Veli Partners with BitDegree to Empower Financial Advisors Through Crypto...

This report will cover all the shifts that the general Crypto market, and some of its most important players, experienced during Q2 2024. Here’s everything you need to know about the most recent quarter in crypto, from raw data and analyses, to novel projects and regulatory news.

Q2 marked a general deceleration of the market, with the total cryptocurrency market capitalization undergoing a -14.5% decrease. This echoed towards the top 5 cryptocurrencies, all of which experienced a drop during this quarter.

This decline was driven by profit-taking after ATHs in Q1, muted response to Bitcoin’s halving, Ethereum inflationary pressure and reduced trading volumes.

Throughout Q2, the world’s top cryptocurrency saw a 12.8% price drop, going from $71,333.48 down to $60,888.45. The lowest price Bitcoin reached in this quarter was $58,200.00 on the 1st of May, while also reaching a price of over $71,000.00 on three different days in the quarter – 8th of April, 20th of May and 5th of June.

The runner-up fared marginally better, with a price drop of 7.5%, starting the quarter at $3,647.82 and ending it at $3,373.08. This was partly due to Ethereum adding almost 121k $ETH to the circulating supply, as emissions outpace burns.

Binance’s BNB held up the best out of the top 5, experiencing a 6.21% decrease, going from $606.91 to $569.17 to close the quarter.

With the memecoin craze losing steam, Solana was no exception to the market and saw its price go from $202.87 down to $168.07, marking a 17.15% drop in the price of $SOL.

Ripple wound up being the biggest loser of the top 5, closing the quarter with a 25% drop, going from $0.629 to $0.472.

On April 19, 2024, the fourth Bitcoin halving took place, reducing the mining reward from 6.25 BTC to 3.125 BTC per block. This event is significant as it enforces a deflationary mechanism, making Bitcoin scarcer and potentially driving up its price over time.

While the halving typically generates heightened interest and trading volume in the lead-up, the immediate aftermath saw Bitcoin’s price stabilize around $64,000, reflecting the complex dynamics between supply reduction and market demand.

Hong Kong, Australia, and Thailand have all approved the launch of spot Bitcoin exchange-traded funds (ETFs) in the second quarter of 2024, marking a significant milestone in the global adoption of cryptocurrencies. These ETFs provide investors with exposure to Bitcoin without the complexities of directly holding the digital asset, making it more accessible to a wider range of investors.

The approvals in these major financial hubs are expected to further legitimize Bitcoin as an asset class and drive increased institutional investment in the cryptocurrency market.

Changpeng “CZ” Zhao, the former CEO and founder of cryptocurrency exchange Binance, was sentenced to four months in prison for money laundering violations.

Zhao pleaded guilty to the charges last year, with Binance agreeing to pay over $4 billion in fines and penalties as part of a settlement with U.S. authorities.

In Q2, Donald Trump began his campaign of public support for Bitcoin and Crypto. At a Bitcoin conference in Nashville, former President Donald Trump vowed to make the U.S. the “crypto capital of the world” if elected, proposing a strategic bitcoin reserve and accepting cryptocurrency donations for his 2024 campaign.

Trump’s pro-crypto stance marks a significant shift from his previous skepticism, as he now aims to attract the support of the cryptocurrency community by contrasting his position with the Biden administration’s regulatory efforts. The former president also pledged to dismiss SEC Chair Gary Gensler and form a crypto advisory council, appealing to bitcoin enthusiasts by referencing the government’s confiscation of digital currencies.

The U.S. House of Representatives has passed the Financial Innovation and Technology for the 21st Century Act, commonly known as the FIT21 crypto bill, with a vote of 279-136, showcasing significant bipartisan support.

This landmark legislation aims to establish a clearer regulatory framework for the cryptocurrency market by delineating the roles of the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) in overseeing digital assets.

In the second quarter of 2024, the Federal Reserve maintained its benchmark interest rate in the range of 5.25% to 5.50%, a level it has held since July 2023. Despite earlier predictions of multiple rate cuts, the Fed has now signaled that only one cut is expected by the end of the year, reflecting a cautious approach as inflation remains above the central bank’s 2% target.

Economic indicators have shown modest improvements, however, the Fed is awaiting more consistent positive data before making any adjustments to interest rates. Investors remain optimistic, but uncertainty persists regarding the timing and extent of future rate cuts.

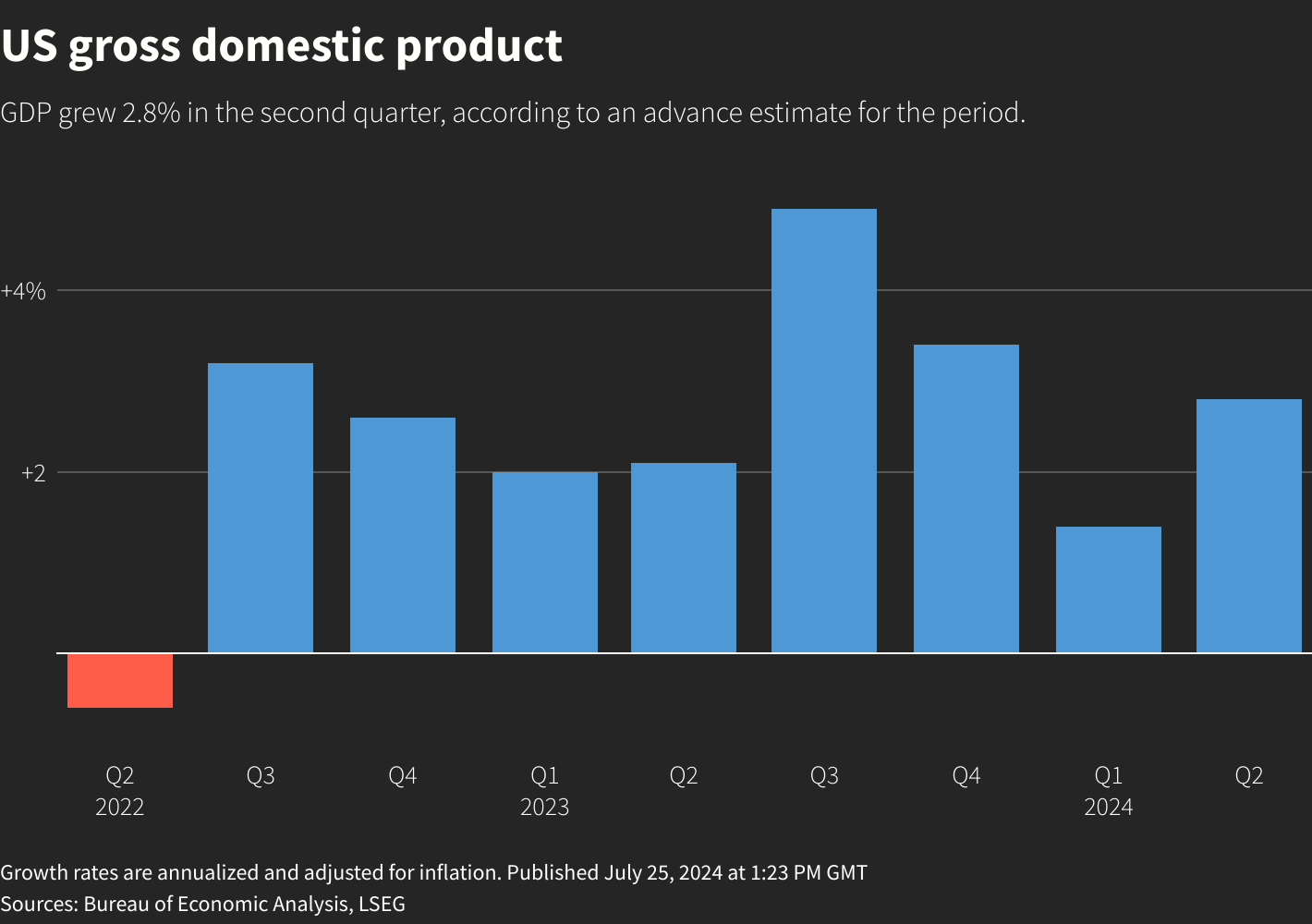

The U.S. economy regained momentum in the second quarter of 2024, with GDP growing at an annualized rate of 2.8%, slightly exceeding expectations.

