Veli Won Best Startup Award by Plug and Play 🏆...

The first quarter of 2024 emerges as the best performing quarter for the entire cryptocurrency market since Q1 2021. The total cryptocurrency market capitalization rose 60% in the first 3 months of the year, accelerated by the approval of multiple Spot Bitcoin ETFs in the United States, as well as the anticipation for the Bitcoin Halving.

This blog dives into the market changes and top events during the first quarter, as well as the on-chain data, crypto sectors, top gainers and hot & new narratives of the quarter.

The total market capitalization of cryptocurrencies has increased from $1.773 trillion to $2.837 trillion, marking a 60% increase in the first quarter of 2024. The market began rising rapidly in February, continuing with an upward trend until mid-March, after which short sideways action began.

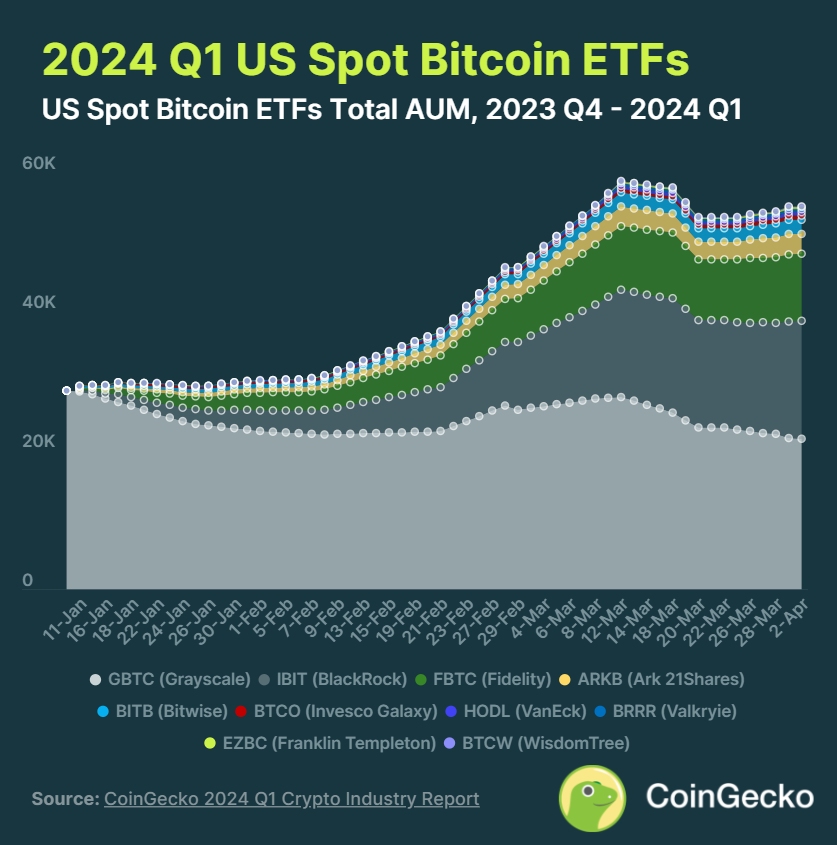

The main factor contributing to such exceptional performance was the approval of a Bitcoin Spot ETF, which became the fastest-growing ETF in the history of ETFs, experiencing significant demand. Companies such as BlackRock, Fidelity, and Grayscale led traditional investment firms in terms of the amount invested by their clients.

BTC Spot ETFs made a substantial impact on the market, contributing approximately $55.1 billion by April 2.

BlackRock’s IBIT ETF has solidified its position as the second-largest BTC ETF, amassing over $17.0 billion in BTC holdings. Notably, it led the pack in terms of trading volume during the first quarter of 2024.

In contrast, Grayscale’s converted GBTC ETF closed April 2 with $21.7 billion in assets under management (AUM). However, it faced a net outflow of -$6.9 billion as early investors capitalized on profits and due to its comparatively higher fees compared to rivals. Nevertheless, it retained its status as the largest BTC ETF throughout Q1.

The leading cryptocurrency in the market by market cap, Bitcoin, saw a price rise from $42,300 to $71,350 by the end of this quarter, reaching its new all-time high (ATH) price of $73,800 in March.

With the approval of the Bitcoin Spot ETF in this quarter, which achieved unprecedented performance, Bitcoin’s price rose by 67% and acceptance of cryptocurrencies surged. With one of the most important and anticipated events approaching—the Bitcoin halving, where miner rewards are cut by 50% and the supply becomes scarcer—the surge in Bitcoin’s price could continue in the coming period, based on historical trends.

Its price was also boosted by ETF talks, as BlackRock filed for a spot Ethereum ETF on the 17th of November, and many financial experts expect that the ETF will be approved in May, as the SEC should make the decision by then. If May’s approval doesn’t happen, the next deadline could be in December.

Ether saw a 60% increase during the first quarter of the year, rising from $2,281 to $3,647, accompanying the overall increase in the cryptocurrency market led by Bitcoin’s surge. The highest price Ethereum reached in this quarter was $4,090, a level not seen since October 2021.

Tether’s market cap continues to rise, with a 13.88% increase from $91.74B to $104.47B, solidifying its position as the dominant leader in the stablecoin market.

Despite regulatory challenges in the U.S. and attacks on Binance exchange and its former CEO Changpeng Zhao in the fourth quarter of 2023, leading to his resignation, Binance’s native cryptocurrency BNB has maintained its position in the top 5 cryptocurrencies. Its price increased from $314 to $521, marking an 85.61% increase in its market capitalization.

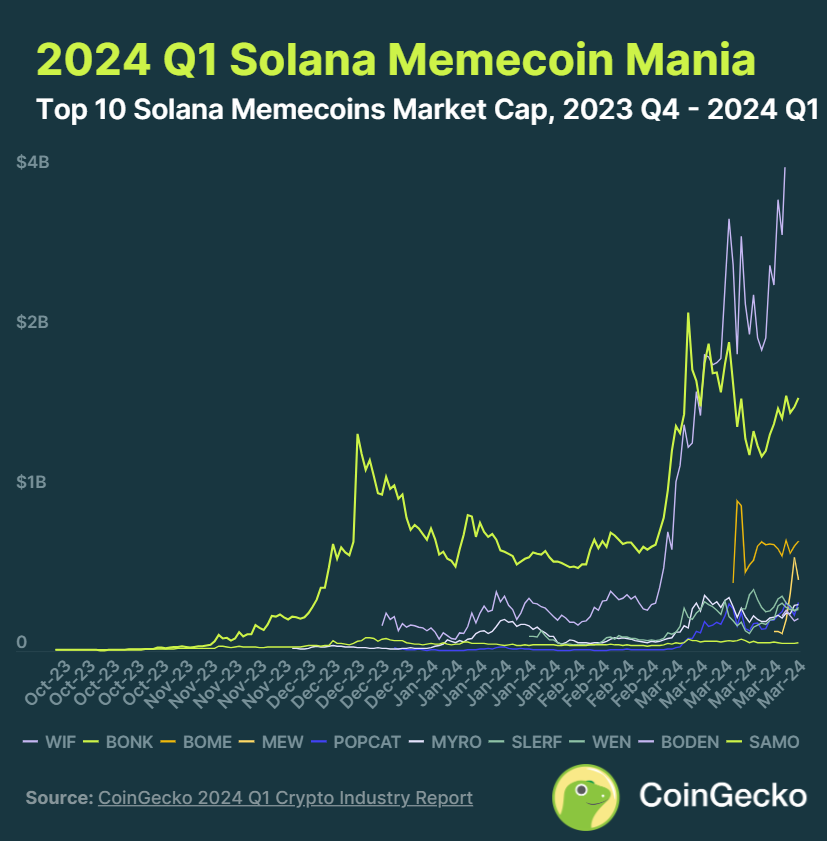

Solana emerged as the best performer among the top 5 cryptocurrencies for the quarter, maintaining its status from Q4 2023, with an approximate 95% increase in the first quarter of the year, rising from $101 to $195.

Solana remains a serious competitor to Ethereum in the blockchain space, continuing to attract more users and adoption. Many traders also interact with ‘Memecoins’ on the Solana network, and their popularity is rising steadily.

On January 10th 2024, the cryptocurrency market witnessed a monumental event with the approval of the first batch of Bitcoin Spot ETFs, including funds by BlackRock, VanEck, Fidelity and Grayscale. The approval of the ETF opened doors for a wider range of investors to gain exposure to Bitcoin, contributing to a surge in demand. As a result, Bitcoin’s market capitalization soared, pushing it even past silver to become the 8th largest asset in the world by market value. The Bitcoin Spot ETF approvals and the subsequent market capitalization surge set the stage for a bullish outlook for Bitcoin and the broader cryptocurrency market in Q1 2024.

