Q1 2025 Market Report This report will cover all the shifts that...

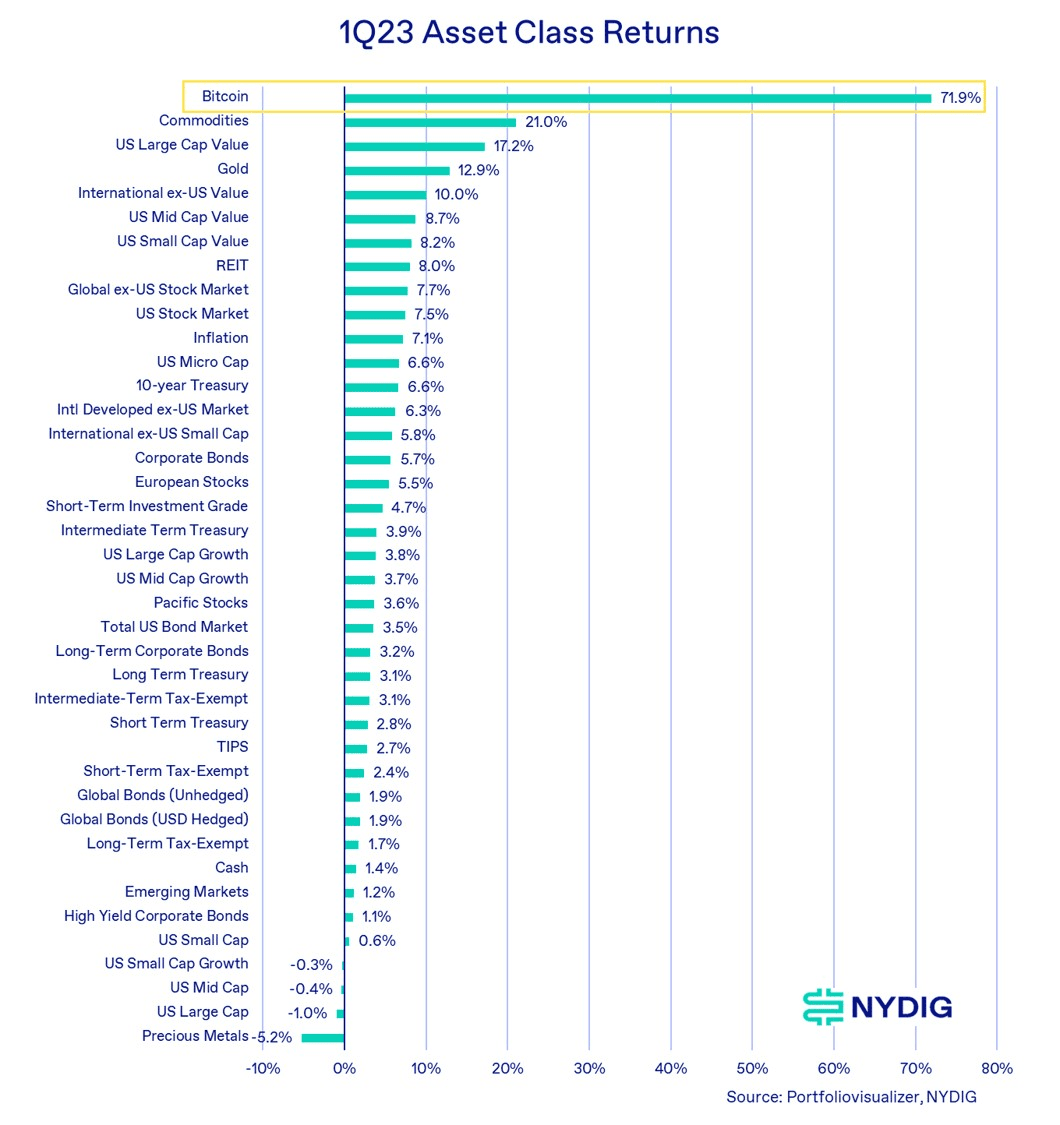

During the first quarter of 2023, the leading cryptocurrency Bitcoin dominated as the most popular financial instrument, delivering a remarkable gain of nearly 70%. This quarter’s surge marks the most profitable period for Bitcoin since March 2021, when it achieved a remarkable 103% increase.

Bitcoin’s performance has exceeded the growth rates of other popular investment options. For instance, Gold has recorded an 8.4% increase, the S&P 500 has had a moderate year-to-date increase of 5.5%, while the Nasdaq 100 has exhibited a 19% uptick. These outstanding returns prove Bitcoin’s continued appeal as a profitable investment opportunity in the financial market.

Another two well-known cryptocurrencies, Ether and Cardano, had impressive gains of 55% and 63%, respectively, during the first quarter of the year. This contributed to an overall positive start to the year for cryptocurrency investors, with the entire market experiencing a substantial increase of around 130%.

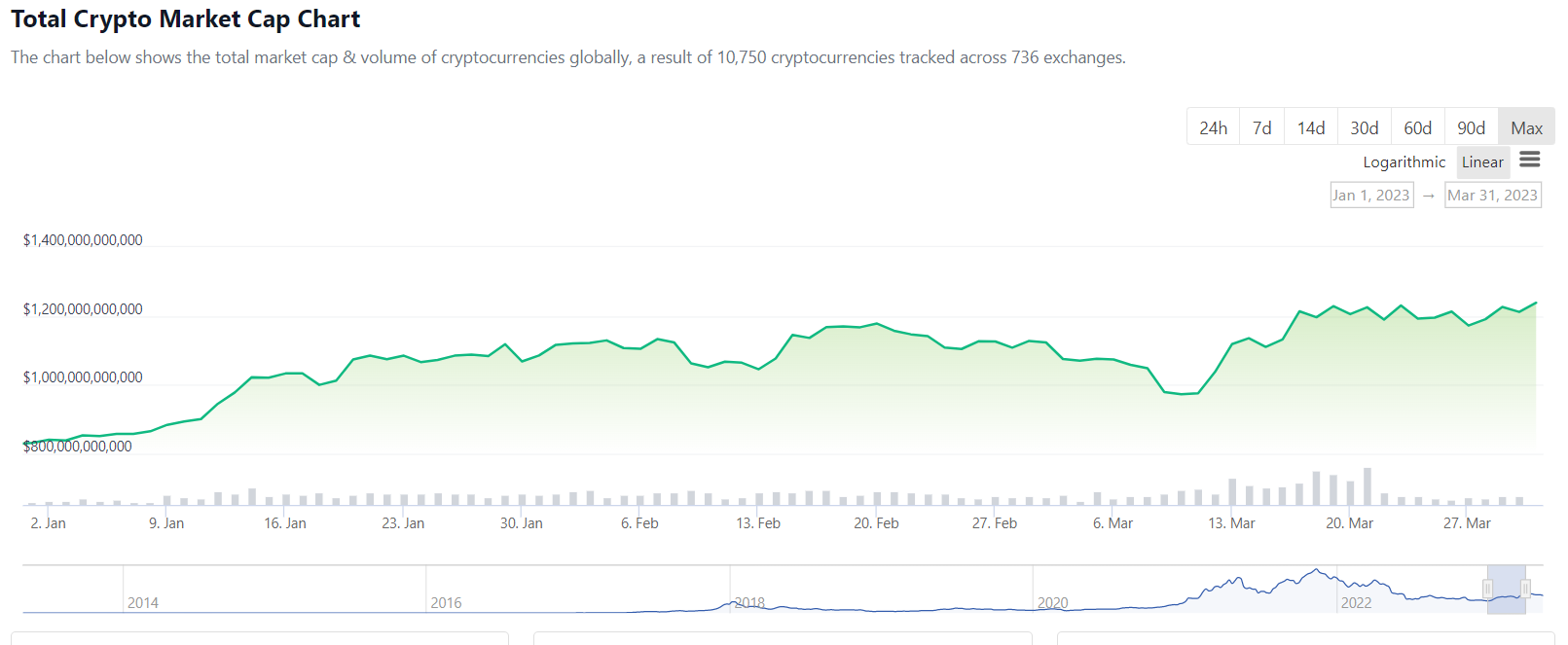

The total market capitalization of cryptocurrencies has increased from $831 billion to $1.23 trillion, marking a growth of 33%. Market was generally in steady uptrend the whole quarter except for the month March when the market experienced some volatility. The Market declined by 8.6% between March 9-11 due to the banking crisis at Silicon Valley Bank and its subsequent ripple effect. However, crypto market quickly recovered from the dip.

Bitcoin outpacing every other investment option in Q1, according to a research report by NYDIG.

During the first quarter of 2023, Bitcoin proved to be incredibly resilient despite the collapse of major crypto-friendly banks, such as Silvergate and Signature Bank. Several factors contributed to this impressive performance, including the ongoing turbulence in the banking sector. This has led many investors to view cryptocurrency as a feasible alternative to centralized monetary systems. The analysis conducted by Finbold on March 21, further bolstered this sentiment, revealing that the cumulative market capitalization of five leading US banks had declined by $108.92 billion in 2023 alone, while Bitcoin’s value increased by approximately $219.86 billion during the same period, indicating its growing popularity as a reliable and profitable investment choice.

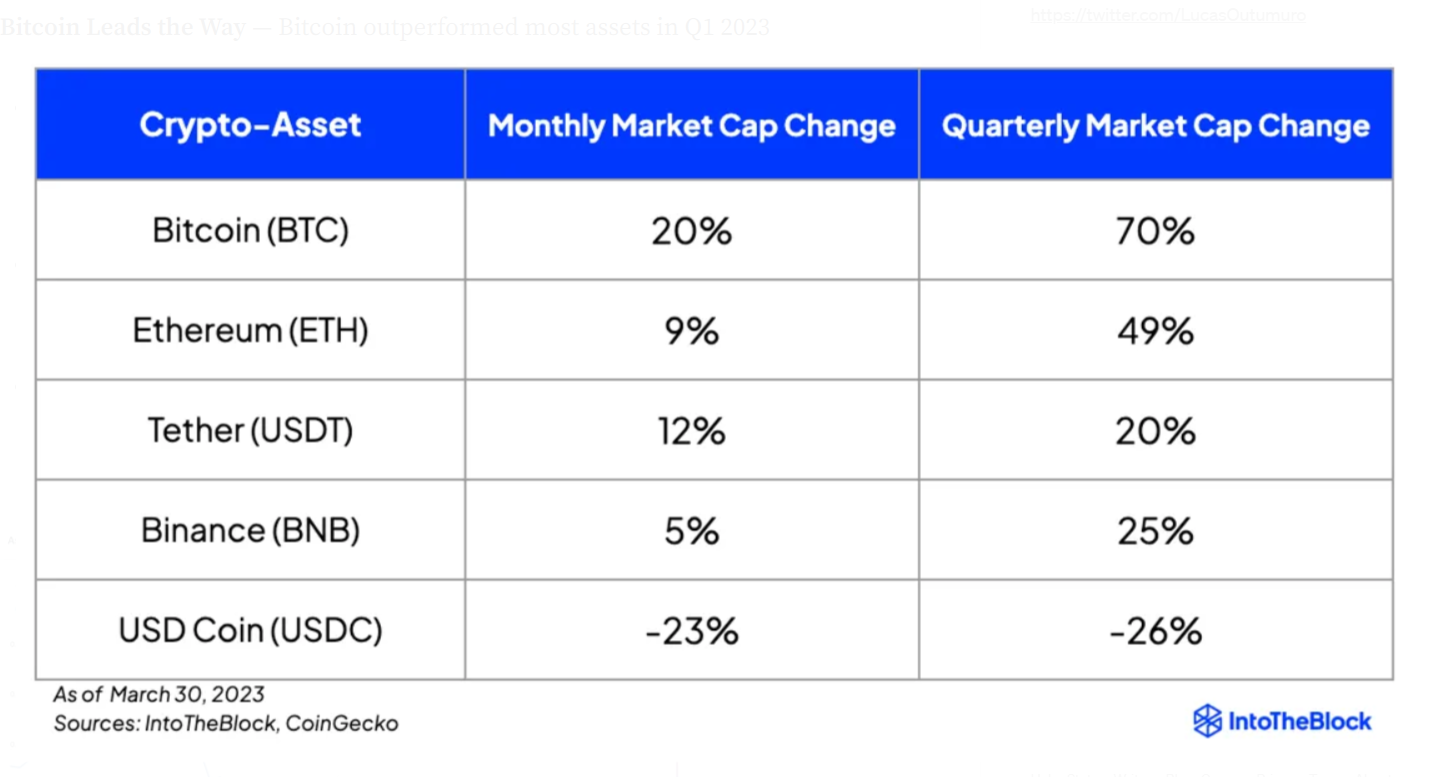

Ether’s 49% quarterly increase also surpassed many crypto-assets (and certainly stocks), though it has lagged behind Bitcoin.

