Veli Won Best Startup Award by Plug and Play 🏆...

This report will cover all the shifts that the general Crypto market, and some of its most important players, experienced during Q1 2025. Here’s everything you need to know about the most recent quarter in crypto, from raw data and analyses, to novel projects and regulatory news.

Q1 saw a significant correction, with the total cryptocurrency market capitalization dropping from $3.99T to $2.84T. This decline impacted the top five cryptocurrencies as well, all of which experienced corrections during the quarter.

The drop was driven mainly by renewed fears following Donald Trump’s tariff war, as the U.S. imposed new tariffs on several countries—sparking market uncertainty and a broad sell-off.

Throughout Q1, the world’s leading cryptocurrency experienced a price drop of approximately 11.8% (24.7% from its highest point), dropping from $93,600 to $82,550. Bitcoin’s highest price during the quarter was $109,573, reached on January 20th, marking the highest value in its history. From its highest to its lowest point during this quarter, the BTC price experienced a 30% correction.

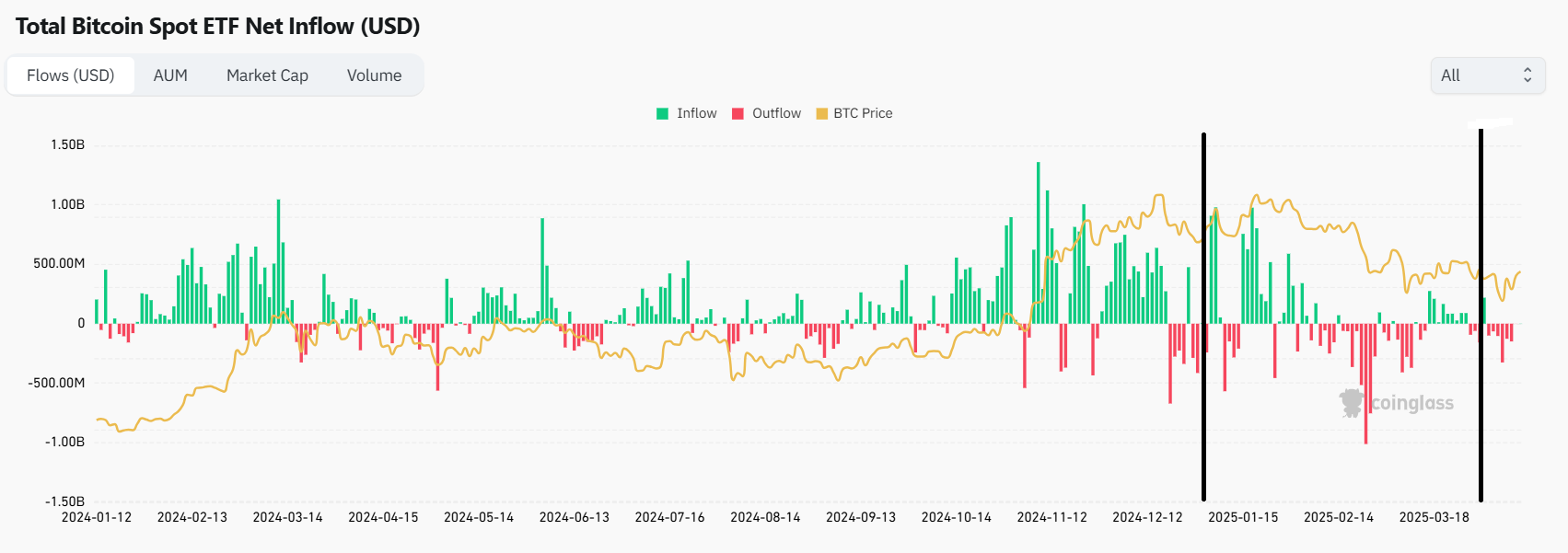

Bitcoin SPOT ETFs

The first quarter of 2025 was challenging for Bitcoin spot ETFs, marked by significant price volatility and investor caution. While some ETFs like IBIT and GBTC faced outflows, others such as FBTC and ARKB attracted new investments, highlighting divergent investor strategies in response to market conditions.

The runner-up saw a heaviest decrease in price compared to Bitcoin and other top 5 cryptocurrencies, with a price decline of approximately 45%, starting the quarter at $3,330 and ending at $1,823. The peak price during this quarter was $3,740, which still fell short of the previous all-time high from November 2021. From its highest to its lowest point during this quarter, the ETH price experienced a 50% correction.

Ripple ended up being the best performer among the top 5, closing the quarter without a price decline, with its value remaining nearly unchanged from the start of the quarter at approximately $2.085. At its peak during the quarter, XRP reached $3.39, a 63.3% increase compared to its opening price in Q1. This rise was attributed to positive developments in its legal battles and the announcement of new partnerships.

Binance’s BNB showed a moderate price decline among the top five cryptocurrencies, dropping approximately 13.9% from $702 to $604.7 by the end of the quarter. The lowest price BNB reached during this period was $500, recorded on February 3rd.

Solana experienced a significant price decline during the quarter, falling from $188.5 to $124.7 – a 30% decrease for $SOL. The highest price reached during the quarter was $294.7 which was pushed by the launch of the $TRUMP token, while the lowest was $112.87 in February.

President Donald Trump’s anticipated crypto-friendly policies initially boosted sentiment, and Bitcoin rose to its current all-time high of US$108,786 on January 20, the day he was inaugurated. Crypto positivity was also reflected in options trading, where open interest outpaced the Bitcoin spot price.

However, low volume provided insufficient support for high prices, foreshadowing the volatility to come. Bitcoin’s price at the end of the Q1 went back to approx. $80,000.

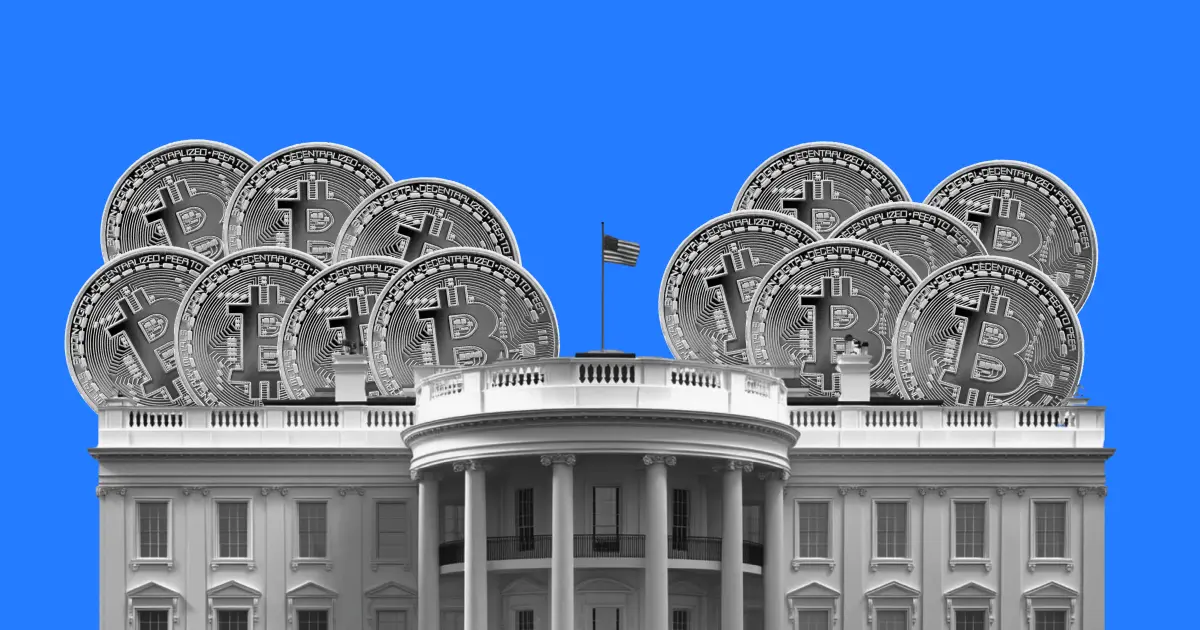

On March 6, 2025, President Trump signed an executive order to create a Strategic Bitcoin Reserve, aiming to position Bitcoin as a national reserve asset. The reserve is to be funded by forfeited bitcoins held by the U.S. Treasury, totaling approximately 200,000 BTC. This initiative sparked debates on the role of cryptocurrencies in national financial strategies.

In February 2025, Bybit, one of the world’s largest cryptocurrency exchanges, suffered a significant security breach resulting in the theft of approximately $1.5 billion in digital assets, including staked Ether (stETH) and Mantle Staked ETH (mETH) .

The attack occurred during a routine transfer from Bybit’s Ethereum cold wallet to a hot wallet. Hackers exploited a vulnerability in the wallet’s user interface, deceiving wallet signers into approving malicious transactions . This sophisticated phishing attack allowed the attackers to bypass security measures and siphon off the funds.

Investigations by blockchain analytics firms and the FBI attributed the hack to North Korea’s Lazarus Group, specifically a subgroup known as TraderTraitor . The stolen assets were rapidly converted into Bitcoin and dispersed across thousands of blockchain addresses to obscure their trail.

Despite the breach, Bybit assured users that their assets were safe and that the exchange remained solvent. CEO Ben Zhou confirmed that Bybit could cover the losses and that withdrawals remained open. The exchange also partnered with Zodia Custody to enhance its security measures and prevent future incidents .

As of March 2025, approximately 88% of the stolen funds remained traceable, with ongoing efforts to recover the assets

Public Companies Increase Bitcoin Holdings: Publicly listed firms collectively increased their Bitcoin holdings by over 95,000 BTC in Q1, a 16.1% rise from the previous quarter. Notably, Japanese investment firm Metaplanet acquired an additional 319 BTC, bringing its total holdings to 4,525 BTC.

On January 17, 2025, just days before his inauguration, President Donald Trump introduced the $TRUMP meme coin, branding it as the “only official Trump meme.” The coin’s value skyrocketed by over 300% overnight, reaching a trading value of nearly $13 billion within two days. However, concerns arose regarding the coin’s association with the president and its potential implications. By April, approximately 40 million $TRUMP tokens, valued at around $320 million, were set to unlock, leading to fears of a price drop due to dilution. Experts anticipated a rapid decline in value, potentially dropping to $3 by the end of May.

Franklin Templeton filed for a Solana ETF, aiming to track SOL’s spot price, reflecting increased demand for regulated investment products.

As regulatory conditions ease and a crypto-friendly president takes office, investors are increasingly diving into digital assets and ramping up their search for the next breakout token, following Bitcoin’s remarkable rally.

The first quarter of 2025 has been characterized by moderated global growth, easing inflation, and cautious monetary policies. However, geopolitical tensions and trade disputes continue to pose risks to the economic outlook.