Sam Bankman-Fried, the former CEO of the now-defunct cryptocurrency exchange FTX, was sentenced to 25 years in prison by a New York judge on March 28, 2024. The sentencing followed Bankman-Fried’s conviction in November 2023 for orchestrating one of the largest financial frauds in U.S. history. The fraudulent scheme involved the misuse of more than $8 billion from FTX customers and investors. The collapse of FTX and the legal actions against Bankman-Fried have raised significant concerns about the risks associated with unregulated financial activities in the digital asset space, potentially influencing future regulatory decisions.

In Q1 2024, BlackRock launched its first tokenized fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), allowing qualified investors to earn U.S. dollar yields through Securitize Markets, LLC. This initiative is part of BlackRock’s digital asset strategy, focusing on tokenization benefits like instant settlement and transferability. The Fund invests in cash, U.S. Treasury bills, and repurchase agreements, offering daily accrued dividends. Issued under specific Securities Act and Investment Company Act rules, the Fund has a $5 million initial investment minimum.

On the 13th of March 2024, Ethereum experienced a significant upgrade known as the Dencun upgrade, which aimed to enhance the network’s scalability and performance. Furthermore, the Dencun upgrade improved performance and lowered fees on Layer 2 Ethereum networks, including Base, Arbitrum and Optimism. However, Ethereum’s progress was also marked by a delay in the launch of its spot ETF, which was pushed back to at least May 2024. This delay may have impacted market sentiment and investor expectations, as the introduction of a spot ETF could potentially increase institutional investment and market liquidity. Despite this setback, Ethereum’s continued focus on development and innovation suggests a positive outlook for its future growth and adoption within the cryptocurrency market.

In the first quarter of 2024, the Federal Reserve left interest rates unchanged and signaled three rate cuts for the year, marking an end to the central bank’s round of 11 hikes in interest rates since March 2022. The Fed’s decision to pause rate hikes and begin easing rates downward was due to the economy slowing from its strong third-quarter pace and inflation easing.

Economists predict that the Fed will cut rates by 0.75 percentage points in total, which could lead to a drop in mortgage rates. The Fed’s decision to leave interest rates unchanged was widely expected and marked an end to the central bank’s aggressive campaign of tightening credit. The Fed’s decision to pause rate hikes and signal rate cuts in 2024 was met with optimism by investors, with all assets jumping after the announcement.

The latest data puts the United States inflation at 2.7% for 2024 – a marginal upward revision from last quarter – but the downward trend continues, decelerating from 4.1% in 2023.

Labour market strength and economic resilience are critical factors that will decide the trajectory of inflation in the quarters ahead.

China’s economy likely grew 4.6% in the first quarter from a year earlier – the slowest in a year despite tentative signs of steadying, maintaining pressure on policymakers to unveil more stimulus measures.

Gross domestic product (GDP) in the world’s second-biggest economy is also expected to grow at a subdued 4.6% pace in 2024 year-on-year, according to the median forecast of 86 economists polled by Reuters, falling short of the official target of around 5.0%.

Data from the United States is not available at time of posting. In the first quarter of 2024, the forecast for real GDP growth has been adjusted upward by 0.7 percentage points to reach 1.5%. However, it’s noted that this growth rate is still slower compared to previous years. The boost in GDP is attributed to strong consumer spending and the resilient labor market, which will help counterbalance the impact of tight monetary policies.

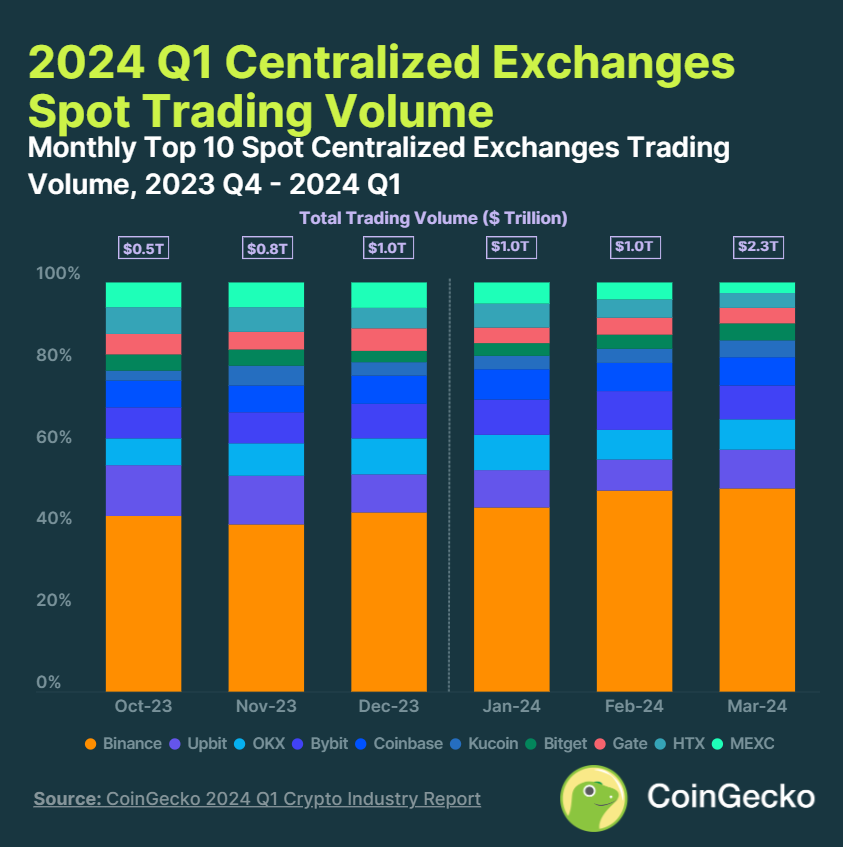

During the first quarter of 2024, exchanges collectively saw a significant increase in spot trading volume, reaching $4.29 trillion. This marks a substantial gain of +95.3% quarter-on-quarter (QoQ). Notably, this volume represents the highest recorded quarterly figure for the top 10 spot CEXes since December 2021.

