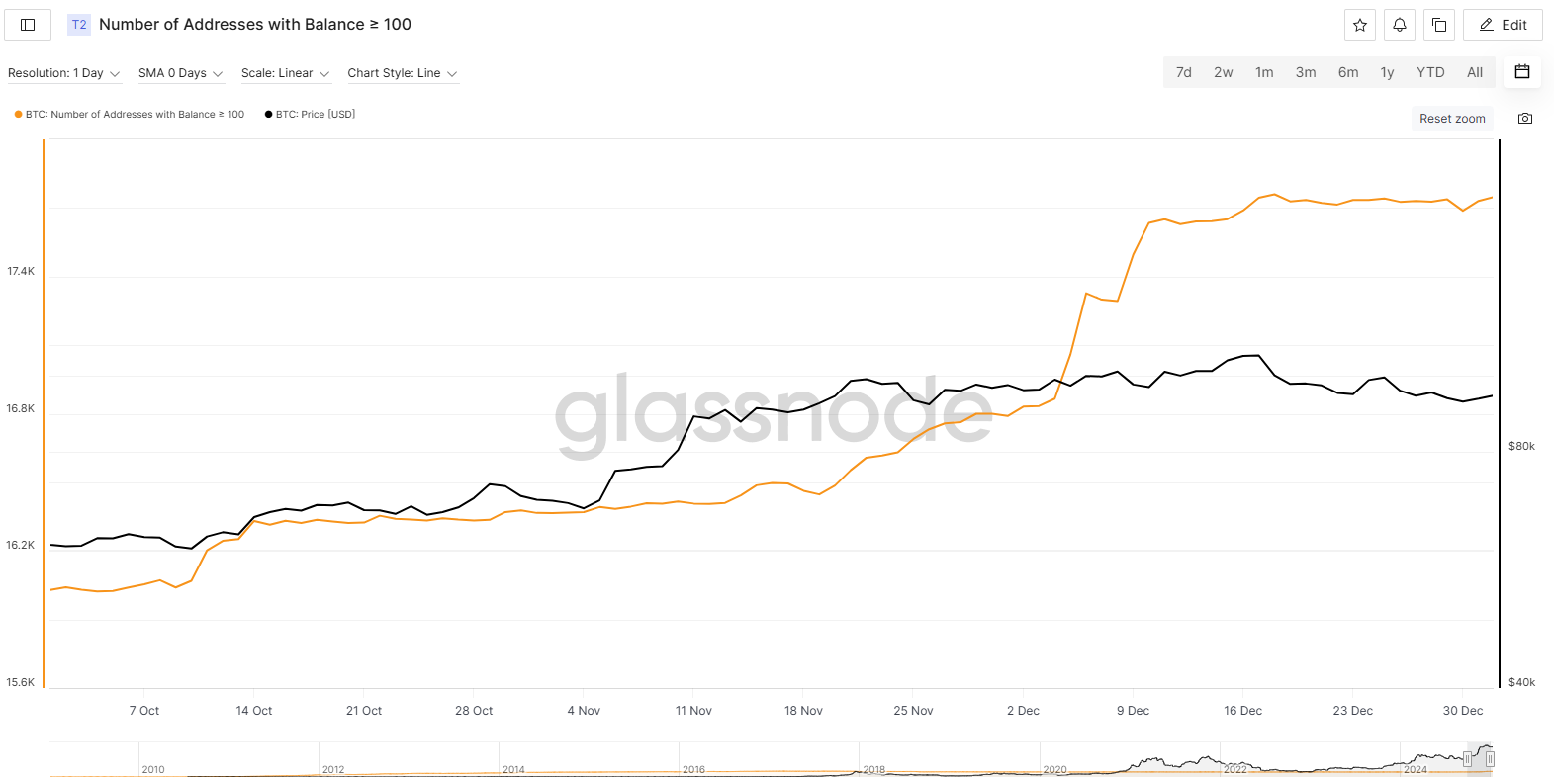

The number of addresses with a balance of ≥ 100 BTC increased during Q4, with the most significant growth occurring after the U.S. election and Trump’s victory in the presidential elections. In contrast, addresses with a balance of ≥ 1,000 BTC experienced a slight decline in Q4, with a slightly sharp downturn on December 16th. Specifically, the number of addresses with a balance of ≥ 100 BTC rose from 16,029 to 17,731, while those with a balance of ≥ 1,000 BTC decreased from 2,077 to 2,056. Smaller individual whales are actively accumulating Bitcoin, while the largest whales remain steady in their holdings. Although, Institutional adoption is highly evident through Bitcoin ETFs, which facilitate the majority of purchases.