Core inflation, as measured by the personal consumption expenditures (PCE) price index, held steady at 2.7% year-over-year in April 2024, in line with market expectations.

Despite the slight upward revision, the overall trend remains downward, with inflation decelerating from 4.1% in 2023.

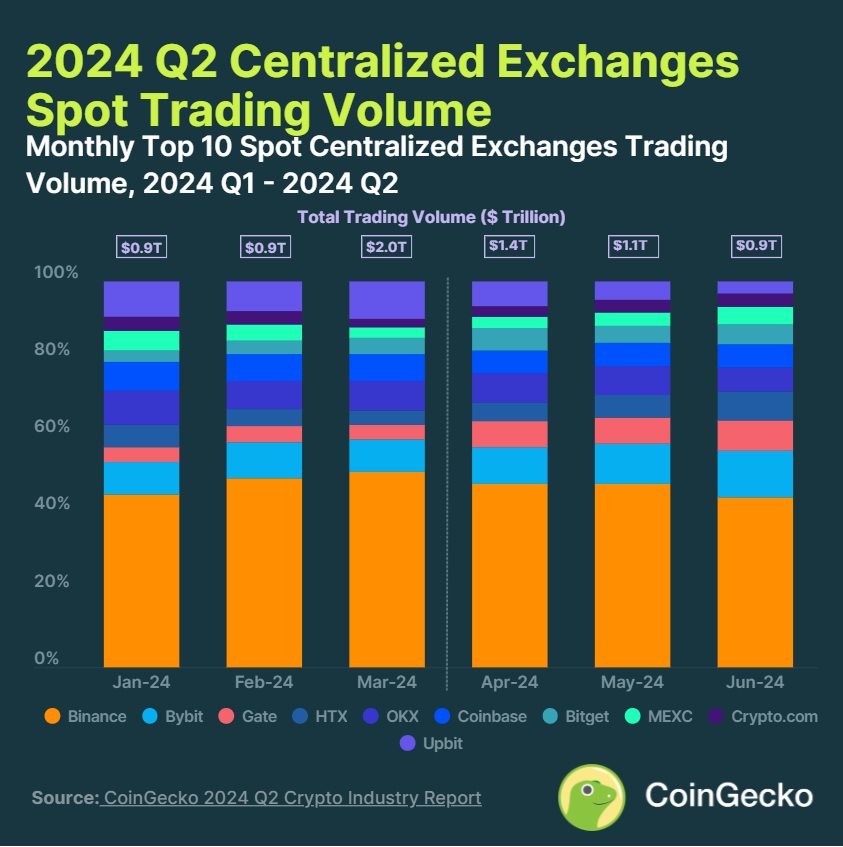

In Q2 2024, the top 10 centralized exchanges (CEXs) had a total spot trading volume of $3.40 trillion, down 12.2% from the previous quarter, in line with the overall crypto market.

Binance remained the largest CEX with a 45% market share despite lower volumes, while Bybit rose to second place with a 12.6% share, overtaking Upbit.

Only four of the top 10 CEXs saw increased trading volumes, with Gate leading at 51.1% growth ($85.2 billion), followed by Bitget at 15.4% ($24.7 billion), and HTX at 13.7% ($25.5 billion). There was also a notable increase in new listings and project launches.