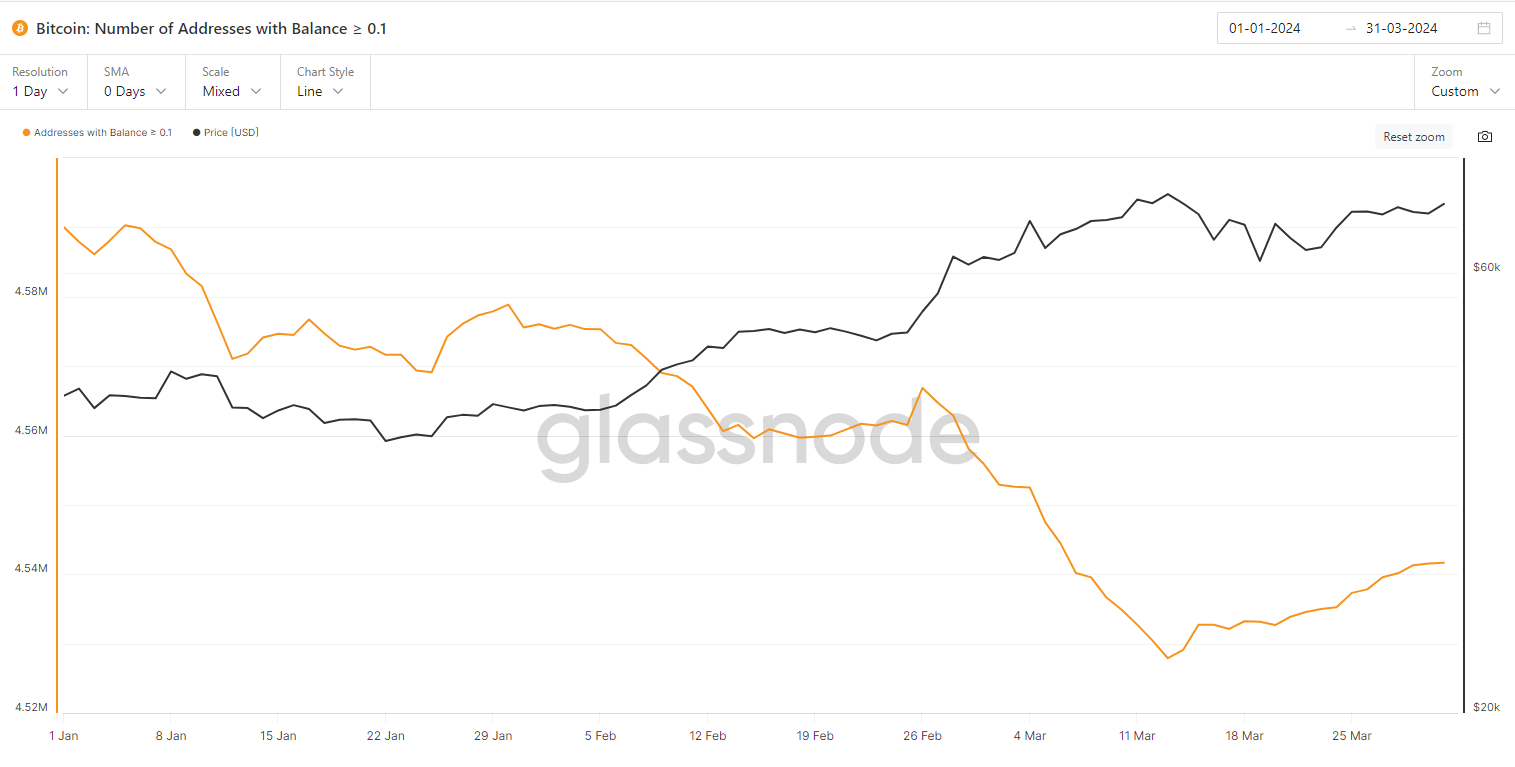

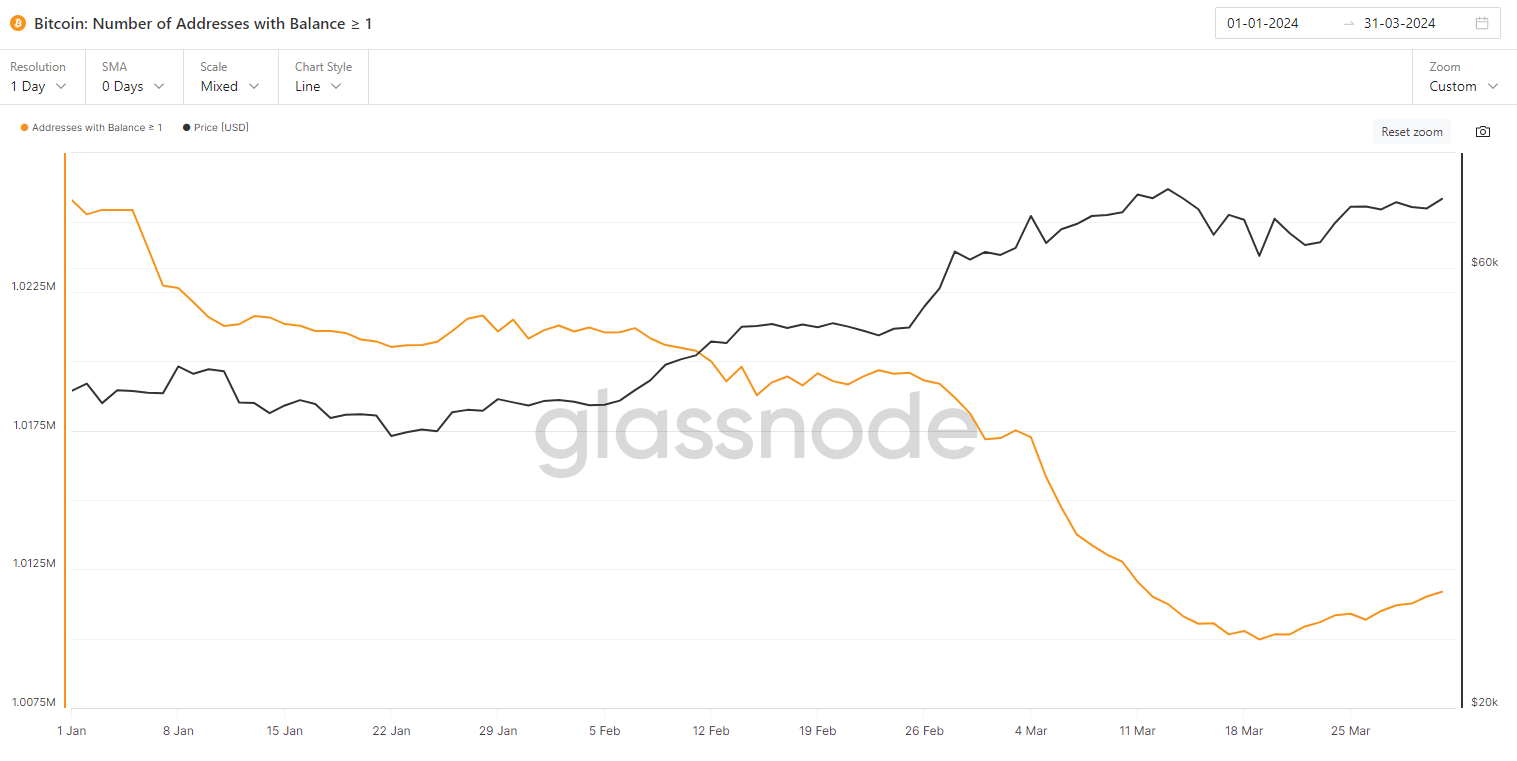

The number of addresses with balances of ≥ 0.1 and ≥ 1 BTC (retail) has been decreasing in Q1, signaling that retail investors are taking profits and selling BTC following the price surge of Bitcoin to a new all-time high of $73,800 in this quarter. Despite the approval of the BTC Spot ETF and its offering by major financial institutions like BlackRock to their wealthy clients, with demand for it surging, it is interesting to observe this retail selling trend. The number of addresses with balances ≥ 0.1 declined from 4.59 million to 4.54 million, and those with balances ≥ 1 decreased from 1.025 million to 1.011 million