In the first quarter of 2025, the Federal Reserve maintained its benchmark interest rate at 4.25%–4.50%, citing persistent inflation and economic uncertainties. Despite earlier expectations for rate cuts, the Fed signaled a cautious approach, projecting only two reductions later in the year, likely starting in June.

This stance impacted the cryptocurrency market significantly. Higher interest rates tend to make fixed-income investments more attractive, leading investors to shift away from riskier assets like cryptocurrencies. Consequently, Bitcoin and other major cryptocurrencies experienced notable declines during this period.

Additionally, the Fed’s decision to slow its balance sheet reduction in April aimed to provide more liquidity to the economy, which could support risk assets, including cryptocurrencies.

Overall, the Fed’s cautious monetary policy in Q1 2025 contributed to increased volatility and downward pressure in the crypto markets.

The global economy is projected to grow at 3.2% in 2025, maintaining the pace from 2024. However, this growth remains below pre-pandemic levels, reflecting ongoing challenges such as trade tensions and subdued investment.

Regional Economic Performance:

United States: The U.S. economy showed signs of slowing, with real GDP growth at 2.3% in Q4 2024. Projections for 2025 have been revised downward, with some forecasts anticipating growth below 1% due to the impact of new tariffs and potential stagflation risks.

Eurozone: The Eurozone economy remained sluggish, with growth projections for 2025 around 0.8% to 1.0%. Factors contributing to this include weak consumer spending and the adverse effects of global trade tensions.

China: China’s economy faced headwinds from escalating trade tensions, particularly with the U.S. GDP growth forecasts for 2025 have been downgraded to between 3.4% and 4.5%, reflecting the impact of increased tariffs and weakening export demand.

Sluggish GDP growth in major economies fueled expectations of looser monetary policy, which is bullish for crypto in the medium term. But near-term market confidence remained fragile due to global instability and economic headwinds.

Overall, while inflation showed signs of moderation in early 2025, geopolitical developments, particularly trade policies, introduced new uncertainties. Central banks remained vigilant, balancing the need to support economic growth with the goal of maintaining price stability.

U.S.

Eurozone

Global

Inflation cooled globally, but new U.S. tariffs may reverse the trend. Central banks began easing policy to support growth. Cooling inflation was good news for crypto long-term, but Trump’s tariffs created inflation fears that spooked markets and caused short-term volatility.

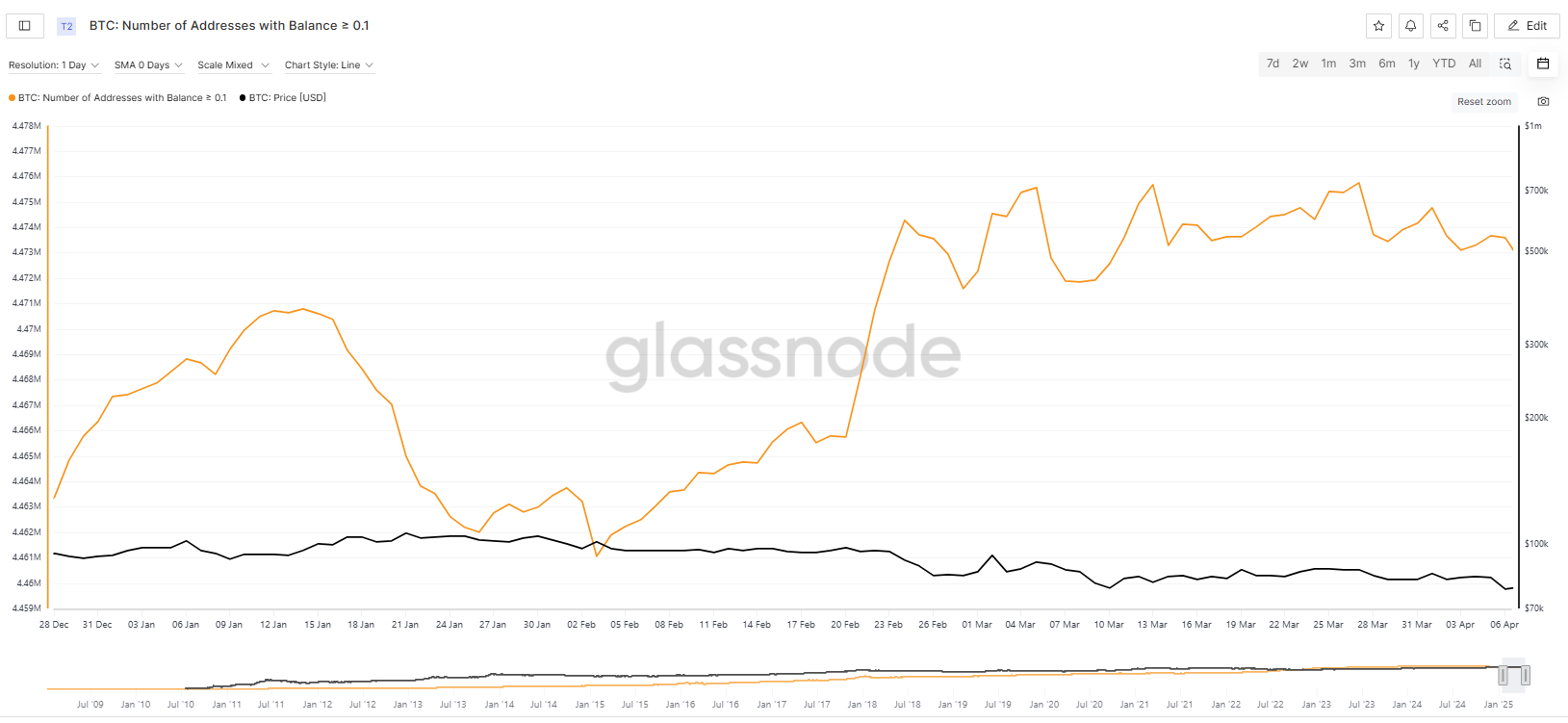

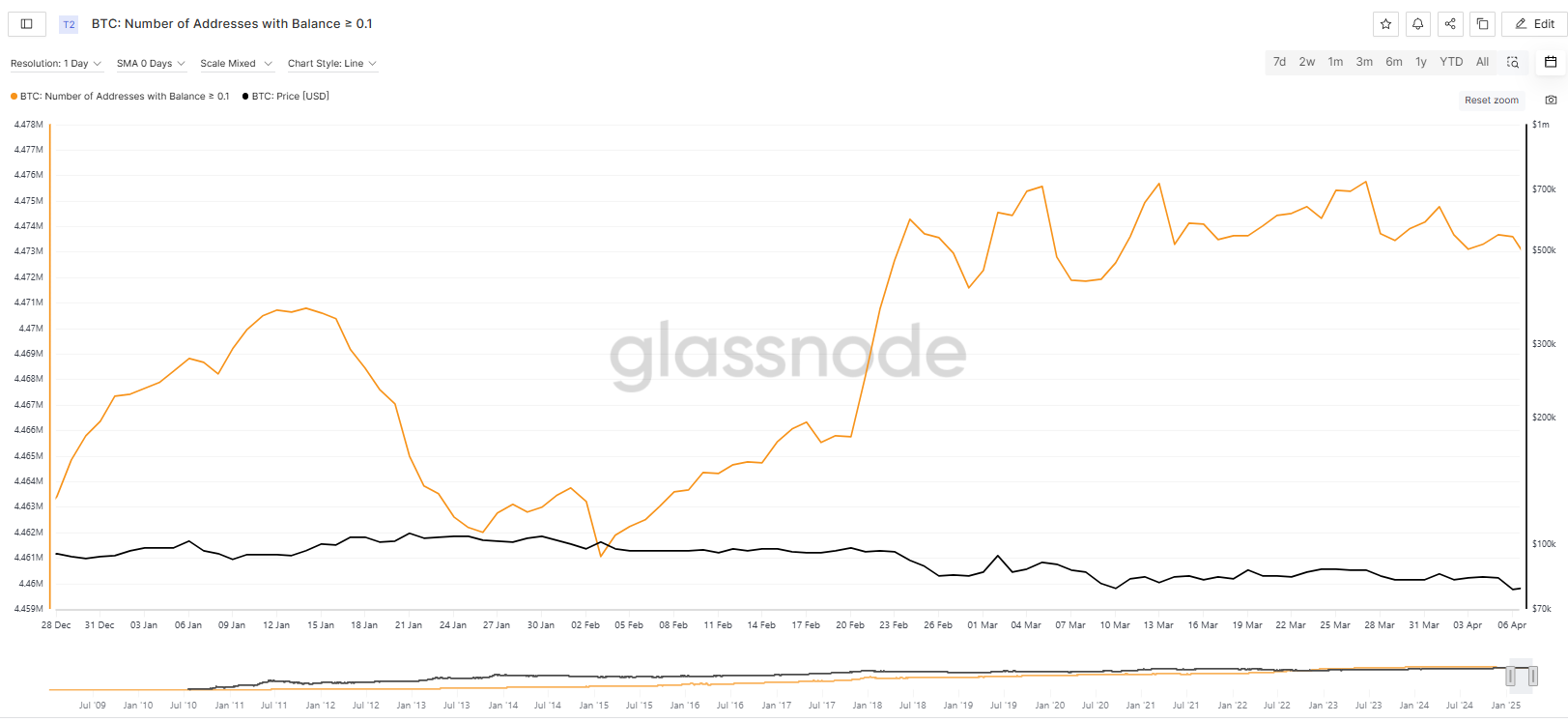

The number of addresses with balances of ≥ 0.1 BTC saw a slight increase in Q1, as did those with balances of ≥ 1 BTC. During the quarter, both types of wallets experienced a drop in numbers in February due to uncertainty caused by the tariff wars, but continued to rise through the end of the quarter. This trend signals that retail investors are still interested in BTC, but bearish events could cause a shake-off quickly. The number of addresses with balances ≥ 0.1 BTC increased from 4.46 million to 4.47 million, while those with ≥ 1 BTC rose from 1.992 million to 1.995 million.