Bitcoin: Number of Addresses with Balance ≥ 100

Bitcoin: Number of Addresses with Balance ≥ 1k

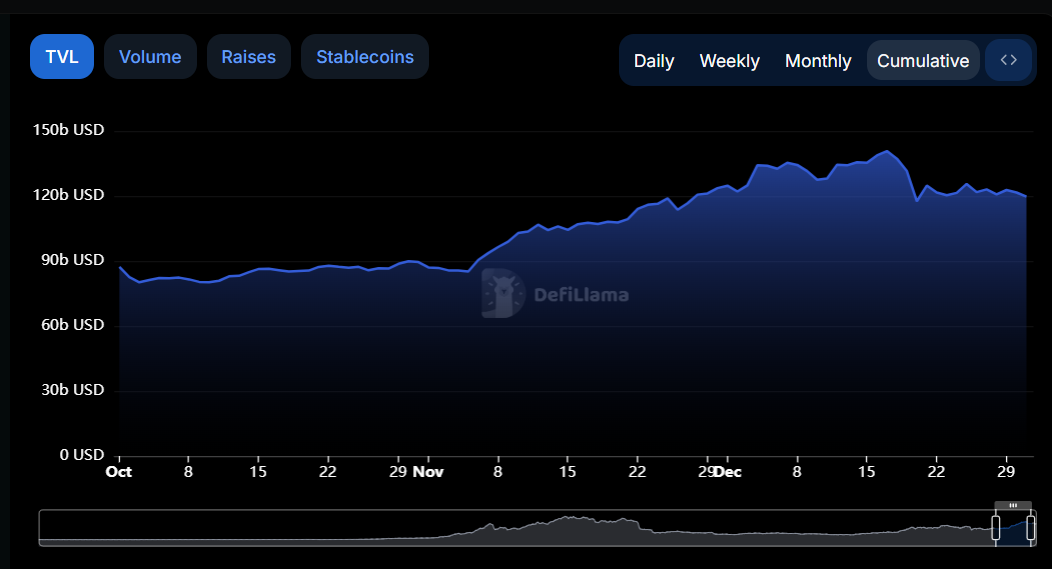

DeFi’s market was growing in Q4 following the overall crypto market rise. The DeFi market cap has increased from $87.294b to $119.726 which is an increase by 37.15% in Q4.

Overall TVL has grown slightly over the past quarter, rising by 37.15%. Regarding the chains, Ethereum had steady changes in market share in Q4, maintaining its dominance with a 55.5% market share, gaining an additional $17.133B in TVL due to the overall market growth.

Solana slightly increased its TVL share from 6.06% to 7.16%, thanks to the memecoin trading still ongoing, securing $8.564B in TVL at the end of Q4 2024.