Bitcoin: Number of Addresses with Balance ≥ 0.1

Bitcoin: Number of Addresses with Balance ≥ 1

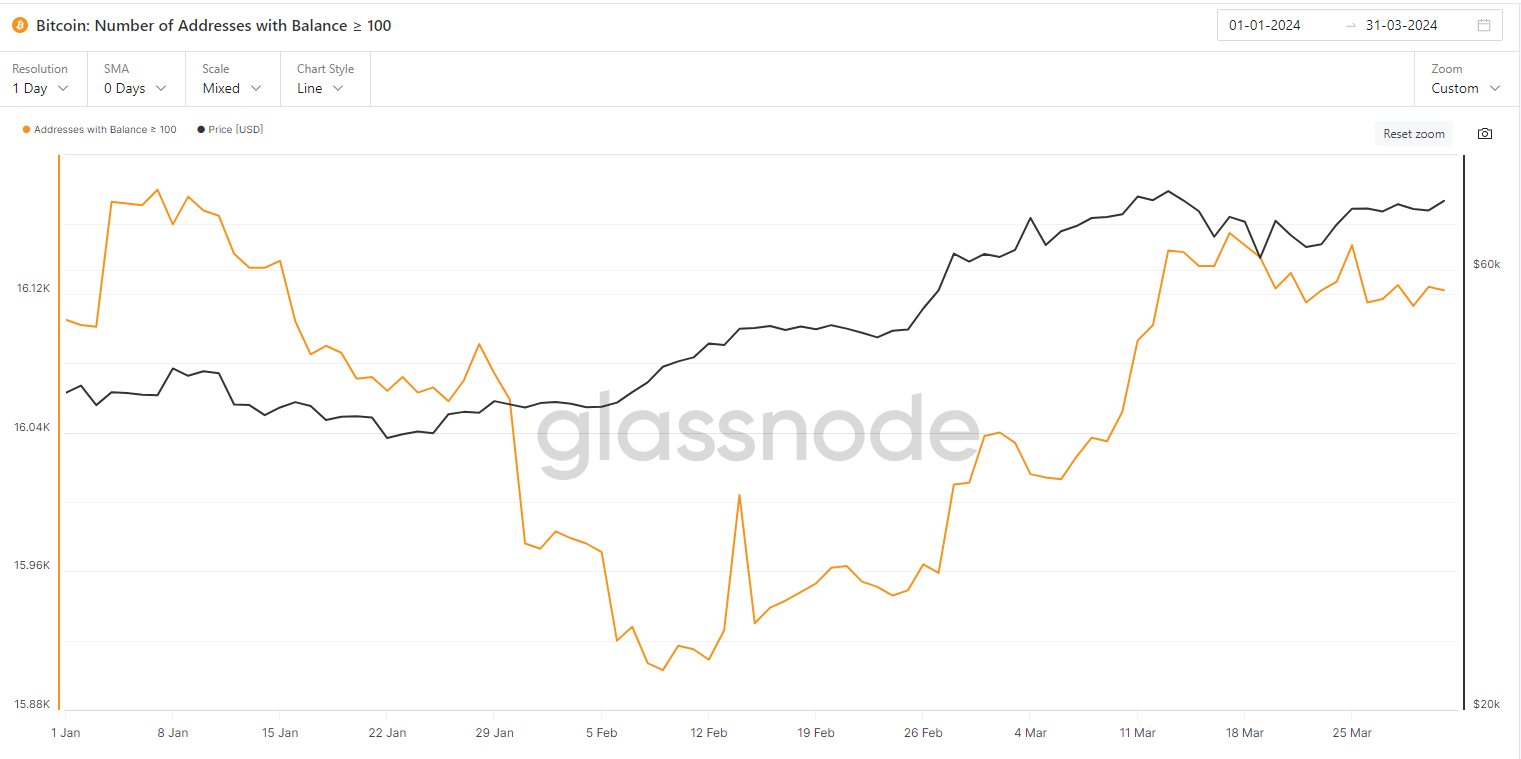

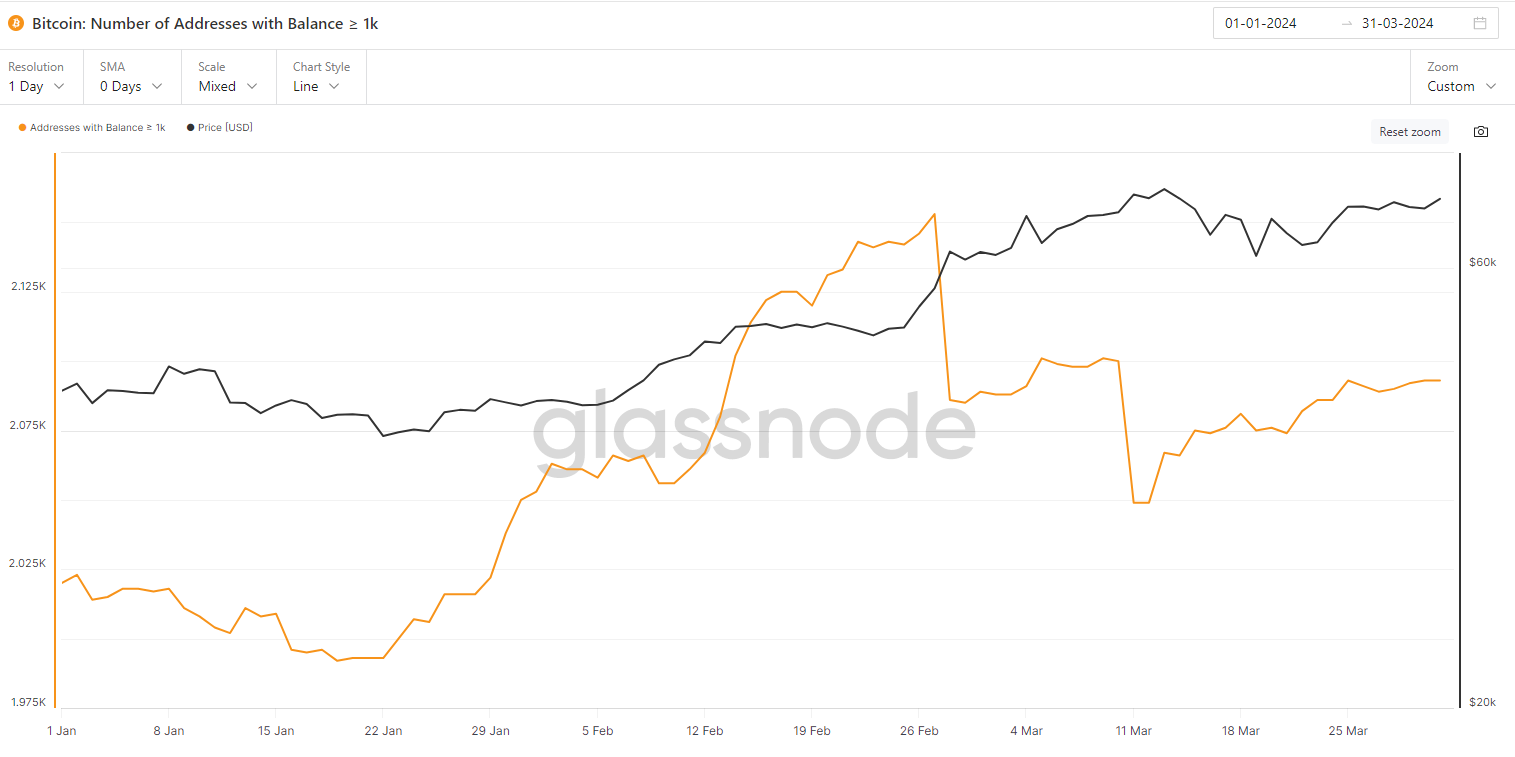

The number of addresses with a balance of ≥ 100 experienced only a slight rise in Q1 and remained nearly unchanged, undergoing a correction in February and then recovering by the end of the quarter. Addresses with a balance of ≥ 1k BTC saw a smaller increase in Q1, peaking at the end of February. The number of addresses with a balance of ≥ 100 increased from 16,105 to 16,122. Simultaneously, the number of addresses with a balance of ≥ 1k BTC rose from 2,020 to 2,093. This suggests that a smaller number of larger entities, known as whales, are slowly accumulating BTC in Q1 without making any significant moves.

Bitcoin: Number of Addresses with Balance ≥ 100

Bitcoin: Number of Addresses with Balance ≥ 1k

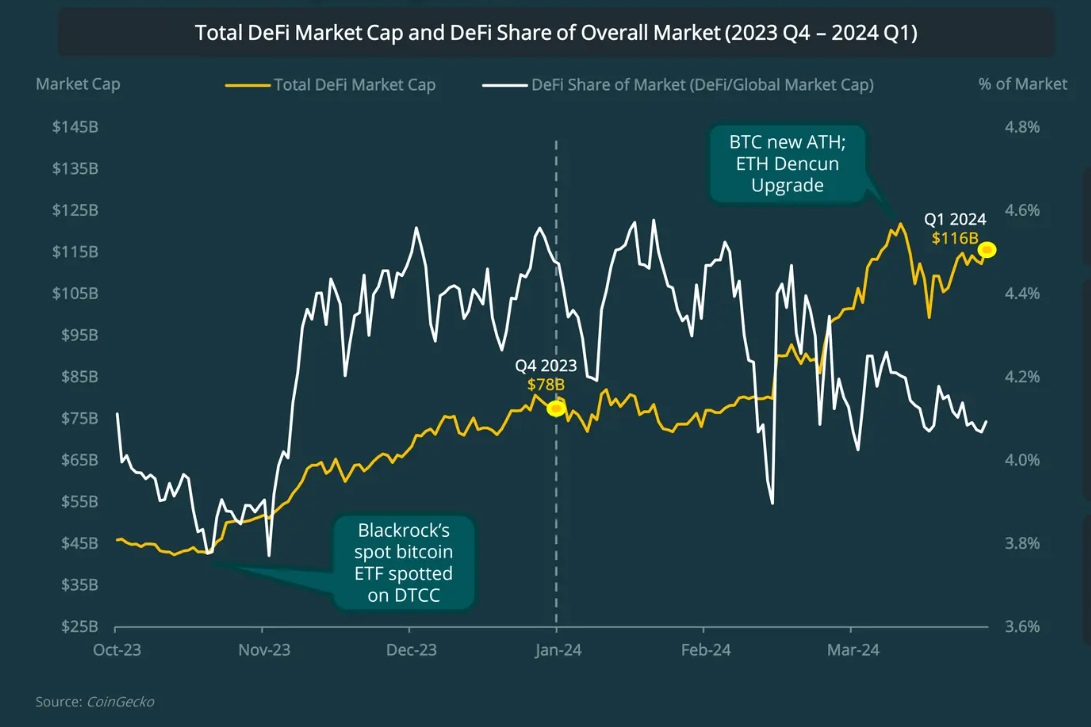

In the first quarter of the year, the DeFi market cap saw a notable upward trend, following the overall trajectory of the crypto market. However, its dominance is gradually decreasing as focus shifts towards Bitcoin and memecoins. Despite this, DeFi still managed to achieve a substantial 49% increase in market capitalization since January 1st, 2024.