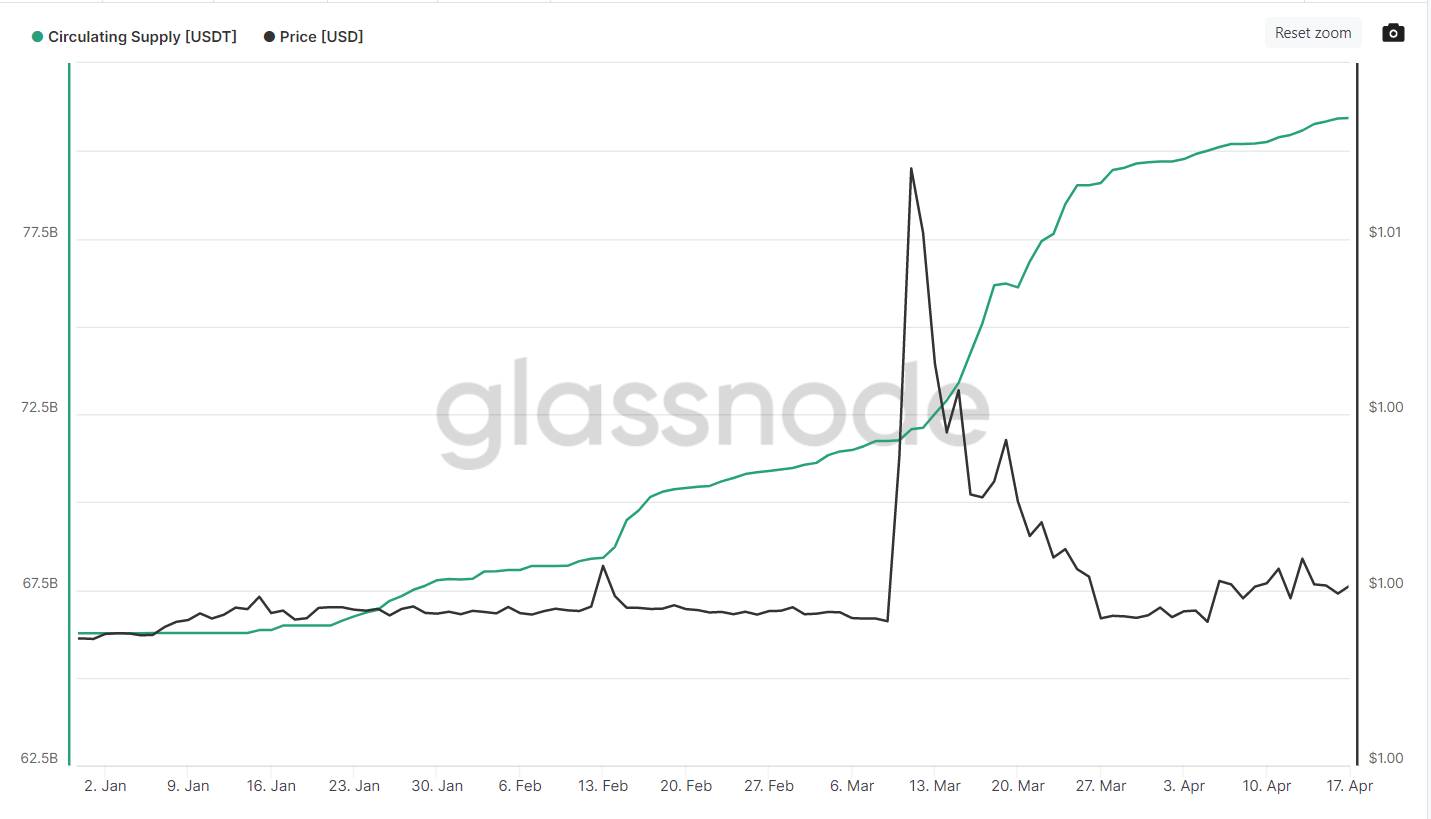

Tether capitalized on the events where USDC lost its peg to the US dollar due to the SilverGate Bank liquidation and stopping of new BUSD issuance. As a result, Tether was able to gain a larger portion of the stablecoin market share.

Despite Binance exchange facing regulatory challenges, Binance’s native cryptocurrency BNB has managed to perform well in the first quarter of the year, gaining 25% in price.

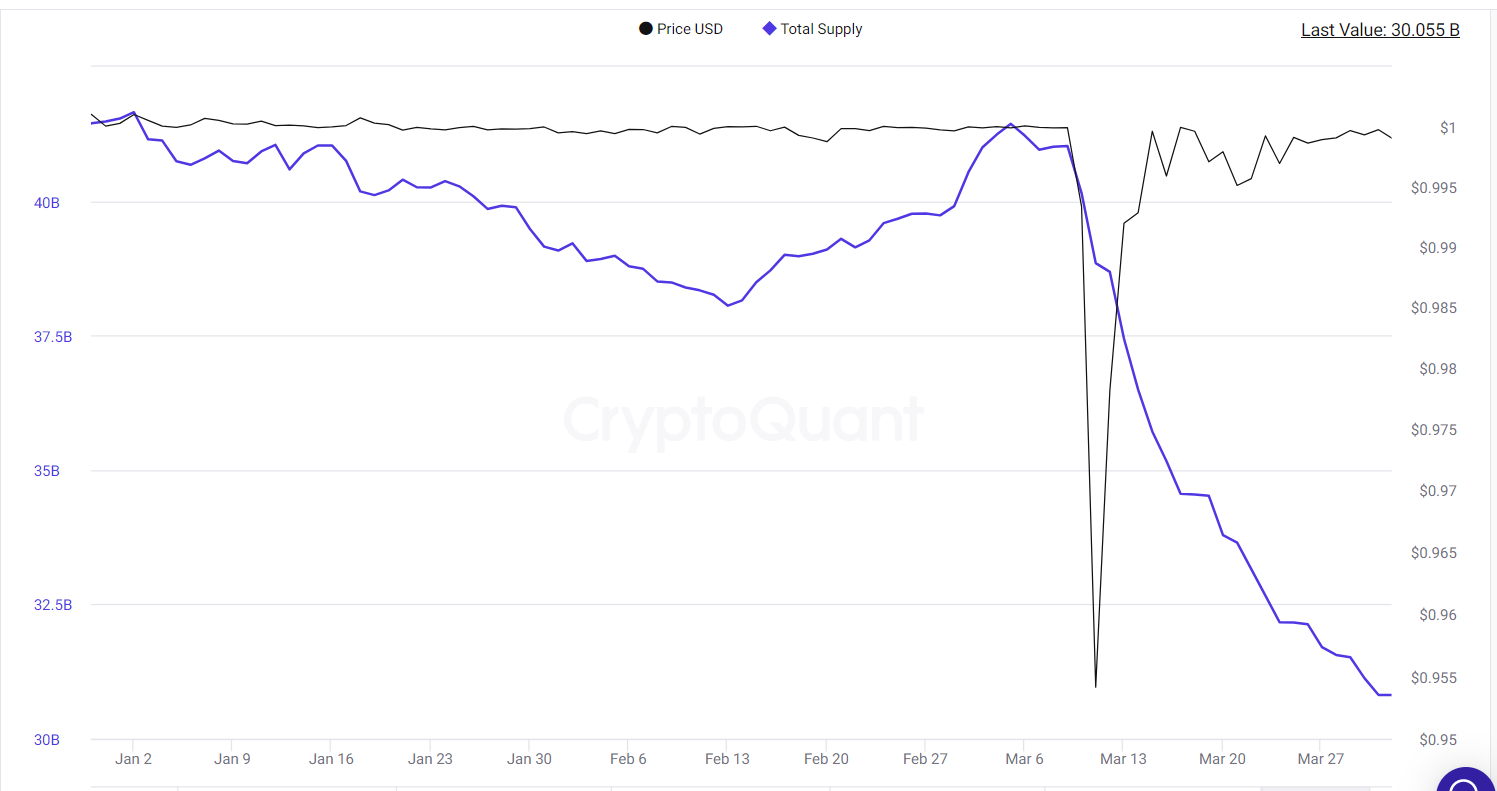

USD Coin (USDC) suffered a significant decrease in market share of about 26% due to the liquidation of SilverGate Bank. This was because a portion of the USDC reserves was held in the bank, which caused USDC to lose its peg to the US dollar, resulting in a decline in trust and confidence in the stablecoin.

Following the announcement that Paxos Trust Company may face legal action from the US Securities and Exchange Commission (SEC) for allegedly marketing BUSD as an unregistered security, the New York State Department of Financial Services (NYDFS) ordered the company to discontinue issuing BUSD. BUSD is a stablecoin backed by the US dollar and branded by Binance. Paxos stopped issuing the stablecoin on February 21, but it confirmed that the ones already in circulation would continue to be backed by US dollar reserves on a one-to-one basis. The company has assured its customers that they can redeem their BUSD until February 2024 and can choose to receive payment in US dollars or convert their tokens to Pax Dollar, another stablecoin issued by Paxos. This order from the NYDFS is part of the regulator’s wider crackdown on the cryptocurrency sector in New York.

Following the collapse of FTX, a crypto exchange, Silvergate Bank, a cryptocurrency-focused lender based in California, experienced a loss of customer withdrawals and ultimately ceased operations. The bank had previously warned that it was undercapitalized due to depositors requesting their funds back. As a result of recent regulatory and industry developments, Silvergate opted for voluntary liquidation. FTX’s failure led to increased volatility in the cryptocurrency markets, and Silvergate revealed that it was being investigated by the US Department of Justice. The bank’s liquidation plan includes a full repayment of deposits, and it reported a loss of $1 billion for Q4 of 2022 due to customers withdrawing over $8 billion in deposits. Several partners of the bank, including Coinbase and Galaxy Digital, terminated their relationships with Silvergate. Additionally, FTX and its infamous affiliated trading arm, Alameda Research, had accounts with Silvergate.

On March 10, the USDC stablecoin, issued by Circle, lost its peg to the US dollar. This happened on the same day that US banking authorities intervened to take control of Silicon Valley Bank (SVB), causing the fiat-backed stablecoin to fall below 90 cents. The reason for the drop was the announcement that Circle had up to $3.3 billion of its $40 billion of USDC reserves at Silicon Valley Bank. This triggered a chain reaction within the DeFi sector, leading to significant drops in market capitalization for certain DeFi sectors.

During the two-day crisis period caused by the depegging of USDC from the dollar, many users opted to trade their USDC coins for other stablecoins and cryptocurrencies like Bitcoin and Ethereum. Tether’s $USDT emerged as a popular stablecoin alternative and gained a significant portion of the market share, experiencing a 20% increase in market capitalization.

The Commodity Futures Trading Commission (CFTC) has accused Binance, its CEO Changpeng Zhao, and a former top compliance executive of allowing US users to access and trade derivative products, such as futures and swaps, which can only be traded on regulated platforms. This accusation bears similarity to the CFTC’s lawsuit against BitMEX in 2020. After the lawsuit, Binance saw a significant surge in withdrawals, with users withdrawing $1.6 billion, including $852 million in just 24 hours. Binance exchange once again demonstrated its stability and ability to handle substantial withdrawal requests.

January 6 – Huobi lays off 20% of staff and USDD depegs

January 20 – Genesis crypto lending business files for bankruptcy

February 6 – Binance suspends USD payments temporarily

February 10 – U.S. SEC targets crypto ‘staking’ with Kraken crackdown

February 13 – Paxos announces it will no longer issue new BUSD

February 23 – Coinbase announces its own Layer 2, Base

March 8 – Silvergate Bank is shutting operations and liquidating its bank

March 11 – USDC stablecoin Depegs due to cash held at SVB

March 22 – Binance reinstates BTC trading fees; Arbitrum airdrops token, SEC Plans Lawsuit Against Coinbase

March 27 – Binance sued by CFTC

In the first quarter of 2023, the global economy has seen some positive signs as inflation and energy prices ease from their peak levels. China’s ending of its zero-COVID policy also provides some growth impulses, though its full impact has not yet been unfolded. Nevertheless, the global macroeconomic environment remains challenging for economies, business and consumers in the year ahead. The global economy is forecast to grow by 2.3% in real terms in 2023, the weakest growth since 1993, apart from the recession year of 2009 and pandemic year of 2020.