Bitcoin: Number of Addresses with Balance ≥ 0.1

Bitcoin: Number of Addresses with Balance ≥ 1

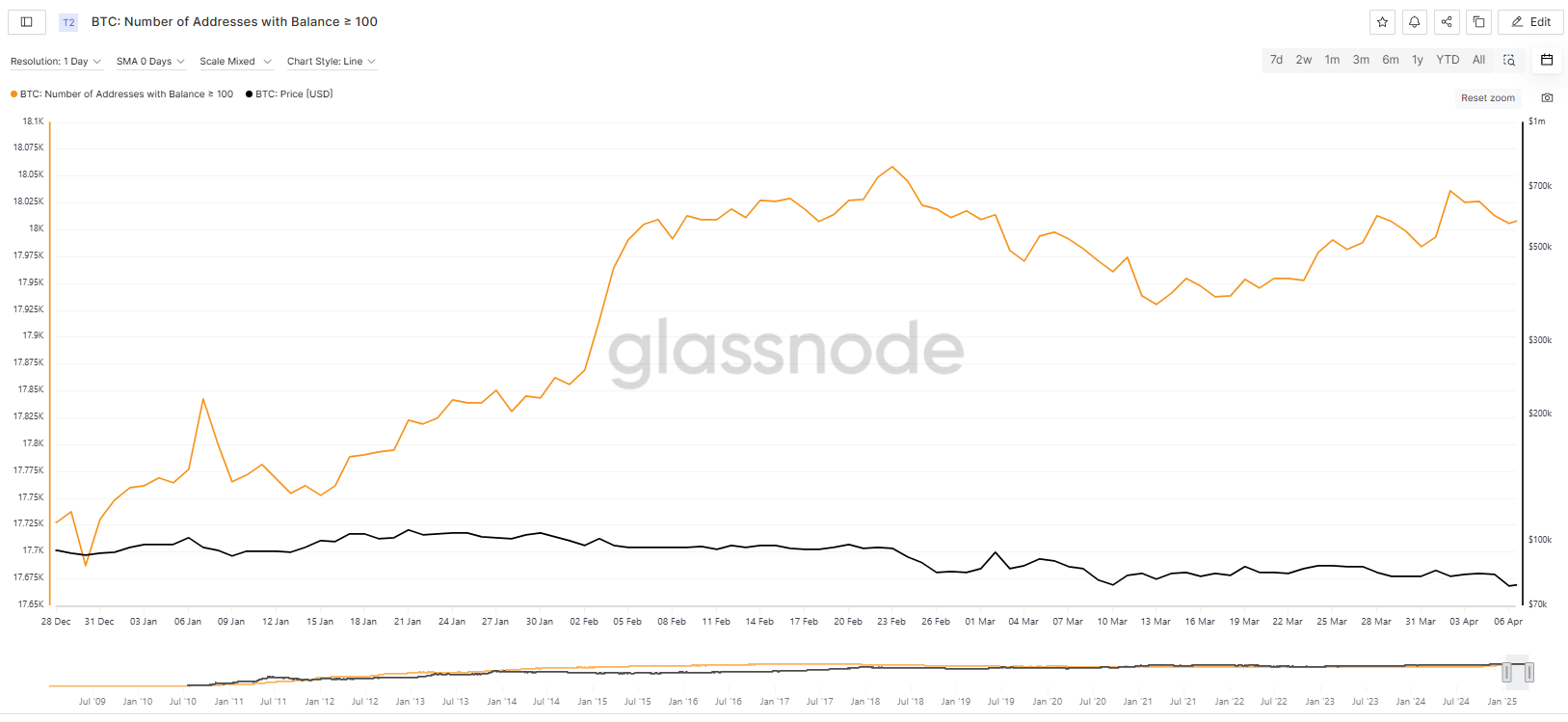

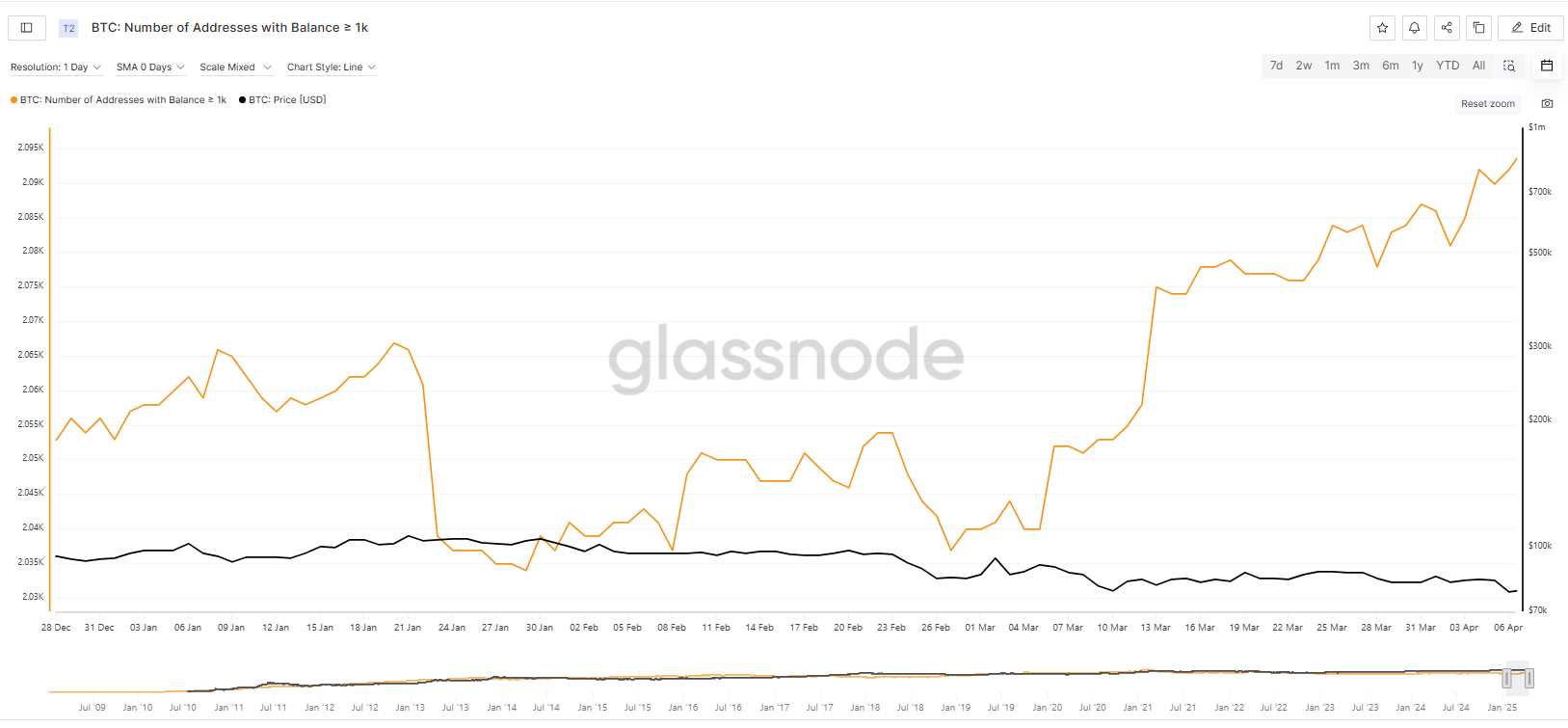

The number of addresses with a balance of ≥ 100 BTC increased during Q1, with the most significant growth occurring during the market crash in February which was caused by the tariff wars. Addresses with a balance of ≥ 1,000 BTC also saw an increase in Q1, despite a dip in numbers during February amid the tariff war correction. Specifically, the number of addresses with ≥ 100 BTC rose from 17,728 to 18,006, while those with ≥ 1,000 BTC increased from 2,053 to 2,092. Smaller individual whales actively accumulated Bitcoin during the February dip, while the largest whales continued increasing their holdings overall, though they briefly reduced their numbers during the correction.

Regarding Bitcoin Spot ETFs, although institutional adoption is on the rise, the first quarter of 2025 was challenging, marked by significant price volatility and increased investor caution.

Bitcoin: Number of Addresses with Balance ≥ 100

Bitcoin: Number of Addresses with Balance ≥ 1k

DeFi’s market was decreasing in Q1 following the overall crypto market correction. The DeFi market cap has decreased from $118.035b to $94.776 which is a decrease by approximately 19.71% in Q1.

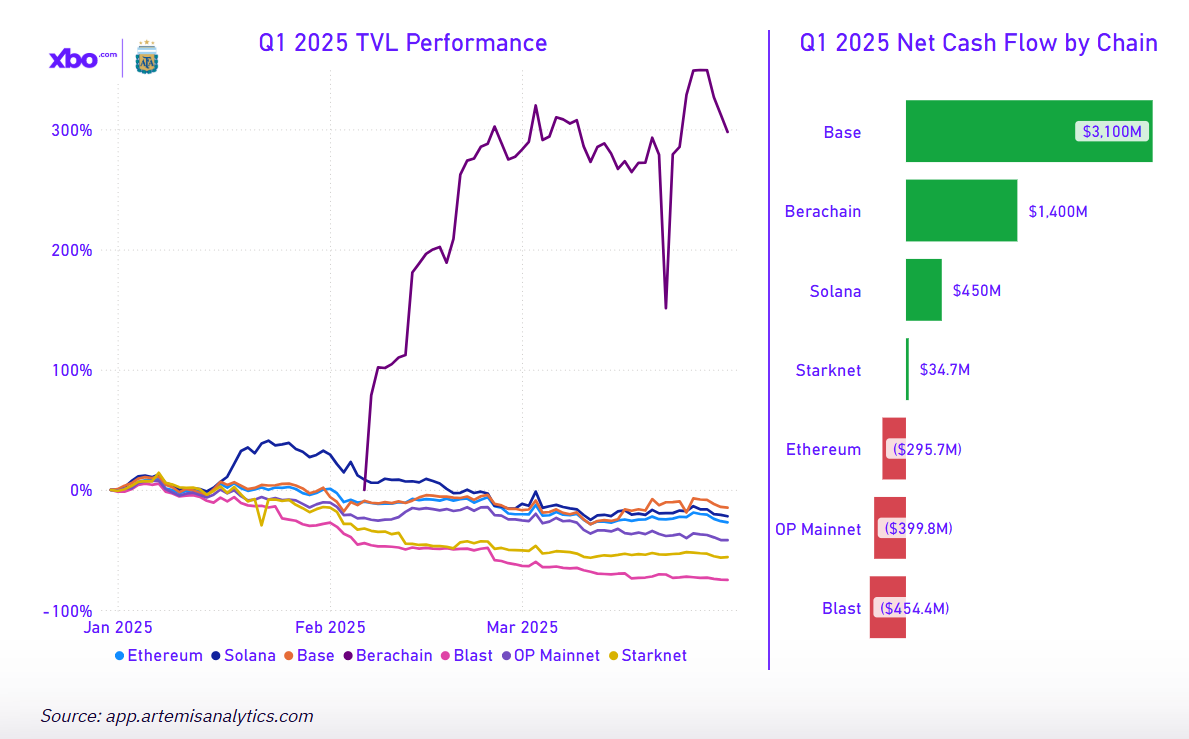

Overall TVL declined over the past quarter, decreasing by 19.71%. As for the chains, Ethereum saw a slight drop in market share in Q1 but maintained its dominance with a 52.26% share (a 4.32% decrease), losing $17.018B in TVL due to the overall market downturn.

Solana’s share remained almost the same in its TVL share around 7.17%, securing $6.623B in TVL at the end of Q1 2025.

