Q2 2024 Market Report This report will cover all the shifts that...

The 4th quarter of 2023 emerges as the best performing quarter since Q1 2023 at the beginning of the year. The total cryptocurrency market capitalization rose 50% in the last 3 months of the year, accelerated by the growing probability of a spot Bitcoin ETF approval in the United States.

As we recap the previous quarter, including market movements, top gainers, headlines and more, this blog post will also go over crypto’s entire 2023 impact and development, and what to expect in the next year.

The total market capitalization of cryptocurrencies has increased from $1.056 trillion to $1.628 trillion, marking an increase of 56% in the last quarter of 2023. The market has steadily been rising the entire quarter, with only a little sideways action in the second half of November. The main factor for such an exceptional performance was the continued demand for a Bitcoin ETF from traditional financial institutions , with companies such as BlackRock also filing for an Ethereum ETF.

The leading cryptocurrency by market cap, Bitcoin, saw a price increase of 52% in the quarter, from $27,900 to $42,600. Bitcoin has seen continued interest during Q4, as more financial institutions in the United States filed for spot ETFs, which are predicted to be approved during 2024. An approval of Bitcoin spot ETFs would mean that the entire United States stock market would have the ability to directly invest in Bitcoin, whereas now they can only invest in the Bitcoin futures ETF, which means investing in a contract, and not in the underlying asset.

Ether saw a 36% increase during the final quarter of the year, rising from $1,730 to $2,360. Its price was also boosted thanks to ETF talks, as BlackRock filed for a spot Ethereum ETF on the 17th of November.

Binance’s BNB coin rose +48% during Q4, as the cryptocurrency’s price increased from $214 to 318$. A price increase to $270 occurred in November, after which a retracement back to $225 happened due to U.S. D.O.J. charges through which Binance was fined $4.3 billion, and their CEO Changpeng Zhao was forced to resign.

Solana emerges as the Quarter’s best performer from the top 5, overtaking XRP (and at one point BNB) to rise up as the fourth biggest cryptocurrency by market capitalization (not including stablecoins). Solana’s price rose an astonishing 370% in the final quarter of the year, jumping from $21 to $100 in just three months. This recent price increase comes as a result of the growing number of users of the Solana blockchain, as more and more traders interact with decentralized applications and “Memecoins”, cryptocurrencies with no underlying utility based on internet memes.

XRP’s price increased the least out of the top 5 in Q4 of 2023, by a respectable 22%. The cryptocurrency’s price increased from $0.51 to $0.63, while achieving its highest price of $0.75 on the 13th of November.

Learn more about Veli strategies here.

In November, the notorious FTX Founder, Sam Bankman-Fried, was found guilty on all 7 charges including defrauding customers, money laundering and campaign finance offenses.

Sam is facing a maximum sentence of 115 years in prison after the defense proved that he defrauded customers for over $8 billion through FTX and their sister company, Alameda research.

In November, Binance, the world’s largest crypto exchange, agreed to a $4.3 billion fine to resolve criminal charges brought by the United States Department of Justice.

The charges included sanctions violations, running an unlicensed money transmitter business and failing to maintain an adequate anti-money laundering program.

Binance’s CEO, Changpeng Zhao, was also ordered to pay a $50 million fine and was forced to step down from his position as CEO.

The Securities and Exchange Commision Chairman Gary Gensler stated that the S.E.C. has eight to ten filings of possible spot exchange-traded products for Bitcoin in front of it for consideration.

This includes filings from financial institutions like BlackRock, BitWise, WisdomTree, Fidelity and Invesco, among several others with pending applications.

As of January 10th, 2024, all of the above mentioned spot Bitcoin ETFs have been approved by the SEC.

BlackRock has also filed for a spot Ethereum ETF with Nasdaq. This move shows a never-seen-before growing interest from the once-crypto-skeptical conglomerate corporation.

This filing could also indicate that BlackRock is not just interested in the “store of value” aspect of crypto (Bitcoin), but also in the technological developments (Ethereum) and how they will impact the future of finance.

Throughout 2023, significant news events and developments were the primary drivers behind the heightened volatility observed in the price. However, apart from these occurrences, there was an unusually long period of low volatility characterized by extended phases of sideways consolidation in the market.

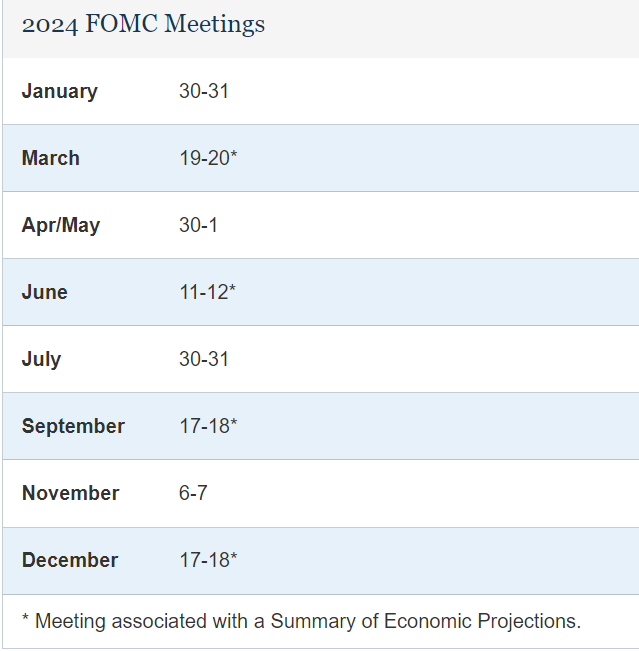

The global economic landscape has been turbulent this year, yet Bitcoin had a remarkable 156% year-to-date returns. Central Banks worldwide have engaged in strict monetary policies to combat inflation, exemplified by the U.S. Federal Reserve’s unprecedented 11 interest rate hikes within the current cycle. By July 2023, the federal funds rate hit its highest target range in 22 years, peaking at 5.25-5.5%. Subsequently, rates have remained at these elevated levels in Q4, as policymakers carefully evaluate the persistent inflation issue. The U.S. Federal Reserve Board pointed to reducing interest rates in 2024.

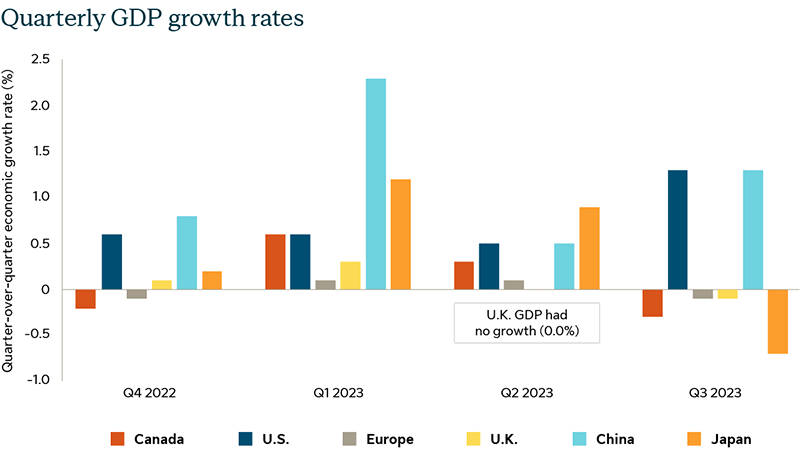

Global inflationary pressures worldwide are easing, indicating that the aggressive rate increases by central banks may be effective. In November, the inflation rate in Canada and the U.S. was 3.1%, in Europe it was 2.4%, and in the U.K. it reached 3.9%. Meanwhile, Japan saw a 2.8% inflation rate in November. Conversely, China is facing deflation, with consumer prices falling by 0.5% year-over-year.