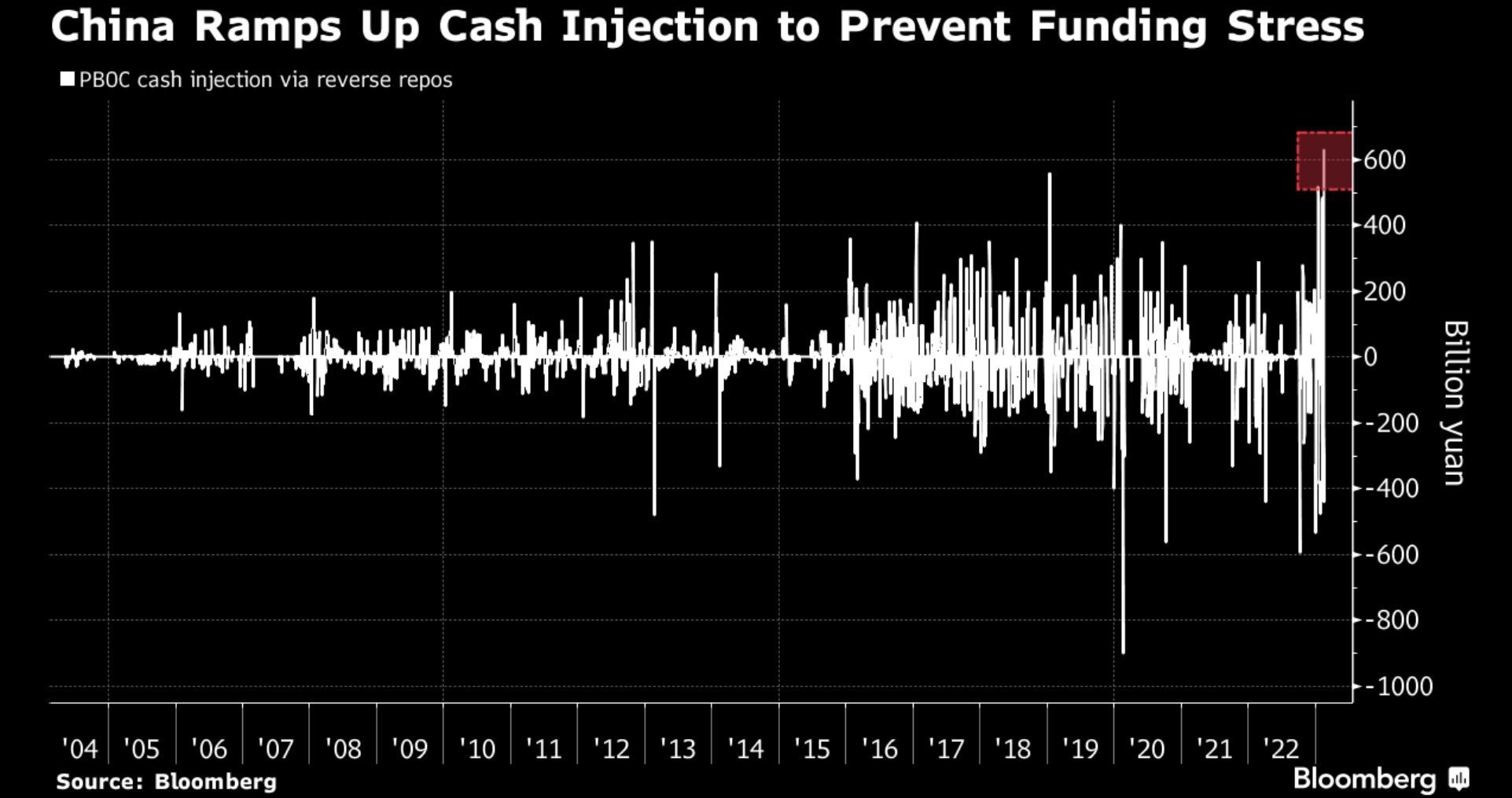

In an effort to stimulate the Chinese economy following the lockdowns caused by the COVID-19 pandemic, the People’s Bank of China injected a substantial amount of liquidity. This injection is believed to have been one of the factors that contributed to the emergence of “China narrative” cryptocurrencies. These cryptocurrencies gained attention due to their potential to benefit from the country’s economic recovery and the government’s policies aimed at boosting its digital economy.

China, as the world’s second-largest economy, has been expanding at a rate approximately 2.2% faster than the US. The People’s Bank of China (PBoC), which is the world’s third-largest central bank, holds around $6 trillion in assets and plays a crucial role in maintaining global liquidity.

While many analysts are primarily focused on how the Federal Reserve’s tightening will impact the pricing of risk assets during this cycle, they may be overlooking the significant easing that is happening in the East. Considering the scale of global easing rather than just the US in isolation could prove to be more effective in analyzing crypto markets. Increased liquidity worldwide generally does well for cryptocurrencies.

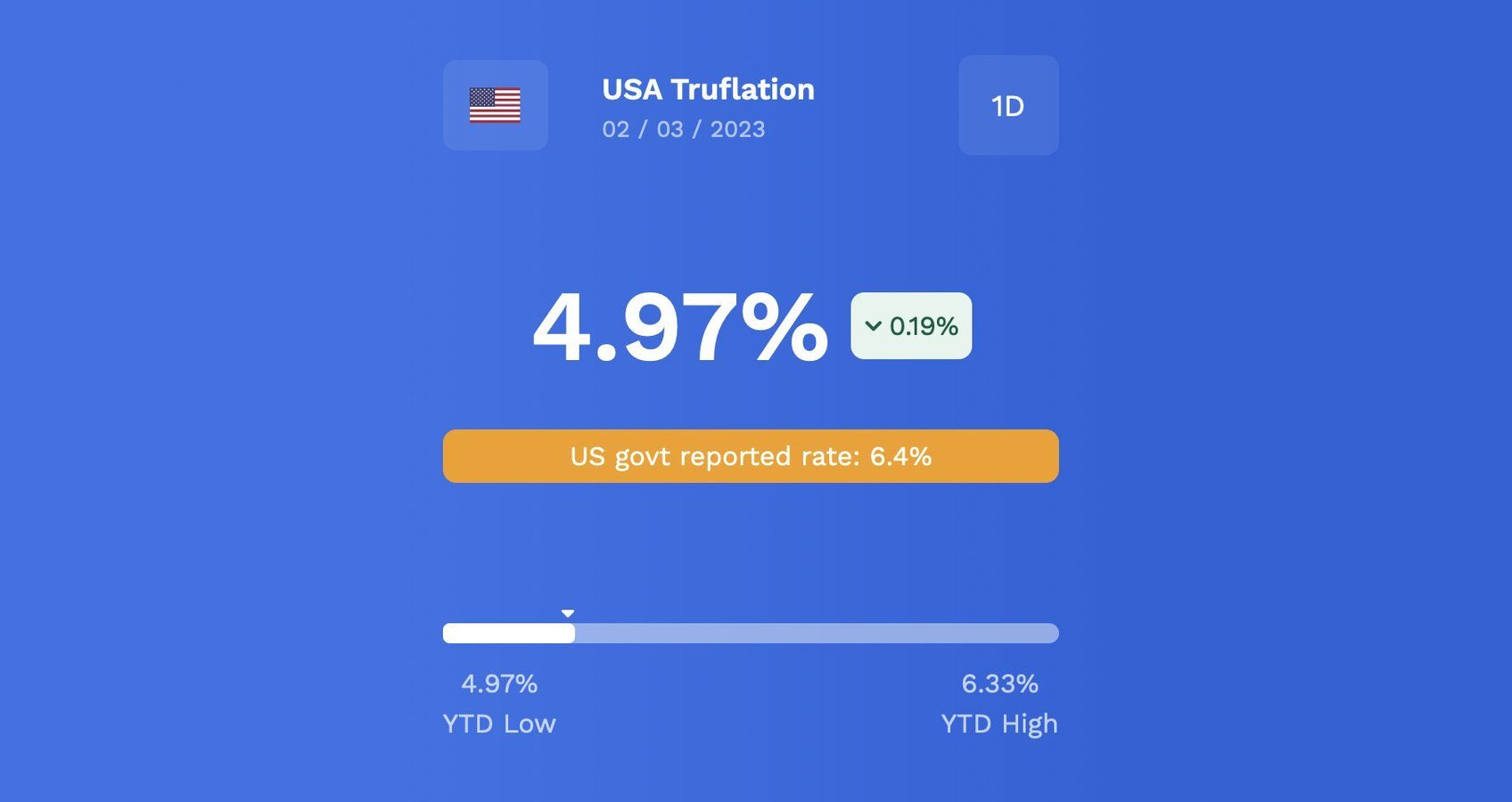

The U.S. inflation rates in Q1 have been declining at a faster pace than anticipated. According to @truflation, the headline inflation rate in the U.S. has dropped below 5%. The Consumer Price Index (CPI), which is a commonly used metric for tracking the costs of goods and services in the US economy, rose by 0.1% for the month. Moreover, the CPI increased by 5% from a year ago, slightly lower than the estimated rate of 5.1%.

With a Goal to bring the inflation rate to 2%, there is still a lot of work on the way, but for sure a cooling off at the moment.

FOMC Meeting Date | Rate Change (bps) | Federal Funds Rate |

March 2, 2023 | +25 | 4.75% to 5.00% |

Feb 1, 2023 | +25 | 4.50% to 4.75% |

Dec 14, 2022 | +50 | 4.25% to 4.50% |

Nov 2, 2022 | +75 | 3.75% to 4.00% |

Sept 21, 2022 | +75 | 3.00% to 3.25% |

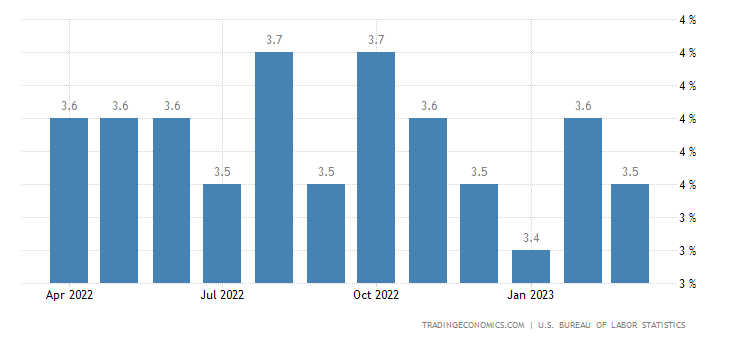

3.50, was expected 3.60 percent, Mar 2023

The Federal Reserve’s goal is to achieve a “soft landing,” which involves reducing inflation without causing a recession, although there is still a possibility of a recession. However, as long as the unemployment rate remains low, the possibility of a recession can be avoided. Ironically, a lack of recession may not be beneficial for the markets because the Federal Reserve cannot introduce additional liquidity. In contrast, an increase in liquidity would generally be beneficial for the cryptocurrency market.