The total value locked (TVL) in DeFi has declined across most blockchains, with a few exceptions like Berachain. Despite the overall drop, the Base network saw strong capital inflows, especially in sectors like real-world assets (RWA), lending, and decentralized exchanges (DEXs). Solana followed a similar pattern – while it was previously known for memecoins, it’s now attracting capital through those same sectors. Meanwhile, Ethereum has continued to lose capital, showing that activity is shifting toward other blockchains.

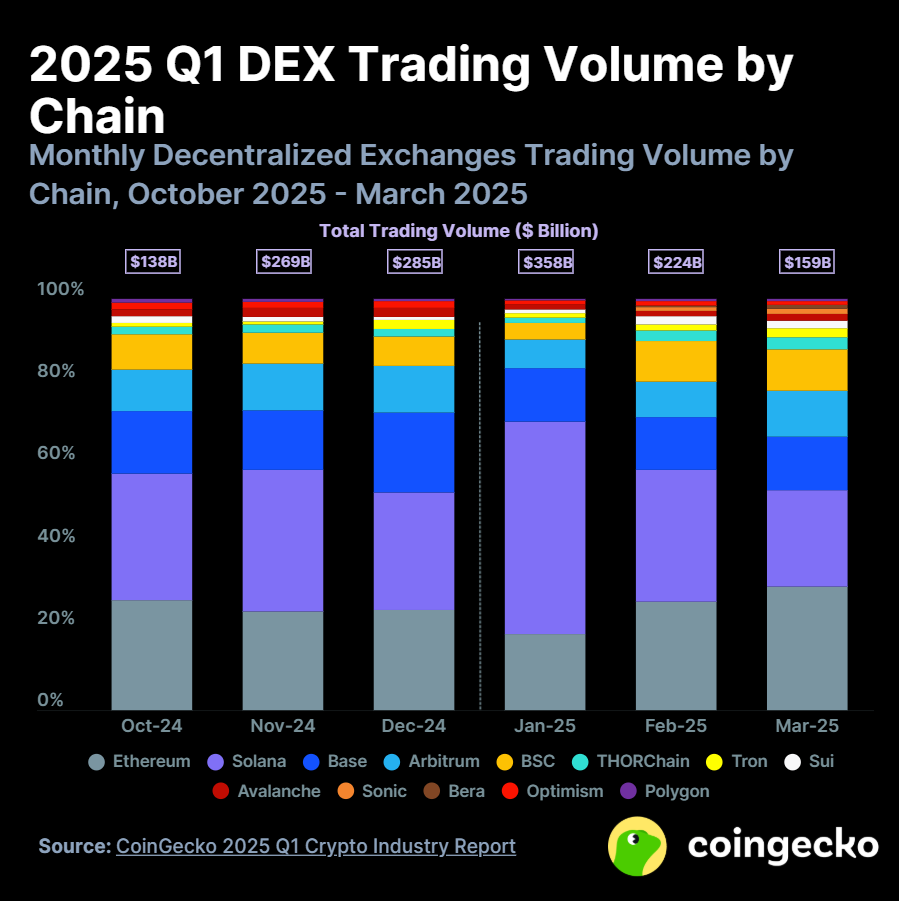

Solana maintained its lead in on-chain spot trading on decentralized exchanges in Q1 2025, handling 39.6% of all such trades since the end of 2024.

In the first quarter of 2025, the NFT market experienced a significant downturn, with total sales plummeting by 63% year-over-year to $1.5 billion, down from $4.1 billion in Q1 2024. March 2025 was particularly challenging, witnessing a 76% drop in sales compared to the same month the previous year.

Platforms like Blur and OpenSea maintained dominance, capturing 37.8% and 36% of the market share, respectively. Magic Eden followed with 15.3%, benefiting from its multichain support. Meanwhile, smaller platforms like Tensor and CryptoPunks Marketplace held minor shares, and others like Bybit and X2Y2 exited the space due to unsustainable drops in trading activity. The quarter marked a period of consolidation, caution, and a reset across the NFT marketplace landscape.

Despite the overall market decline, certain NFT collections demonstrated resilience and even growth:

Pudgy Penguins: Achieved $72 million in sales during Q1 2025, marking a 13% increase from the same period in 2024.

Doodles: Saw sales rise from $22.6 million to $32 million, a 41.6% increase, potentially driven by increased mainstream visibility and collaborations.

Milady Maker: Experienced a 58% rise in sales volume, indicating growing interest and engagement.

Conversely, prominent collections faced significant declines:

CryptoPunks: Sales dropped by 47%, from $114 million in Q1 2024 to $60 million in Q1 2025.

Bored Ape Yacht Club (BAYC): Experienced a 61% decrease in sales volume, falling from $78 million to $29.8 million.

Overall, while the NFT market faced considerable challenges in early 2025, certain collections and segments demonstrated resilience, suggesting a potential shift towards more utility-driven and community-focused projects.

In Q1 2025, the stablecoin market saw strong growth, with total market cap climbing to $226.1 billion by the end of the quarter, an increase of $24.5 billion since January 1st, reaching its ATH. This surge was fueled by greater institutional interest, higher demand for on-chain liquidity, and the continued dominance of two major players: Tether (USDT) and USD Coin (USDC).

Tether (USDT): Maintained dominance with a market cap of $144 billion, representing 63% of the stablecoin market.

USD Coin (USDC): Achieved a market cap of $59 billion, capturing 27% of the market. Circle, the issuer of USDC, filed for an IPO under the ticker “CRCL,” targeting a valuation between $4–5 billion. The increased issuance of USDC likely reflects market confidence that Circle, a U.S.-registered company, will obtain an American license ahead of its rivals. Nevertheless, analysts believe Tether will also eventually secure a U.S. license, given its position as one of the world’s largest holders of U.S. government securities.

Ethena’s USDe: Emerged as the third-largest stablecoin with a $5 billion market cap, offering high-yield opportunities to institutional investors.

Ethereum: Continued as the primary platform for stablecoins, hosting 53.4% of the total supply.

TRON: Accounted for 28.5% of stablecoin supply, with USDT on TRON reaching $65.7 billion and daily transfer volumes averaging $19 billion.

Solana: Experienced a 146% surge in stablecoin supply, reaching $12.5 billion, driven by increased activity and new token launches.

Tether (USDT): Maintained dominance with a market cap of $144 billion, representing 63% of the stablecoin market.

USD Coin (USDC): Achieved a market cap of $59 billion, capturing 27% of the market. Circle, the issuer of USDC, filed for an IPO under the ticker “CRCL,” targeting a valuation between $4–5 billion. The increased issuance of USDC likely reflects market confidence that Circle, a U.S.-registered company, will obtain an American license ahead of its rivals. Nevertheless, analysts believe Tether will also eventually secure a U.S. license, given its position as one of the world’s largest holders of U.S. government securities.

Ethena’s USDe: Emerged as the third-largest stablecoin with a $5 billion market cap, offering high-yield opportunities to institutional investors.

In the first quarter of 2025, the Real-World Asset (RWA) sector within the cryptocurrency market experienced significant growth, driven by increased institutional participation, technological advancements, and favorable regulatory developments.

The momentum in RWA tokenization is expected to continue, with projections indicating potential growth to $500 billion by the end of 2025, excluding stablecoins. This growth is anticipated to be driven by increased institutional adoption, technological advancements, and the development of regulatory frameworks that provide clarity and support for tokenized assets.

In Q1, Bitcoin reached its current all-time high (ATH) of approximately $109K before experiencing a downturn, making a 30% correction, which is still considered normal during a bull run. This correction has been fueled by SPOT ETF outflows since the beginning of February. Additionally, global financial events, particularly those involving the USA and the Trump administration, such as tariff wars, have contributed to the market decline, alongside ongoing geopolitical conflicts.

It has now been 11 months since the last Bitcoin halving, and historically, BTC price peaks around the 17th-18th month after a halving, which would suggest a peak in September or October 2025, also possibly in November or December.

Regarding altcoins, they have underperformed, and are currently close to its bear market prices, but are still expected to historically follow Bitcoin’s price movement until the end of this bull run. Altcoins have the potential for a greater upward trend compared to Bitcoin.

BTC has corrected 30% during the current downturn, dropping from $109K to $77K. The bottom of this correction could potentially be in the range of approximately $69K–$59K (a 35%–45% correction), with $69K being the more likely scenario. However, this does not guarantee that the price will reach those levels.

Historically, such a range has been possible in similar market conditions and could be reached in the coming months. This range could potentially also present one of the best buying opportunities of this cycle.

That said, BTC could still correct further to $49K (a 55% correction) and continue its rally afterward, but the likelihood of reaching that level is lower. If BTC were to drop to $49K, the probability of a strong recovery and continuation of the upward trend would be significantly reduced and most likely the prolonged bear market would start.

RSI – Monthly – overbought

On the monthly timeframe, Bitcoin remains highly overbought. Such levels are typical during a bull market, but they indicate that we may be approaching the top (in a months-long timeframe) or have already reached it.

The overbought condition has slightly eased with the current correction, and the red dot (white-circled) suggests that in the next 2–4 months, the market could see further downside or move sideways within the $69K–$100K range.

On the weekly timeframe, following the current correction, BTC is now in oversold territory. This suggests that we may be near the bottom of the correction in the short term. It could also indicate a potential sideways movement over the next few months, likely within the $69K–$100K range.

On the weekly timeframe, we can see that BTC’s price has bounced off the 50-period Exponential Moving Average (EMA), which could serve as a potential support level for a short-term rebound.

A possible scenario, based on historical patterns, could be a sideways movement over the next 2–3 months within the $69K–$100K range (or a bit less likely range of $59K–$100K). After that, BTC could potentially reach its target of $120K–$150K by the end of the year.

Historically, the bull run does not appear to be over yet, but the possibility of it ending should not be dismissed.

Everyone certainly expected altcoins to perform much better and reach higher prices in this cycle. So why did they underperform, and did they actually underperform compared to the previous cycle?

If we analyze the overall market capitalization of altcoins, it appears that the total market cap has reached nearly the same levels as in the 2021 cycle—$1.5T to $1.65T. This suggests that, in terms of market capitalization and inflow of money/demand, altcoins have performed similarly to the previous cycle.

Comparing the total crypto market capitalization from the last cycle’s peak to the current cycle’s peak:

Altcoin market capitalization could move sideways between $850B and $1.2T over the next few months. After that, a bullish scenario – hopefully the last leg up – could unfold.