The U.S. economy saw a robust annualized growth of 4.9%, while China experienced a 4.9% year-over-year expansion. In contrast, Europe faced a slight contraction with a 0.1% decline in its economy, and the U.K. witnessed a similar 0.1% shrinkage in its gross domestic product. Japan, on the other hand, recorded a more significant downturn, with its economy contracting by 2.9% on an annualized basis.

The submission of BlackRock’s Spot BTC ETF application created a significant impact on the market, signaling substantial interest in the digital asset industry from the world’s largest asset manager. Post-FTX’s revival, there has been a resurgence in the industry, notably seen through increased participation by sophisticated institutional players, indicating a growing positive sentiment and steady rise in involvement.

Reviewing the year-to-date performance of Gold, Equities, and Crypto in 2023, all these asset classes exceeded initial expectations. Bitcoin has outperformed all the major asset classes in 2023, especially in Q4. Market dynamics, especially in responsive assets like technology stocks and cryptocurrencies, favor investors who predicted the peak of inflation and interest rates by mid-year. Such foresight positioned them well, capitalizing on optimistic speculation surrounding high-growth investments, ultimately securing significant gains.

With global inflation easing, central banks are in a dilemma: too easy on policy might bring back inflation, while tight policies could trigger a recession. Global inflation has potentially peaked, but the journey to stability may lead to moderate growth until 2025. The projection: a slowdown in global economic expansion to 2.8% in 2024 and 2.9% in 2025, down from 3% in 2023. While the combination of sluggish growth and persistent inflation above the desired 2% threshold raises concerns for the overall economy, the crypto industry has shown promising indicators over the past year despite these challenges.

There might be a divergence in correlation between traditional assets and cryptocurrencies because of several unique catalysts that could attract new investments, like the approval of the Spot ETF or the BTC halving event. However, it’s crucial to remain aware of the possibility of a recession, as this could have a broad impact that new demand might find challenging to outweigh. Most importantly, keeping an eye on global liquidity will offer insights into how Bitcoin might perform throughout the year. Liquidity cycles, which often align with BTC halving cycles, typically influence the strength or weakness associated with Bitcoin’s price movements.

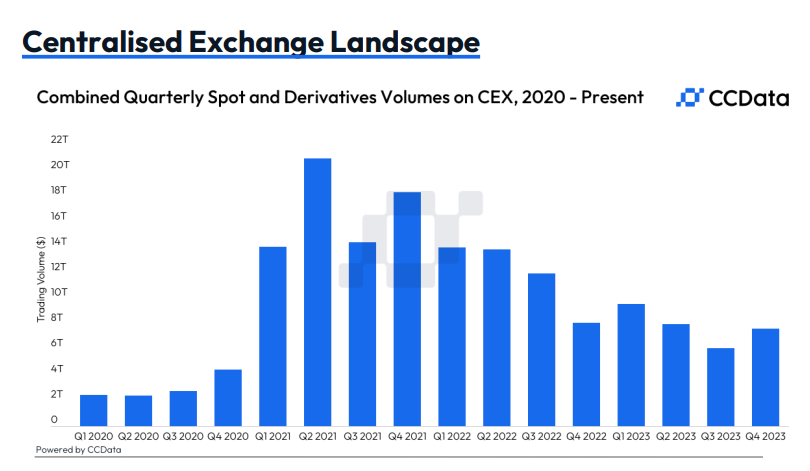

During Q3 2023, trading volumes on centralized exchanges reached multi-year lows, marking the lowest quarterly volume since Q4 2020. Such diminished volumes often signify the conclusion of a market cycle, indicating the return of volatility and subsequent price appreciation, similar to what was observed in Q4 2023.

Anticipated catalysts such as the approval of the spot Bitcoin ETF in the US and the Bitcoin halving event are expected to prompt a surge in trading volumes across crypto markets as they transition into a new cycle.

The number of addresses with balances ≥ 0.1 and ≥ 1 BTC has seen slight growth, which shows that retail is gradually accumulating BTC in Q4. The addresses with a balance of ≥ 1 BTC experienced a slight decline during October but continued to rise afterward. The number of addresses with balances ≥ 0.1 raised from 4.49m to 4.58m, and ≥ 1 from 1.022m to 1.025m.

Bitcoin: Number of Addresses with Balance ≥ 0.1

Bitcoin: Number of Addresses with Balance ≥ 1

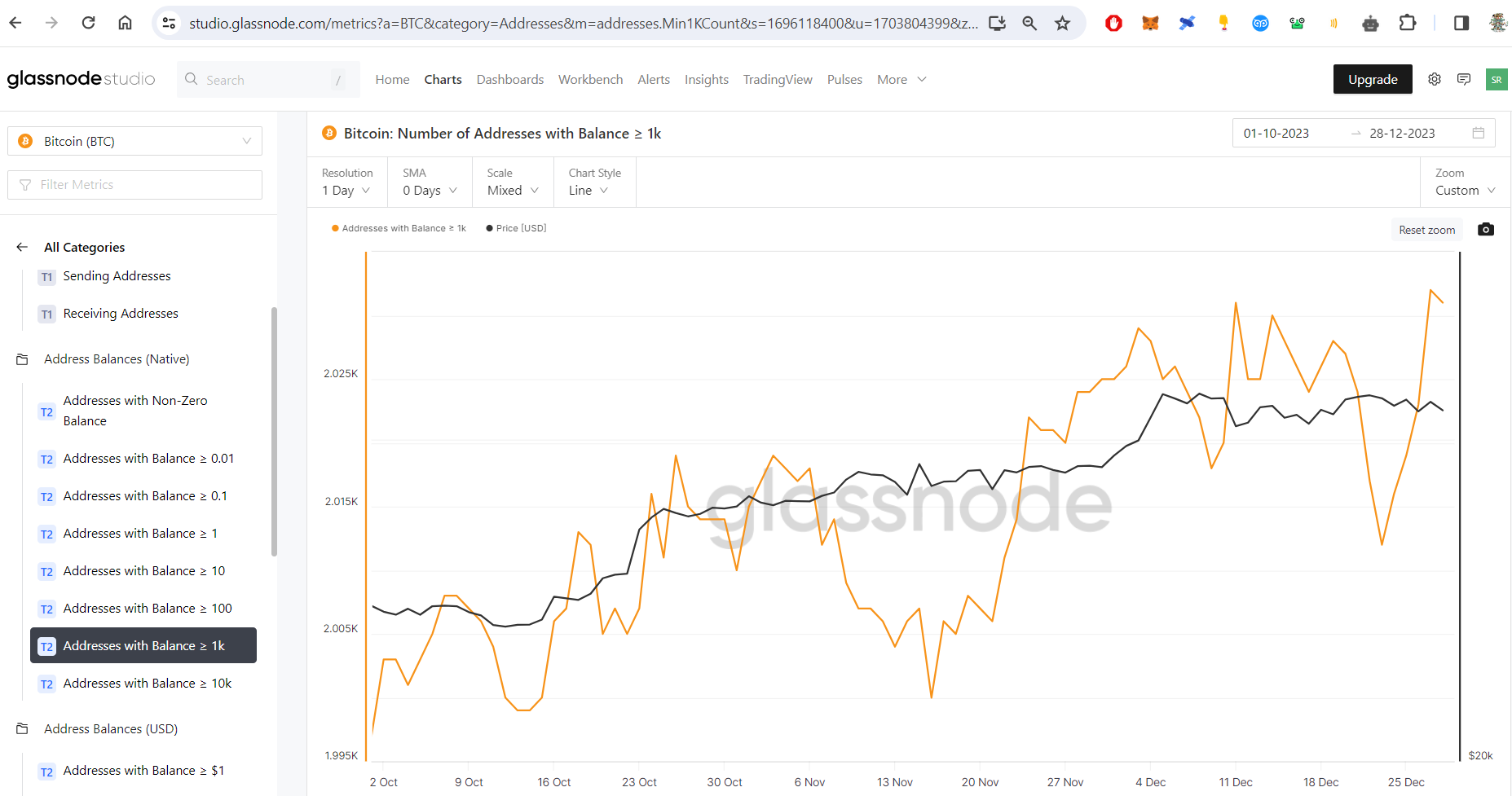

The number of addresses with a balance of ≥ 100 and ≥ 1k BTC has finally begun to gradually rise in Q4 after a prolonged period of stagnation. Addresses with a balance of ≥ 100 experienced a slight increase, peaking in November, with the count rising from 15,992 to 16,144. At the same time, the number of addresses with a balance of ≥ 1k BTC has slowly started an upward trend after a downtrend since March 2022. This suggests that larger entities, known as whales, have begun accumulating BTC in Q4, as the count rose from 1997 to 2031 addresses.