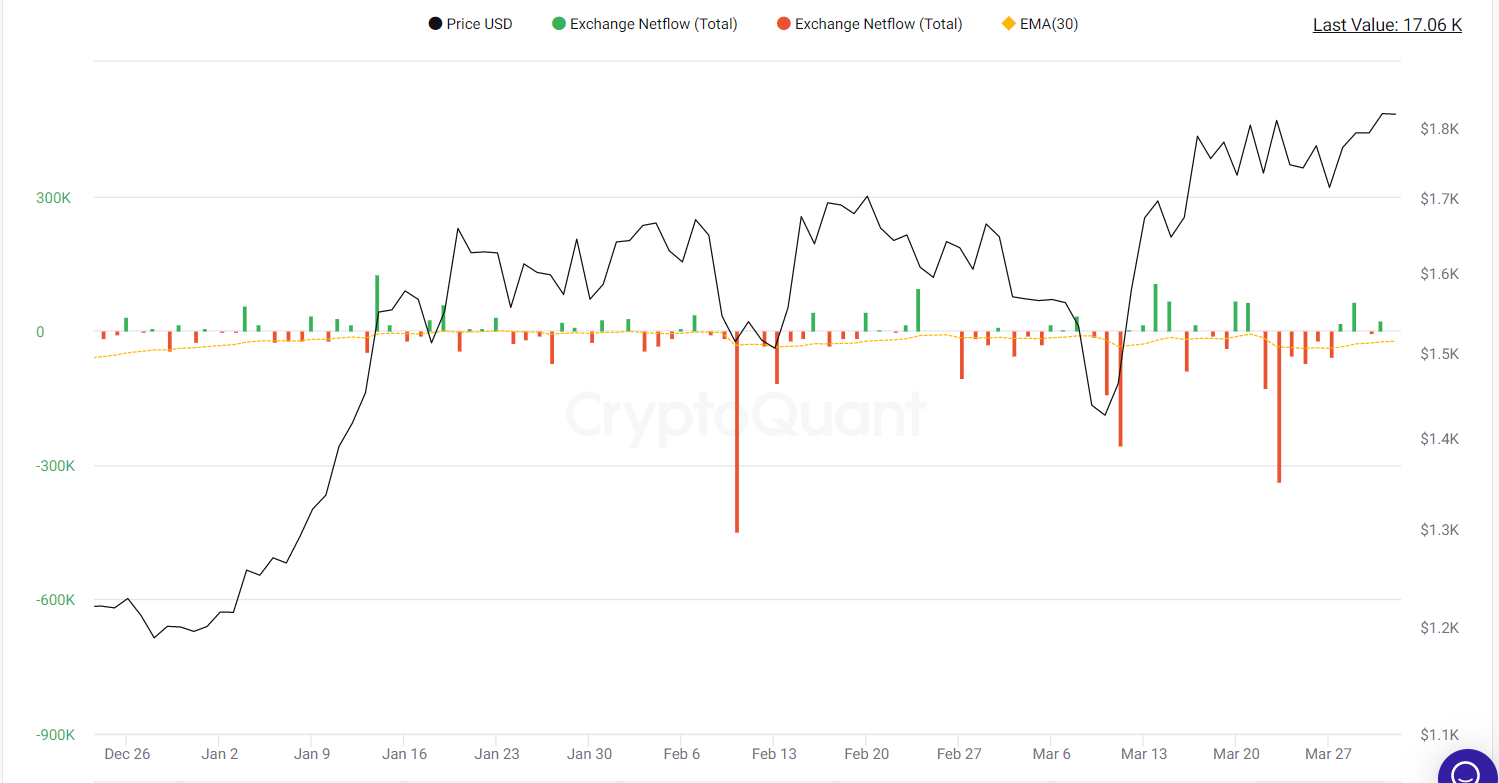

Exchange Netflows – refer to the overall inflows minus outflows of a particular cryptocurrency in and out of centralized exchanges. In general, an increase in crypto going into exchanges may indicate a selling pressure, whereas withdrawals could suggest an accumulation of the asset.

In Q1, Bitcoin experienced net inflows of $663 million to centralized exchanges, which is a marked contrast from the previous quarter’s $4.1 billion in outflows. This shift is likely due to investors taking profits in light of the significant price increase in this quarter.

Bitcoin: Exchange Netflow (Total) – Q1

In the current quarter, approximately $815 million worth of ETH has left exchanges, with the amount of ETH on Exchanges continuing to decline. However, the magnitude of this decrease is lower than the previous quarter’s net outflows of $5.8 billion.

Ethereum: Exchange Netflow (Total) – Q1

Network Fees — Sum of total fees spent to use a particular blockchain. This metric can provide insights into the willingness of users to spend and the level of demand for using cryptocurrencies such as Bitcoin or Ether.

Quarterly fees for Bitcoin reached their highest since Q4 2021, fueled by Ordinals’ NFT expansion.

Ethereum fees climbed to their highest since Q2 2022, caused by events like the USDC de-peg and the ARB and BLUR airdrops.

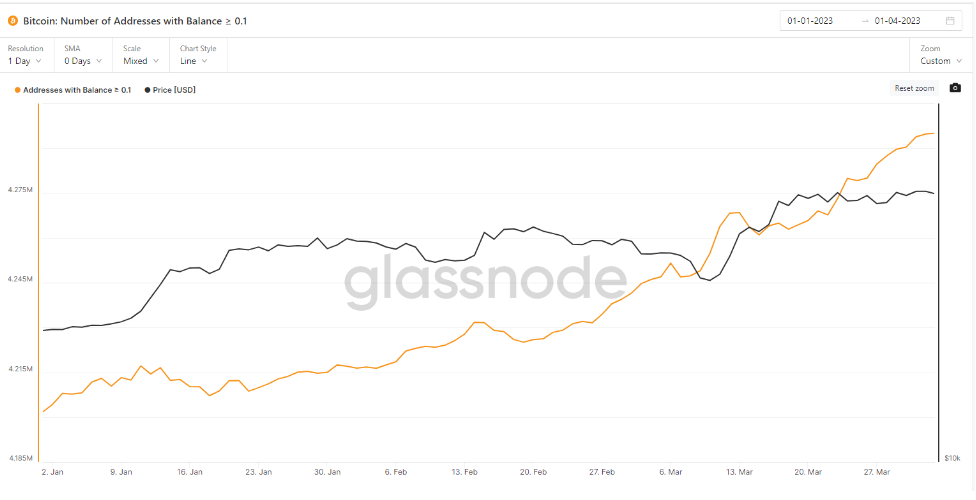

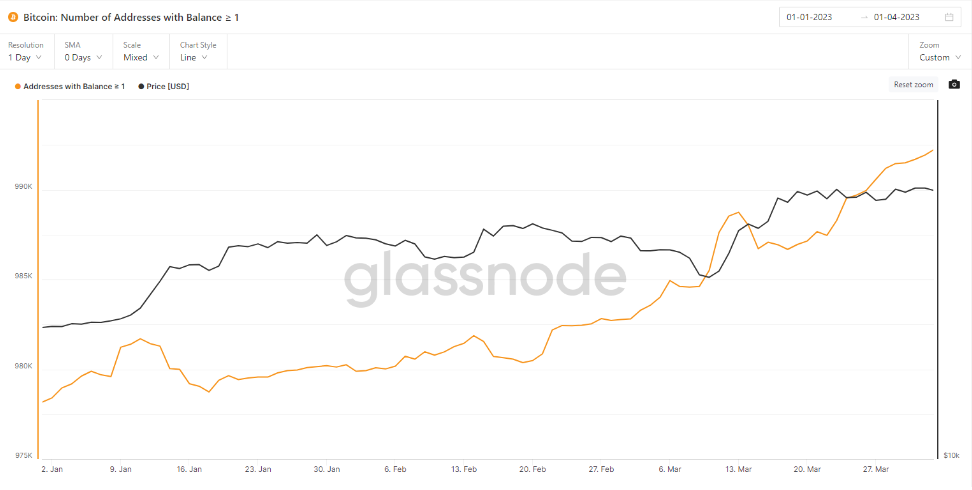

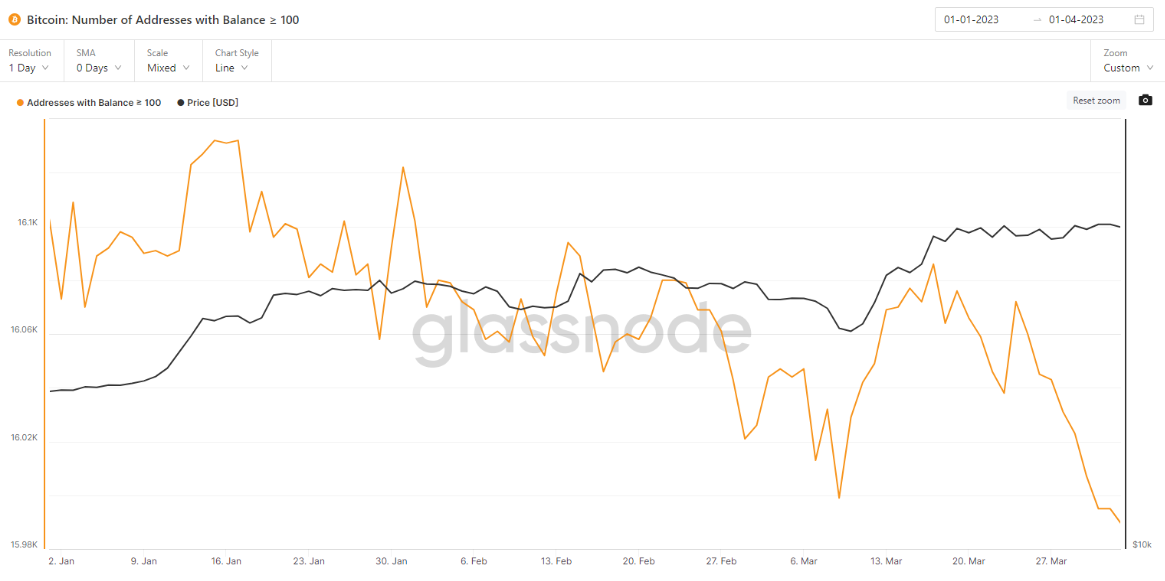

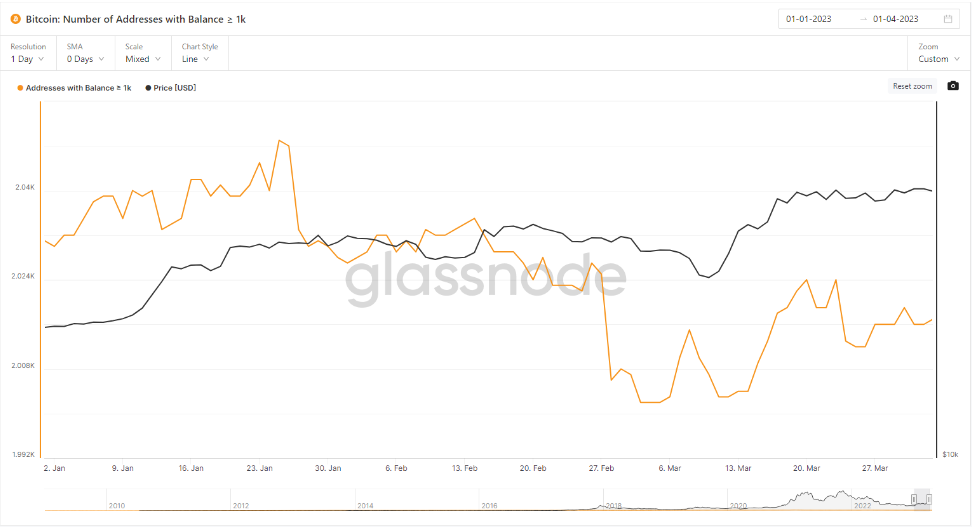

BTC Addresses balances – Retail VS Whales

The number of addresses with balances ≥ 0.1 and ≥ 1 BTC (retail) has continued to grow, suggesting that retail is still buying Bitcoin and accumulating in the Q1. The number of addresses with balances ≥ 0.1 raised to 4.29m, and ≥ 1 to 991.9k.

Bitcoin: Number of Addresses with Balance ≥ 0.1

Bitcoin: Number of Addresses with Balance ≥ 1

The number of Addresses with Balance ≥ 100 and ≥ 1k BTC has shrunk in the Q1. Addresses with Balance ≥ 100 shrunk following the raise in price, which suggests that some Whales were taking profit on the recent upward moment. The number of addresses shrank from 16,102 to 15,995. The number of Addresses with Balance ≥ 1k continues its downtrend since March 2022, which suggests that bigger whales didn’t start accumulating BTC yet and are still gradually selling. The number of addresses fell from 2031 to 2016.