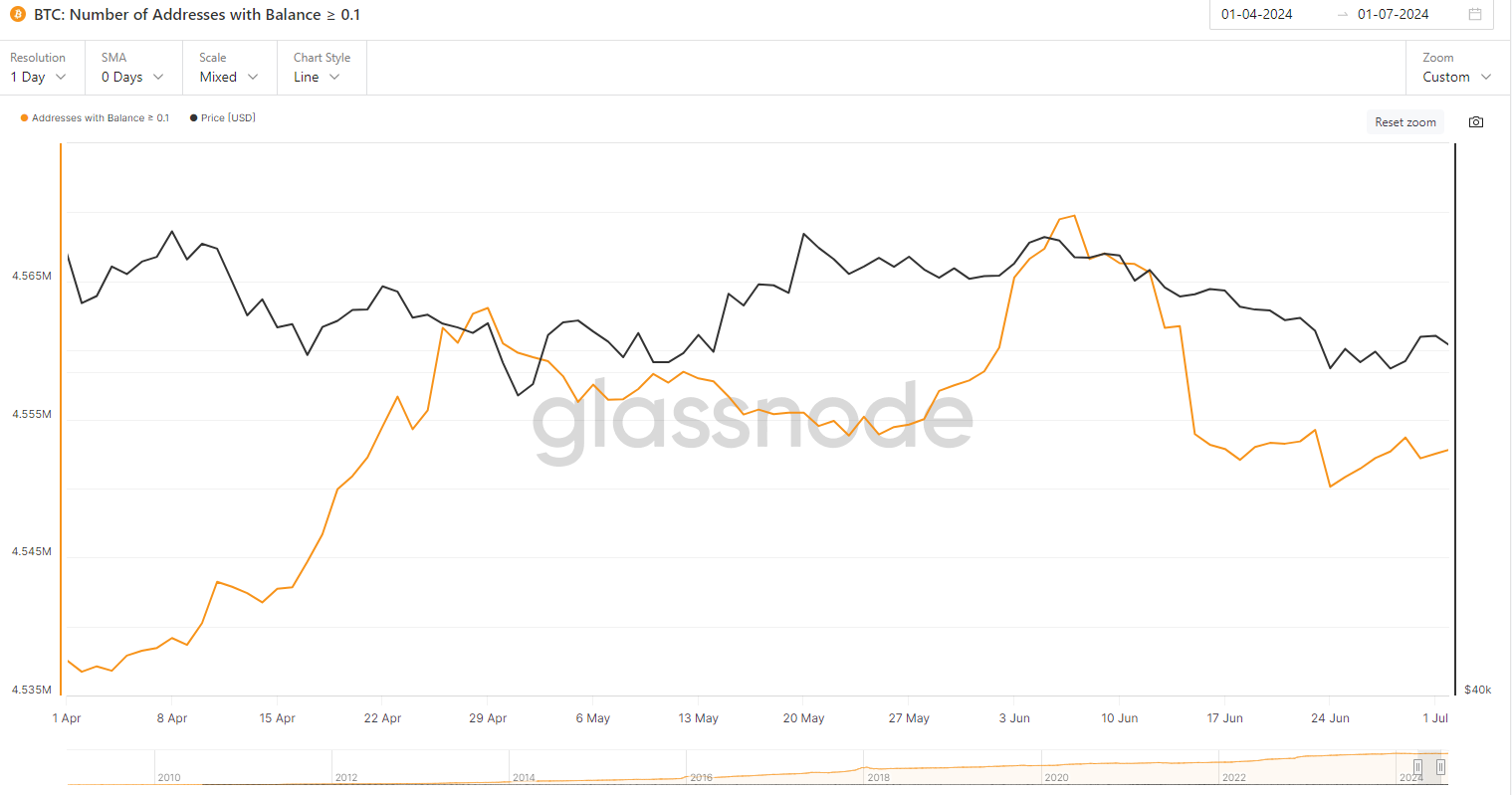

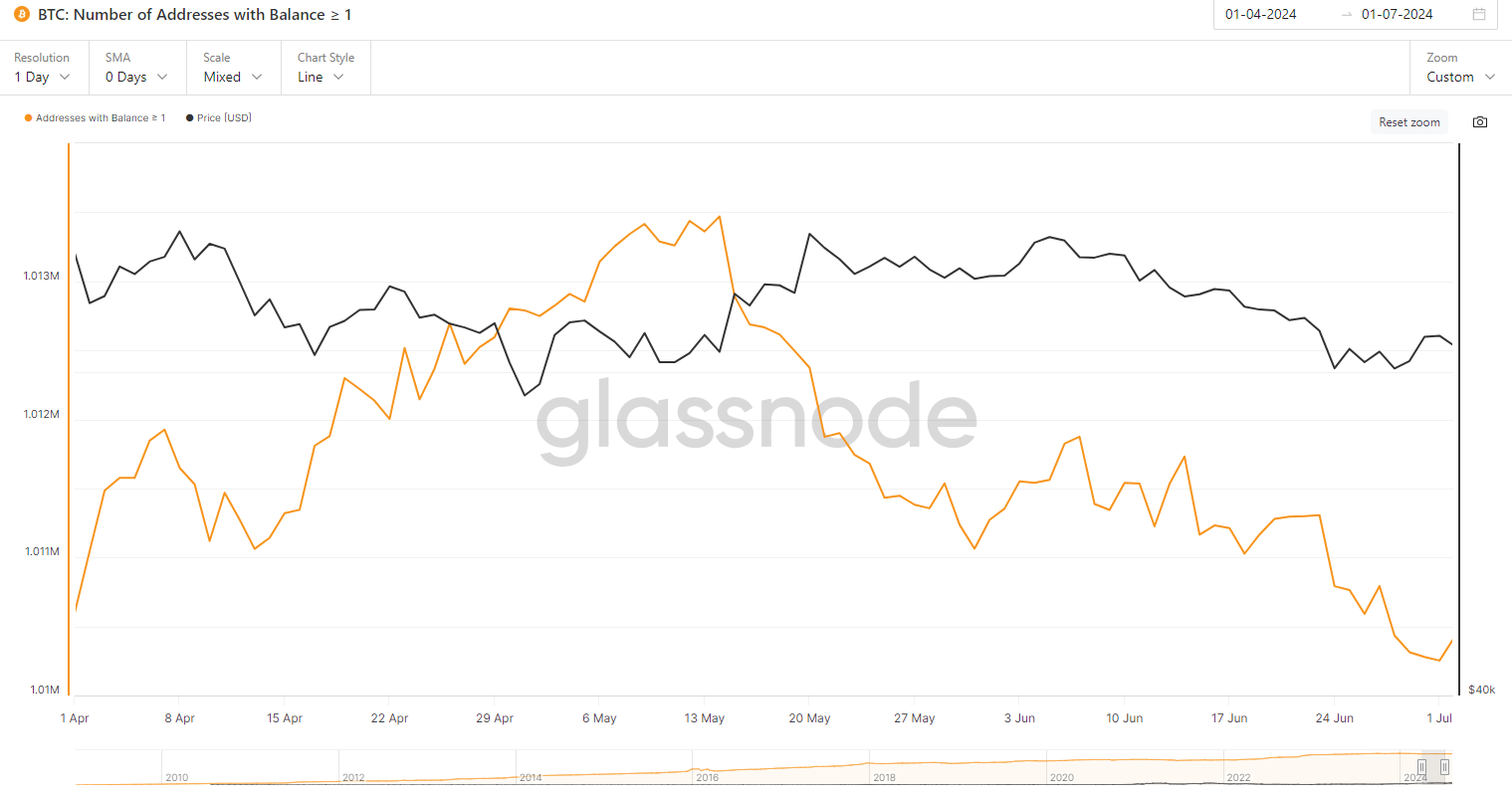

The number of addresses with balances of ≥ 0.1 BTC had a slight increase, while those with ≥ 1 BTC have been slightly decreasing and almost remained the same in Q2, signaling that retail investors are cautious after a big surge in BTC price, and there is not a lot of retail interest at the moment. Despite the approval of the BTC Spot ETF and its offering by major financial institutions like BlackRock to their wealthy clients, with demand for it surging, it is interesting to observe a calm retail trend. The number of addresses with balances ≥ 0.1 BTC rose from 4.53 million to 4.55 million, and those with balances ≥ 1 BTC decreased from 1.0105 million to 1.0102 million.