Bitcoin: Number of Addresses with Balance ≥ 100

Bitcoin: Number of Addresses with Balance ≥ 1k

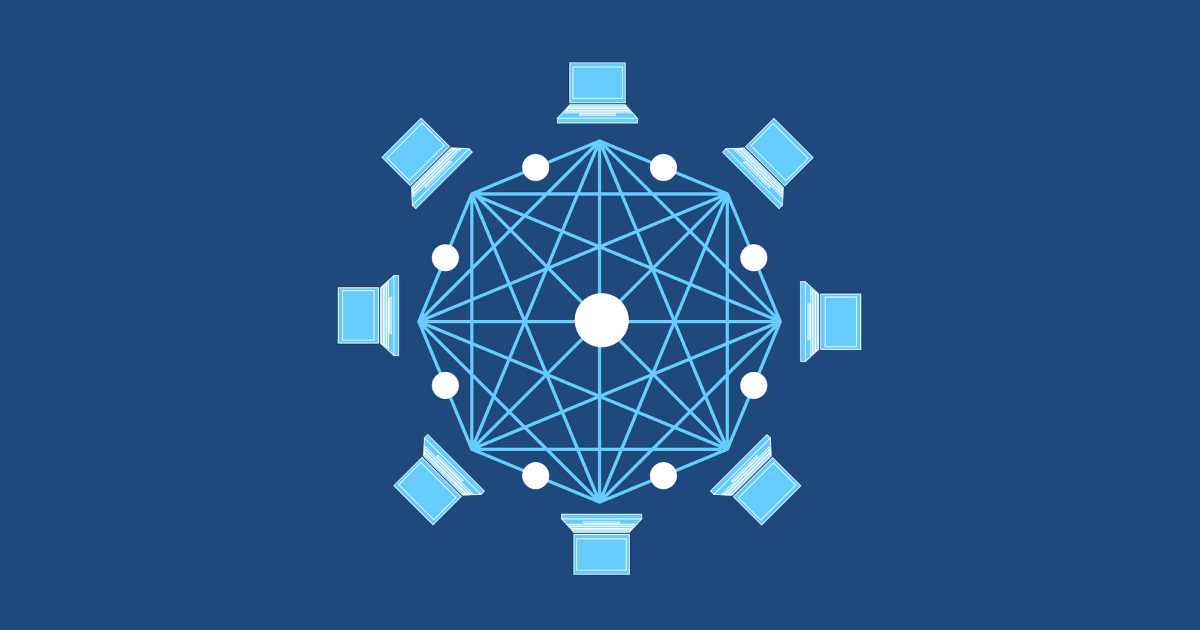

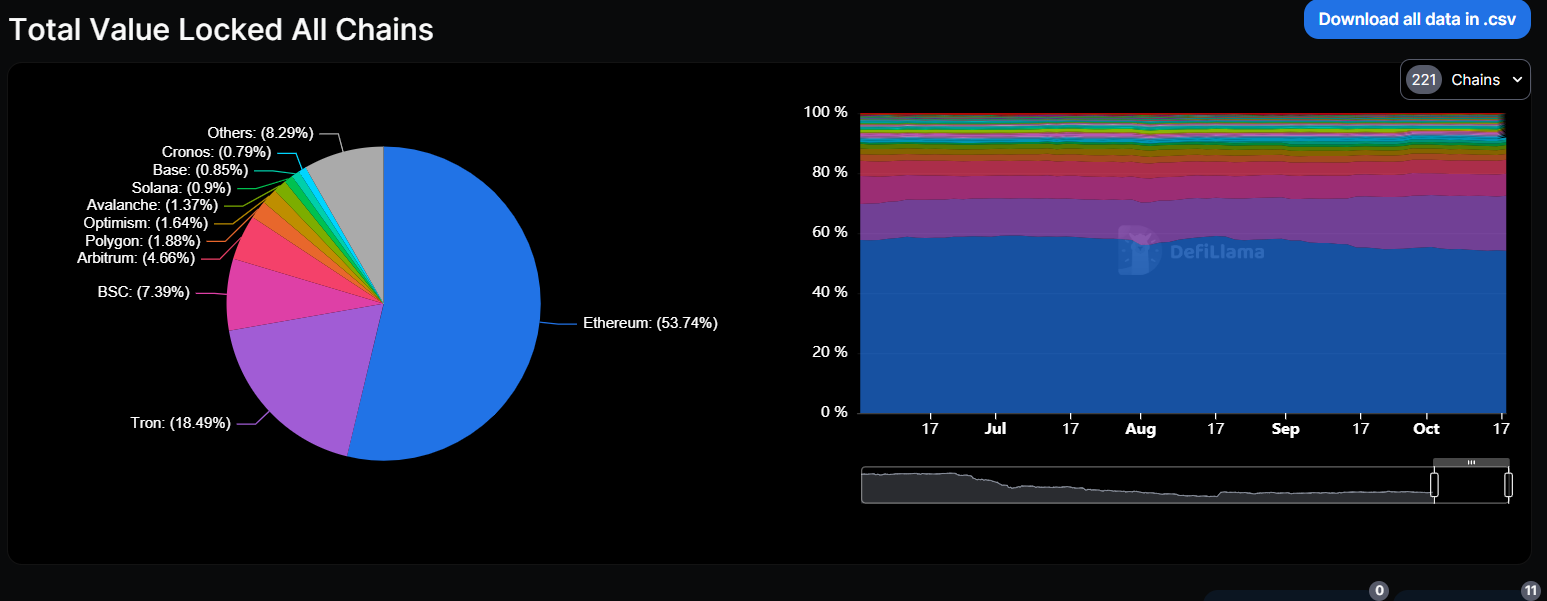

TVL (Total Value Locked) in DeFi remains highly concentrated on Ethereum, which dominates with 54% and had a slight rise from Q3. Ethereum is followed by Tron, BNB, and Arbitrum. In Q4, interest in the Solana chain has risen significantly, resulting in a threefold increase in TVL. Other blockchains, such as Avalanche and Cardano, have also demonstrated slight growth in TVL.