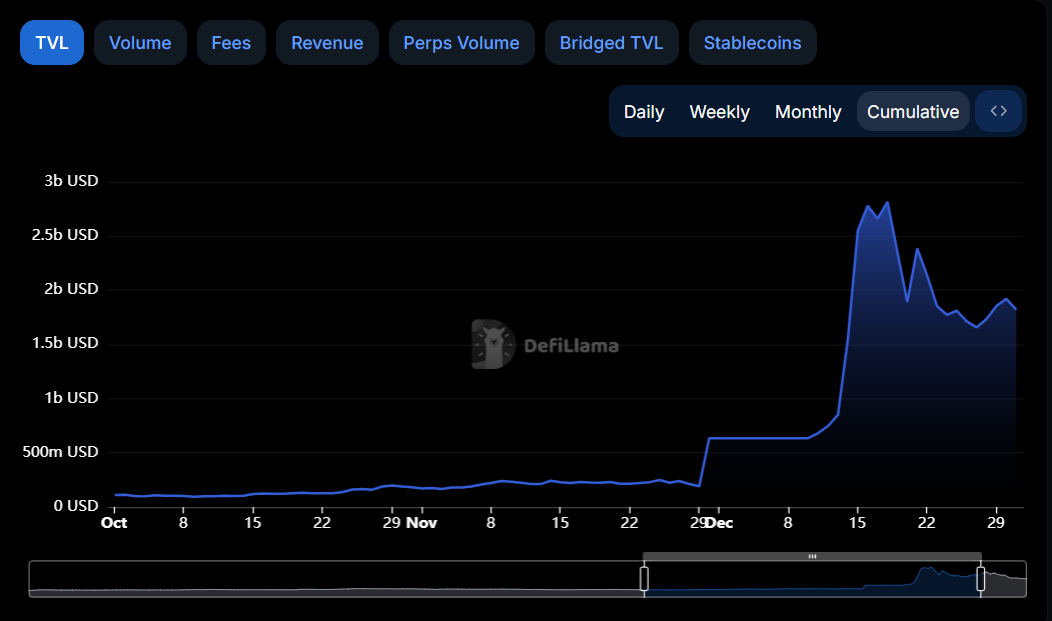

SUI and HYPERLINK have established themselves on the DeFi map with rapid TVL growth in Q4 2024. SUI’s TVL surged by 75.19%, rising from $959.09 million at the start of October to $1.68 billion by the end of December. Similarly, HYPERLINK experienced an impressive 1,580.77% increase in TVL, climbing from $108.41 million to $1.822 billion.

Sui TVL

Hyperliquid TVL

NFT trading volumes increased in Q4 approximately by 100% from $1.12B at the beginning of Q4 to $2.24B at the end of Q4 2024, but still far far away from the trading volumes seen in the 2021 bull run.

Blur led the NFT market in Q4 2024, generating $903 million in trading volume over the past 90 days and capturing 40% of the market share. OpenSea followed as the second-largest marketplace with $622 million in sales and a 28% share, driven largely by Ethereum NFTs, which accounted for 65% of total trading. Magic Eden ranked third, with $374 million in sales, dominated by Bitcoin Ordinals NFTs, which made up 71% of its trading volume.

Pudgy Penguins, a popular NFT collection of 8,888 Ethereum-based tokens created by Igloo, was the top-selling collection in Q4 2024. Over the past 90 days, it generated $313 million in trading volume, marking a 423% increase compared to the previous quarter.

The Q4 crypto rally significantly boosted demand for stablecoin liquidity, both off-chain and on-chain. Borrowing costs for USDT and USDC on Binance’s margin trading platform more than doubled in November compared to October, reflecting increased demand for leveraged positions in spot and futures markets. While borrowing rates eased in December as market sentiment stabilized, they remained higher than in October.

The stablecoin market cap rose by approximately 27.12%, increasing from $168.45 billion to $214.14 billion.

Tether remained the number one stablecoin by market cap and kept rising, increasing its market cap from $119.5 billion to $138.76 billion, a growth of approximately 16.12%.

Following the U.S. elections, Tether’s USDT saw significant net buying, increasing its dominance among stablecoins from 72% in November to 84% in December. However, this trend could change after Binance announced a strategic partnership with Circle in December. Beyond zero-fee promotions, the partnership focuses on driving USDC adoption, with Binance planning to use USDC for its treasury operations.