Bitcoin: Number of Addresses with Balance ≥ 0.1

Bitcoin: Number of Addresses with Balance ≥ 1

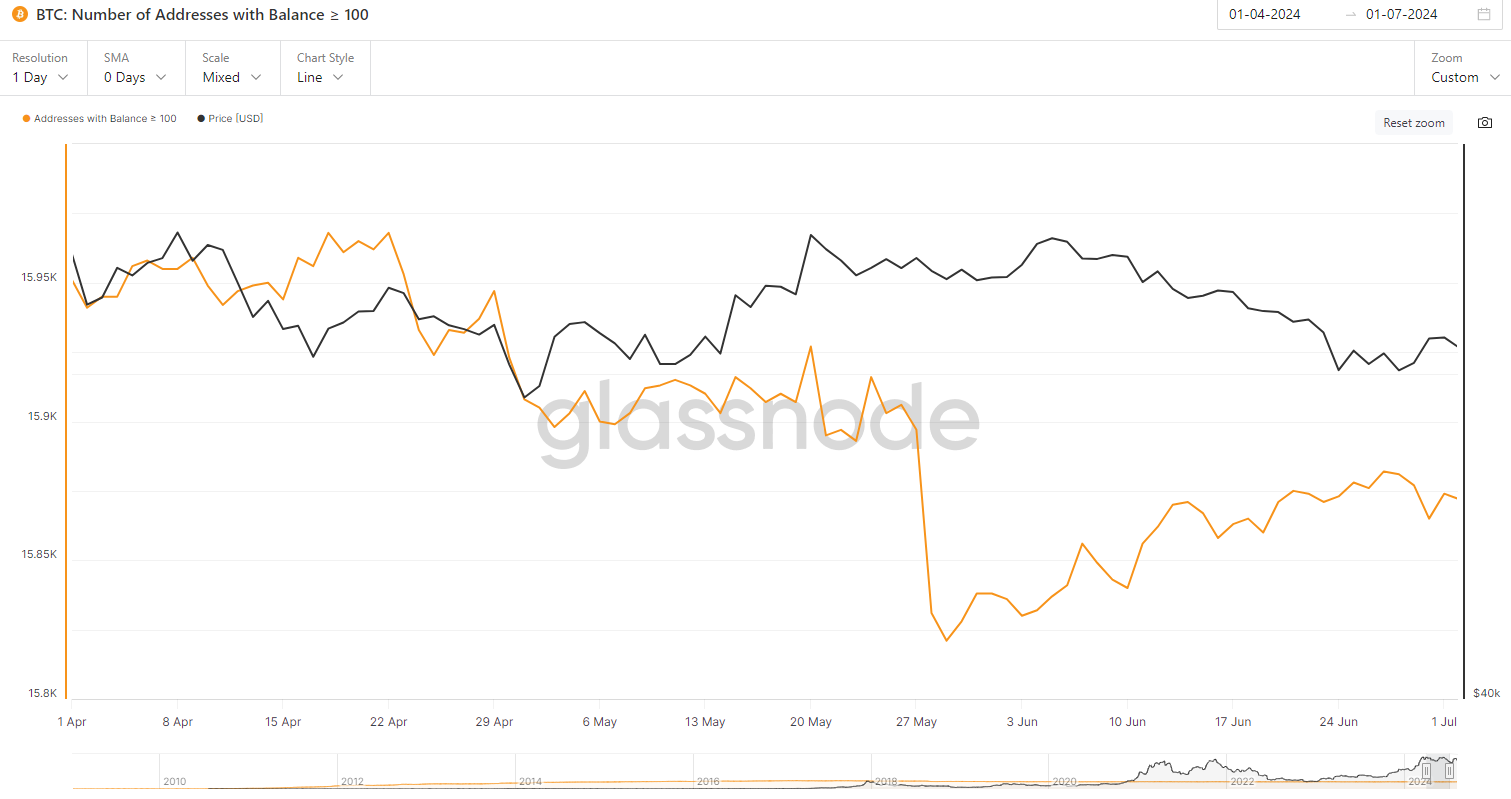

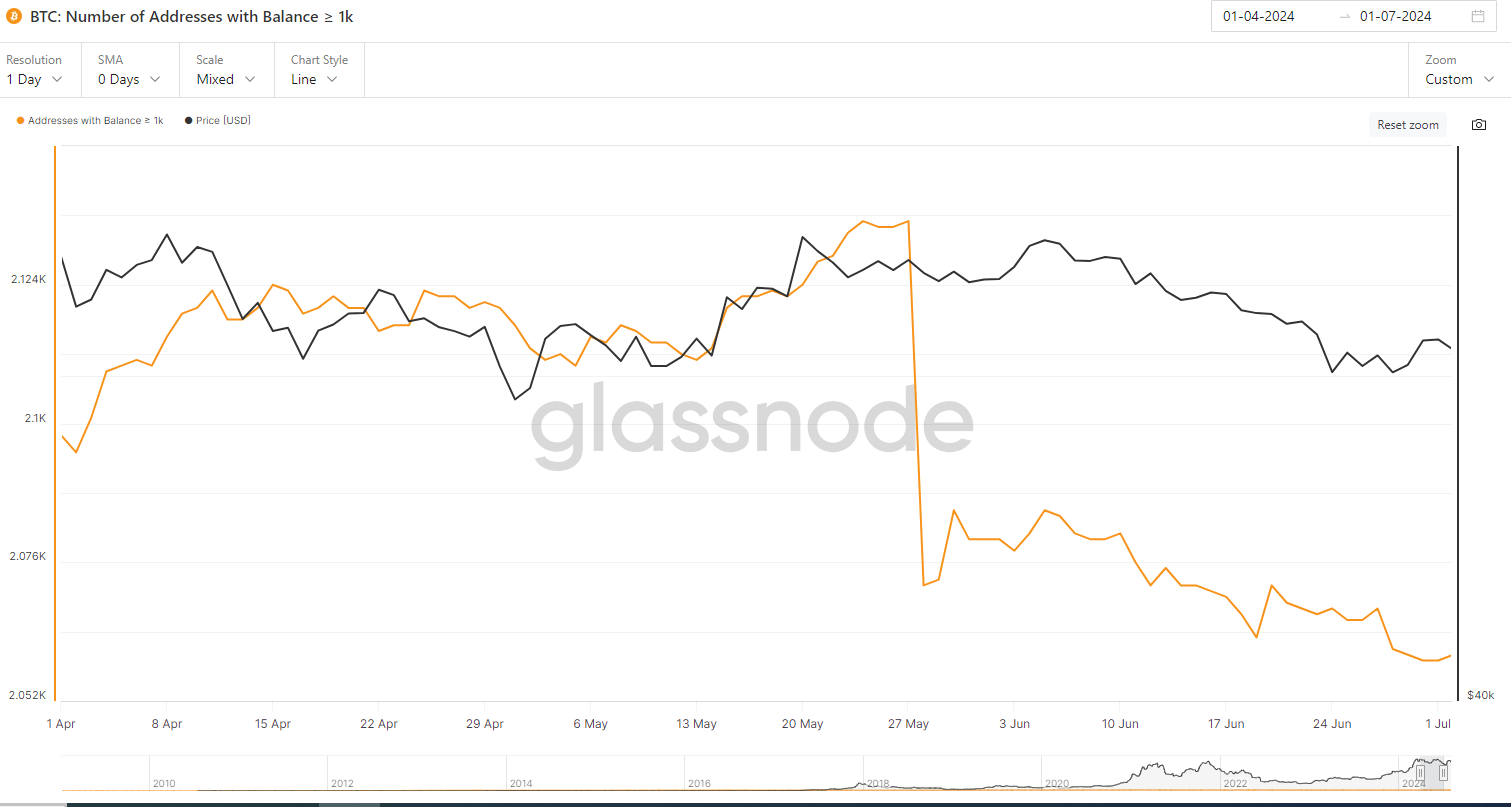

The number of addresses with a balance of ≥ 100 BTC experienced a slight decrease in Q2, with the number steadily decreasing during this quarter. Addresses with a balance of ≥ 1k BTC also saw a decrease in number in Q2, with a sharp downturn on May 27th. The number of addresses with a balance of ≥ 100 BTC decreased from 15,951 to 15,874. Simultaneously, the number of addresses with a balance of ≥ 1k BTC decreased from 2,098 to 2,059. This suggests that while most of the larger entities, known as whales, remained steady, a small number of whales potentially sold BTC in Q2. Overall, whales did not make any significant moves in this quarter.

Bitcoin: Number of Addresses with Balance ≥ 100

Bitcoin: Number of Addresses with Balance ≥ 1k

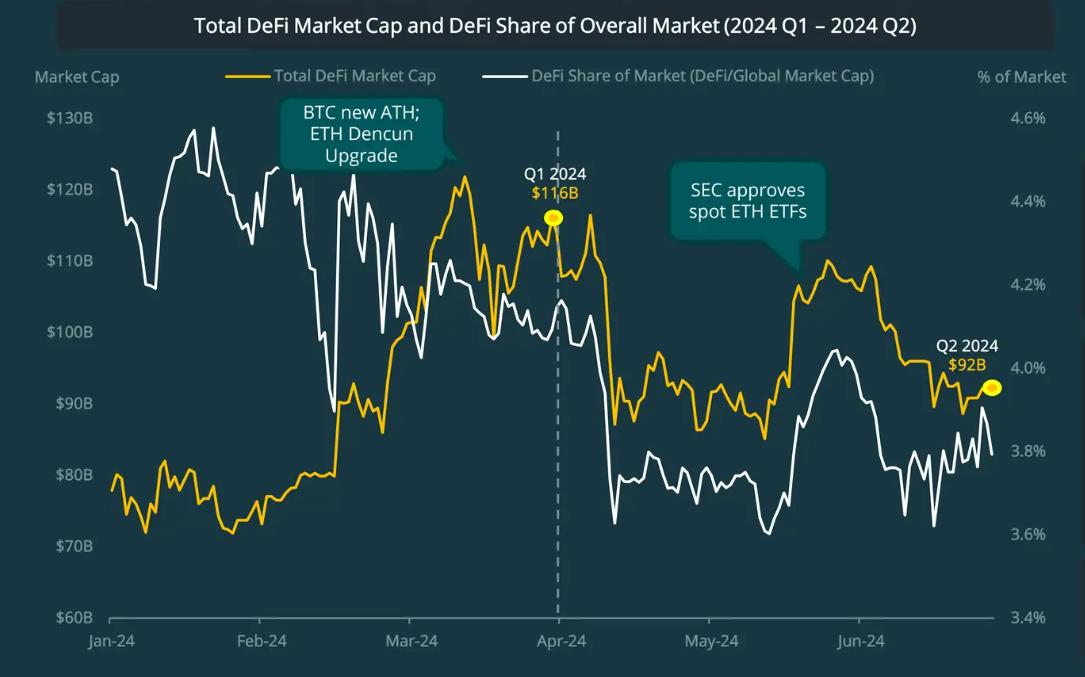

DeFi’s market share continued to decline after the market downturn in early Q2, but the unexpected approval of US spot ETH ETFs offered some relief.