Ethereum

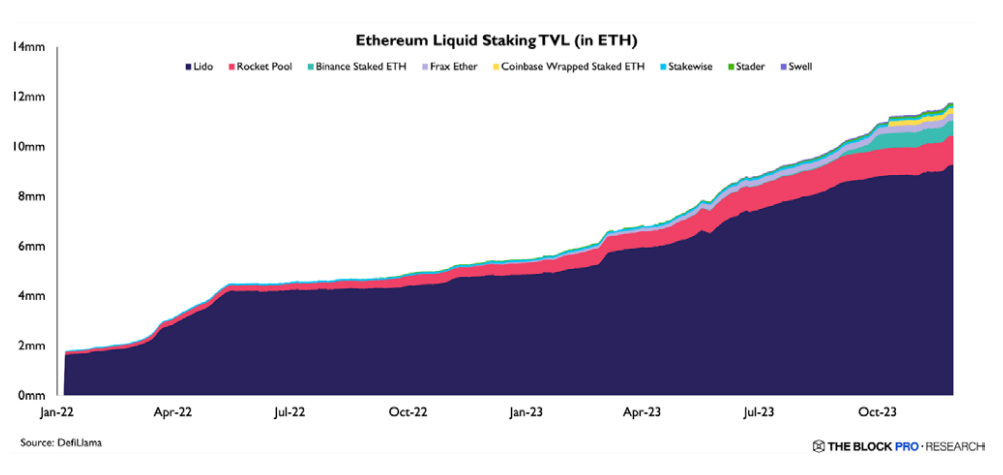

In 2023, the Ethereum liquid staking sector stood out as a DeFi powerhouse. Its success can be credited to two key factors: the appeal of stable returns generated from liquid staking during a bear market characterized by low volatility, and the surge of ‘liquid staking finance’ protocols, elevating the utility of staked tokens.

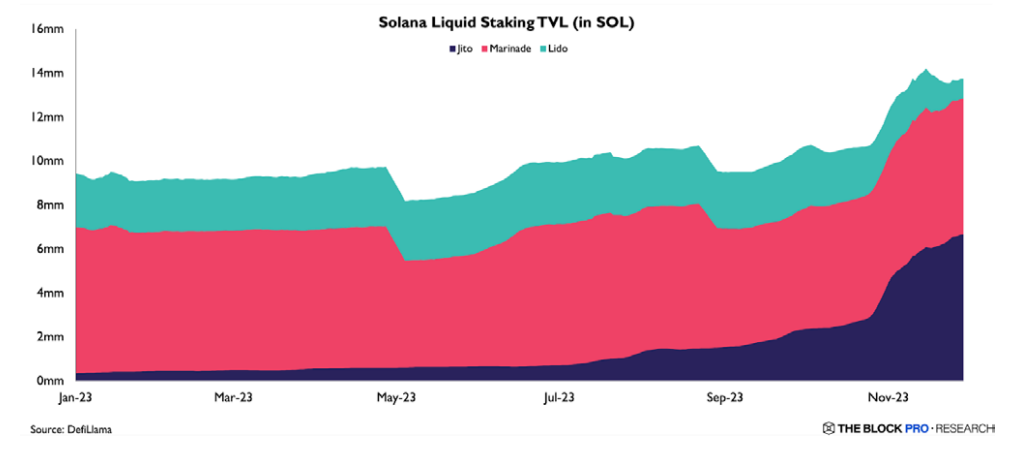

Solana

As Ethereum’s liquid staking ecosystem matures, Solana’s counterpart is swiftly emerging. In a notable milestone, Jito surpassed Marinade in Total Value Locked (TVL) in November, solidifying its status as the premier liquid staking protocol on Solana. Jito’s ascent is attributed to its successful rewards program, including an airdrop, marking an early triumph in the space.

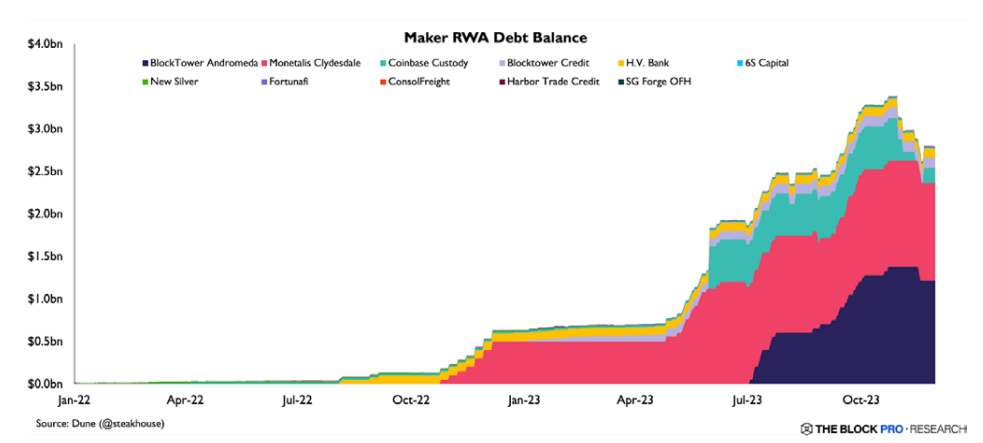

In 2023, the DeFi landscape witnessed substantial growth across various segments, including the notable expansion of real-world asset tokenization. Maker’s strategic move to incorporate real-world asset (RWA) collateral, issuing 2.8 billion DAI from RWA-collateralized debt positions, played a pivotal role in this surge. These RWA positions not only represented over half of the total 5.4 billion DAI supply but also contributed around 80% to Maker’s overall revenue through generated fees

RWA Adoption Fueled by High-Yield Returns

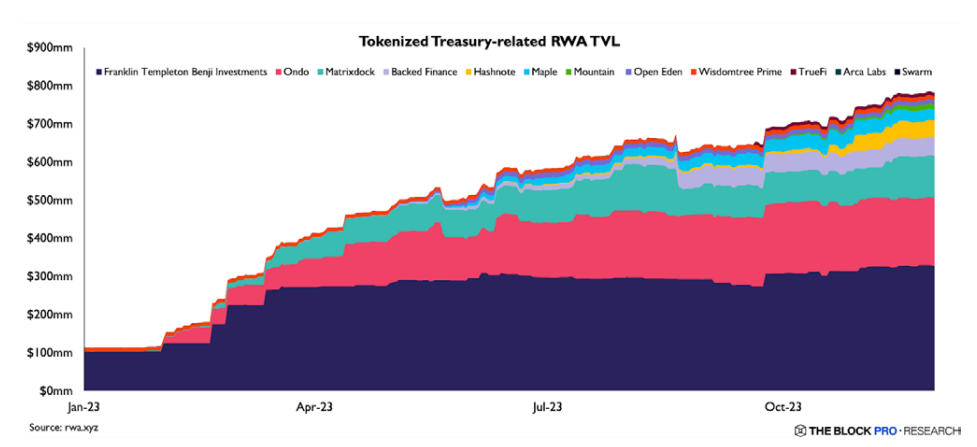

In the realm of DeFi, tokenized securities, especially those linked to U.S. Treasuries, gained momentum beyond Maker’s influence. The Total Value Locked (TVL) in these securities experienced a significant surge, totaling $782 million. Two prominent contributors to this growth were the Franklin OnChain U.S. Government Money Fund on Stellar and the Ondo Short-term U.S. Government Bond Fund on Ethereum.