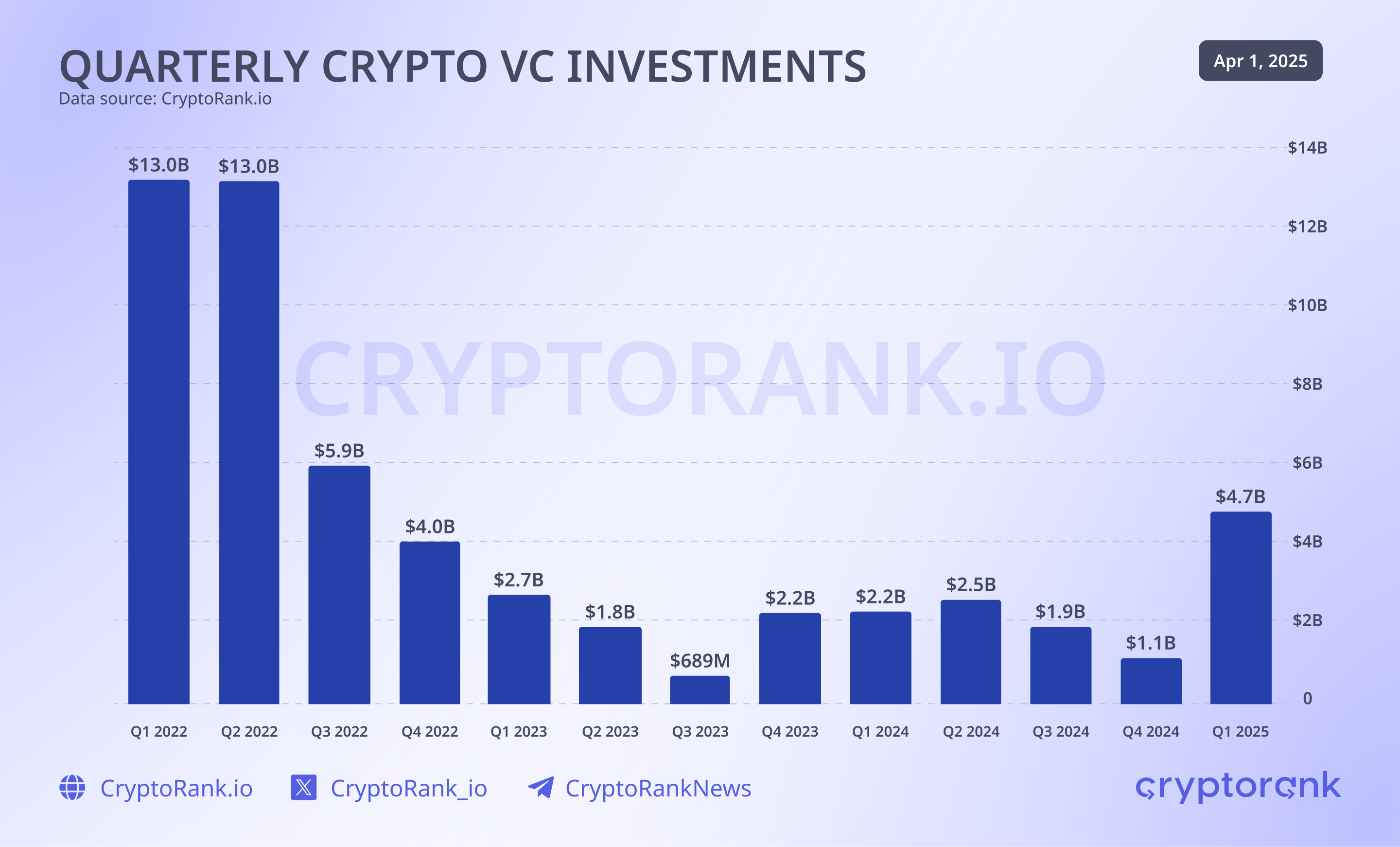

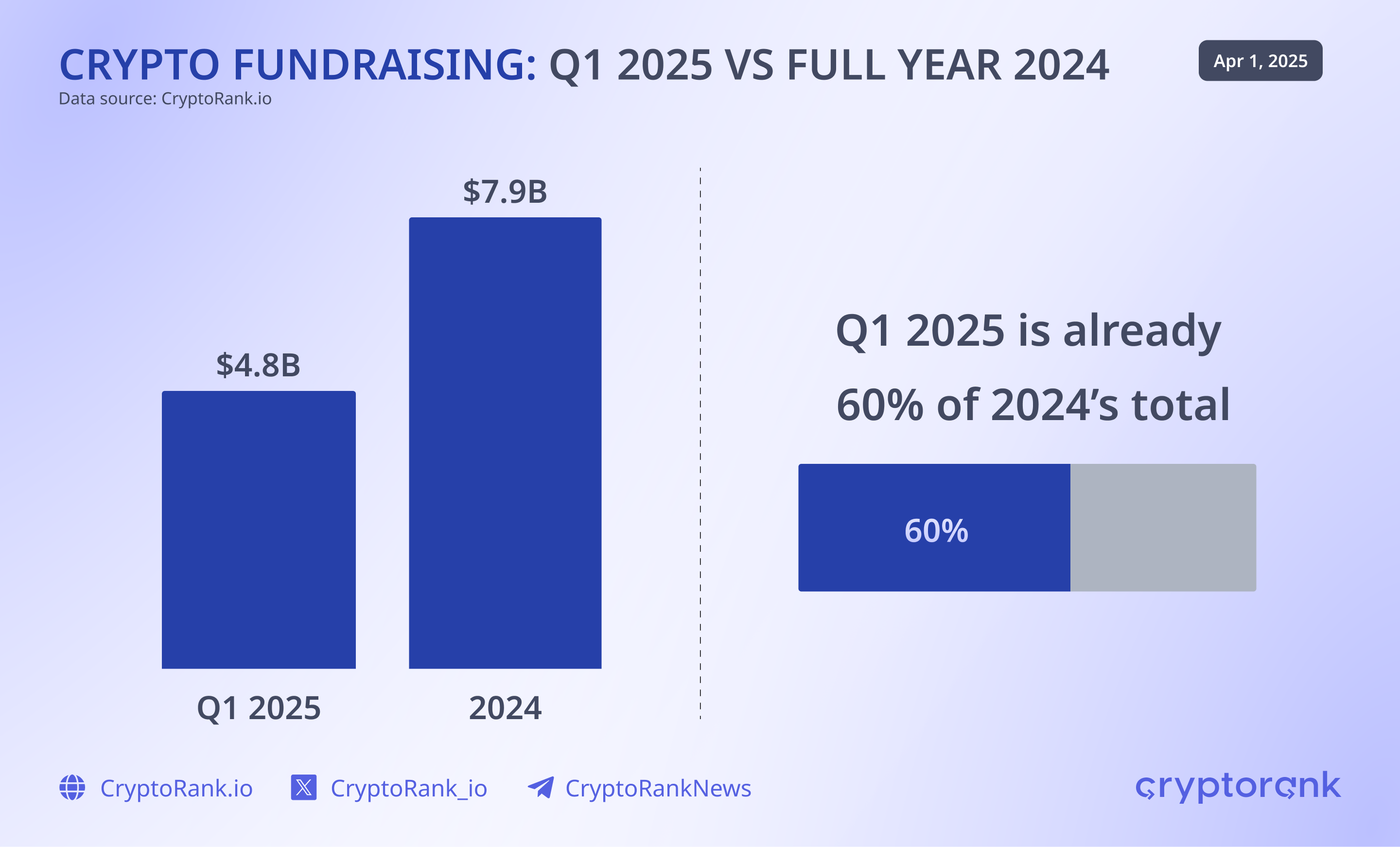

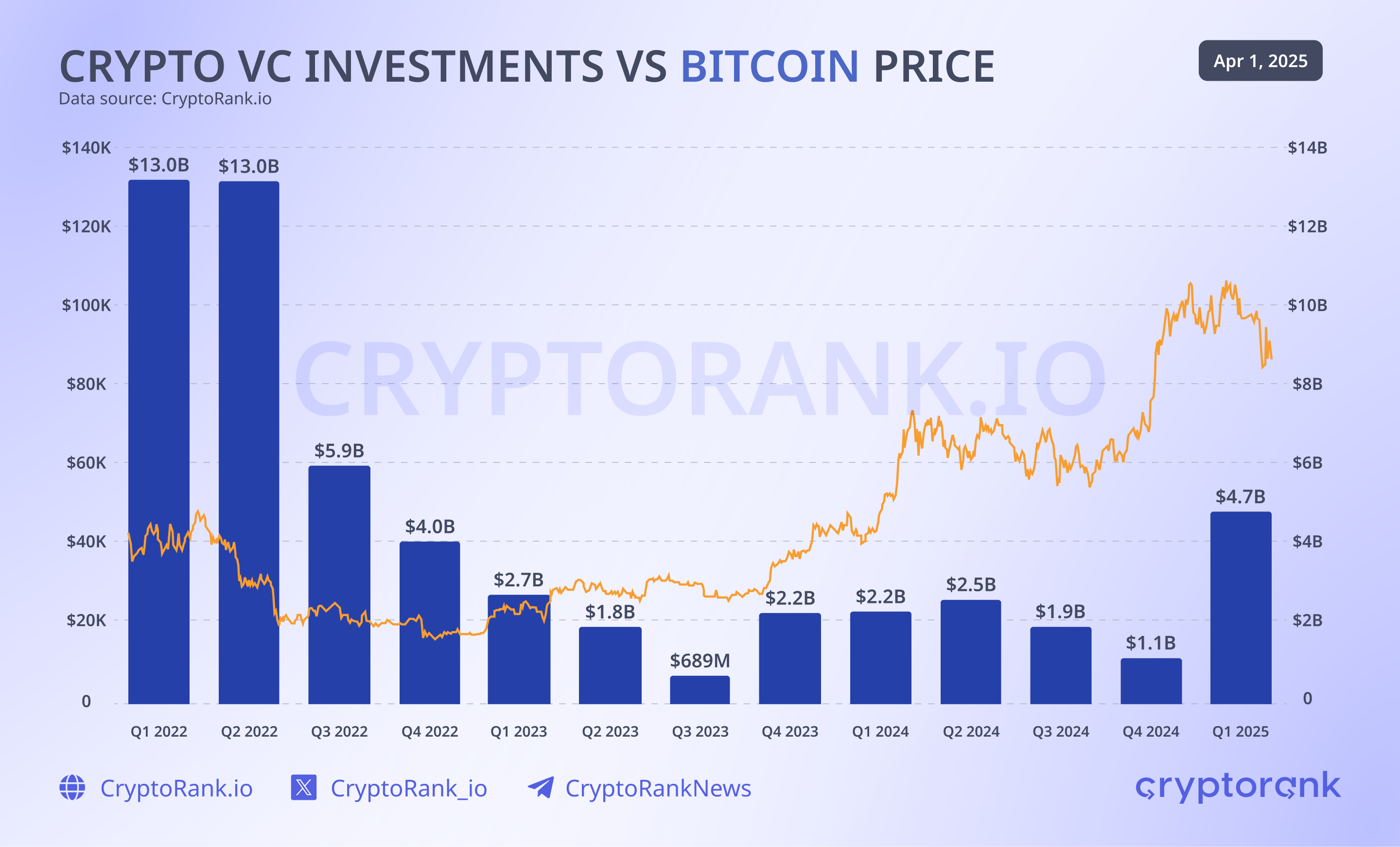

Even with an uncertain macro environment, venture capital investment in crypto jumped to $4.8 billion in Q1 2025 – the highest it’s been since Q3 2022. A key driver of this surge was a massive $2 billion funding round for Binance led by Abu Dhabi’s MGX, now the biggest deal in crypto VC history. This record-setting raise signals that institutional investors are showing renewed interest in large-scale crypto infrastructure projects, despite broader market hesitation.

