Q1 2025 Market Report This report will cover all the shifts that...

The rise of Bitcoin has created a whole new universe of possibilities for redefining how assets and investments are created, managed, and traded. Blockchain, the technology that underpins the first cryptocurrency in history, is an example of distributed ledger technology that has opened the door to numerous financial options.

It’s only a matter of time before we’ll be witnessing how blockchain changes the financial environment. This will be achievable by simplifying the process of dividing an asset into smaller units that represent ownership. As a result, this will encourage the democratization of investment in previously illiquid assets, and establish more equitable markets.

Every type of asset, including paintings, digital media platforms, real estate, stock in a business, and collectibles, can be tokenized on a distributed ledger. The advent of tokenization may profoundly alter how we invest in assets, from works of art to buildings. So, what is asset tokenization?

So, what is asset tokenization?

Table of contents

Tokenization refers to the revolutionary technology that has the power to alter the way we perceive ownership and value transaction. Since the emergence of blockchain-based platforms and decentralized finance (DeFi) apps, this cutting-edge technology has grown in popularity.

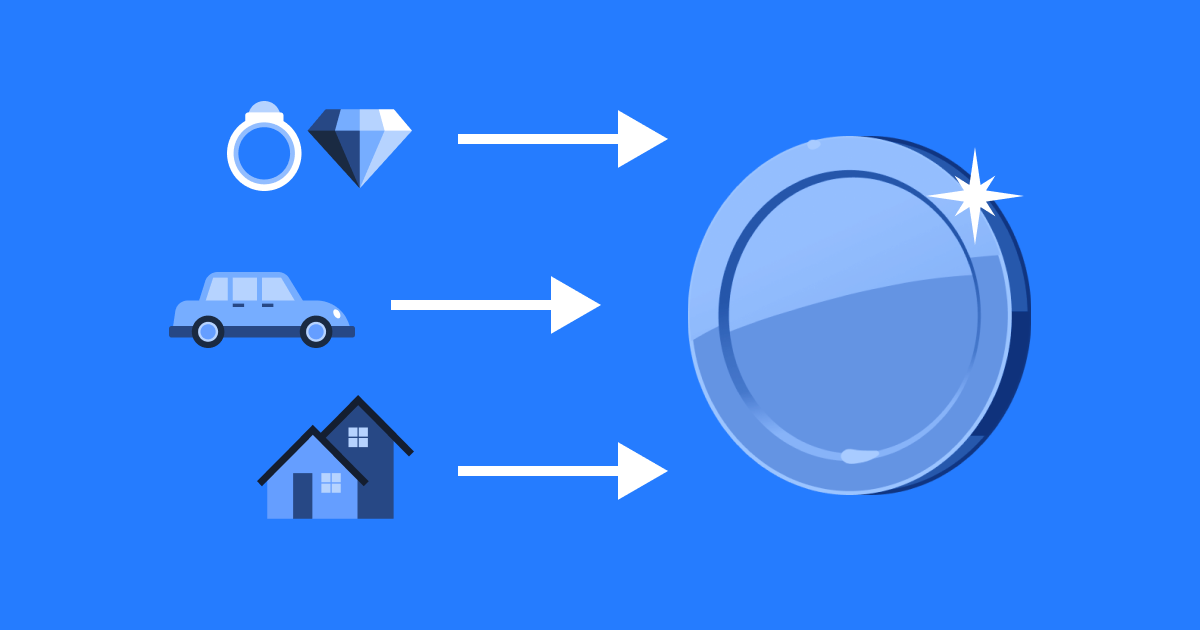

In essence, the tokenization of assets is the process of making a digital representation of a tangible asset, that can be traded on a blockchain network. This could be a work of art, a building, or even a commodity such as silver or gold. By being converted into digital tokens, these assets are ready to be traded on a blockchain without middlemen like banks or brokers. This enables anyone, regardless of location or financial resources, to invest in these assets.

The greater liquidity that tokenization offers for assets is one of its main advantages. The ease with which tokens can be traded on blockchain networks enhances the value of assets by making it much simpler to find buyers and sellers. This is crucial for assets such as real estate which can be challenging to sell fast on conventional markets.

Another reason for asset tokenization is the improved security and transparency it offers. However, it has recently garnered significant attention for its potential to transform the ownership and management of both traditional and non-traditional assets. A decentralized ledger also eliminates the need for a central authority to verify or authenticate transactions, since all transactions are recorded on a ledger. This makes the trading process much more time and money-efficient.

Tokenization is a powerful instrument for democratizing investment access. The creation of digital tokens which stand for fractional ownership enables anyone to invest in assets that were previously available only for wealthy investors or organizations. By enabling everyone to take advantage of the possibilities provided by global markets, it is possible to build more equitable and inclusive financial systems.

Tokenization of assets is not a new technology. However, it has recently garnered significant attention for its potential to transform the ownership and management of both traditional and non-traditional assets.

Asset owners, investors, and traders can all profit from tokenization in multiple ways. Since it permits fractional ownership of assets, investors can now effortlessly enter marketplaces that were out of reach before. Additionally, it offers liquidity to typically illiquid assets such as real estate, fine art, and collectibles, and makes it simpler for owners to sell their possessions.

Furthermore, asset tokenization lowers the transaction costs associated with conventional asset ownership. By getting rid of middlemen like brokers and custodians, tokenization can greatly lower the fees related to asset possession, transfer, and management. As a result, investors may be able to enter markets that were previously out of their price range.

Real estate is among the traditional assets that have been significantly impacted by tokenization. The tokenization of real estate assets has facilitated investors’ engagement in this market by enabling them to buy fractional ownership in real estate properties. By buying tokens that reflect a portion of the property, investors can join the real estate market without having to raise the substantial amounts of capital necessary for conventional real estate investing.