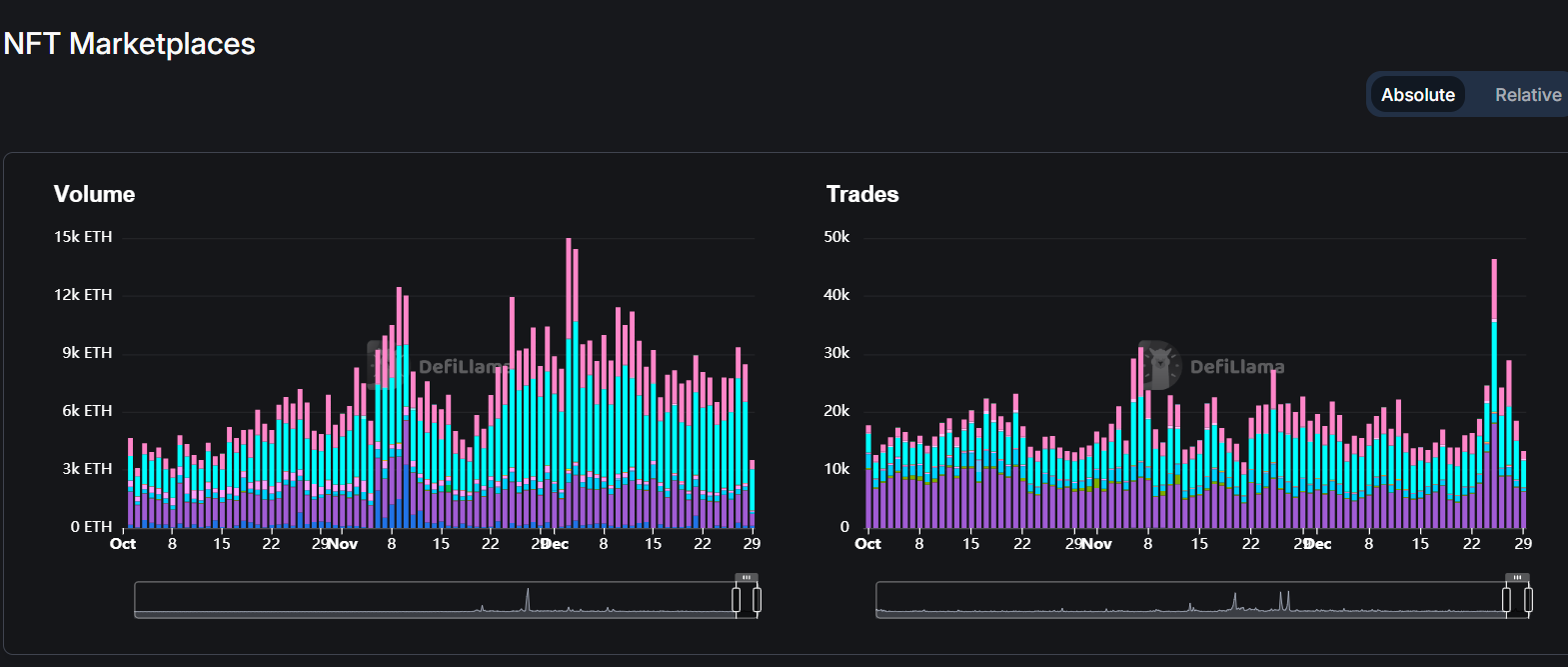

Blur and OpenSea remained top platforms for NFT sales with the highest volumes and market shares of 54.71% and 20.79% of the entire NFT market. Ethereum remains the top non-fungible tokens (NFTs) blockchain with the biggest market share and trading volume in Q4 (84% rise). The biggest volume rise, NFTs have seen on the Solana chain and within Bitcoin in Q4.

NFT Collections

Collections in the mid-tier, such as Pudgy Penguins, Mad Lads, and Milady Maker, are seeing notable rises in floor prices and trading volume, signaling a rising market interest. At the same time, established collections like CryptoPunks, Azuki, and Bored Ape Yacht Club, considered blue-chip in the NFT space, have also encountered significant price increases.

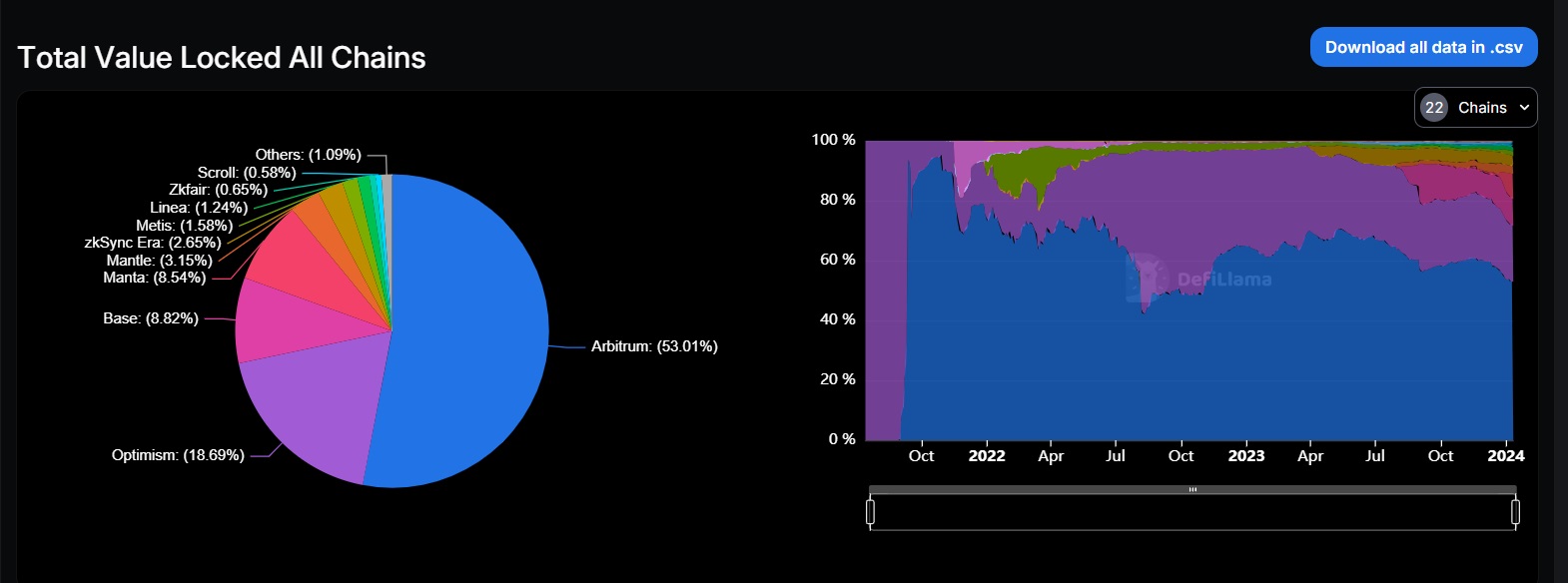

Among roll ups, Arbitrum remains the chain with the most TVL locked, with $2.65b locked and TVL share of 53.01%. 2nd place remains for Optimism with $935.43m locked and 18.69% TVL share. Projects with good progress in Q4 are Base and Manta with $441m and $427m value locked.

By the end of Q4, the stablecoin market cap experienced an increase, rising from $124.3 billion to $132.80 billion.

USDT maintained its dominance as the biggest stablecoin by market capitalization making a 70.84% (Jan. 10) of the total stablecoins market cap (currently, mc of USDT – $94.6b) with a rise of around 9% in market capitalization in Q4.

USDC remained the 2nd largest stablecoin by market cap with a slight decrease in market capitalization by 1%, having a market cap of $24.1b.

DAI and TrueUSD had a decline in market caps by 6% and 44%, having market caps of $5.16b and $2.28b, while First Digital USD had an increase of 78% in market capitalization with a current market cap of $2b.

There are just around 3 months left before the next Bitcoin halving occurs! With this event approaching, the price action is already on the rise in anticipation. Besides that, news of a SPOT ETF is also quickly stimulating prices. With the Bitcoin price already tripling this year, sideways action could occur until the halving. However, given the significance of this event, prices could still continue to rise or rise faster than anticipated. According to historical cycles, Bitcoin should have reached its bottom in November 2022 at around $16k per BTC. As for altcoins, they have started making their first significant moves in price rise but still have a lot of room for growth. Some corrections and sideways trading are expected on the way up, but looking long term, altcoins are still positioned low.