Venture capital allocations in Q1 2025 already account for 60 percent of the total capital deployed during all of 2024. This acceleration suggests growing conviction among investors that crypto may be entering a new phase of adoption, with capital inflows potentially signaling the early stages of market revival.

Unlike previous cycles, Bitcoin’s price movements and venture capital activity are no longer closely aligned in real time. Instead, VC funding now tends to follow one to two quarters after major price shifts. For example, Bitcoin’s strong performance in Q3 and Q4 of last year helped drive a surge in crypto startup funding in Q1 2025. But this lagging trend also means that the recent dip in prices could lead to reduced VC activity in the months ahead.

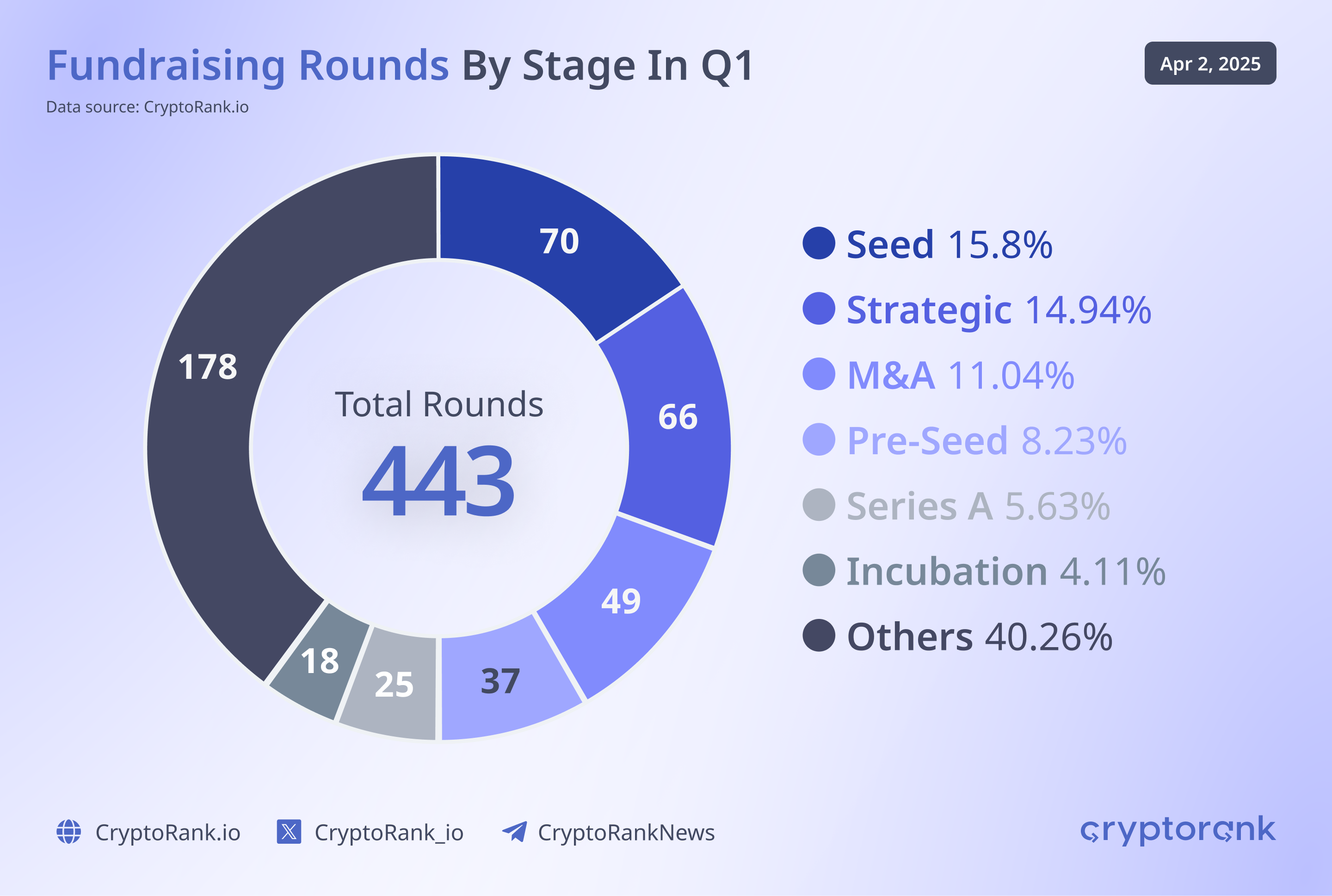

As expected, Seed rounds made up the bulk of deals in Q1, underscoring that the crypto startup landscape is still in its formative phase – even as the blockchain industry nears its 20-year mark. The focus on early-stage funding reflects the emergence of new sectors and the continued effort to discover scalable, sustainable business models within the space.

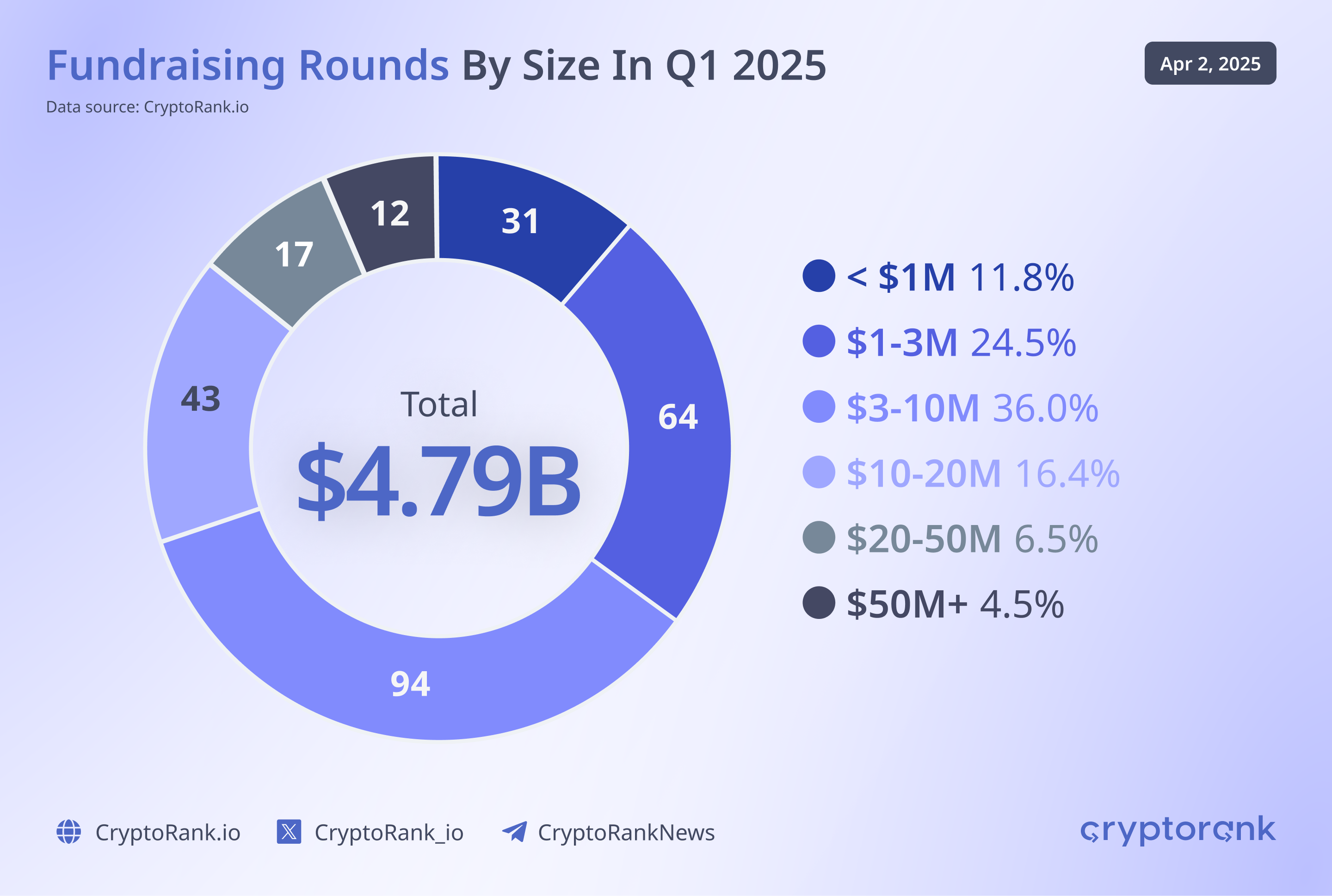

While smaller rounds under $10 million still made up almost two-thirds of all deals in Q1, larger fundraises are becoming more prominent. The quarter saw twelve deals exceed $50 million, indicating growing investor confidence in more mature, high-impact projects. This shift suggests a maturing market – where early-stage innovation continues, but there’s also increasing capital support for teams with strong track records or institutional backing, reflecting a healthy balance between experimentation and scale.