USDC remained the second-largest stablecoin by market cap, increasing from $35.59 billion to $43.8 billion, a rise of approximately 23.07%.

In Q4, a historical and highly anticipated event occurred as Bitcoin surpassed the $100k mark, reaching an all-time high (ATH) of $108.4k! This surge was attributed to Trump’s victory in the presidential elections and massive institutional demand driven by SPOT ETFs. Following a 71% increase in Bitcoin’s price to its ATH during the quarter, the market naturally began to consolidate after the heated rally.

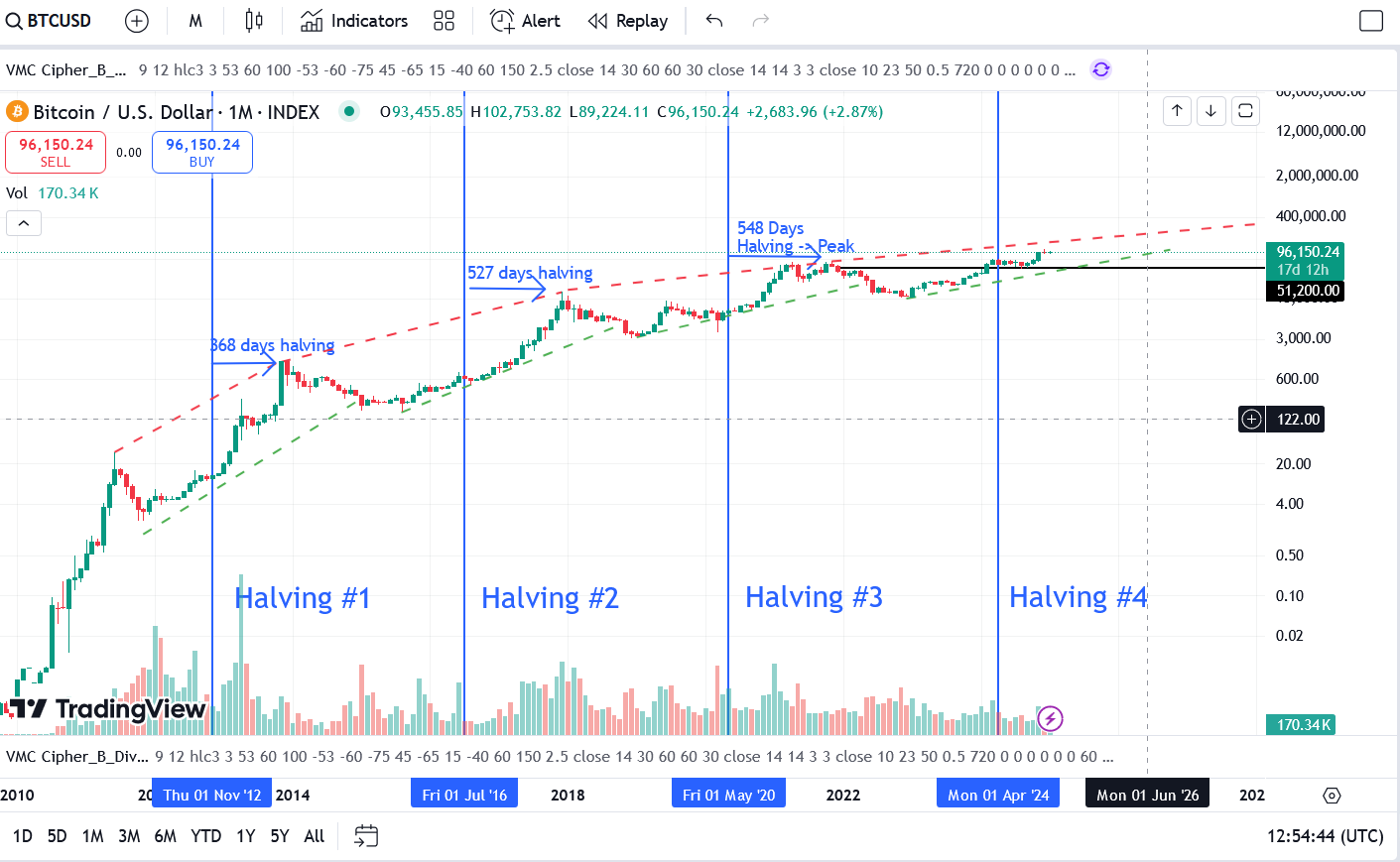

According to historical cycles, Bitcoin is expected to continue its rally in 2025 and experience several strong bull-run months during the year. Historically, the crypto bull run could last until the end of 2025, typically from October to December. Along the way, corrections in Bitcoin’s price ranging from 20–50% are expected as a normal occurrence. Regarding altcoins, they have also performed well, are currently at a midpoint, and are expected to historically follow Bitcoin’s price movement until the end of this bull run. Altcoins have the potential for a significantly greater upward trend compared to Bitcoin, as many have yet to reach their previous all-time highs (ATHs).

When analyzing the monthly timeframe and adopting a longer-term perspective, we observe that Bitcoin (BTC) is currently in overbought territory. The levels (circled in white in the image below) have begun rising again after a brief cooling period, aligning with BTC’s price increase in recent months. Despite this overbought condition, there remains potential for further bullish momentum when compared to the overbought levels observed in previous cycles. Historically, the bull run is expected to continue throughout 2025, likely extending into October–December, with periodic corrections along the way.