When examining the monthly timeframe and adopting a longer-term perspective, we observe that Bitcoin (BTC) currently resides in relatively overbought territory, gradually inching towards higher levels. Currently, the first significant resistance that needs to be overcome is around $48-52k. Historically, BTC prices should test the next big resistance at $48-52k levels and linger within the range of $30k – $52k until the halving. With the approval of the Bitcoin SPOT ETF carrying significant weight, the BTC price could continue to increase and go much higher in this period; however, historical trends suggest it should stay within the mentioned range. During this phase of the cycle, historically, the largest altcoin by market cap, Ethereum, is expected to take over and increase its dominance percentage.

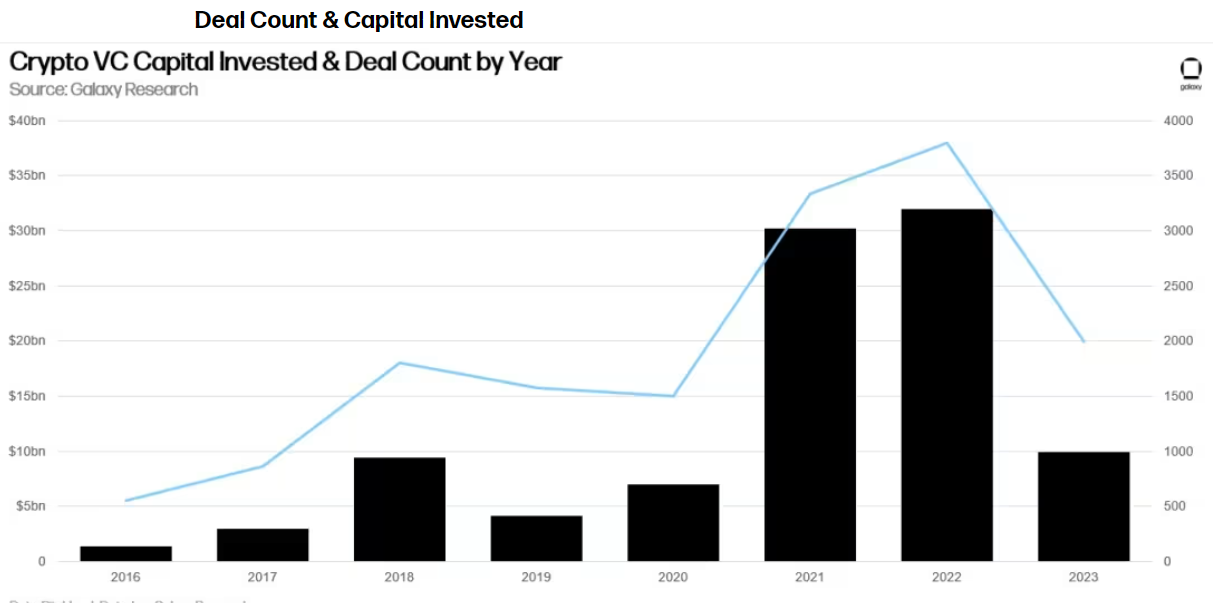

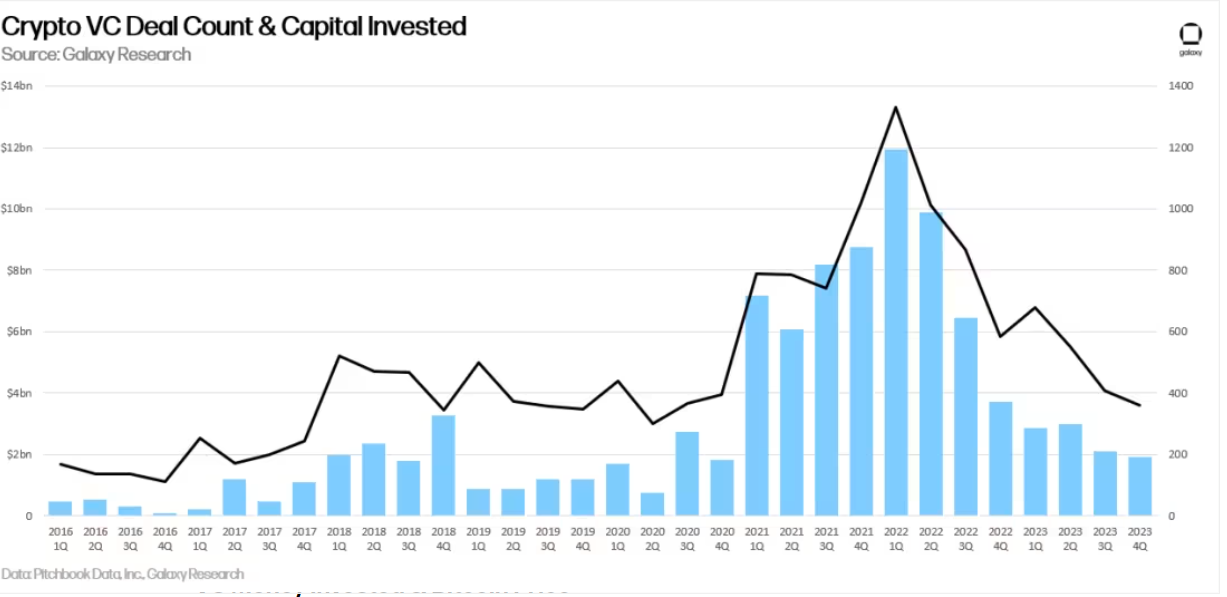

In 2023, cryptocurrencies saw remarkable price surges, with BTC rising over 160% and ETH up by 90%. Despite these gains, crypto venture capital investment took a notable dip compared to the banner year of 2022, finishing the year with only a third of the investment across just over half the deals. However, as the crypto industry gears up for a surge in 2024 and central banks consider easing, there’s potential for renewed interest in crypto venture capital this year according to Galaxy Digital research.

In 2023, crypto venture capital marked its third-largest year in terms of both deal count and capital invested, even though both metrics experienced a substantial decline from the highs of 2022.

Quarterly trends show ongoing declines in both deal count and capital investment. In Q4 2023, $1.98 billion was invested across 359 deals, a slight decrease from the figures in Q3 2023.