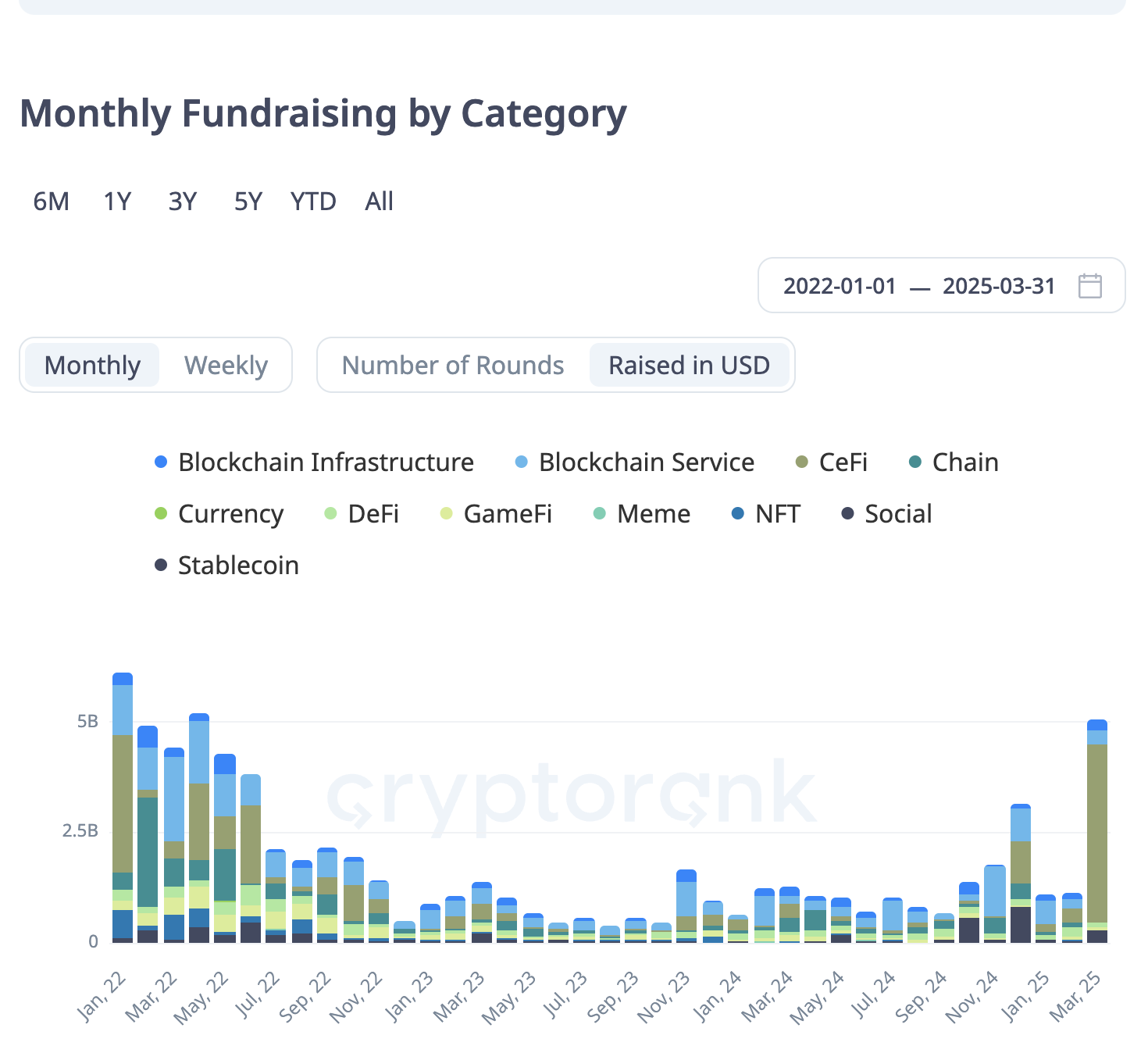

In Q1 2025, venture capital flowed mainly into three key areas: centralized finance (CeFi), blockchain infrastructure, and blockchain services. These sectors remain attractive to investors thanks to their clearer revenue models and stronger user engagement. Standout examples include Phantom, the popular Solana wallet, and Walrus, a DePIN protocol, both showing how the market favors projects with real-world utility and solid user traction.

Conversely, DeFi was one of the most active sectors by number of deals in Q1. Although the total capital raised was relatively modest, the volume of funding rounds shows that investor interest in decentralized finance hasn’t faded. Smaller deal sizes and lower valuations reflect the overall market cooldown and a more cautious outlook on DeFi in the short term. Still, the steady deal flow signals that investors see DeFi as a space ripe for innovation and long-term opportunity, even if they’re currently deploying capital more conservatively.

Investors remained active in key emerging areas, with AI, DePIN, and real-world assets (RWA) standing out as top categories of interest. These sectors are drawing attention from both crypto-native and traditional VCs, reflecting a broader shift toward use cases with real-world utility, strong infrastructure potential, and the ability to appeal beyond just the crypto crowd.

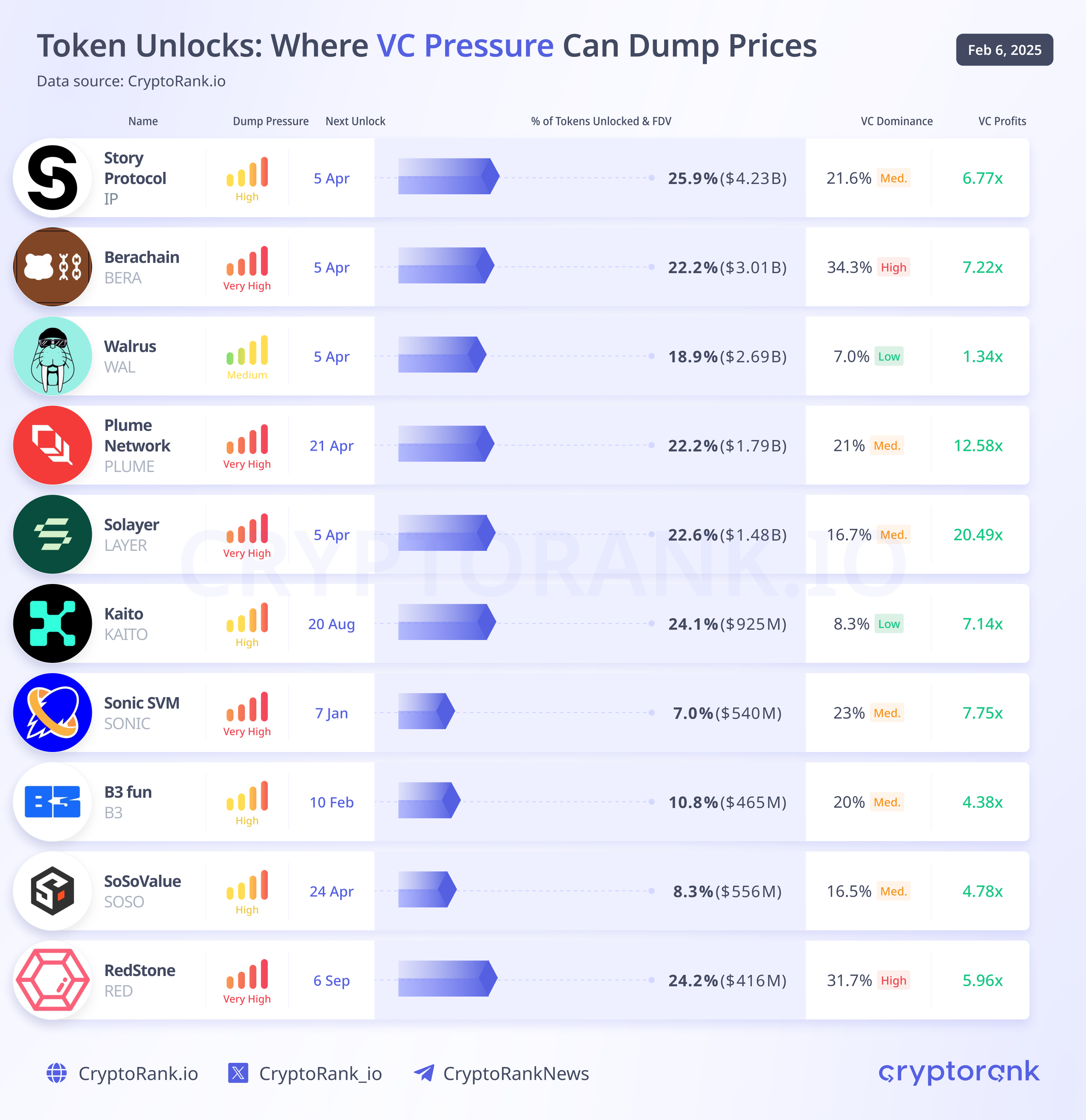

In Q1, a wave of major VC-backed token launches introduced nearly $20 billion in upcoming unlocks, setting the stage for significant market shifts in the months ahead. Projects like Story Protocol, Berachain, and Plume Network – each with low float ratios – are particularly important to watch. Their token structures can heighten price volatility and create imbalances between early backers and retail investors, making unlock schedules a critical factor for market participants to track.

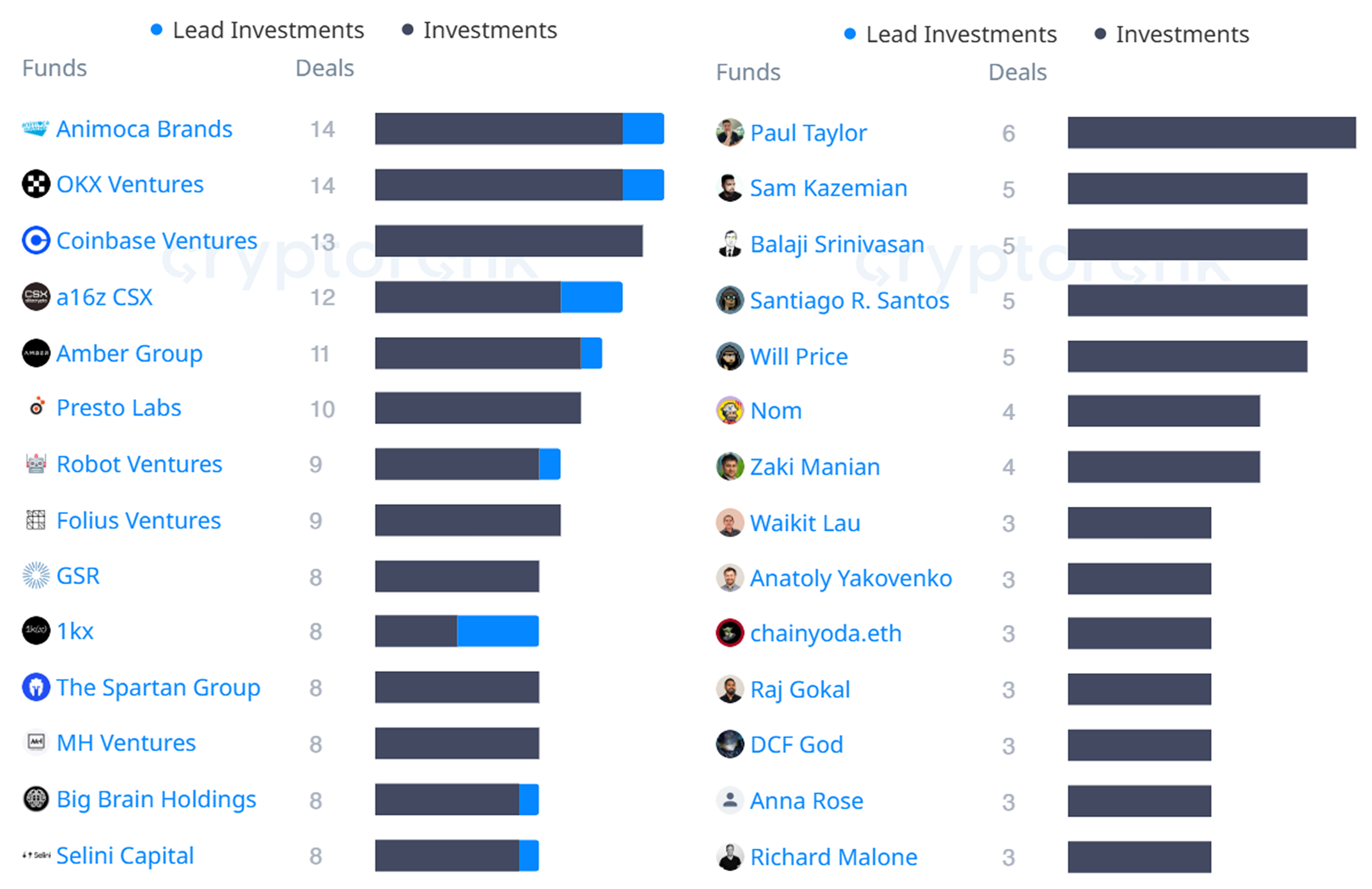

In Q1, Animoca Brands and OKX Ventures stood out as the most active crypto venture firms, concentrating mainly on small- to mid-sized deals. Interestingly, among the top 15 most active investors, only one other fund linked to a centralized exchange made the list – Coinbase Ventures. This points to a shifting landscape, where traditional venture firms are gaining more influence, while capital from CEX-backed funds plays a less dominant role.