The DeFi market cap has decreased by 20.7% compared to April 1, 2024.

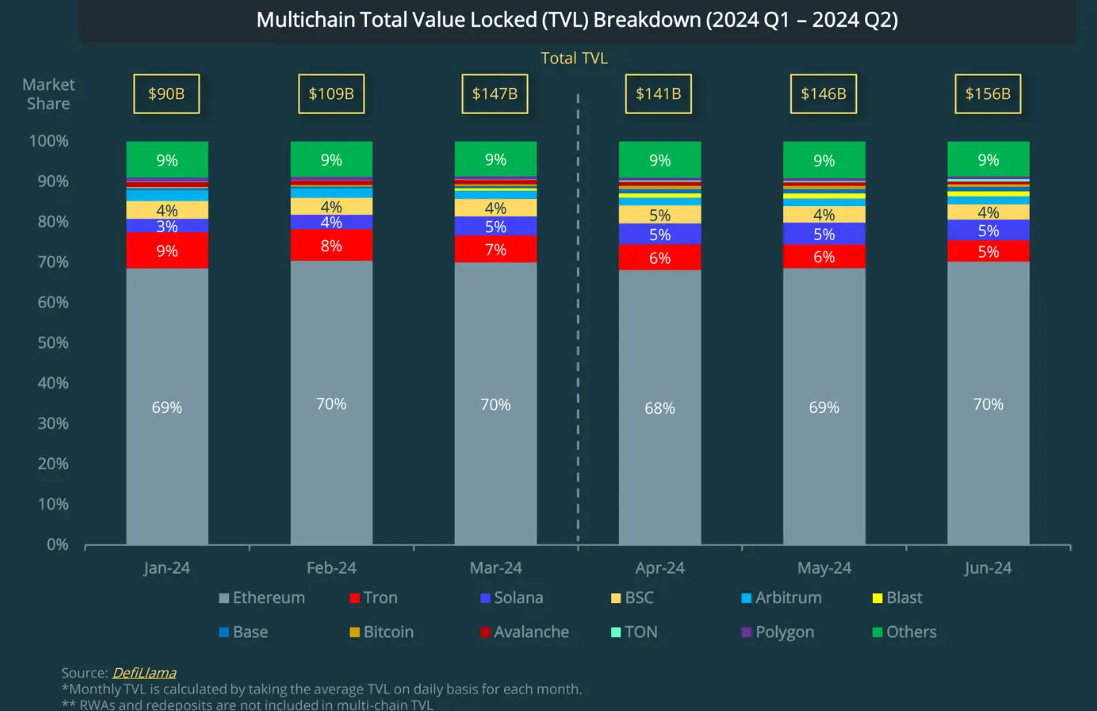

Overall TVL has grown slightly over the past quarter, rising 5.9% from $147B at the end of Q1 to $156B in Q2. Although Ethereum lost some market share early in the quarter, it largely retained its 70% dominance, gaining an additional $6.3B in TVL due to the ongoing restaking hype with Karak and Symbiotic.

Solana maintained its 5% TVL share thanks to the memecoin mania initiated by Pump.fun and celebrity/PolitiFi memecoins, attracting $1.1B in TVL inflows in Q2 2024.

The TON blockchain has seen exponential growth in Q2 2024, with TVL jumping 344% from $204M at the start of April to $907M at the end of June, making it the 10th largest chain by TVL, driven by the success of Tap-to-Earn games like Notcoin.

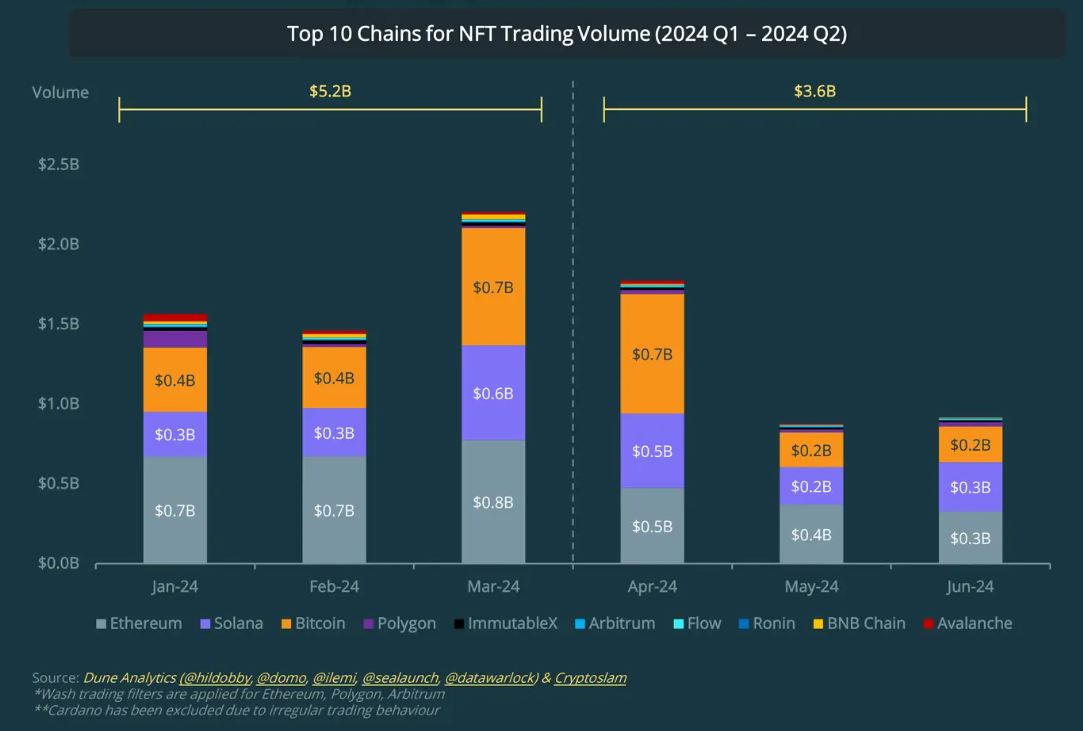

NFT trading volumes dropped 31.8% from $5.2B in Q1 to $3.6B in Q2 2024, though still higher than most of 2023. Ethereum remains the top chain for NFTs, despite a 44.8% volume drop, holding 32.7% of the market. Solana nearly caught up, with over $1B in volume, just $17M short of overtaking Ethereum in June. Bitcoin NFTs, despite initial hype, saw a 69.6% decline in volume from $737M in March to $224M in June.