Technically, the price of BTC is expected to reside within the $85k–$102k range before entering the final stage of the bull run later this year. The broader downside target is $70k, which, while appearing less likely at the moment, is not entirely impossible. Anticipated upward price targets for Bitcoin range between $120k and $150k, with the potential to reach significantly higher levels during this cycle.

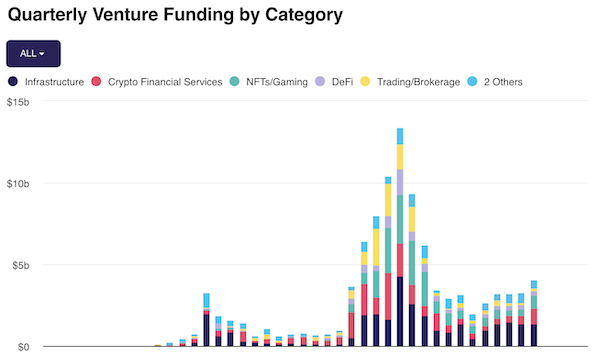

In the fourth quarter of 2024, venture capital investments in the cryptocurrency industry experienced a significant rise, reaching $4 billion through 687 deals, according to Odaily. This represents the largest quarterly investment since late 2022.

The infrastructure sector attracted the most funding, followed by financial services, which received $970 million. Web3 projects accounted for the most deals with 141, while NFT and gaming projects were close behind with 132 transactions. Trading and brokerage investments declined from $320 million in the first quarter to $161 million in the fourth quarter.

Here are five leading crypto VCs, along with their key investments during the Q4 2024:

Binance Labs: As the venture capital and incubation arm of Binance, Binance Labs closed 19 deals in Q3 and Q4 of 2024, focusing on early-stage projects in Web3 infrastructure, DeFi, and blockchain-based gaming. Notable investments include:

Sahara Labs: Secured $38 million in Series A funding to develop privacy-focused decentralized identity solutions using zk-SNARK technology.

Andreessen Horowitz (a16z): Based in Menlo Park, California, a16z is renowned for its broad investment portfolio across various technologies, including AI and gaming. In 2024, a16z led a $75 million investment pool for the Speedrun 2024 Accelerator Program, supporting pre-seed gaming startups, with total investments amounting to approximately $250 million. I

Pantera Capital: Established in 2003, Pantera Capital is one of the first U.S.-based Bitcoin investment firms, focusing exclusively on blockchain technology and digital assets. In 2024, Pantera Capital invested $50 million in the Series B funding round of Stafi Protocol, a decentralized staking platform, with total investments around $200 million.