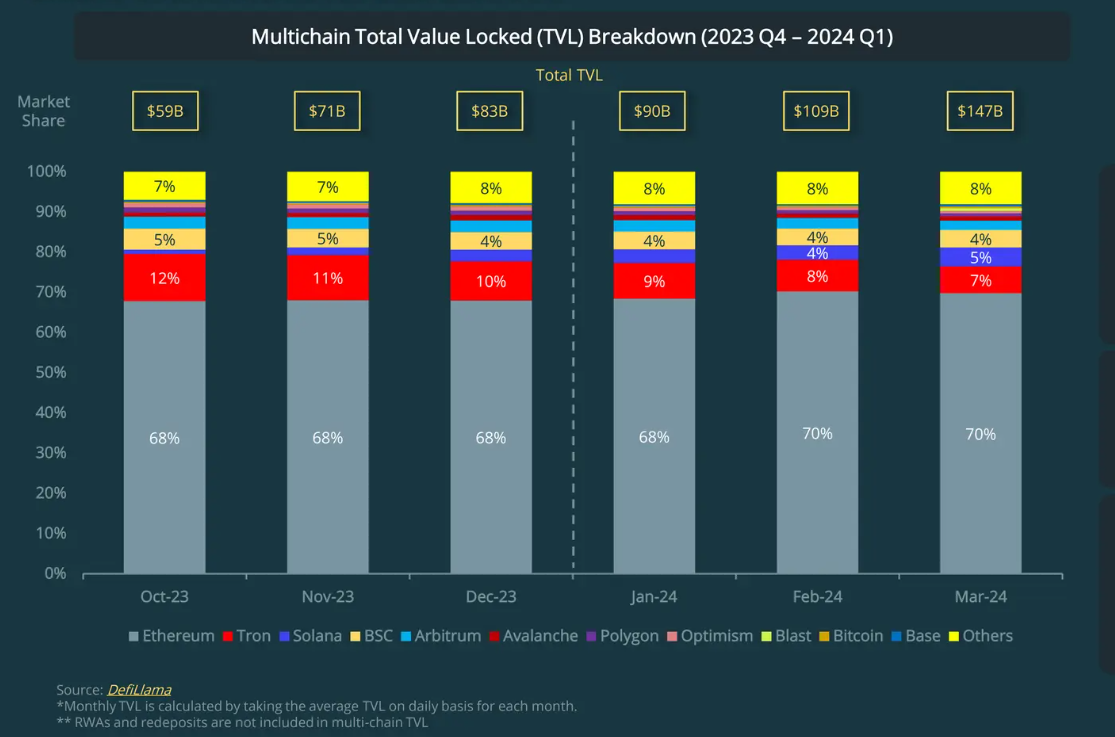

The increasing trend of restaking has contributed to Ethereum expanding its market share to 70%. Additionally, Solana has surpassed BNB Smart Chain, boasting over $8.7 billion in Total Value Locked (TVL).

Solana’s resurgence, fueled by its recent memecoin surge, has seen its Total Value Locked (TVL) share rise from a mere 1% last October to 5% currently. Meanwhile, emerging Layer-2 networks like Base and Blast are gaining ground, challenging established ones like Optimism and Arbitrum.

Overall Multichain TVL has been on a steady rise since last year, experiencing a notable surge of 78% from $83 billion at the end of 2023 to $147 billion in the first quarter of 2024.

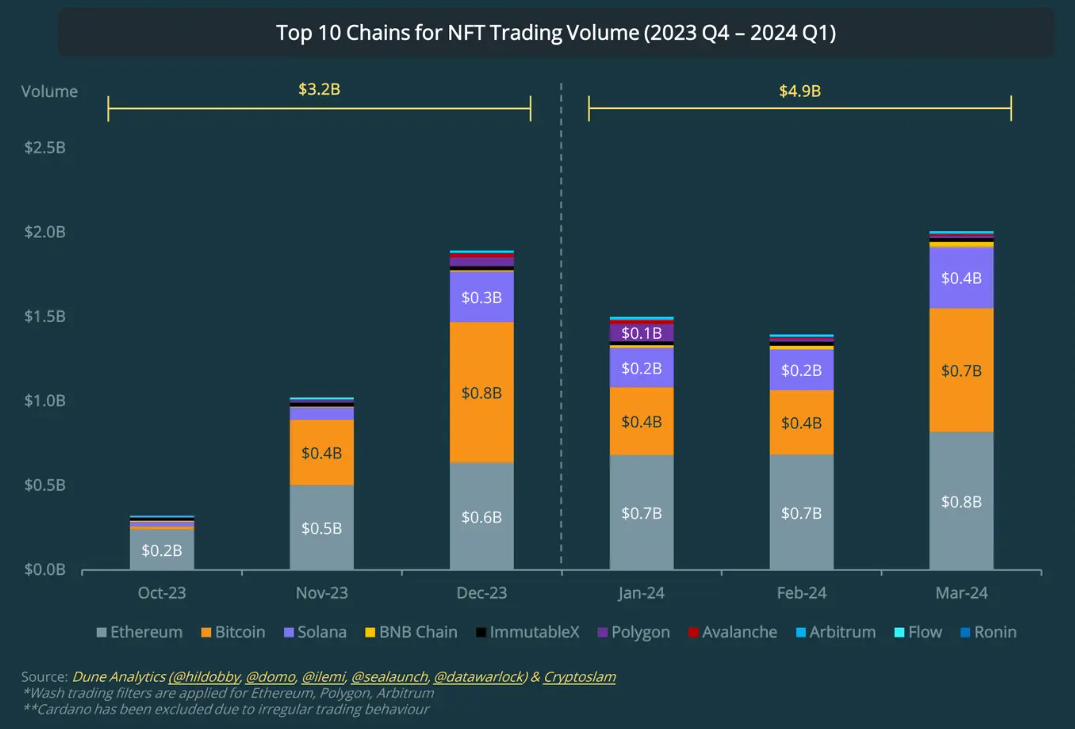

The NFT market saw a continued recovery in the last quarter, benefiting from renewed interest in Bitcoin and Solana NFTs. Despite a 20.7% dip in January’s trading volume, NFT trading volumes across the top 10 chains surged by 51.5% from $3.2 billion in 2023 Q4 to $4.9 billion in 2024 Q1. Ethereum regained its position as the leading NFT chain, with over $2.2 billion traded in the first quarter of 2024, although it faces competition from Bitcoin and Solana, which are attracting strong interest in their NFT ecosystems.

Polygon experienced a significant spike in trading volume in January, reaching $105 million due to the launch of the Gas Hero NFT game. However, trading volumes on the network sharply declined by 88% to $12.7 million in March.

Stablecoins maintain their position as the frontrunner in daily active users across all categories, constituting over 41% of all web3 user activity. However, some other categories witnessed higher quarter-on-quarter activity growth, hinting at potential catching up.

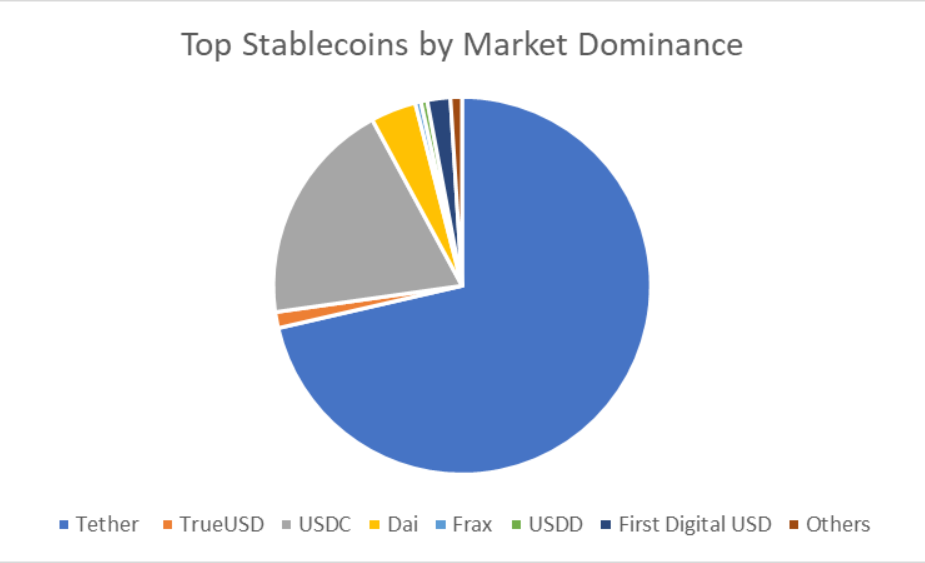

USDT continues its dominance in the stablecoin sector, commanding approximately 75% of the total stablecoin market cap. In the first quarter of 2024, USDT surpassed a market cap of over $100 billion for the first time, joining the ranks of Bitcoin, Ethereum, Binance Coin, and Ripple as the fifth crypto asset to achieve this milestone. Following USDT, USDC holds a market cap of $25.9 billion. Additionally, Dai, First Digital USD, and TrueUSD are notable contenders in the stablecoin market.

Despite processing over 10 times the number of transactions compared to USDC in the first quarter of 2024, USDT has recently been surpassed by USDC in terms of volume and average transaction size. This shift can be attributed in part to Coinbase’s efforts in the first quarter of 2024 to deepen the integration of USDC on their platform and promote its usage on their Layer-2 network, Base, by subsidizing fees.

The Bitcoin halving recently occurred on April 19th! Prior to this event and its anticipation, BTC price hit the ATH before the halving. Additionally, SPOT ETF inflows were stimulating prices in the last few months. With the Bitcoin price already tripling this year, and prices rising too quickly before the halving, sideways action could occur afterward.