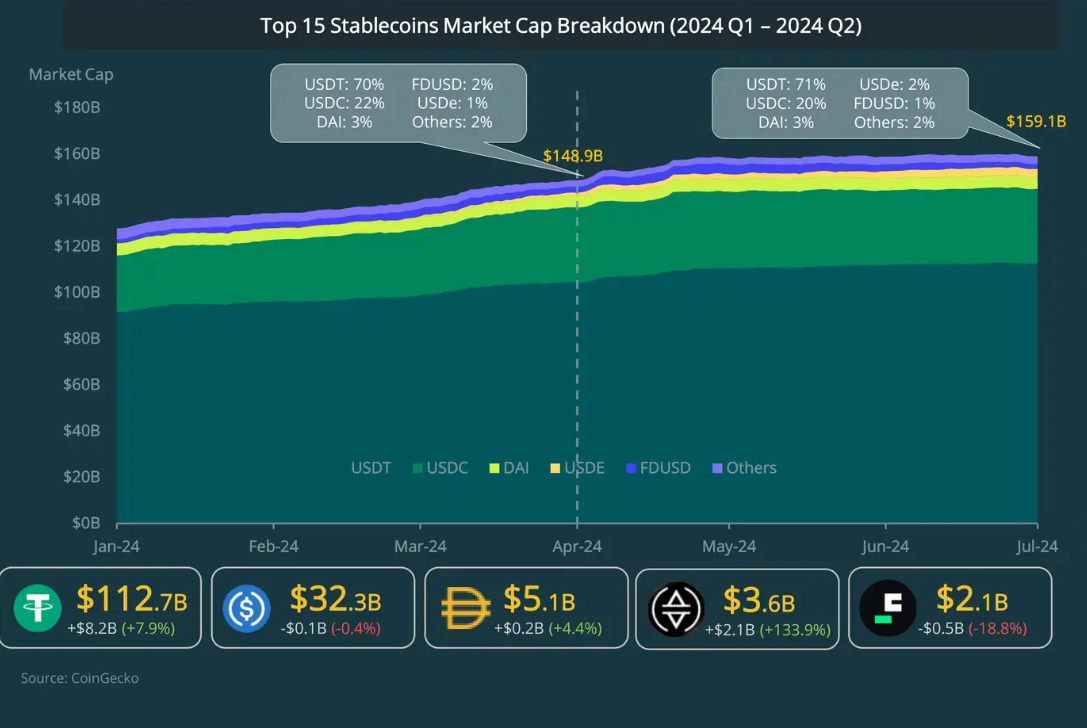

Despite the overall decline in the crypto market cap, the top 15 stablecoins saw a 6.8% increase in Q2 2024, gaining $10.2B. USDT had the largest gains, adding $8.2B (+7.9%), followed by USDe, which increased by $2.1B (+133.9%), doubling its market share to 2%. Tether remains dominant, continuing to grow its lead.

Among the top 5 stablecoins, FDUSD experienced the biggest drop, decreasing by 18.8% (-$0.5B). Outside the top 5, PYUSD rose by $0.2B (+124.6%), and Ethereum layer-2 Blast’s USDB entered the top 10 with a $403.7M market cap.

In Q2, a historical event occurred on April 19th – a Bitcoin halving! Prior to this event and in anticipation of it, the BTC price hit an all-time high (ATH). Additionally, SPOT ETF inflows stimulated prices in Q1. With the Bitcoin price already tripling in the first quarter of the year, the price started to correct naturally after the halving event and the heated market, as it had risen too quickly.

According to historical cycles, Bitcoin is expected to continue its rally at the end of this year (November/December) or possibly at the beginning of 2025, and come on strong for several bull run months in 2025. As for altcoins, they are currently at a low point and should historically follow Bitcoin’s price movement, potentially rising. Many altcoins are still at their bottom compared to Bitcoin in price.

When examining the monthly timeframe and adopting a longer-term perspective, we observe that Bitcoin (BTC) still resides in overbought territory. However, we can see that the levels (circled in white) have started to cool off a bit, which is good preparation for the start of the next potential run. Even with this overbought level, there is still room for one more bull run, which historically should last for a few months in 2025.

Technically, the price of BTC should normally reside between the $40k-$70k range before starting its final stage of the bull run.

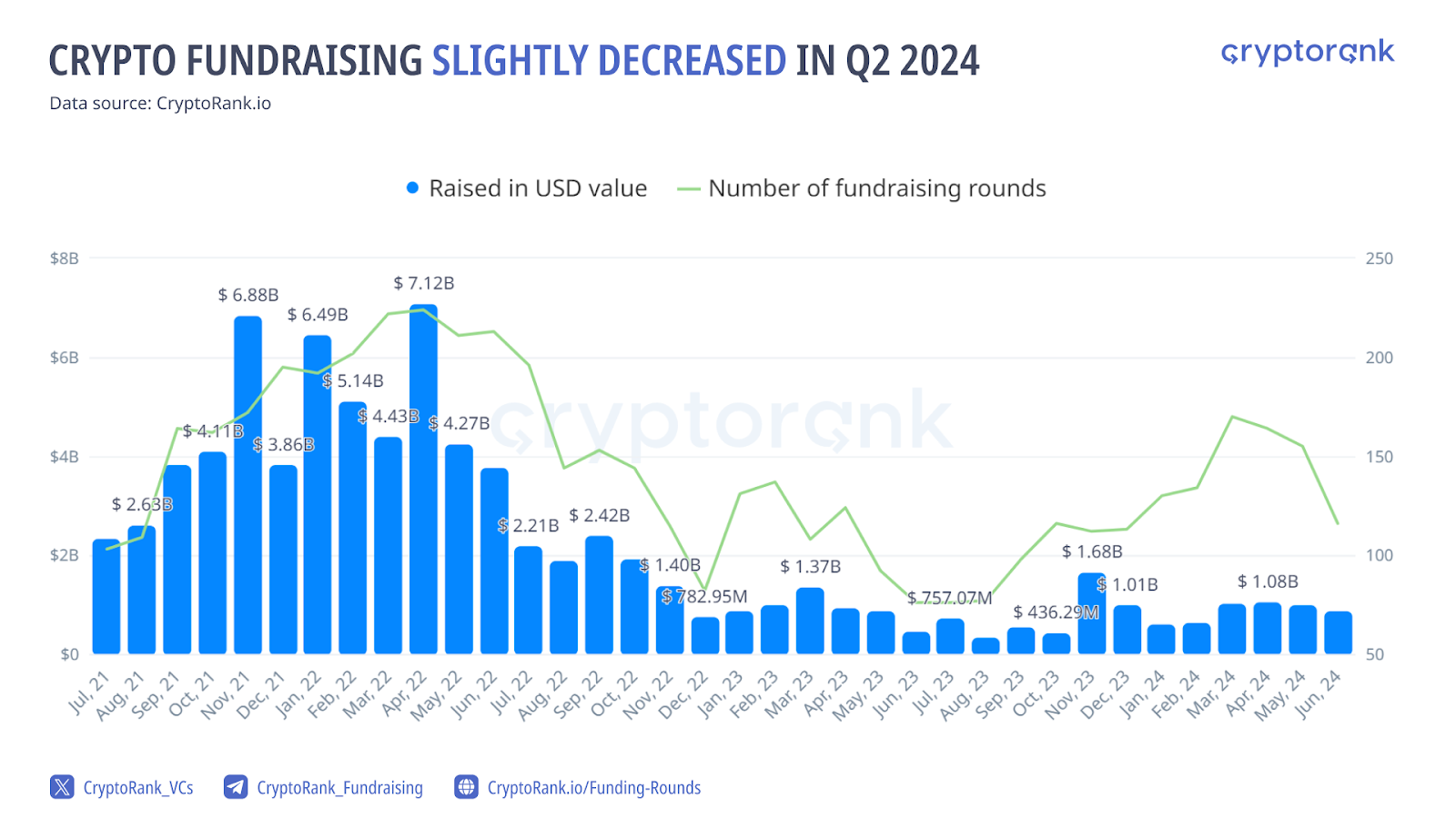

From a long-term perspective, crypto fundraising has stayed relatively stable since early 2023, when Bitcoin was around $20,000. This steadiness mirrors the overall pessimism in the crypto sector and indicates a general decline in fundraising activity.