Coinbase Ventures: The venture arm of Coinbase, headquartered in San Francisco, focuses on strategic investments to drive the growth of the crypto ecosystem. In 2024, Coinbase Ventures invested $30 million in the Series A round for Parcl, a blockchain-based real estate platform, with total investments around $300 million.

In the fourth quarter of 2024, cryptocurrency venture capital (VC) investments were predominantly directed towards the following sectors:

Blockchain Infrastructure: Infrastructure projects continued to attract significant funding, with their share of total quarterly funding rising from 26% in Q4 2022 to 44% in Q3 2024. This trend underscores the ongoing emphasis on enhancing the foundational layers of blockchain technology to support scalability, security, and interoperability.

Decentralized Finance (DeFi): DeFi experienced substantial growth, with funding nearly doubling compared to previous periods. This surge reflects increased investor confidence in decentralized financial systems that offer alternatives to traditional banking and financial services.

Gaming and Metaverse: The gaming sector, particularly projects integrating blockchain technology, maintained strong investor interest. Gaming projects led in cumulative funding, indicating a belief in the potential of blockchain to revolutionize gaming experiences through true ownership of digital assets and play-to-earn models.

Artificial Intelligence (AI) Integration: There was a notable increase in investments at the intersection of AI and blockchain. Venture firms recognized the potential for AI to enhance blockchain applications, leading to funding in projects that leverage both technologies to create innovative solutions.

Tokenization of Real-World Assets: Initiatives focused on tokenizing traditional assets, such as real estate and commodities, gained traction. This trend reflects a growing interest in bringing real-world assets onto the blockchain to improve liquidity, accessibility, and efficiency in asset management.

In the fourth quarter of 2024, venture capital (VC) investments in the cryptocurrency sector exhibited notable regional trends:

North America: The United States maintained its leadership position, with significant investments channeled into blockchain infrastructure, decentralized finance (DeFi), and gaming sectors. Notably, Andreessen Horowitz (a16z) launched a $4.5 billion crypto fund, underscoring the region’s commitment to the crypto ecosystem.

Europe: The region attracted approximately $10 billion in VC funding across various sectors, including fintech, cleantech, and AI. Germany, in particular, increased its startup investments by over 33%, outpacing France and solidifying its position as a European innovation hub.

Asia: The venture capital environment in Asia during 2024 was characterized by significant investments in blockchain startups, with a focus on infrastructure and decentralized applications. Notably, Sygnum, a crypto-focused bank with a presence in Singapore, achieved a $1 billion valuation after raising $58 million in its latest funding round.

Many projects achieved success in the 4th quarter of 2024. The biggest gainers, once again, came from the memecoin category, accompanied with the AI cryptocurrencies. We will single out one coin which marked Q4 and had astonishing gains in this quarter and 2024 year overall.