Bitcoin: Number of Addresses with Balance ≥ 100

Bitcoin: Number of Addresses with Balance ≥ 1k

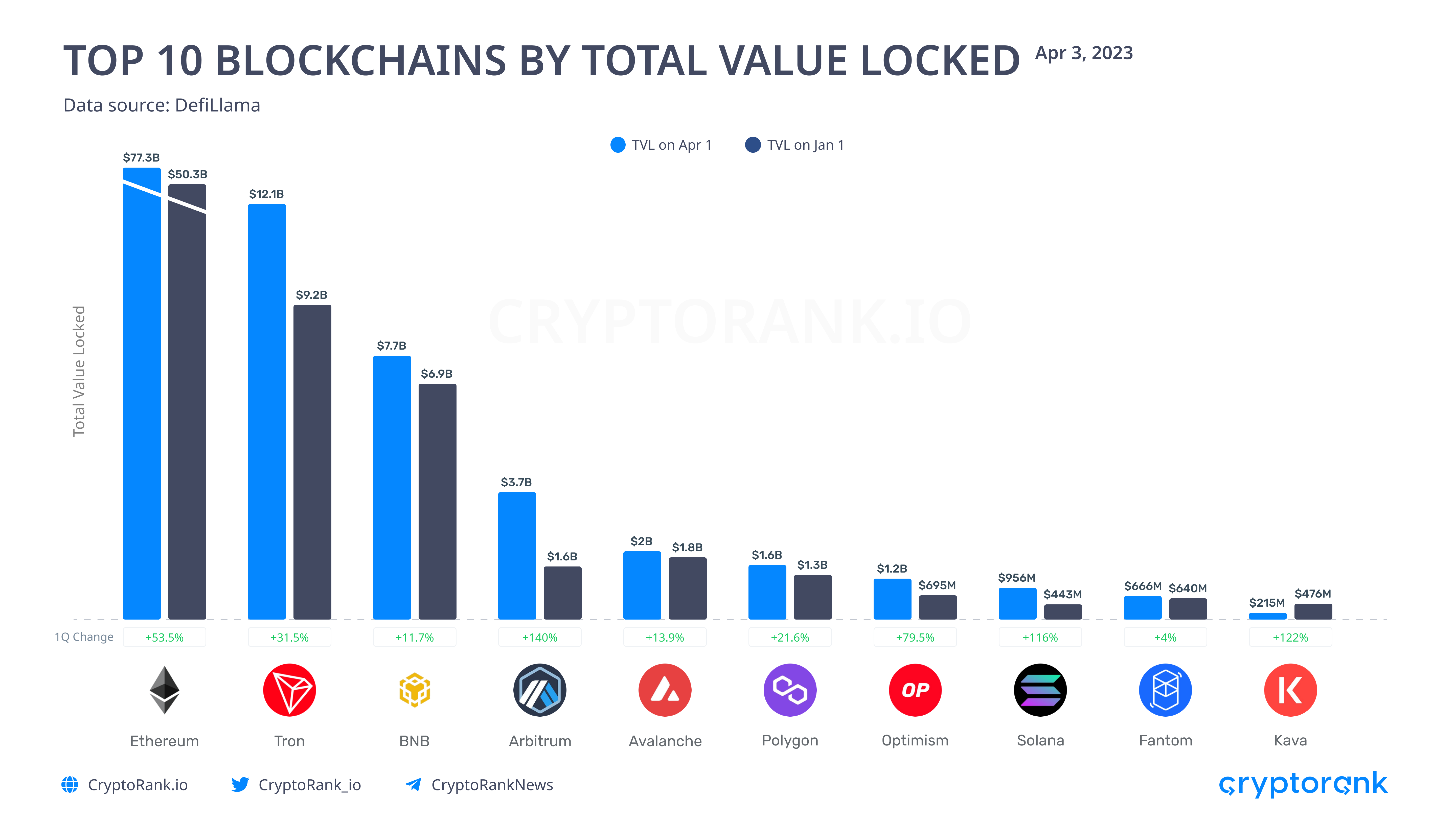

When we talk about DeFi, we can look at some numbers to get a sense of what’s going on. For example, the total value locked in DeFi has gone up by almost 40% since the beginning of the year. Ethereum is still the most popular blockchain for DeFi by a wide margin, but some other networks like Tron, Arbitrum, Solana, and Optimism have also seen significant growth in terms of TVL in the first quarter of 2023. DeFi ecosystem rose 65.2% by $29.6 billion.

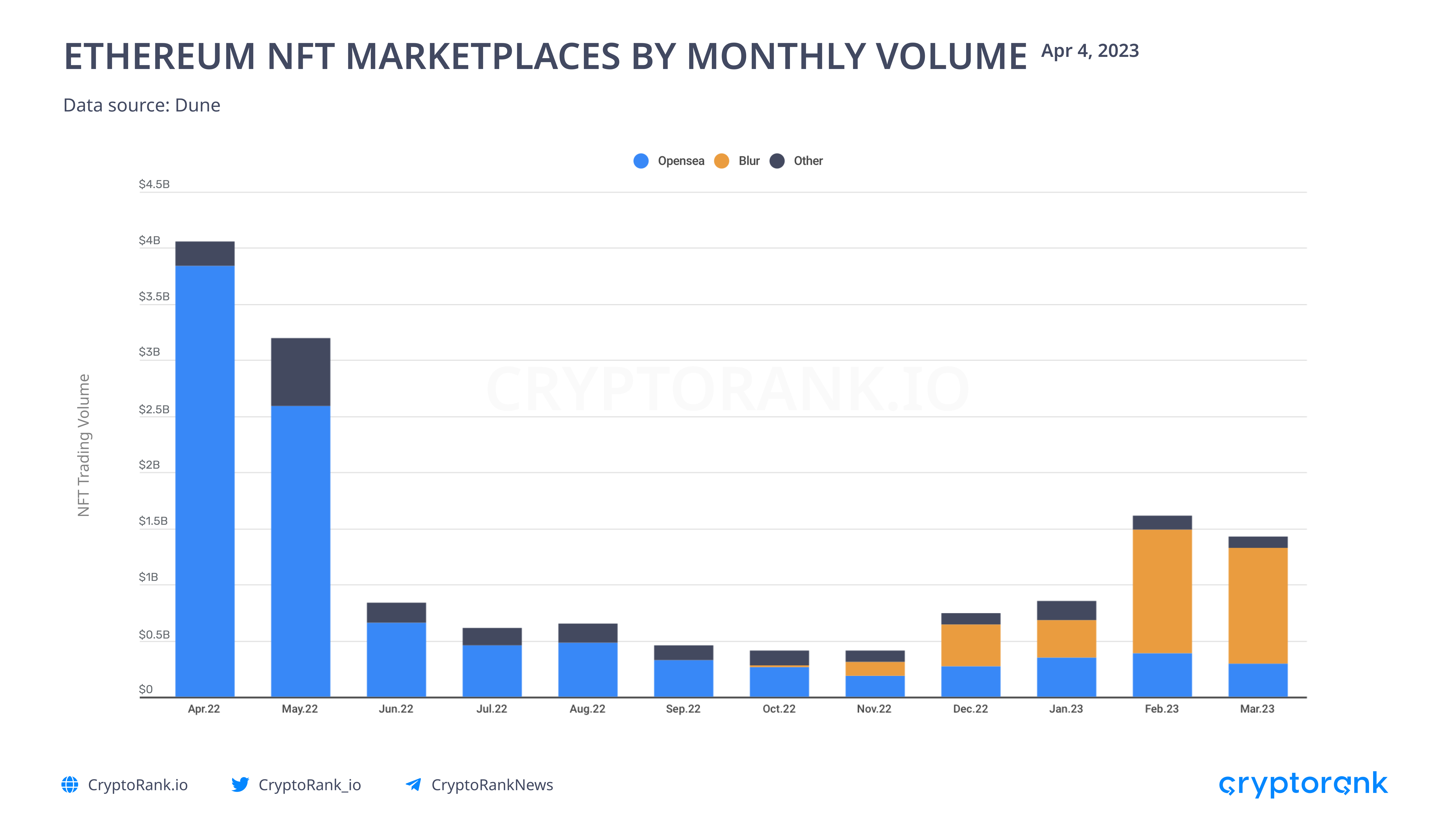

The NFT market remains the same except for an increase in trading volume. The increase in trading volume is mostly caused by Blur’s airdrop. Blur is a new NFT platform launched in October 2022. Within six months, it has dethroned former market leader OpenSea, growing its market share from 52.8% in December 2022 to 71.8% in March 2023, and currently dominates the top 6 NFT marketplaces. Meanwhile, OpenSea’s market share shrunk from 29.3% to 21.7% over the same period.

The “Bitcoin NFTs” trend gained momentum after the launch of Ordinal Inscriptions in late January. Since then, several prominent projects have announced their intentions to release NFTs on the Bitcoin network. Yuga Labs, renowned for their Bored Ape Yacht Club NFT collection, released their TwelveFold NFT collection on Bitcoin in March. This collection was sold at auction and managed to sell 288 pieces, raising a total of 735.7 BTC.

Corporate adoption of NFTs is also increasing, as evidenced by Amazon’s recent announcement of its plans to launch an NFT marketplace on an EVM-compatible blockchain. Additionally, the successful launch of a new batch of Starbucks NFTs has bolstered confidence in the NFT market.

Layer 2 is a rapidly expanding sector within the crypto industry, and there are several notable developments worth mentioning:

Coinbase launched Base, its own Ethereum layer-2 network in February. It will serve as a new home for Coinbase’s on-chain products and an open ecosystem for decentralized apps. Base was created in partnership with Optimism, and Coinbase intends to utilize the platform to onboard more users into the web3 ecosystem by minimizing entry barriers and creating a straightforward on-ramp from Coinbase and other chains like Ethereum, Solana, etc.

Arbitrum’s highly-anticipated ARB token was finally distributed on March 23, with the project decentralizing its inventory to its most loyal users. The excitement surrounding the token was so intense that it caused the project’s main website and Arbiscan, the Arbitrum equivalent of Etherscan, to crash. Eligible wallets were able to claim their airdrop via either site, contributing to the overwhelming demand for the token.

Matter Labs has launched the alpha mainnet of its Ethereum scaling solution, zkSync Era, to the public after several years of development. The launch comes hot on the heels of Arbitrum’s public airdrop, and marks another significant development in the scaling solutions space. Users can now start utilizing the layer-2 technology, including bridging and other features offered by zkSync.

The stablecoin market experienced a decline of $6.2 billion or 4.5%, with USDC and BUSD being the two stablecoins that were hit the hardest. The loss of confidence in stablecoins, such as BUSD and USDC, can be attributed to regulatory actions by the SEC and specific incidents. Following the SEC’s tightened regulations in January, Paxos had to stop issuing new BUSD tokens. Furthermore, USDC faced a crisis in mid-March when it was revealed that its parent company Circle had stored $3.3 billion in cash reserves at the now-defunct Silicon Valley Bank.

Market share transfer USDC, BUSD => USDT

USDC total supply

BUSD total supply

USDT Total supply

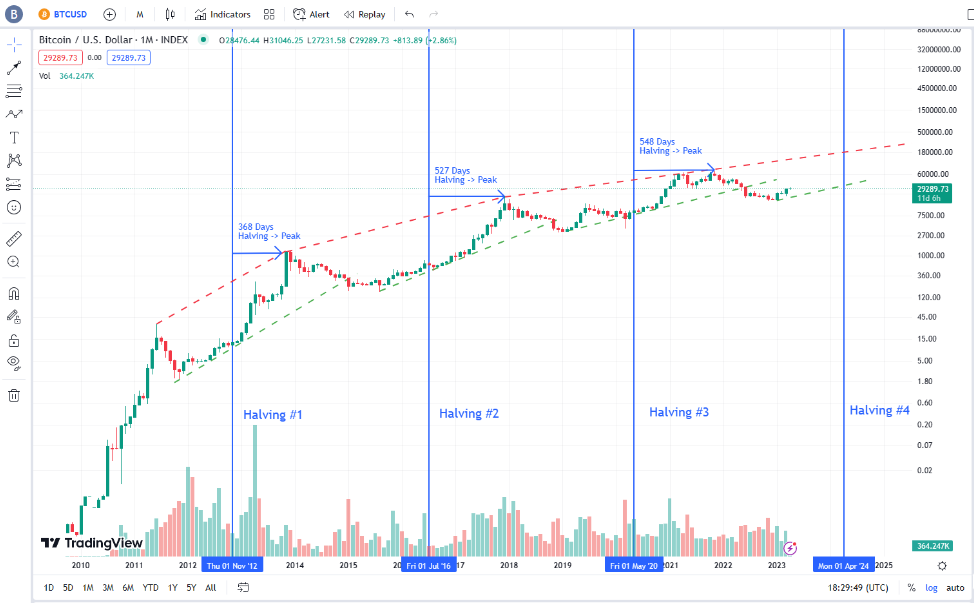

Based on the current mining rate, there’s approximately one year left before the next Bitcoin halving occurs, which suggests that the crypto market may experience a period of sideways trading before the next bull run begins. According to historical cycles, Bitcoin should have reached its bottom in November 2022 at around $15k per BTC. However, there’s still a chance for prices to quickly drop below the November lows before the halving occurs. It’s likely that Bitcoin will experience periods of sideways trading with occasional upward trends and downward corrections. As for altcoins, they may also experience sideways trading, but with a higher likelihood of dipping lower and reaching new lows before the halving and subsequent bull run.