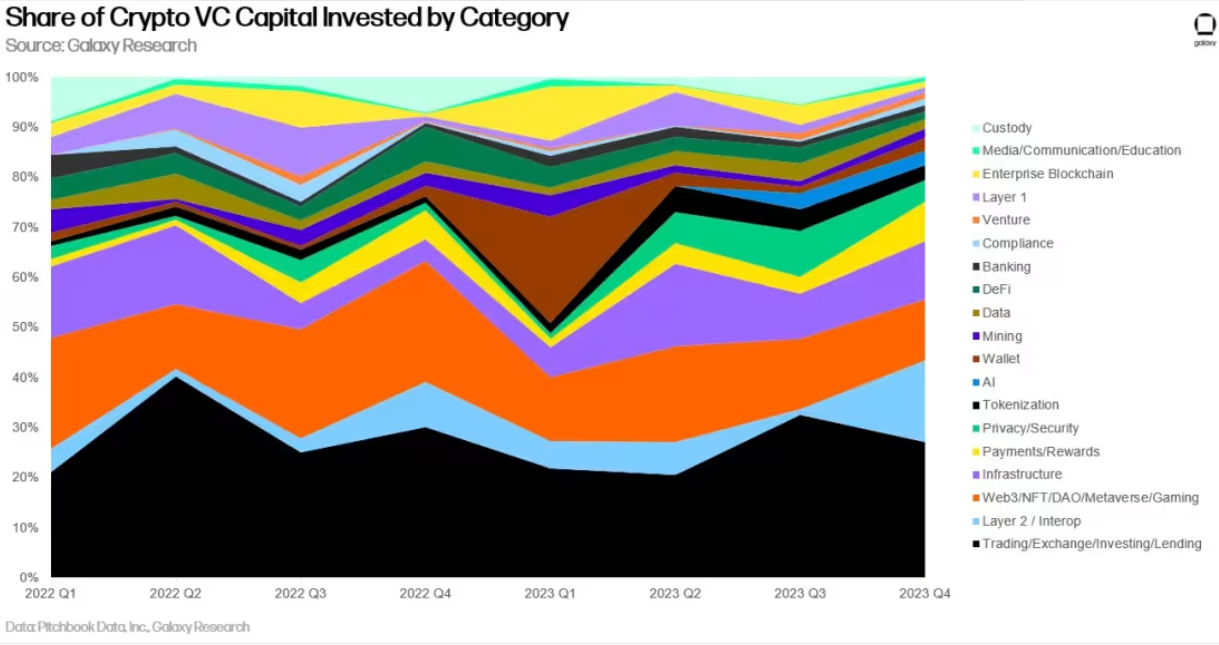

Continuing a trend, startups in Trading, Exchange, Investing, and Lending secured the highest venture capital funding for the fourth consecutive quarter, constituting 27% of the total. Notably, the Layer 2 & Interoperability category secured the second-highest funding at 16%, driven by Wormhole’s impressive $225 million fundraising. Web3 claimed the third spot with 12% of the total capital raised, while the newly introduced AI category maintained a steady presence, accounting for about 3% of the overall raised capital.

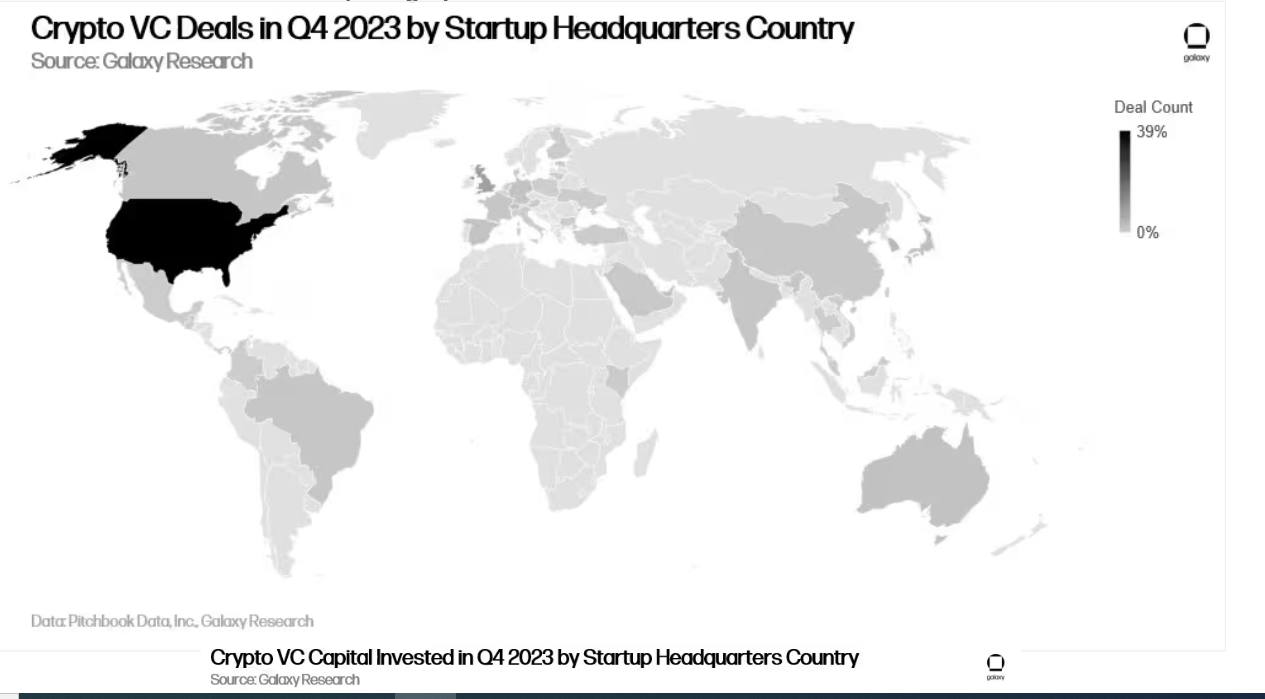

In 2023, the United States maintained its dominance in both deal count and capital investment. Notably, almost 40% of the deals in Q4 involved startups headquartered in the United States.

Among the list of gainers, you can find a diverse range of projects. However, there doesn’t seem to be a prevailing trend or overarching narrative that would drive the entire industry, similar to the DeFi boom in 2020-2021, the emergence of GameFi in 2021, or the buzz surrounding AI in the early part of 2023.

The price of the memecoin BONK surged in October with the introduction of single-sided staking pools, enabling holders to earn yields without a second asset. The recent announcement on December 14th of Coinbase listing the token further fueled BONK’s momentum. Unlike other meme coins with longer histories and similar market caps, such as PEPE, BONK experienced the ‘Coinbase Effect,’ gaining mainstream legitimacy and reaching Coinbase’s large user base. This listing is not only elevating BONK but also benefiting the broader Solana ecosystem.

KEX‘s recent price surge is fueled by increased activity on the KIRA Network, a platform offering crypto-backed lending and borrowing services. Utilizing major cryptocurrencies like KEX, Bitcoin, and Ethereum as collateral, KIRA provides borrowers with low interest rates, flexible durations, and penalty-free early repayment options.

NEON, associated with the Solana-based project, surged an impressive 4000% from October to January 2024, reaching a peak of $3. This outstanding performance propelled NEON into the top 400 in market capitalization on CoinGecko. The Neon protocol, functioning as an EVM platform on the Solana network, facilitates the deployment of Ethereum-compatible smart contracts using the Solidity programming language for Solana users.

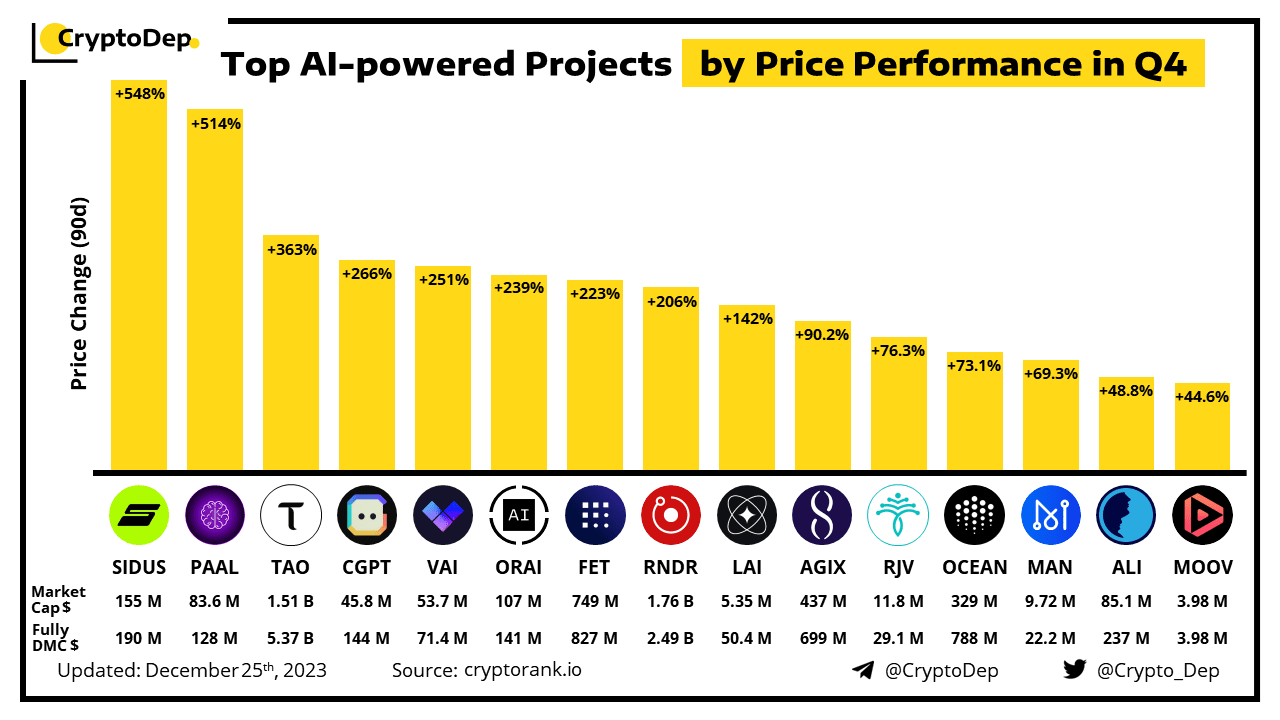

This year, the AI narrative has gained significant momentum in the crypto industry. Here are the top-performing projects harnessing AI in Q4 2023.