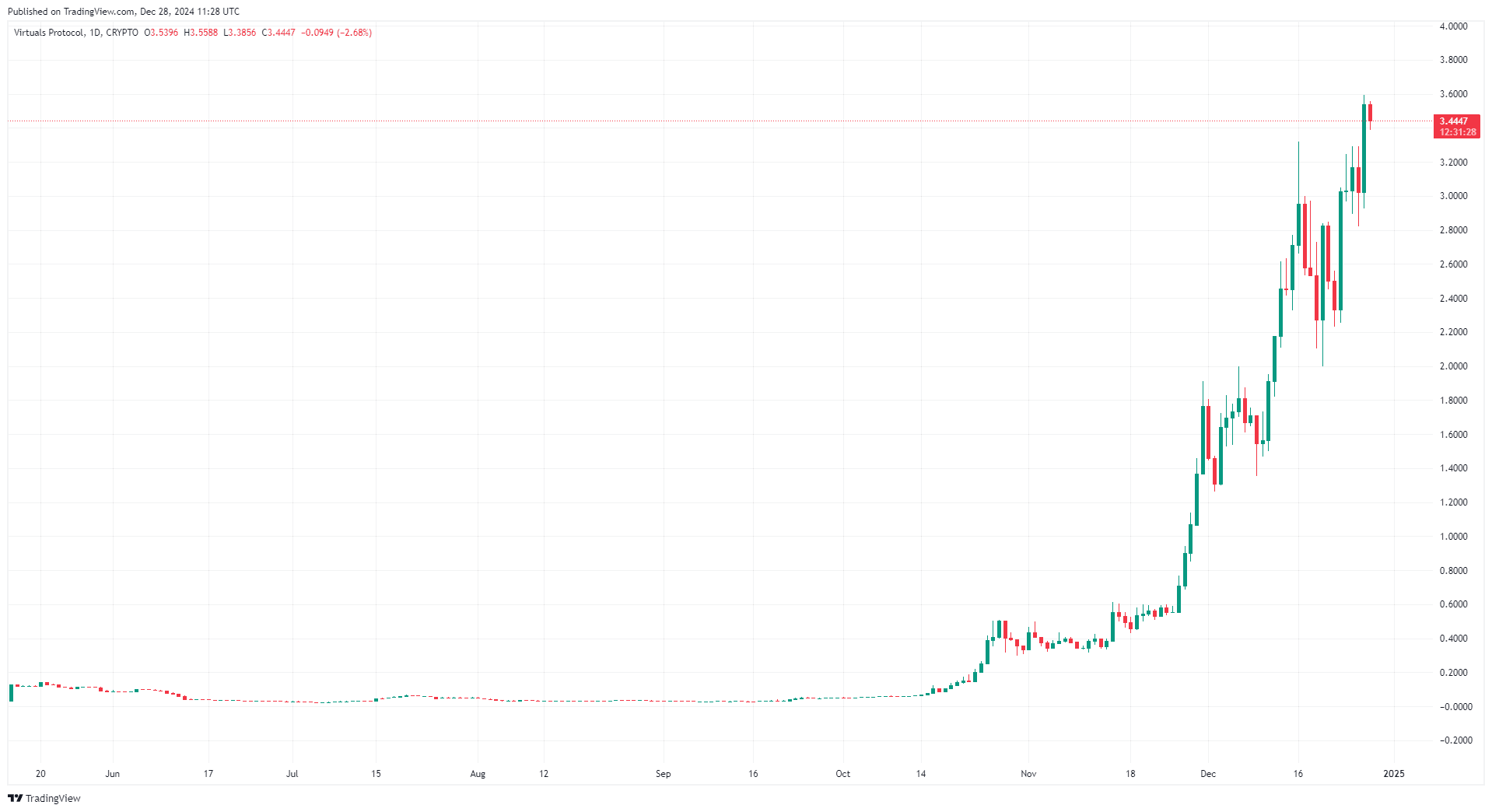

Virtuals Protocol (VIRTUAL) , a leading token in the decentralized AI-driven ecosystem, made headlines in 2024 with its meteoric rise, fueled by artificial intelligence hype and growing adoption. The price of VIRTUAL soared by an astonishing 6787.32% in Q4!

The emergence of Crypto AI Agents in the blockchain and crypto sphere is one of the narratives dominating conversations in Q4 2024. This technology combines artificial intelligence (AI) with blockchain capabilities, offering new ways to automate, analyze, and make decisions in the crypto ecosystem. The biggest gainer in 2024 was a token from this niche that we just mentioned in the previous chapter, Virtual Protocol which soared 23079.2% in price in 2024!

In the fourth quarter of the year, tokens inspired by internet memes emerged again as one of the most profitable trends.