When we look at the monthly frame and take a longer-term view, we can observe that Bitcoin (BTC) is still slightly oversold (white circled), but it is moving towards the overbought territory. At present, the first significant resistance that needs to be overcomed is at around $31k. If BTC can surpass this level, then the next major resistance is at around $38k. Big downside supports are around $19k (previous all-time high), followed by $16k and $13.8k. Based on historical trends, BTC’s price may remain within the range of $19k-$38k until the next halving in April. Alternatively, the range could be wider, extending from $13.8k to $47k.

BTC

Looking at the shorter time frame, specifically the weekly time frame, we can observe that BTC is presently overbought. While there is still some room for further overbought conditions, BTC is currently trying to break the $31k resistance level. If BTC breaks through this resistance, it could potentially reach the $38k area and become very overbought, which may prompt some investors to take profits in the short term. On the other hand, if BTC gets rejected at this resistance, we could expect to see it remain in a sideways trading range between $25k-$30k over the next few weeks, or with a wider range of $20k-$30k.

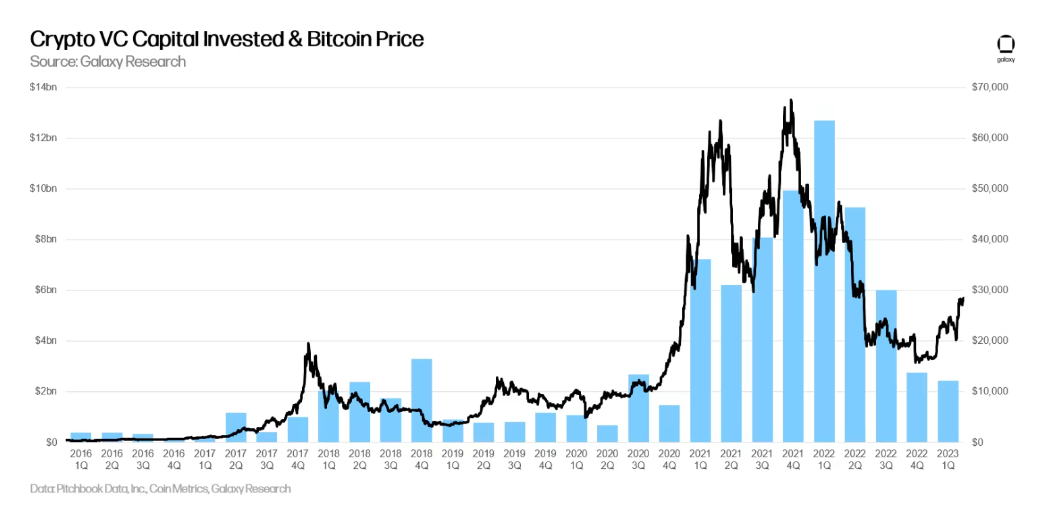

The trend of declining Venture Capital (VC) investments into cryptocurrency firms persisted in Q1 2023, as VC funding worth only $2.4 billion was made. According to a report by Galaxy Research, this is the lowest amount of VC funding recorded since Q4 2020.

Deal count was up from Q4 2022 at 439 (vs. 366 in the prior quarter).

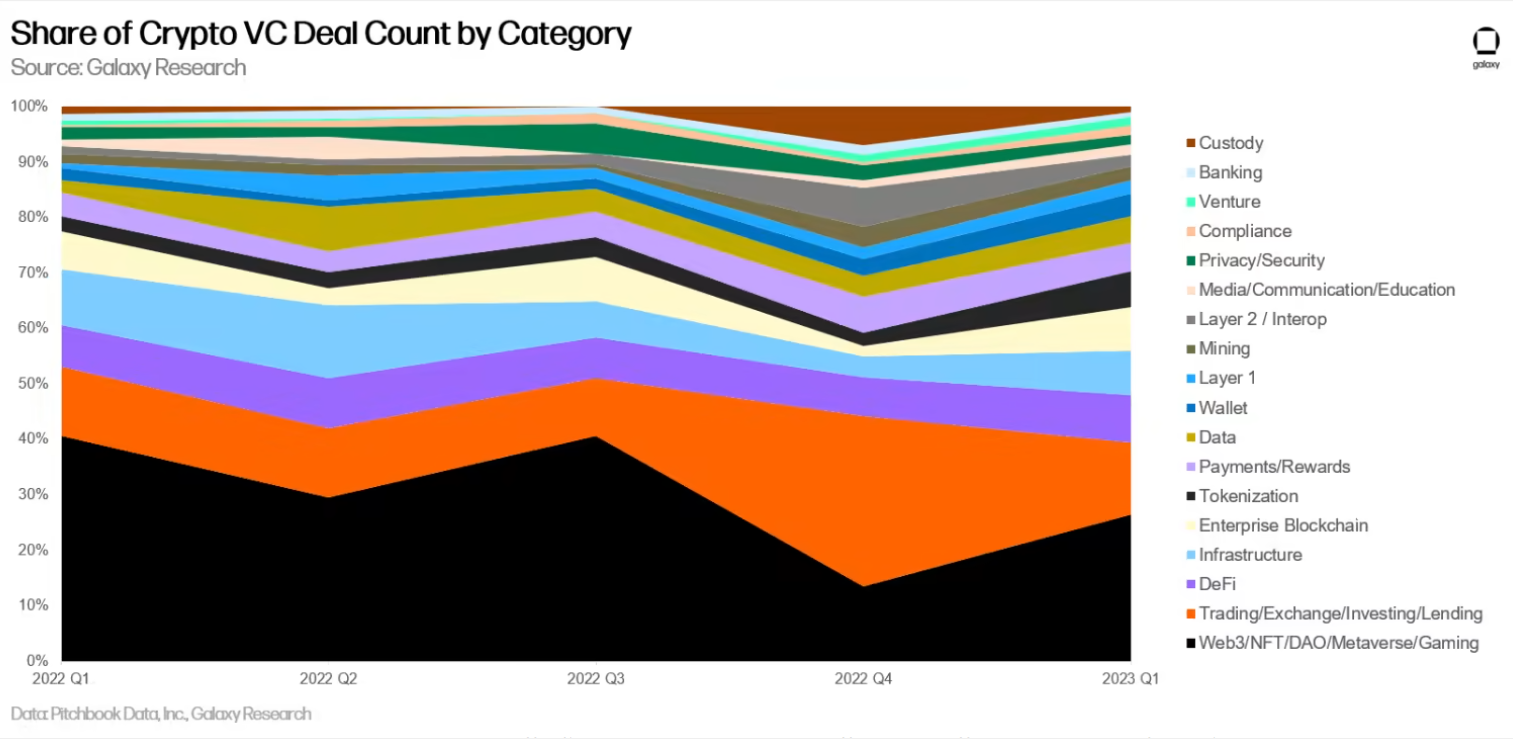

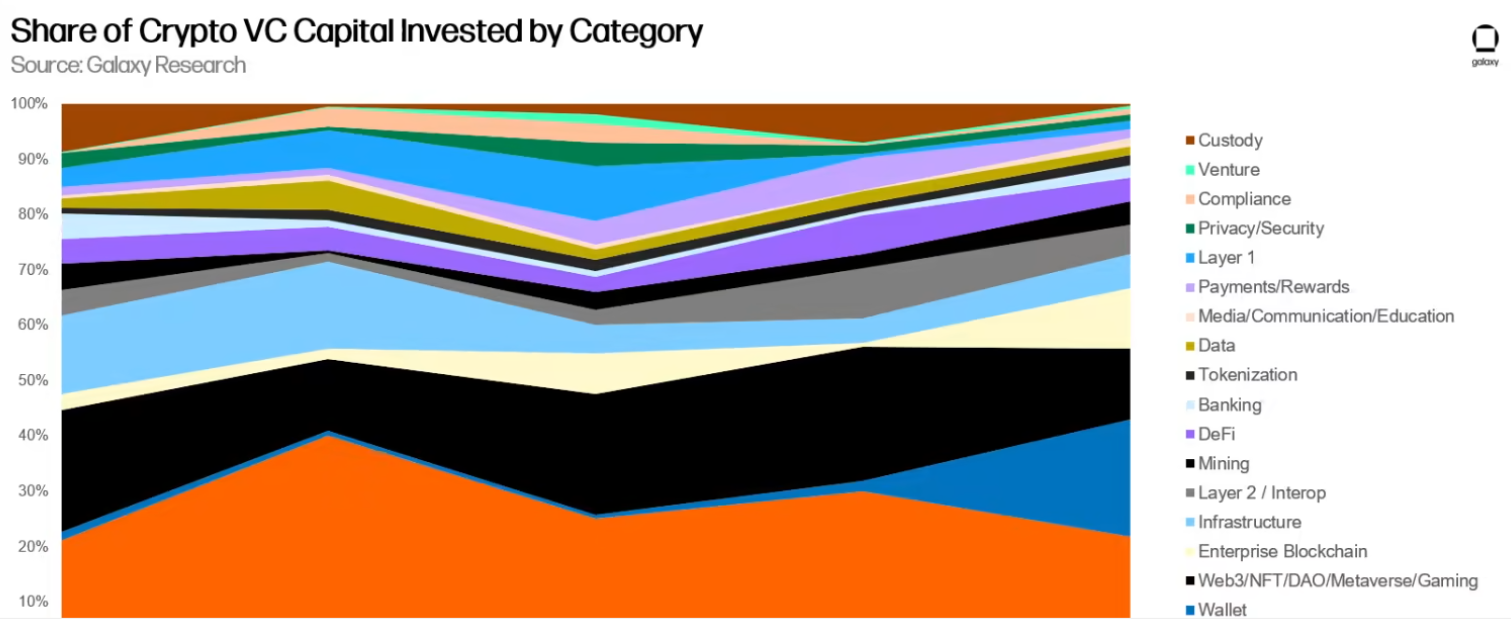

By deal count, companies building in the Web3, NFT, DAO, Metaverse, and Gaming subsector regained the top spot, followed by Trading, Exchange, Investing, and Lending companies.

Trading, Exchange, Investing, and Lending startups raised the most venture capital in Q1 2023 ($538m, 22% of all money raised), while Wallet companies raised the second largest share ($519m, 21%). The Wallet segment was dominated by hardware wallet manufacturer Ledger.

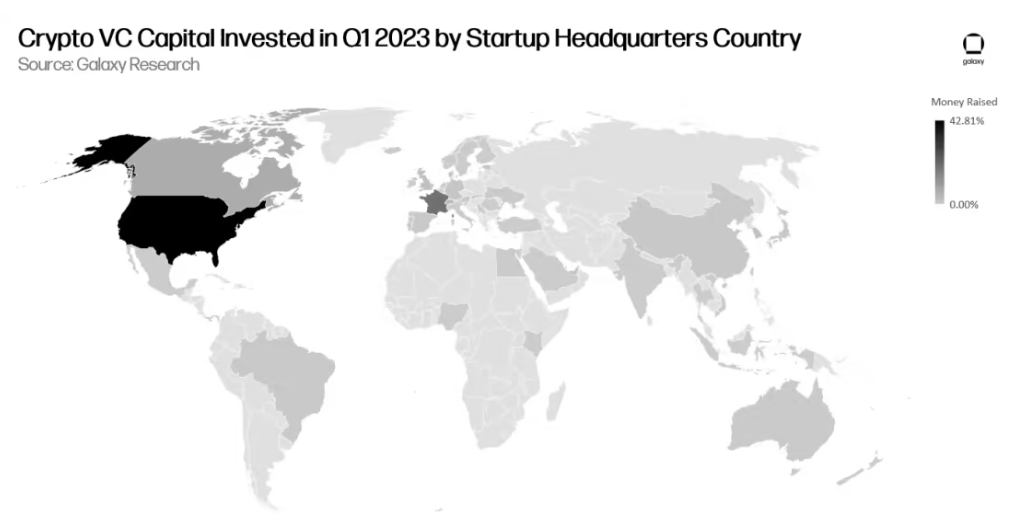

In Q1 2023, companies based in the United States were dominant in terms of both deals completed and money raised in the crypto VC space. Specifically, US-based firms raised 42.8% of all crypto VC funding during this period. France followed with 19.4%, while Canada and Switzerland accounted for 6.6% and 4.1%, respectively.