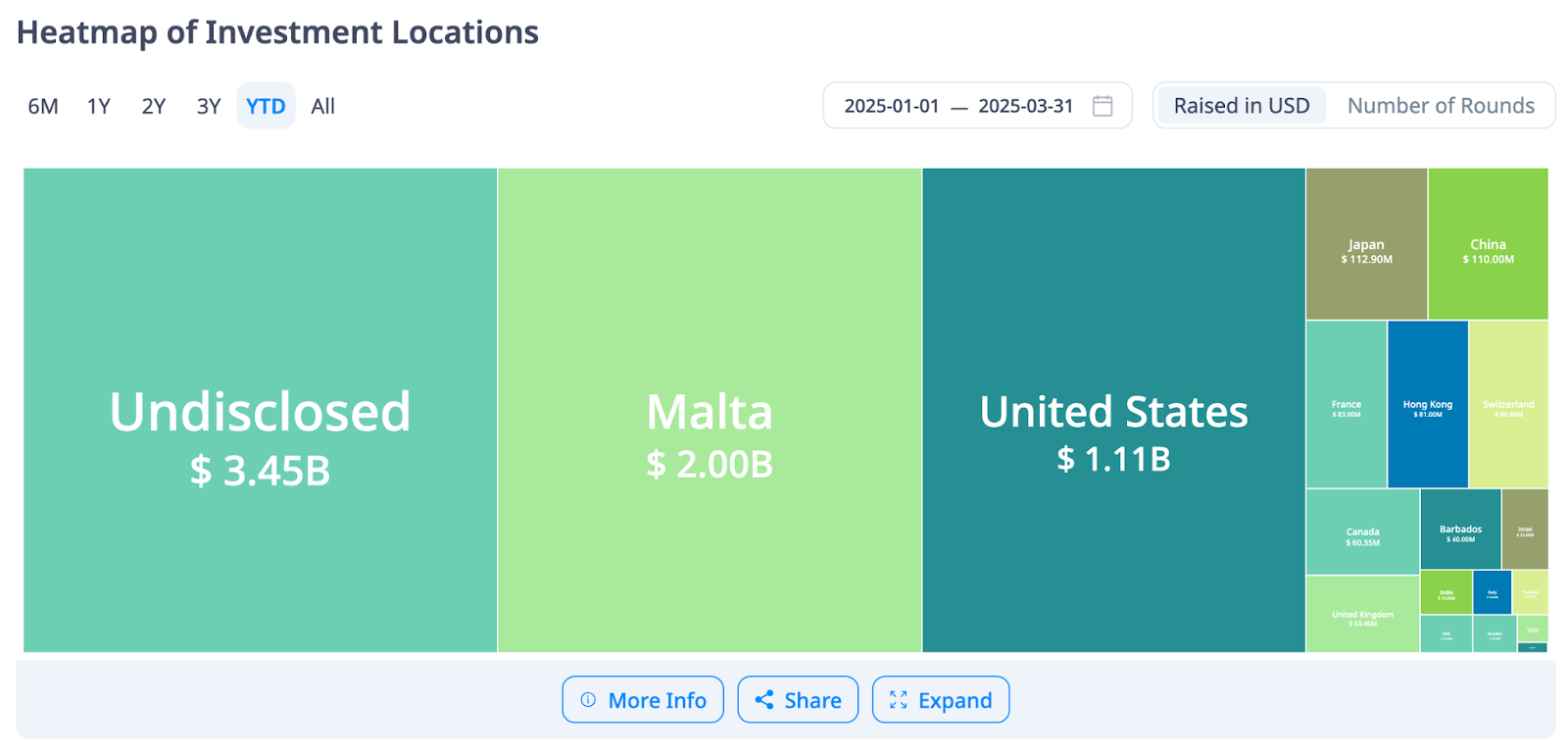

The United States remained the top hub for crypto venture funding in Q1, with U.S.-based investors involved in nearly 215 deals. Asian investors, particularly from Japan and China, showed rising activity, while select European countries also stayed engaged. Thanks to a more favorable regulatory tone and a growing pro-crypto stance from policymakers, the U.S. is poised to reinforce its leadership. With strong capital resources and an improving policy environment, it’s well positioned to remain the global epicenter of crypto venture activity.

Driven by the $2 billion Binance deal, Malta took the lead in jurisdictional fundraising activity in Q1. However, The United States was the truly dominant jurisdiction, which continued to host the majority of venture-backed projects and capital. Meanwhile, new activity is steadily emerging across Asia, with Japan, China, and Hong Kong seeing increased project formation and growing investor interest. This geographic diversification highlights the global nature of crypto venture capital and the increase in competitiveness of non-Western markets.

Here are the top cryptocurrency gainers in Q1 2025:

Formerly known as BinaryX (BNX), FORM led the market with a remarkable 460.7% increase, driven by its rebranding and renewed investor interest.

VON secured the second spot with a 414.8% surge, bolstered by strong community support and market momentum.

coinstats.app

XCN saw a 349.6% rise, attributed to its robust use cases and growing user base.

With innovative technology offerings, SQD experienced a 203.9% increase, attracting significant investor attention.

XPR’s 142.9% growth reflects heightened user interest and confidence in its platform.

These substantial gains highlight the dynamic nature of the cryptocurrency market in early 2025, with emerging projects and rebranded tokens capturing significant investor interest. The performance of these assets underscores the importance of staying informed about market trends and developments.

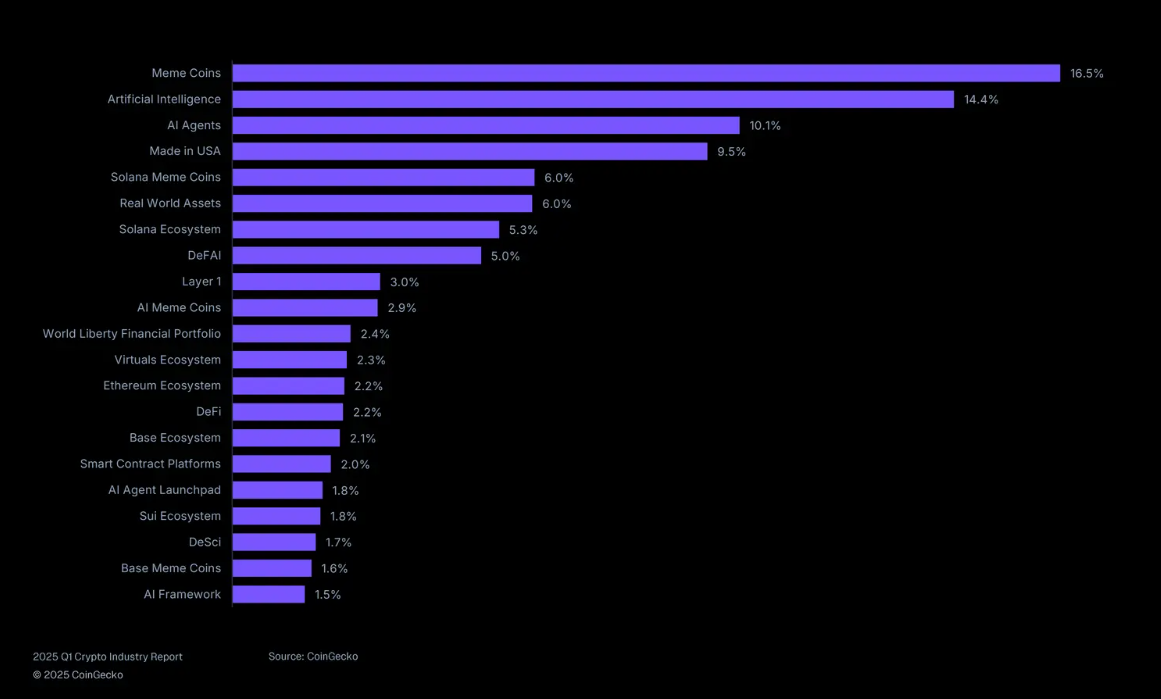

Al and Meme Coins were the main crypto narratives in 2025 Q1, accounting for 62.8% of investor interest. Made in USA tokens showed a sharp rise in interest

Source: Coingecko

In Q1 2025, AI and meme coins dominated crypto narratives. Out of the top 20 themes, six were meme-related and five focused on AI. AI took the lead in investor interest, accounting for 35.7% globally, surpassing meme coins at 27.1%.

The “Made in USA” narrative also gained traction, reaching 9.5% of interest, boosted by Donald Trump’s executive order to explore creating a Digital Asset Stockpile.

Among blockchain ecosystems, only four – Solana, Base, Ethereum, and Sui – made it into the top 20 narratives, with Solana and Base standing out as the most talked-about.

Q1 2025 was a quarter of contrasts in the crypto space , marked by historic highs, sharp corrections, institutional milestones, and ongoing innovation across sectors. Despite market volatility driven by geopolitical tensions and macroeconomic uncertainty, the industry demonstrated resilience. Bitcoin reached a new all-time high of $109,573 before entering a healthy correction, while altcoins faced mixed performance.

Meanwhile, venture capital rebounded strongly, driven by both early-stage bets and large infrastructure deals, and narratives like AI, DePIN, and RWAs gained serious momentum. With Bitcoin’s halving cycle still playing out and regulatory conditions evolving, Q2 and beyond may prove pivotal in shaping the next leg of the market cycle.

Veli Partners with DEC Institute to Equip Finance Professionals for...

Inside the Mechanics of Crypto Indexes – How Are They...