Veli Won Best Startup Award by Plug and Play 🏆...

Every index starts by defining which assets could potentially be included in it- the list of all the assets is called an “Investment Universe”.

Common methodologies include:

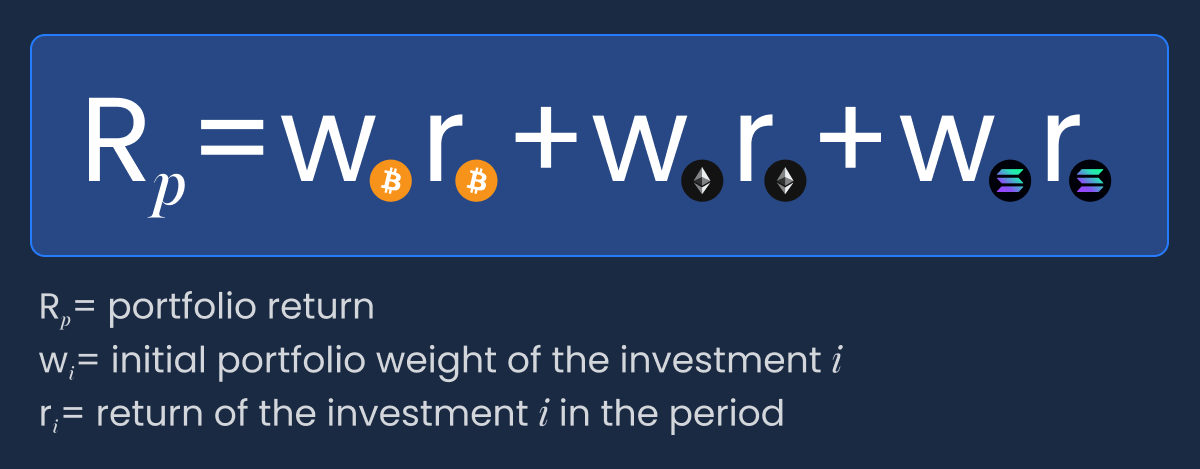

bigger coins, with larger market-caps (like BTC, ETH) get a higher share. Example: if BTC = 50% of total crypto market cap, it represents 50% of the index.

every coin adds roughly the same “risk impact” to the overall index - the more volatile the asset, the smaller the weight.

each coin has the same share - for example, 10 coins = 10% each.

are also used - for instance, setting a 20% max cap per asset prevents one coin from dominating the portfolio.

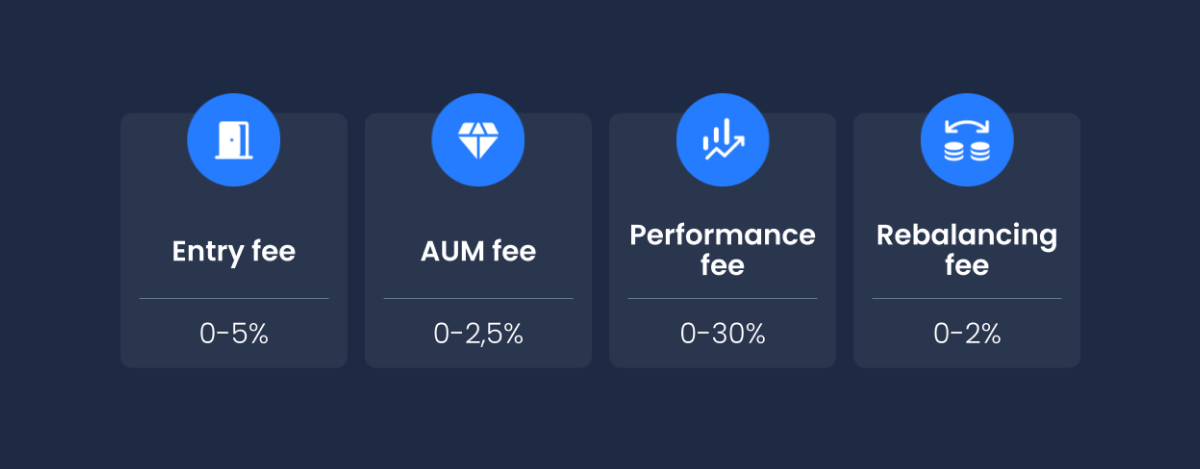

Indexes transform passive users into recurring revenue streams - because even when investors “do nothing,” the system rebalances and collects small fees. This way, you are monetizing your existing user base, without additional sales efforts. This has proven to be a good way to generate sustainable revenue during slowdowns/bear markets.

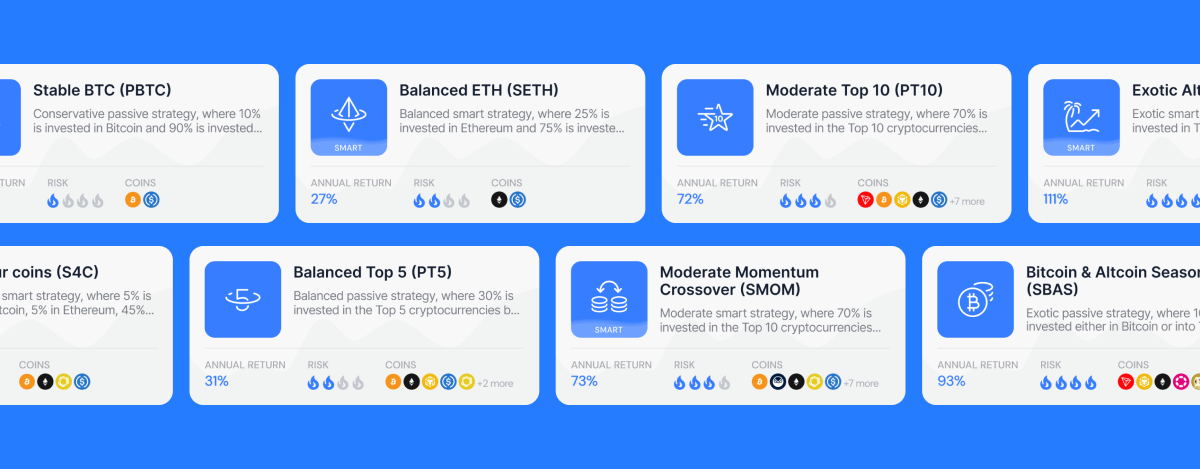

This is the simplest and most popular way to invest in any asset class. Diversification provides an aspect of safety, while automatic rebalancing allows users to always have the most up-to-date coins in their portfolio (and not continue holding bags of poor performing coins).

Overall, indexes are an excellent product, both for users and for platforms, which is why early indicators are showing that the next wave of crypto adoption is going to come through crypto indexes (on crypto platforms) and ETFs that follow a crypto index (on traditional financial investment platforms).

If this sparked an idea for an index – whether it’s a DeFi Leaders Index, AI Tokens Basket, or a Strategy with Yield-bearing coins – our team at Veli can help you design and launch it fast.

You can reach out anytime – we’re always happy to help you build and test an index concept before it goes live.

Veli Partners with DEC Institute to Equip Finance Professionals for...

Veli Partners with EIMF to Bring MiCA and Compliance Education...