Crypto sentiment is on the rise, and games are not laging behind. A substantial growth in blockchain gaming is foreseen, with highlighting Immutable’s IMX token, which surged 45% post collaboration with Merit Circle and totally 284% during the Q4. Ronin’s RON token saw a 309% increase, and Beam 461% in Q4 among others. One of the biggest Metaverse projects, The Sandbox’s SAND, is up 90% in the Q4. Some of the tokens like Mythical Games’ MYTH is gaining traction, and OAS is poised for growth with Ubisoft’s Champions Tactics Grimoria Chronicles, among others. The crypto space in 2024 anticipates significant game launches, mints, and an expanding ecosystem.

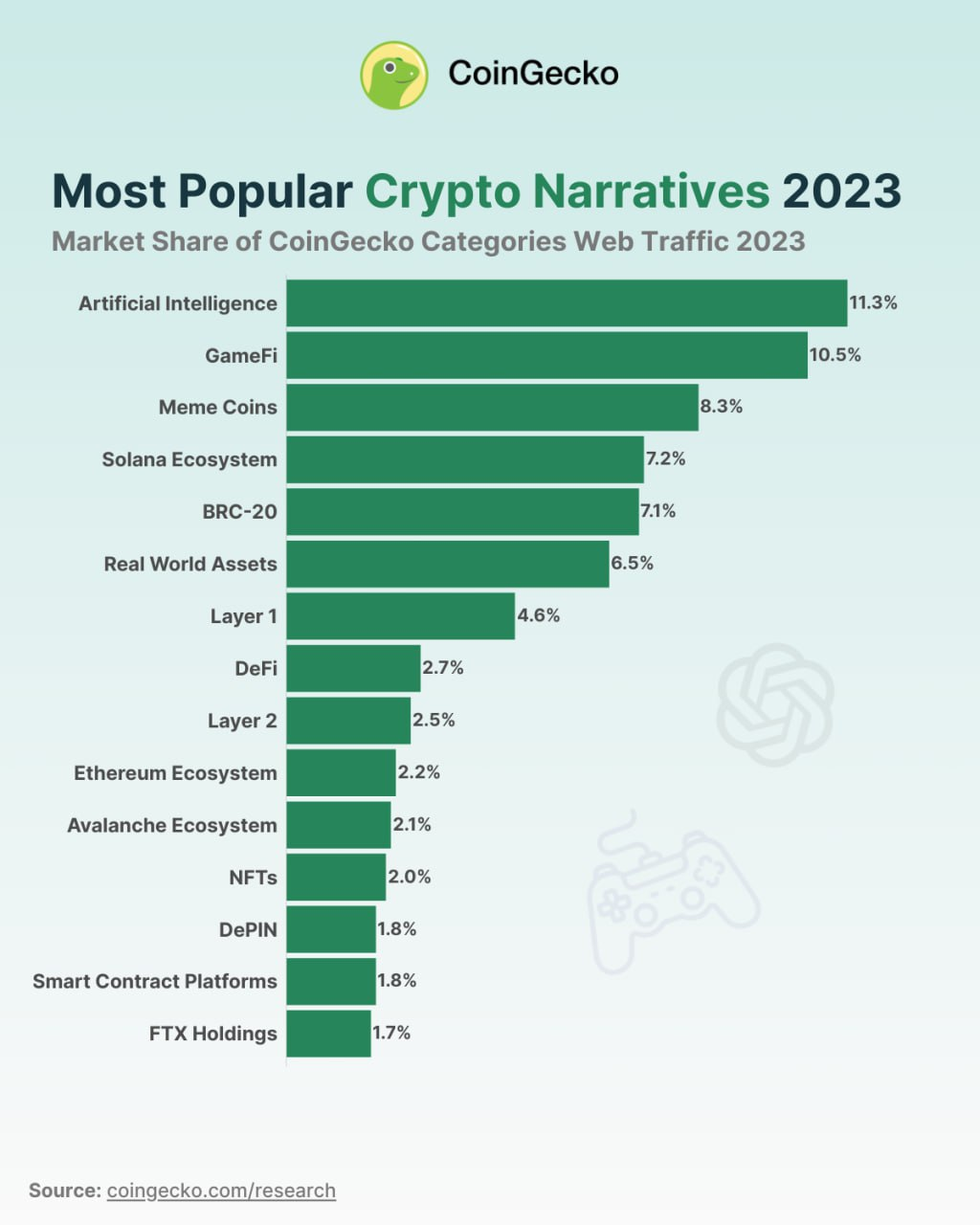

In 2023, the top 15 crypto narratives, spanning AI, GameFi, and Meme Coins, dominated investor interest with a substantial 72.3% share. Artificial Intelligence took the lead, claiming 11.32% of the narrative space, fueled by the momentum generated since the launch of ChatGPT. GameFi witnessed a significant comeback, marked by major gaming companies entering blockchain development, while meme coins like Bonk flourished, highlighting the ever-evolving dynamics of the crypto landscape.

Overall, the last quarter of 2023 was extremely positive for the cryptocurrency markets, both price and innovation wise. The total cryptocurrency market cap increased more than 50%, while Bitcoin also rose 52% and Ethereum rose 36%. Furthermore, Bitcoin outperformed all the major asset classes in Q4.

The most notable events of the quarter include the FTX founder, Sam Bankman-Fried’s sentencing, Binance’s CEO resigning, and the rise of spot Bitcoin filings, which have as of the 10th of January 2024 all been approved. Furthermore, BlackRock has filed for a spot Ethereum ETF, still awaiting approval.

Centralized exchange data suggests that the trading volume during Q4 2023 was noticeably larger than during Q3 of the same year. The number of addresses with balances of ≥ 0.1 and ≥ 1 BTC has seen slight growth, while the number of addresses with a balance of ≥ 100 and ≥ 1k BTC has finally begun to gradually rise in Q4 after a prolonged period of stagnation.

The DeFi sector remains focused on Ethereum, with the chain having 54% of total DeFi total value locked, followed by Tron, BNB and Arbitrum. Emerging DeFi sectors in Q4 2023 include Liquid Staking, RWA, NFT and L2s. Meanwhile, the top narratives of the quarter include AI, GameFi, Meme Coins, the Solana Ecosystem and BRC-20 tokens.

With a positive quarter to end 2023, we enter 2024 with bullish sentiment. With the Bitcoin spot ETF recently being approved, and the next Bitcoin halving waiting for April, 2024 is poised to be an exceptional year for the cryptocurrency ecosystem.

Latest Articles

Veli Partners With Krypto-Verzeichnis to Empower Digital Asset Financial Advisors We’re thrilled...

Veli Acquires European Crypto License to Enhance Regulatory Status As of July...