Art is another industry where tokenization has had an effect. It has enabled investors to buy a portion of the equity in art collections. Due to the increased accessibility of the art market, demand and market liquidity have both increased.

Tokenization has also left its mark on non-traditional asset markets like loyalty points, intellectual property, and even carbon credits. These assets can be traded more easily on a worldwide level when they are tokenized, enabling asset owners to monetize their holdings.

Tokenization of assets has become a powerful instrument for owners and investors seeking to boost the liquidity and flexibility of their assets in recent years.

Increased availability is among the key advantages of tokenization. Traditional assets like real estate or private equity can be illiquid and hard to transfer. Since it allows for fractional possession of these assets, tokenization facilitates the purchase and sale of shares.

Additionally, tokenization enables 24/7 trading, which is not feasible with conventional assets that can only be traded at specific times. Ultimately, increased liquidity makes it simpler for buyers to diversify their portfolios.

Tokenization also has the potential to increase access to investment possibilities. Institutional investors and authorized investors frequently have exclusive access to traditional assets like real estate or private equity. Because tokenization enables fractional ownership, smaller investors can take part in these investment possibilities.

Despite all the benefits of tokenization, this process of digitalization of physical assets has its own risks and challenges. Here are some of them.

Regulatory challenges. Regulatory compliance is one of the main problems with tokenization. Since the regulatory environment surrounding tokenization is still developing, legal and regulatory requirements that pertain to tokens are still unclear. Tokenization may be governed by money laundering laws, securities laws, and other legal frameworks, depending on the region. If you don’t follow these rules, you risk facing harsh legal and financial repercussions.

Liquidity risks. Tokenization can boost the liquidity of specific assets; however, it can also raise liquidity risks. It might be challenging for investors to sell their tokens and for buyers to find tokens to buy if they are not tradable on conventional exchanges.

Such a lack of liquidity can cause price volatility and make it challenging to estimate a token’s actual worth. Additionally, during stressful or uncertain market conditions, tokens may be susceptible to illiquidity risks, which can be problematic for investors who need to sell their assets rapidly.

Cybersecurity risks. Tokenization of assets carries certain cybersecurity risks as well. Tokens are stored on decentralized ledgers which can be susceptible to hacking and other online dangers. Thus, the security and protection of the blockchain technology used by token issuers are crucial.

Any security lapse could lead to the theft or loss of private data or credentials. While the appropriate security protocols and measures can help mitigate this risk, token issuers still encounter challenges.

Market risks. Investors may be exposed to market risk due to tokenization. The same market factors that affect conventional assets can also affect tokens. Thus, their value may be impacted by changes in market sentiment, prevailing economic circumstances, or business trends. To fully grasp the market dynamics and potential risks involved with investing in tokens, investors must perform extensive due diligence.

Lack of transparency. Underlying assets may become less transparent as a result of tokenization. Tokenized assets might not be as transparent as the traditional ones supported by real assets or observable financial instruments.

Although token issuers are required to provide all pertinent information regarding the underlying assets, there may still be questions regarding the assets’ actual worth or who owns them. The inability of investors to make informed choices due to this lack of transparency can also increase price volatility.

Thanks to its enormous potential, the industry for asset tokenization is expanding rapidly. In 2021, the market size was estimated at $4.8 billion. By 2030, it is projected to grow to a whopping $20.63 billion at a compound annual growth rate (CAGR) of 20%.

The trend toward the digitalization of financial assets is evident, and the use of blockchain technology in asset tokenization is becoming increasingly popular. So, what can we expect in the future?

The market’s extension beyond conventional assets like real estate and art is possibly one of the most important trends in the tokenization of assets. We may anticipate a greater spectrum of assets, such as intellectual property, patents, and even personal property, being tokenized in the future. This market development will give investors more varied investment possibilities and enable them to realize the value of previously inaccessible assets.

The adoption of non-fungible tokens (NFTs) in the market is yet another trend in tokenization. NFTs are distinctive digital assets that can represent anything, including collectibles and artwork. Investors can possess fractional shares of a special asset, like a priceless work of art, and trade those shares on a blockchain network by combining NFTs with asset tokenization.

What we can also expect to see in the future is more regulation and standardization of tokenization. Governments and regulatory bodies will probably intervene to offer a framework for the process of tokenization as the market expands. The risk of fraud and scams will be lower owing to this regulation, leading to an increase in investor security.

Furthermore, the development of tokenization will be significantly influenced by technological advancements. Smart contracts, i.e., self-executing contracts that automatically enforce the terms of an agreement, are just one example. They can be implemented to control voting rights, automate dividend distribution, and enforce regulatory compliance.

Decentralized finance (DeFi) systems, are another breakthrough in asset tokenization. DeFi platforms have the ability to completely change how assets are traded and managed since they leverage blockchain technology to provide a transparent and secure trading environment.

As we’ve learned so far, the tokenization of physical assets, real estate, and art has created a whole new universe of opportunities for investors. The rise of blockchain and cryptocurrencies has radically changed our perception of investing.

Yet, navigating the intricacies of crypto investing can be intimidating, especially for those who are new to the area. It can be difficult to pinpoint the best investment options given the large number of tokens that are accessible, each with its own special characteristics and possible hazards.

Plus, crypto investment and risks go hand in hand due to several reasons: market volatility, the absence of regulations, and the likelihood of scams. The age of tokenization has created a variety of new investment options, but it is crucial to approach these investments cautiously.

Both the risks and the potential profits might be very high. Investors may manage the difficulties of cryptocurrency investing and find the possibilities that are best for them by doing extensive study and due diligence.

Latest Articles

Veli is Going for the MiCA License! A new era in compliance...

Over 100 New Coins Added to the Veli Platform! 🚀 Earlier this...