$ invested in startups: 136.2 million

# of projects funded: 10

Coinbase Ventures financed 10 projects, namely Alkimiya, Obol Labs, Architect, Alongside, Azra Games, MSafe, Chaos Labs, Avalon Corp, Term Labs and EigenLayer.

$ invested in startups: 107.8 million

# of projects funded: 9

DWF Labs funded 9 projects in various stages of development: Mask, YGG, Inverse Finance, Beldex, Conflux, Tonstarter, Radix, So-Col, and Alchemy Pay.

$ invested in startups: 131.5 million

# of projects funded: 6

a16z funded 6 projects in different stages of development: Voldex, Alongside, Towns, Believer, Capsule, and CCP Games.

invested in startups: 53.5 million

# of projects funded: 10

Shima Capital provided investment support to 10 projects: MSafe, Quasar, Open Forest Protocol, Quantum Temple, Sleepagotchi, Cedro Finance, OrbLabs, Monad, 3RM and Strider.

$ invested in startups: 35.5 million

# of projects funded: 6

Jump Crypto financed 6 projects at different stages of development: Ulvetanna, MSafe, Port3 Network, VRRB Labs, C3 and Affine.

Abu Dhabi’s tech ecosystem, Hub71, has launched a new $2 billion initiative to support startups specializing in Web3 and blockchain technology in the region. Dubbed the “Hub71+ Digital Assets ecosystem,” the initiative will not only provide financial backing, but also grants startups access to various programs, as well as potential corporate, government, and investment partners. A press release on Wednesday detailed the comprehensive nature of the program.

Dubai’s new regulatory body, the Dubai Virtual Assets Regulatory Authority (VARA), has been established under the Dubai-Virtual-Assets-Law to regulate, monitor, and oversee virtual asset services in the UAE. Given its broad responsibilities, the VARA has the authority to classify virtual assets, establish their value, and set trading standards and guidelines. The ultimate goal of the VARA is to establish the UAE as the world’s foremost CryptoHub.

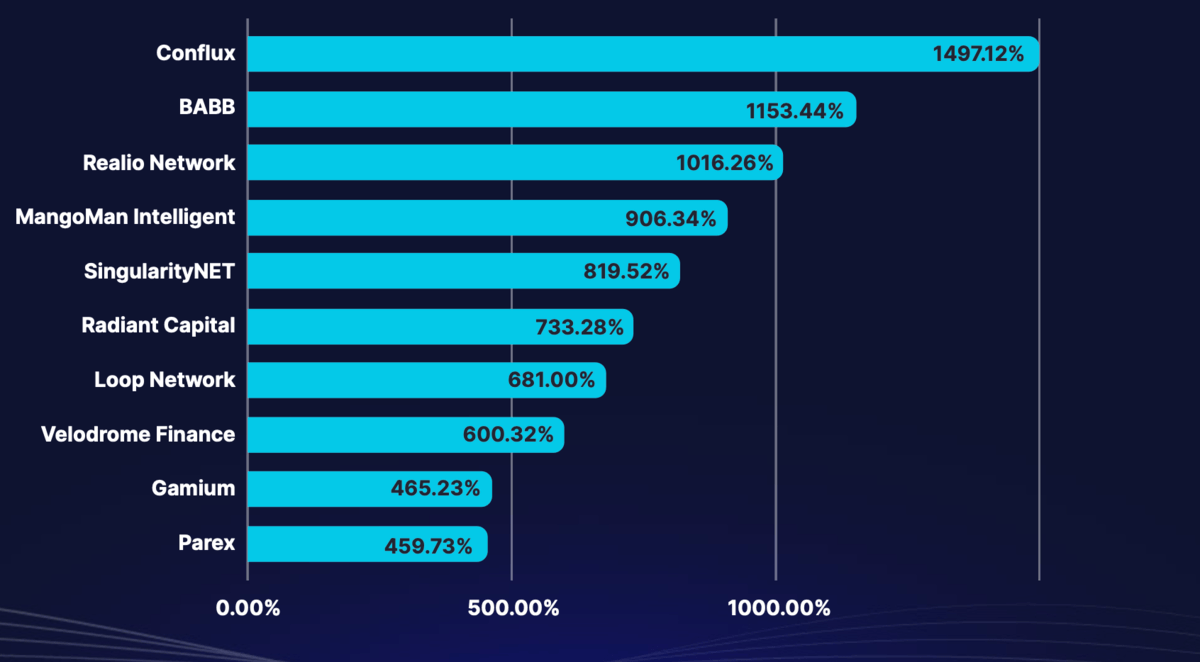

By CMC

After filtering tokens with substantial trading volume, reported by Coinmarketcap, Conflux (CFX) emerged as the top gainer. CFX is the only public blockchain in China that is fully compliant with local regulations. This surge in price was largely driven by the “China narrative” and strategic partnerships with China Telecom, Xiaohongshu, and XCMG.

Following Conflux (CFX), the tokens BABB (BAX) and Realio Network (RIO) have emerged as the next top gainers. These tokens aim to disrupt traditional sectors, with BABB focused on transforming the banking industry and Realio Network targeting the real estate sector.

SingularityNET (AGIX) – decentralized AI marketplace, running on blockchain.

Radiant Capital (RDNT) – a lending market on Arbitrum, with plans to expand cross-chain.

Velodrome Finance (VELO) is a decentralized exchange built on the Optimism network, currently with the highest total value locked (TVL) in the Optimism ecosystem.

Despite the current turbulent state of the market, these are the sectors that have been experiencing significant growth:

AI has been a popular narrative in this quarter. After the launch of ChatGPT in November 2022, several AI-based blockchain projects witnessed substantial growth in both price and trading volume. Notably, early market entrants such as SingularityNet (AGIX) and Render (RNDR) experienced over 800% and 190% growth, respectively, during Q1 2023. Additionally, a number of new blockchain/AI projects emerged, including CryptoGPT (GPT) and AIPAD (AIPAD).

The past quarter witnessed remarkable growth in several “Chinese coins,” including Conflux Network, a Layer1 blockchain that reportedly has the approval of the Chinese government, and Nervos Network, which is a multi-layer blockchain designed for decentralized applications.

The “China narrative” can be attributed to the rise of Hong Kong’s plan to establish a crypto hub, which could potentially create a favorable regulatory environment.

The Layer 2 narrative gained momentum with the highly anticipated Arbitrum ARB token airdrop. Arbitrum has emerged as the leading Layer 2 project in terms of Total Value Locked, ranking 4th among all chains with an impressive $2.37 billion locked. Alongside Arbitrum, other projects such as Immutable X, Optimism, Polygon, and more, enjoyed significant popularity during this quarter. On top of that, Coinbase announced the creation of Base, its own Ethereum Layer 2 network.

11 – 12 January – METAVSUMMIT – Dubai, UAE

25 – 27 January – Quantum Events – Miami, USA

15 – 16 February – Fintech & Crypto Summit – Bahrain

16 – 17 February – Blockchain Fest – Singapore

27 – 28 February – Blockchain Economy London Summit – London, UK

8 – 9 March – Crypto Expo – Dubai, UAE

27 – 29 March – FinTech India Expo – New Delhi, India

29 – 30 March – WOW Summit – Hong Kong

At the moment, the crypto market is experiencing a very positive phase after a long time. The market momentum from the beginning of the year has continued and allowed critical levels to be broken. Despite some negative news, even Bitcoin only experienced a slight decline, which did not last long. While the volume is still relatively low and volatility is worth considering, the market has clearly awakened compared to late 2022.

In many ways, the market has boosted itself with a chain of events triggered by positive expectations. For example, Blur’s airdrop gave a boost to other projects, which stimulated increased activity and prices. New narratives have been awakened like Artificial Intelligence (AI) and China narrative coins accompanied by Layer 2s. In addition, the macro picture has been contradictory, which has developed an excellent moment for crypto, making it one of the most interesting moments in the history of cryptocurrencies.

However, challenges are not behind yet. Crypto fundraising is still experiencing a decline since the first quarter of 2022. It is more important than ever to watch for the global macroeconomic picture as crypto steadily becomes an essential part of the global economy. Despite some governments being against it, more and more entities are choosing to work with crypto. Problems on financial markets may affect the crypto market too, mainly damaging the valuations of crypto startups as one of the riskiest types of investments. But in such times, cryptocurrencies may demonstrate their strengths and take a solid place in the global payment system. Moreover, the next Bitcoin halving is approximately a year away, and its impact is yet to be seen.

The new quarter in 2023 is up and running, and the crypto market is still showing strength after 3 months of upward move. With a +6.64% movement over the past day, Bitcoin—the largest crypto asset—is priced at around $29.8k at press time. Judging by the history, month May could be another month of rising prices, but also a point where traders could start taking profits after a 4 month bull run. The saying among stock traders, “Sell in May and go away”, holds a certain significance for a reason. With the continuation of the crisis in the banking sector, with another bank collapsing – First Republic Bank $FRC, Bitcoin is straightening its position as a viable alternative to centralized monetary systems, but overall macroeconomic picture could push the prices down as the negative economy is still in charge and potential official recession.

The banking narrative is currently holding Bitcoin’s price and could reflect in more people acquiring it.

A bearish near-term factor, however, that could dampen the bull run effect is the emergence of a major whale seller and the upcoming possible recession in the USA. That is the United States government moving to sell 41,000 seized bitcoins. It is expected to happen in the Q2 or Q3 of 2023. All sold at today’s market prices, the whale-sized sale could lead to a $1.1B supply increase as a result.

In April, a smooth Shapella upgrade completed Ethereum’s transition to Proof-of-Stake. This was one of the major upgrades of the Ethereum network. After activating the Shapella upgrade — which introduced validator withdrawals — developers are now making progress on the next upgrade, “Cancun-Deneb,” expected to occur later this year. This upgrade will likely make transactions on rollups 10-100 times cheaper. This will augment Ethereum’s scalability beyond the current capabilities of Layer 2 solutions and will reduce gas prices. So in the long term, more exciting things are coming for Ethereum.

From April 12 onwards, Ethereum initiated the Shanghai upgrade, enabling the withdrawal of around $35 billion worth of 18 million tokens that were previously locked in staking contracts. This development has sparked a surge in institutional investment in staking, as early data reveals that the leading staking platforms for institutional investors have recorded three times more new deposits compared to the previous month.