However, given the significance of this event and SPOT ETF, prices could still continue to rise or rise faster than anticipated. According to historical cycles, Bitcoin should continue the rally at the end of this year and come on strong in 2025. As for altcoins, they have started making their first significant moves in price rise but still have a lot of room for growth; some of them are still at their bottom compared to BTC in price. Some corrections and sideways trading are expected on the way up, but looking long-term, altcoins are still positioned low.

When examining the monthly timeframe and adopting a longer-term perspective, we observe that Bitcoin (BTC) currently resides in quite overbought territory, gradually inching towards highly overbought levels. Even with this overbought level, there is still room for more. BTC broke all previous resistances and reached its ATH price.

Historically, BTC prices should continue rising from here with the start of the heavy bull run at the end of this year. With the BTC halving occurred and approval of the Bitcoin SPOT ETF carrying significant weight, the BTC price could continue to increase and go much higher in this period; however, we should bear in mind that BTC price rose too quickly before the halving event and some correction or sideways action could occur, possibly exceeding the 17% correction that has already happened. During this phase of the cycle, historically, the largest altcoin by market cap, Ethereum, is expected to take over and increase its dominance percentage.

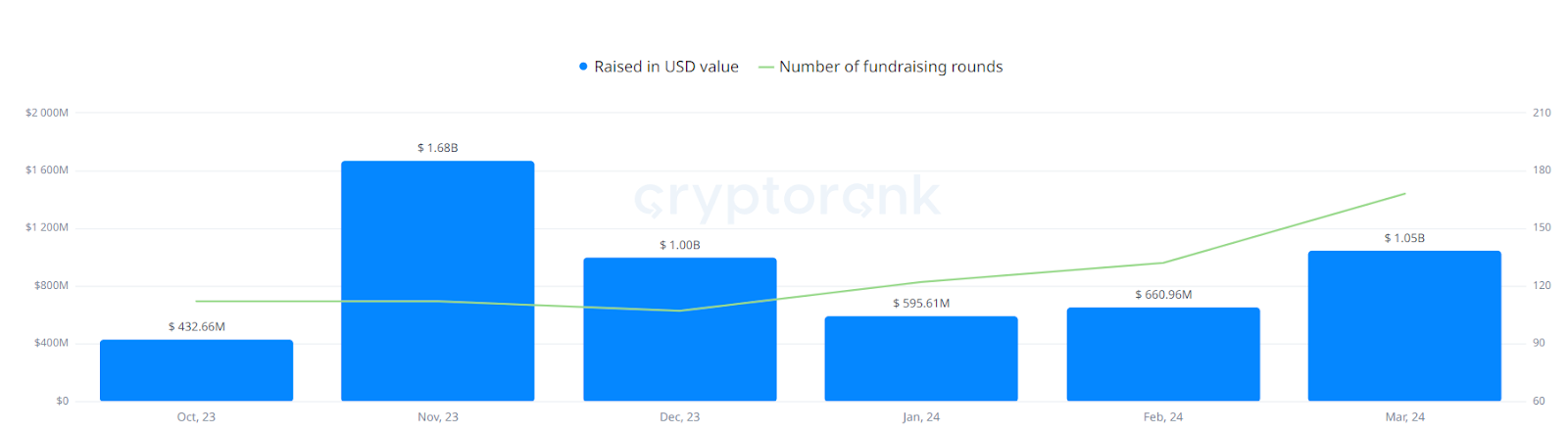

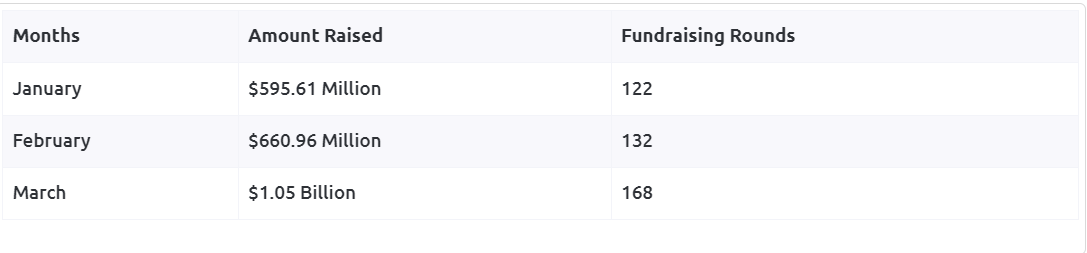

During the initial quarter of 2024, venture capital (VC) investments in the cryptocurrency sector saw a significant increase, marking a reversal from a two-year decline. On-chain data indicates a rise in the number of projects securing VC funding since the fourth quarter of 2023. However, there was a noticeable decrease of nearly $800 million in investment compared to the fourth quarter of 2023.

The number of projects securing funding surged by more than 40%, reaching levels similar to those seen in the fourth quarter of 2023. This suggests that venture capital funding in the crypto sector is steadily increasing.

Funding for cryptocurrency firms began surging in January and saw a gradual increase following the SEC’s approval of a spot Bitcoin ETF and a substantial influx into ETFs. By March, investments had exceeded $1 billion.

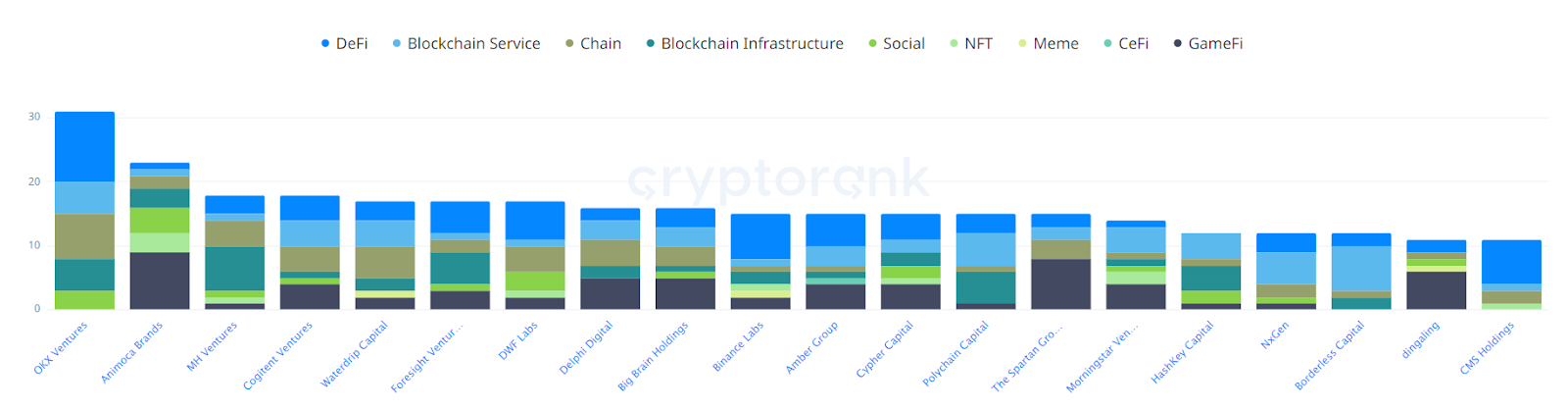

During the first quarter, active investment in the crypto space was driven by firms native to the industry, including OKX Ventures, Animoca Brands, MH Ventures, and DWF Labs.

In the initial quarter of 2024, the fundraising scene saw a notable shift with DeFi taking the lead, capturing a significant 25% share of total investments. In contrast, interest in Blockchain Services among venture capitalists decreased, now representing only 18% of the overall funding.

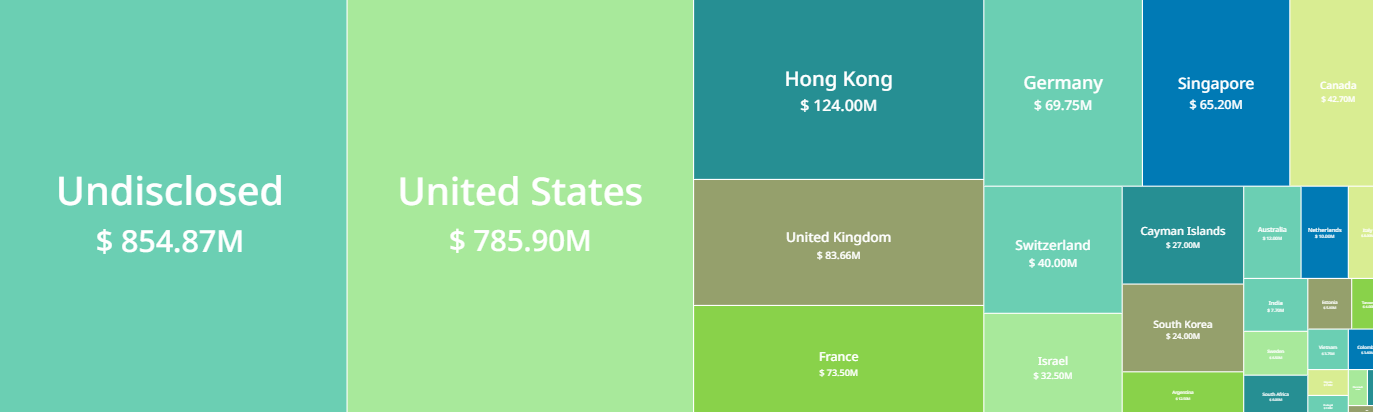

The United States emerges as the frontrunner in cryptocurrency fundraising, securing the top spot among investment destinations. It amassed nearly $785 million for crypto ventures, accounting for approximately 34% of the global investment total. Hong Kong closely follows, taking the second position in the crypto funding landscape with a total investment of $124 million.