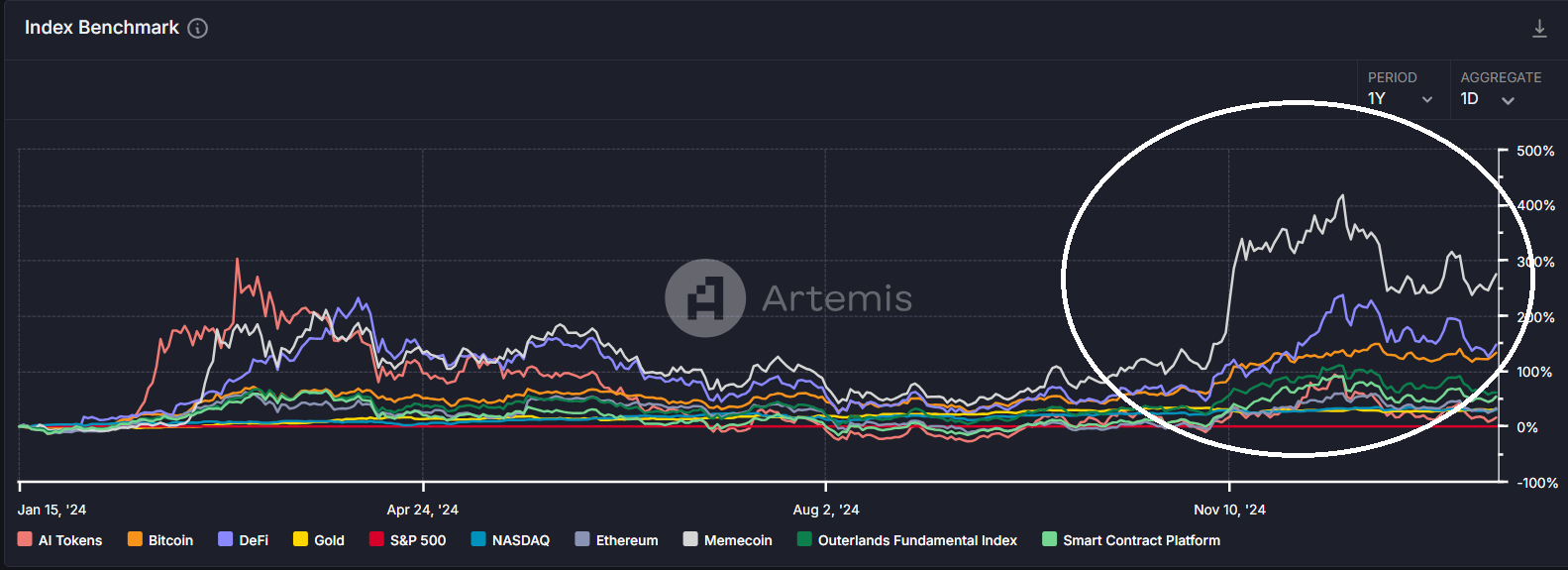

How well memecoins performed can clearly be seen through the benchmark index. As of November 29, 2024, data from Artemis Terminal shows that memecoins have delivered a remarkable benchmark index performance of 279.8%, far exceeding Bitcoin’s 118.9% and gold’s 27.4%. While AI tokens initially dominated the market in early 2024, memecoins overtook them in March and sustained a benchmark performance above 40%. In the latter half of the year, as the market rebounded, memecoins, Bitcoin, and gold all showed positive correlation, but memecoins consistently outperformed the others.

In Q4, the cryptocurrency market experienced a significant surge, with the total market capitalization hitting an all-time high of $3.908 trillion! On December 5, 2024, Bitcoin crossed the $100,000 mark, marking one of the most historic milestones in its history.

Key events like Donald Trump’s presidential victory, which fueled optimism about a more crypto-friendly approach, combined with a surge in SPOT ETF inflows, ignited a rally in the cryptocurrency market.

Overall, the crypto market experienced strong performance and increased adoption in Q4, with ongoing advancements laying an amazing foundation for future growth.

Veli Partners with DEC Institute to Equip Finance Professionals for...

Inside the Mechanics of Crypto Indexes – How Are They...