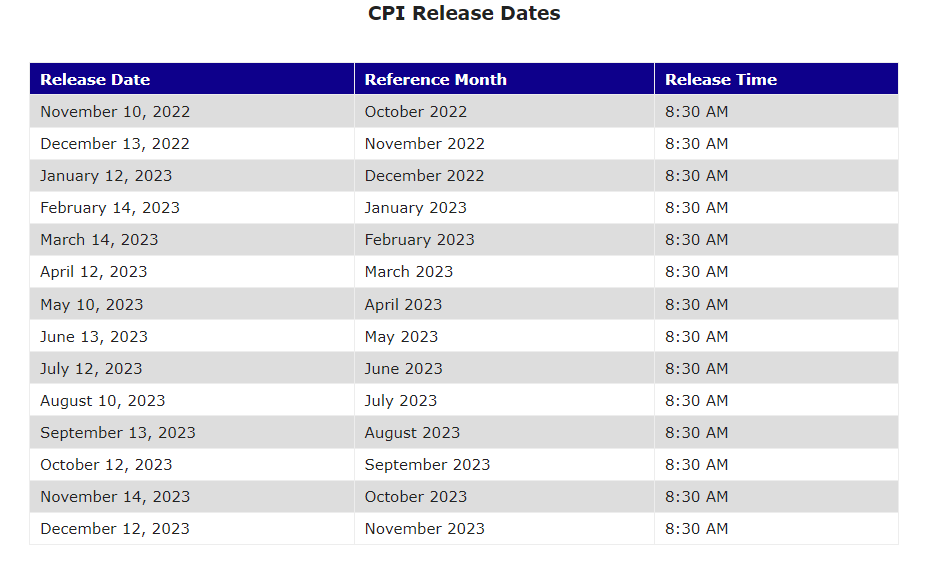

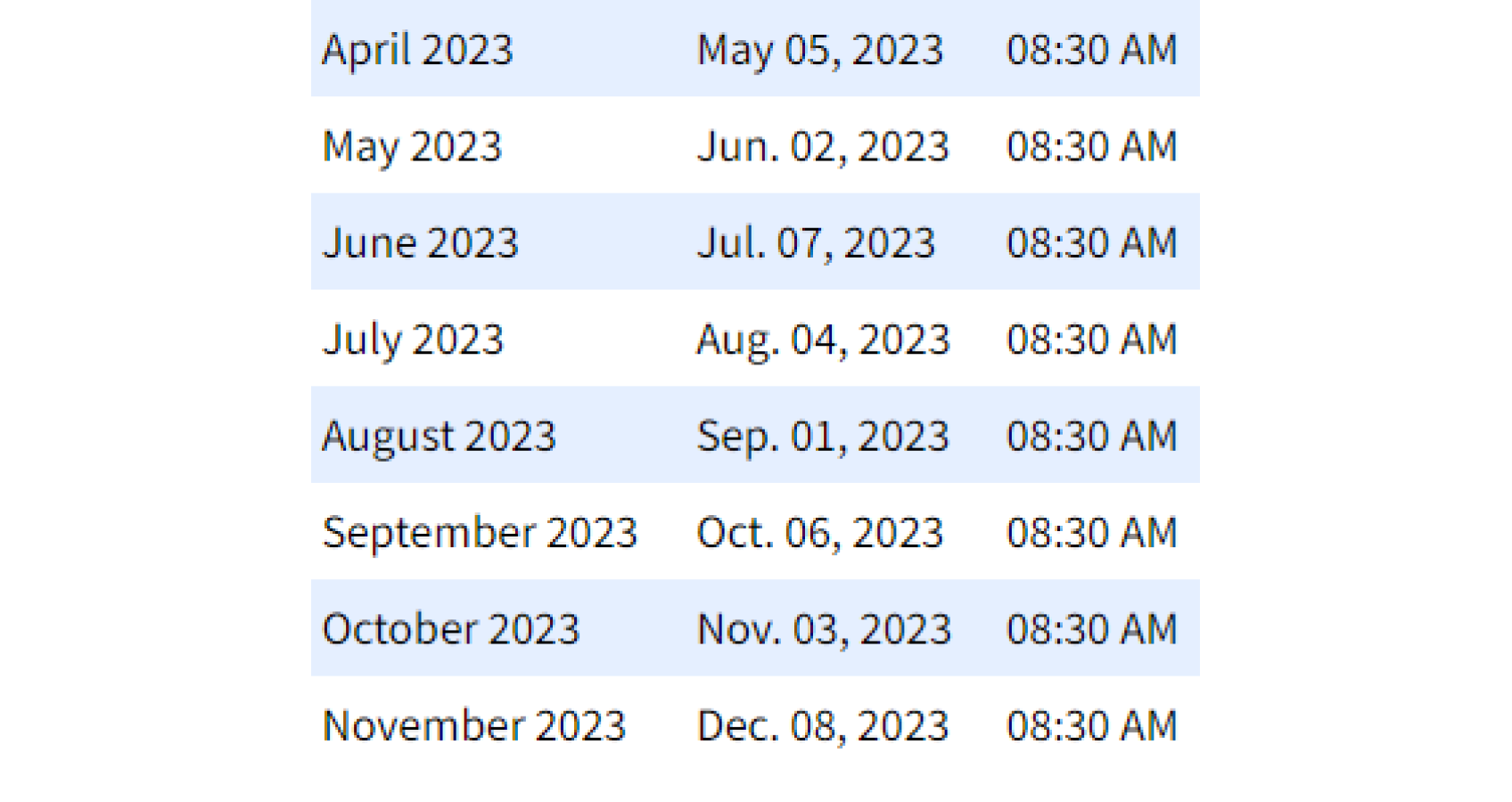

As for the U.S. CPI report, the April inflation figures were revealed on Wednesday, May 10. US inflation falls to 4.9%, lower than expectations. During its recent FOMC meeting, the Federal Reserve (Fed) refrained from revealing its plans regarding interest rate adjustments. Fed Chair Jerome Powell mentioned that we are nearing the end or may have already reached the end of rate hikes. However, considering the decrease in inflation figures, it is likely that the Fed will adopt a more cautious approach. This could result in a pause in interest rate increases. Investors might find some relief and potentially increase their investments. Nevertheless, it’s important to note that the Fed has a target inflation rate of 2%, while the current figures are double that number.

CPI release dates 2023

The Federal Reserve has likely completed most of its interest rate hikes, leaving the question of how many more increases can be implemented before the U.S. economy reaches a breaking point.

On May 3rd, the Federal Reserve approved its 10th interest rate hike within a slightly over a year and hinted that the current tightening cycle might be coming to an end. The Federal Open Market Committee (FOMC) unanimously raised the benchmark borrowing rate by 0.25 percentage points. This rate impacts various consumer debt products such as mortgages, auto loans, and credit cards, as it reflects what banks charge each other for overnight lending.

With this increase, the fed funds rate now stands at a target range of 5%-5.25%, the highest level since August 2007.

In 2023, it is expected that employment will decrease due to an economic slowdown. That’s the only way which could potentially lead to an official recession. A recession across all markets typically results in a market decline, and its most significant impact is usually felt approximately two months after the official announcement. The prevailing slowdown implies that workers may have to settle for lower quality jobs, often offering minimal pay and inadequate hours. Additionally, as prices rise at a faster pace than nominal labor incomes, there is a risk of a cost-of-living crisis that could push more individuals into poverty. This trend exacerbates the already significant income declines experienced by low-income groups during the COVID-19 crisis, which affected many countries.

The regulatory landscape surrounding cryptocurrencies presents a mixed bag, making it challenging to categorize it as either bullish or bearish. On one hand, we have seen positive developments such as Bakkt securing regulatory approval for a substantial $155 million crypto deal. Europe has also introduced MICA regulations, providing a framework for the regulation and operation of cryptocurrencies. Additionally, the establishment of the Dubai Virtual Assets Regulatory Authority (VARA) in Dubai further demonstrates the region’s commitment to the virtual asset sector. The UAE government has set its sights on becoming the world’s leading CryptoHub, emphasizing their ambition in the crypto space.

On the other hand, in the west, Bittrex Global is shuttering operations in the U.S. because of the regulatory environment. U.S. legal actions taken by the government against Kraken, Coinbase, Ripple, and Binance are ongoing.

The future impact of regulations on the market remains uncertain, but considering that a significant portion of crypto users are based in the US, there is a possibility of volatility in the coming months.

Similar to Dogecoin, this particular cryptocurrency is inspired by a well-known internet meme. However, in this instance, it takes its cues from Pepe the Frog, an adorable cartoon character that has unfortunately become associated with alt-right, anti-Semitic, and white supremacist groups. Despite this controversial background, PEPE has seen an astronomical rise in value, surging by approximately 2000% in just the past month alone. At one point, it even boasted a market capitalization of over $1 billion. Some investors have made truly staggering returns, having spent a mere $250 to acquire trillions of PEPE tokens that have since appreciated in value to generate profits of $8 million or more. A growing number of individuals hold the belief that PEPE has the potential to achieve the same level of widespread recognition and market capitalization as DOGE and Shiba Inu.

A platform that was widely popular during the early 2000s has made a return with a new approach to revolutionizing the way artists and fans engage with one another. LimeWire, provides an opportunity for content creators, artists, and brands to create communities for their most enthusiastic supporters based on membership. The presale of its newly created token LMWR is currently ongoing. Given the platform’s significant user base in the past, there is considerable potential for the token to experience high demand and widespread usage upon its release.

Blocktrade, a well-established exchange, has introduced its very own utility token, BTEX. This token offers numerous benefits to users of the exchange, including enhanced privileges while trading and utilizing the Blocktrade Exchange by holding the native token. Currently, the token is only available in a presale exclusive round, but it will be made available for public sale starting May 18th. Given the exchange’s existing user base and financial resources, there is a significant potential for the token to expand in tandem with the growth of the exchange itself.

GMX is a cutting-edge decentralized spot and perpetual exchange that operates on the Arbitrum One blockchain, offering ultra-low swap fees and zero price impact trades. The exchange built on Arbitrum One Blockchain. Arbitrum is robust Ethereum layer-2 Rollup technology that is specifically designed to enhance the speed and scalability of Ethereum smart contracts. GMX DEX has the potential to become one of the top decentralized exchanges in the market, owing to Arbitrum’s immense capabilities and its potential huge user base. Arbitrum is currently the leading layer 2 solution in terms of Total Value Locked, and there are indications that it could potentially become a Layer 1 solution of its own in the future. This is hardly surprising, given its impressive performance and capabilities in enhancing the speed and scalability of Ethereum smart contracts. The GMX token is a utility and governance token.

BOB, the latest addition to the meme coin mania, made its debut in April 2023. Since then, it has witnessed a remarkable surge in both price and trading volume, captivating the attention of investors. In just two weeks, BOB has soared by 4744% in price and attracted a 1000% increase in unique holders. These numbers reflect the token’s short-term popularity within the meme coin mania. BOB has not only gained significant traction among investors but has also caught the attention of high-profile individuals, including Elon Musk. Musk, known for his influential presence on Twitter, expressed admiration for BOB’s virtual explainer and even professed his affection for it publicly on the social media platform.

Airdrop zkSync Era

zkSync Era is a Layer-2 protocol that utilizes cutting-edge ZK technology to scale Ethereum while preserving its core values of freedom, self-sovereignty, and decentralization.

It is one of the Layer-2 solutions that has the potential to disrupt the industry by offering scalability to Ethereum.

Matter Labs, the team behind zkSync,has successfully secured a substantial funding of $458 million from prominent investors such as Blockchain Capital and Dragonfly Capital. They have also hinted at their plans to introduce their native token in the future. By participating in zkSync’s mainnet and testnet, you may potentially qualify for an airdrop when they officially launch their token.

More info how to participate here: https://airdrops.io/zksync/

Airdrop Starknet

StarkNet stands out as a significant player in the ZK-rollup space, and there is a strong likelihood of a token airdrop associated with it. As a decentralized and permissionless Validity-Rollup, StarkNet functions as a secondary network built on top of Ethereum. This innovative approach enables decentralized applications to access unlimited computational power while upholding Ethereum’s security and compatibility.

Following the launch of Starknet’s mainnet in November, the platform has witnessed a surge in deposits, attributed in part to the recent Arbitrum announcements. Total deposits on Starknet have spiked by 45%, reaching $2.49 million, as users eagerly anticipate the potential for the next airdrop.

More info how to participate here: https://airdrops.io/airdrop/starknet-round-1/

Airdrop Scroll

Scroll, an Ethereum layer-2 solution known as a “true zkEVM,” stands out for its complete EVM compatibility. Following a successful funding round that raised $30 million in April 2022, Scroll launched on the Ethereum Goerli testnet in February. The anticipated mainnet launch is scheduled for late 2023. Notably, they have secured a total of $80 million in funding from prominent venture capital firms like Polychain and Sequoia, making it highly probable for Scroll to launch its own token. Early users who have engaged in testnet actions have a good chance of receiving an airdrop if Scroll indeed introduces its own token.

More info how to participate here: https://airdrops.io/scroll/

Airdrop Sei Network

Sei Network has recently confirmed that they will be conducting an airdrop of 1% of their token supply to testnet validators and participants. As their testnet is still operational, users have the opportunity to potentially qualify for this airdrop. Sei Network is a layer-1 blockchain constructed using the Cosmos SDK, with the aim of becoming the leading chain for decentralized exchanges (DEXs) in the domains of DeFi, NFTs, and GameFi.

More info how to participate here: https://airdrops.io/sei/

ETH Portland/Date: May 12 2023/Location: Portland, OR

Bitcoin 2023/Date: May 18-20, 2023/Location: Miami, Florida

BlockSplit conference/Date: May 22-25, 2023/Location: Split, Croatia

Next Block Expo/Date: May 24-25 2023/Location: Warsaw, Poland

Non Fungible Conference (NFC)/Date: June 7-8 2023/Location: Lisbon, Portugal

Epic Web3 Conference/Date: June 9 2023/Location: Lisbon, Portugal

Blockchance 2023/Date: June 7-8 2023/Location: Hamburg, Germany

Latest Articles

Veli is Going for the MiCA License! A new era in compliance...

Over 100 New Coins Added to the Veli Platform! 🚀 Earlier this...