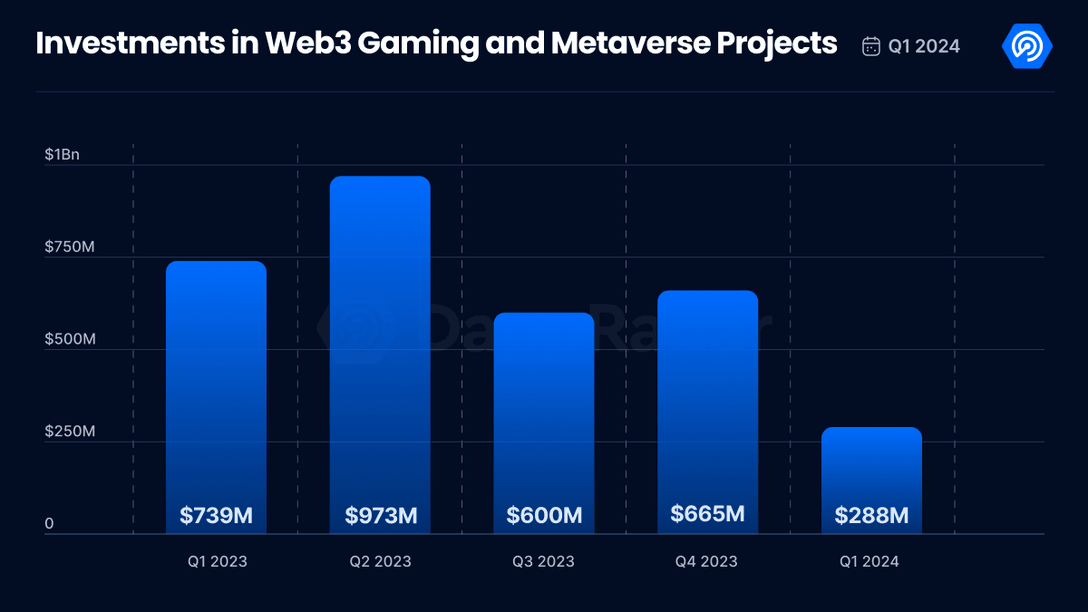

According to data from DappRadar, the sector received $288 million in funding during Q1, marking a significant 57% decrease from Q4 2023. However, amidst this, Gunzilla Games managed to secure $30 million for its upcoming free-to-play battle royale game, Off the Grid. This funding, led by CoinFund and Avalanche’s Blizzard Fund, aims to support the game’s expansion across multiple gaming platforms, including Sony PlayStation, Microsoft’s Xbox, and PC.

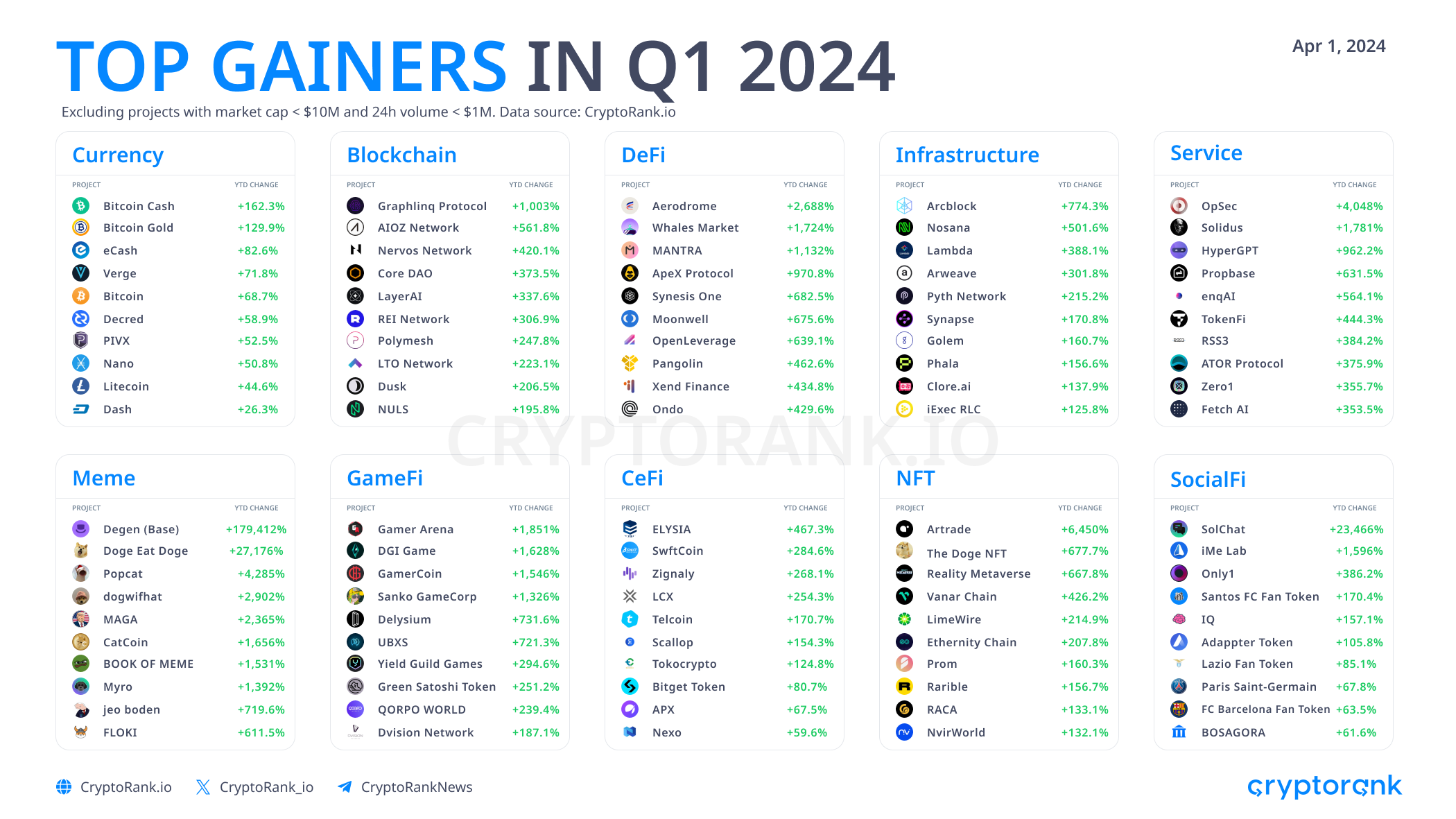

In the first quarter of 2024, several projects have seen remarkable success. Bitcoin Cash and Bitcoin Gold lead the currency domain, while Aerodrome, Whales Market and Mantra all saw gains of over 1000% in this period.