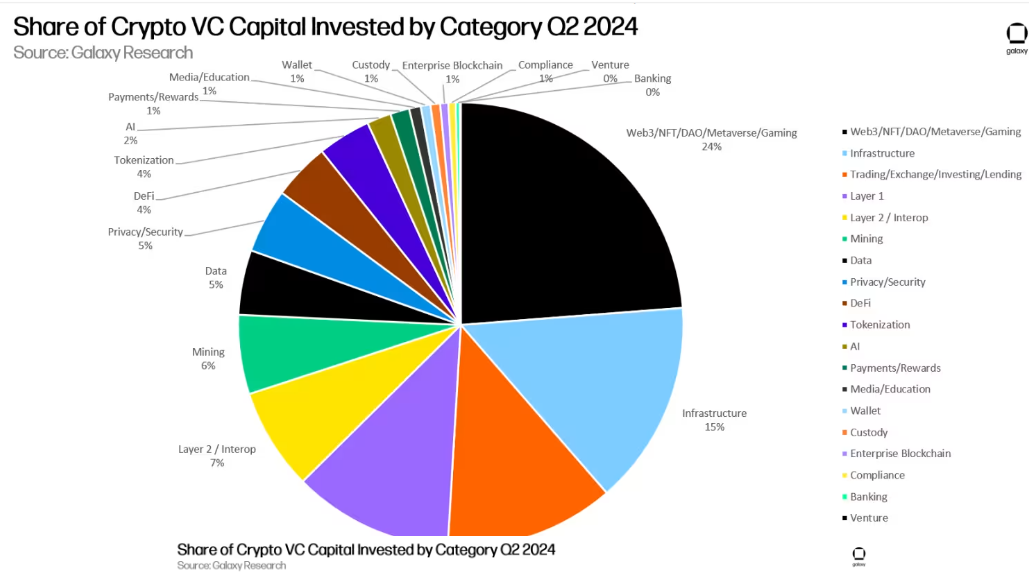

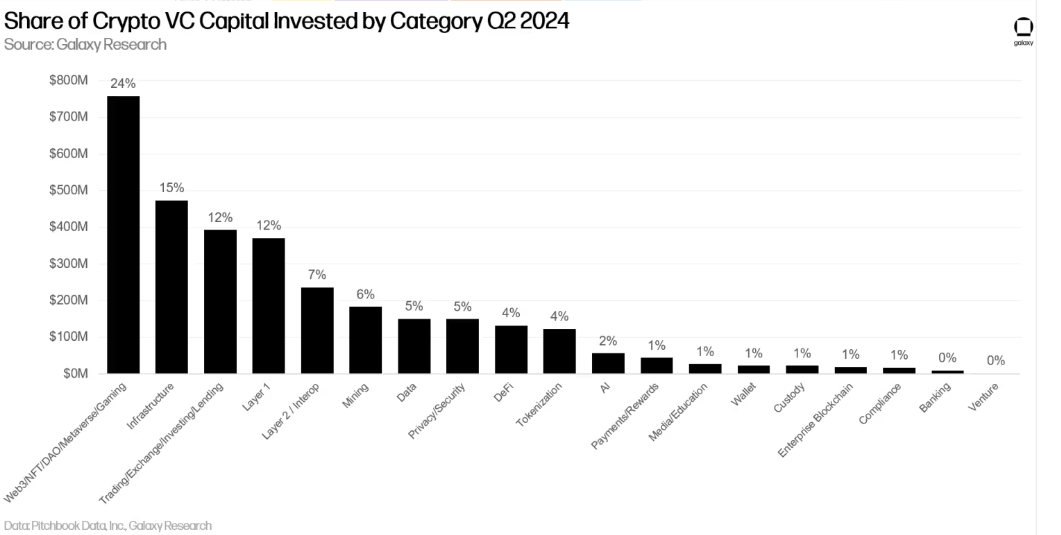

In the short term, fundraising in Q2 saw a 27% increase compared to Q1, rising from $2.35 billion to $2.98 billion. There has been a notable uptick in investments in infrastructure projects, indicating that the market is currently prioritizing the development of solutions to address internal challenges. Although the most attractive category remained “Web3/NFT/DAO/Metaverse/Gaming”.

Among the most active crypto investors is Animoca Brands, which frequently invests in the GameFi sector. OKX Ventures has also become a very active investor this year.

Spartan and HashKey Capital stand out as the most active Tier 1 investors this quarter.

Companies and projects in the “Web3/NFT/DAO/Metaverse/Gaming” category raised the largest share of crypto VC capital in Q2 2024, accounting for 24% of the total, with $758 million in fundraising. The two largest deals in this category were Farcaster, which raised $150 million, and Zentry, which secured $140 million.

Following the “Web3/NFT/DAO/Metaverse/Gaming” category, Infrastructure, Trading, and Layer 1 companies each attracted 15%, 12%, and 12% of the invested capital, respectively. Notably, the market share for Layer 1 investments increased more than sixfold, driven by significant deals from Monad and Berachain, which raised $225 million and $100 million, respectively. Additionally, Bitcoin Layer 2s raised $94.6 million in Q2 2024, marking a 174% increase from the $34.7 million raised in Q1 2024.

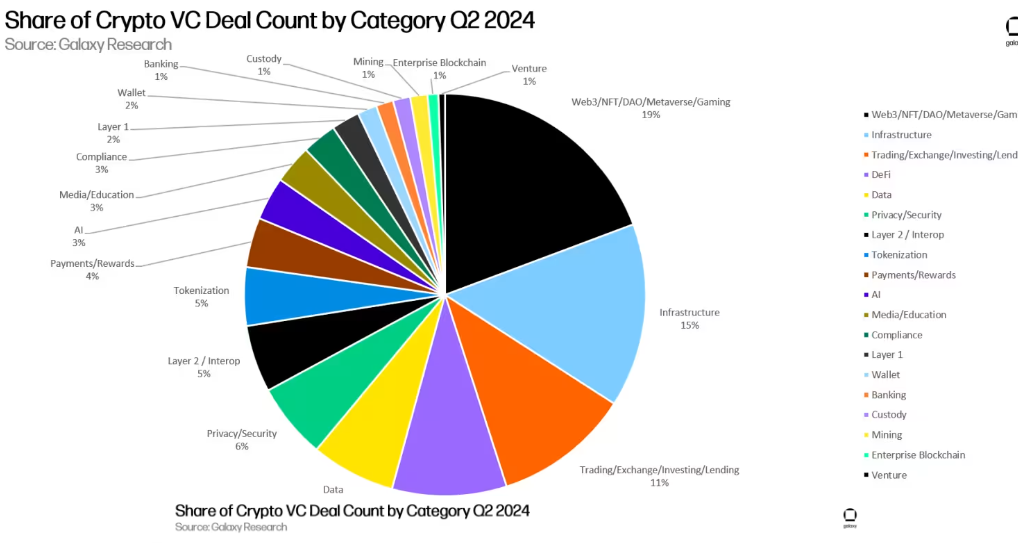

In terms of deal count, Web3 led the way with 19%, driven by an increase in decentralized social media and gaming-related deals. Although there was a decline in re-staking related crypto startups raising funds in Q2 2024, the infrastructure category ranked second with 15% of the deals this quarter.