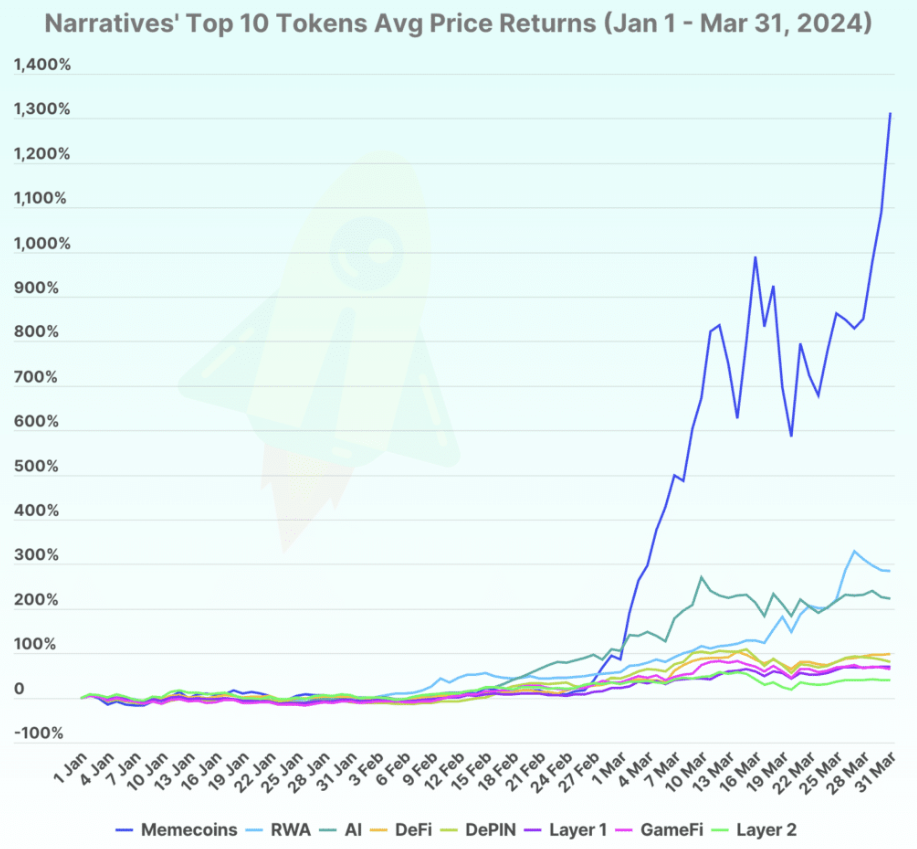

The most impressive gainers, however, come from the Meme category, where projects like dogwifhat, Popcat, and Book of Meme have seen multiple fold price increases. The top leader in that category is Degen on the Base blockchain, with a mind boggling gain of 180,000%.

Other categories with notable gains include SocialFi, GameFi, NFT and Service.

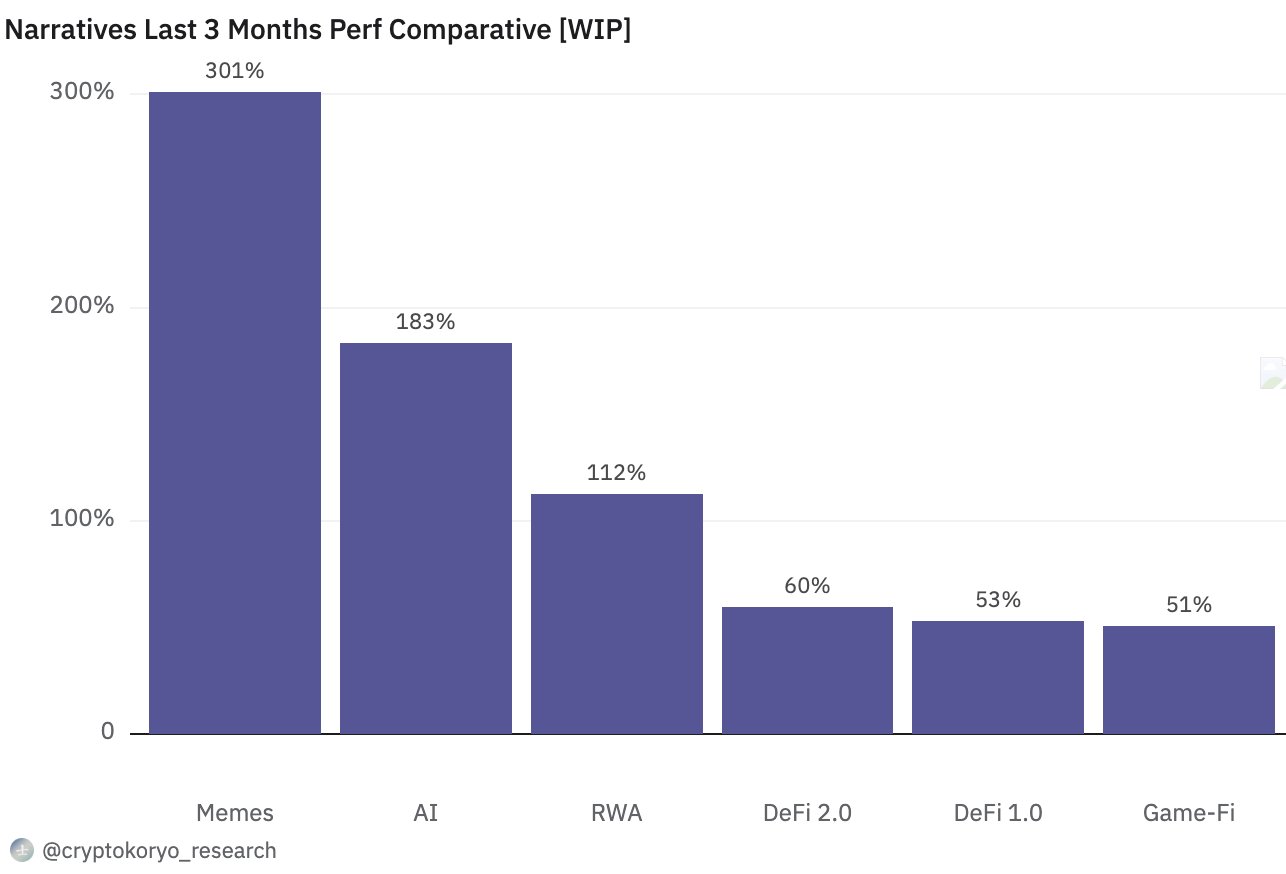

Tokens based on internet memes took the throne for being the most lucrative narrative in the first quarter of the year, by a large margin. Meme tokens, particularly on the Solana ecosystem, gained significant traction in Q1 due to the blockchain’s low transaction fees and fast speeds.

The top projects with the most volumes were even listed on top centralized cryptocurrency exchanges, such as Binance, contributing to the sector’s growth across different blockchains. This list includes tokens such as $BOME, $PEPE and $WIF.

Tokenization of real-world assets continues to cement its place as a top narrative, thanks to BlackRock’s initiative to launch a $100 million dollar tokenized fund. RWA secured the second position in terms of performance, achieving an impressive return of 285.6% in the first quarter of 2024.

The AI sector continued to thrive, driven by events like Nvidia’s GTC2024 conference. The growth in the AI sector was further bolstered by Binance’s listing of Bittensor’s $TAO, one of the top AI projects by market cap, at $3.8 billion. Artificial intelligence placed as third narrative by returns, with a 222% return. The top performers in the AI narrative were AIOZ Network (AIOZ) and Fetch.ai (FET), according to CoinGecko.

The DeFi sector, on both Layer 1 and Layer 2 blockchains, has seen significant growth thanks to new and innovative protocols, such as Jupiter, which conducted its airdrop in Q1. Overall, DeFi achieved moderate returns of 98.9%, led by Uniswap (UNI), Ribbon Finance (RBN), Jupiter (JUP), Maker (MKR), and The Graph (GRT).

Competition in the layer 2 sector is fierce, with projects like Blast and Manta conducting asset bridging activities to attract liquidity and incentivize developers. Other notable developments included Merlin’s airdrop, emerging stars such as $PORTAL in the GameFi sector, the release of Uniswap v4, and the increasing popularity of modular architectures. L2 narrative saw a 39.5% gain.

Overall, the first quarter of 2024 was extremely positive for the cryptocurrency markets, both in terms of prices and adoption. The rise in overall crypto market capitalization was accelerated by the approval of multiple Spot Bitcoin ETFs in the United States, as well as anticipation for the Bitcoin Halving. The total cryptocurrency market cap increased by 60%, with Bitcoin reaching its all-time high price and Ethereum seeing a 60% increase.

The quarter’s most notable events included the approval of Bitcoin spot ETFs, Sam Bankman-Fried being sentenced to 25 years in prison, BlackRock launching a tokenized fund, and the Ethereum Network Dencun Upgrade, along with the delay of a Spot ETH ETF to May 2024.

Data from centralized exchanges indicates a significant increase in spot trading volume during Q1 2024, rising by +95.3% quarter-on-quarter. The number of addresses with balances of ≥ 0.1 and ≥ 1 BTC decreased in Q1, suggesting that retail investors were taking profits and selling BTC following its price surge, while the number of addresses with balances of ≥ 100 and ≥ 1k BTC slightly rose in Q4.

The DeFi sector remained focused on Ethereum, with its TVL expanding to 70% of the total market share. Additionally, Solana surpassed BNB Smart Chain in TVL. The top narratives of the quarter included Memecoins, RWA, AI tokens, and DeFi.

With a positive start to 2024, the second quarter began with bullish sentiment. The recent Bitcoin halving and the potential approval of an Ethereum Spot ETF in May indicate that 2024 is poised to be an exceptional year for the cryptocurrency ecosystem.

Veli Partners with DEC Institute to Equip Finance Professionals for...

Inside the Mechanics of Crypto Indexes – How Are They...