Trading and DeFi-related crypto companies followed, accounting for 11% and 9% of all deals completed in Q2 2024, respectively.

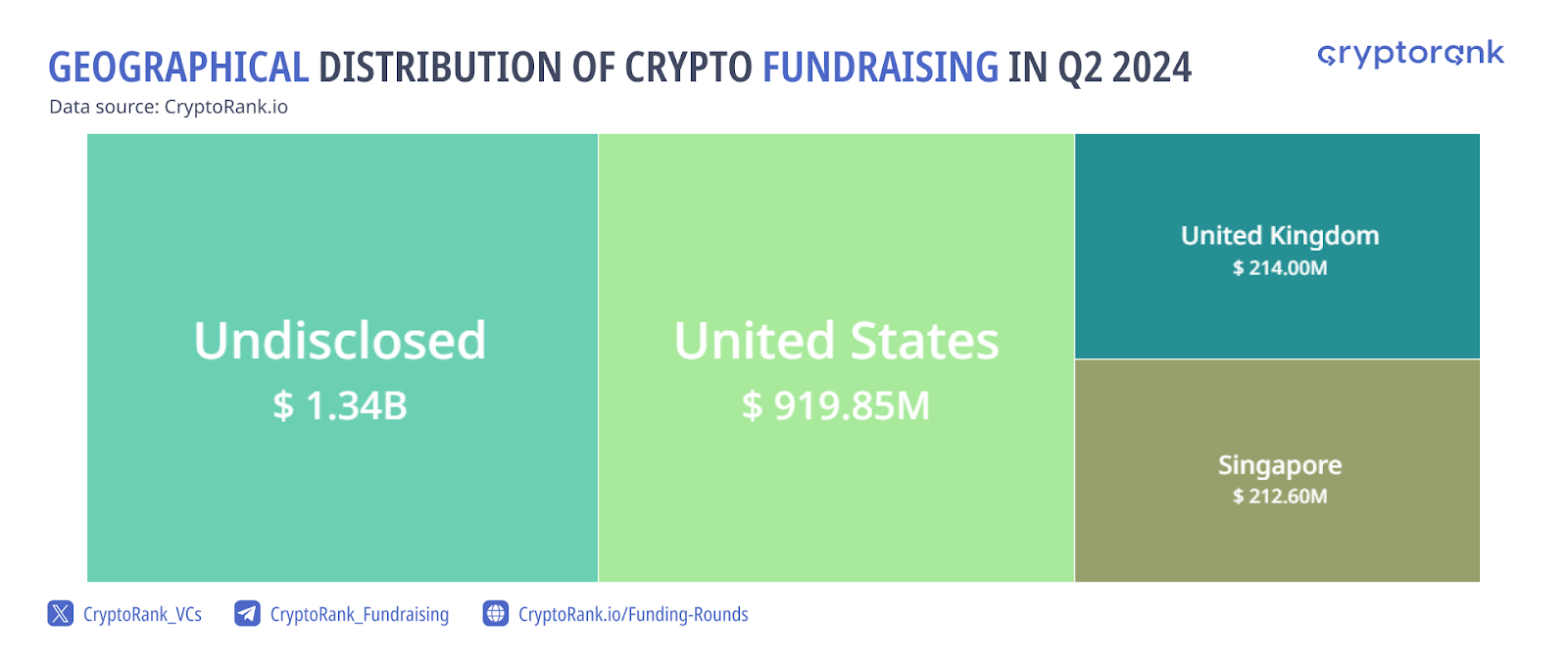

The United States remains the leading jurisdiction for crypto fundraising, followed by the United Kingdom and Singapore.

Many projects achieved success in the 2nd quarter of 2024. The biggest gainers, once again, came from the memecoin category, with Apu Apustaja having a return of over +1,000.00%. Top Blockchain tokens included Telegram’s TON with +40.9%, Kaspa with +36.6% and Monero with +32.2%.

In the DeFi category, Oxygen paved the way with +235% growth, while Pomerium was the top GameFi project with a return of +105%. Other notable gainers included Gleec with +718%, Sabai Protocol with +193%, Celsius with +177% and TARS Protocol with +173%.

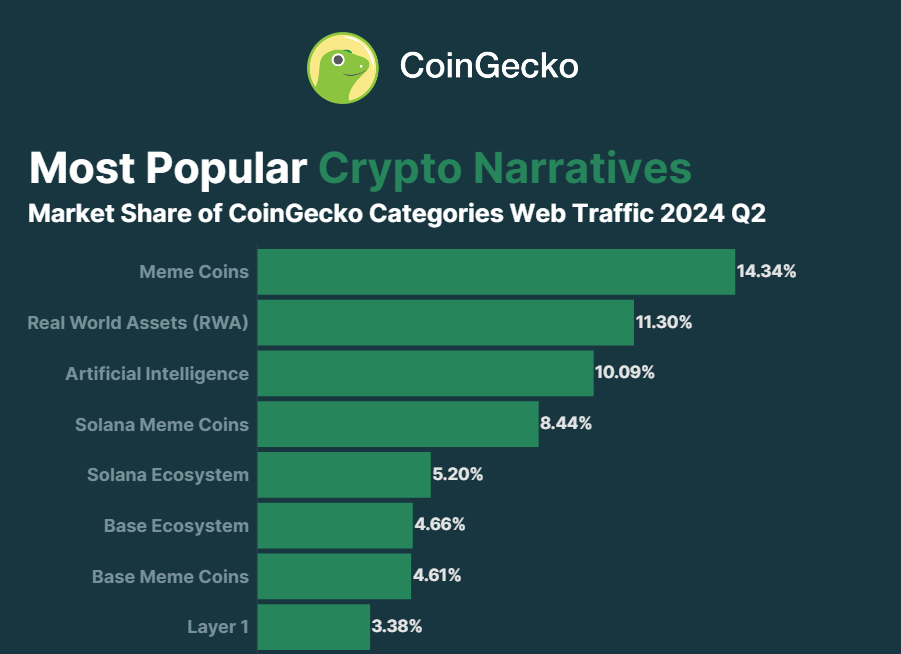

In the second quarter of the year, tokens inspired by internet memes emerged as the most profitable trend, dominating the market and capturing 14.3% of the crypto market share.

Tokenization of real-world assets continues to cement its place as a top narrative, taking over the 2nd spot in the list, as well as 11.3% of the crypto market share

The AI sector continued to thrive in the 2nd quarter of 2024, achieving the third space on the list and 10.09% of the crypto market share.

Echoing the growth of the entire memecoin sector, memecoins specifically on the Solana blockchain grew for the 2nd quarter in a row and captured 8.44% market share.

Although $SOL saw a drop in price in the 2nd quarter of the year, the overall Solana ecosystem grew its user base and captured 5.2% market share.

Despite a 14.4% decline in total cryptocurrency market capitalization in Q2 2024, closing at $2.43 trillion, the quarter showcased several positive developments that indicate a resilient market.

Key events, such as Bitcoin’s fourth halving and the growing popularity of meme coins, real-world assets, and artificial intelligence narratives, captured significant market attention, accounting for 35.7% of the market share. Furthermore, the next most likely president of the United States came forward in support of Crypto and Bitcoin.

Overall, while the market cap saw a downturn, the underlying trends and ongoing developments suggest a robust foundation for future growth.

Veli Partners with BitDegree to Empower Financial Advisors Through Crypto...

Veli is Going for the MiCA License! A new era...