Veli Won Best Startup Award by Plug and Play 🏆 Thanks to...

Due to the high level of risk involved, buying cryptocurrencies without a strategy in place can frequently result in the loss of invested money. Even though most experts would concur there is no “perfect” trading strategy, there are still some of them worth mastering in order to trade successfully.

There are numerous ways to trade cryptocurrencies. Therefore, before you begin trading crypto, you need to have a sufficient understanding of not only the concept of cryptocurrencies but also how those trading strategies work.

Some of the most widely used strategies involve day trading, swing trading, intra-day trading, position trading, investing, and scalping. While some of these approaches overlap, the basic idea is that we move from the fastest-paced trading strategy, known as scalping, to the most long-term strategy, known as investing.

You can go for a strategy that appeals to you or combine various styles depending on the asset or your goals when trading. Whatever the case, it is advisable to modify your strategies to fit the trading style that suits you best.

For example, investors are typically not so concerned with smaller time frames, volatility, and technical support/resistance. For that reason, they will keep their main position unleveraged. Scalpers, on the other hand, may attempt to front-run support and resistance on a 5-minute chart by implementing leverage.

The most effective way to see what strategy fits you best is to try them out. However, it’s important to be honest with yourself about whether they are effective enough for you. What you should also take into account is how those strategies affect your well-being in terms of emotions and logic.

In simple terms, if a particular style makes you feel unbalanced and distracts you from your objectives, it’s probably not a good fit for you. Furthermore, if you are consistently losing your money, it’s an evident signal that the trading strategy is not for you.

The best options for a novice or casual investor are typically position trading and investing because they require less technical expertise and micromanagement. Let’s delve into the bits and bobs about crypto position trading.

Table of contents

The practice of holding a position in crypto trading for a longer period of time is known as position trading. Position traders adopt a long-term perspective and may hold their positions for weeks, months, or even years. A sheer contrast to this strategy is “day trading” where traders seek to make money by buying and selling cryptocurrencies within a single day.

To illustrate what position trading is, we may compare it with investing, as these two strategies are pretty similar. Traders who implement this strategy frequently use fundamental analysis to pinpoint cryptocurrencies they think will increase in value over time.

The analysis may encompass various elements such as the project’s technology, team, market demand, and general market trends. A trader will invest in a cryptocurrency they feel is undervalued or has significant growth potential, hold onto the position, and wait for the price to reach their goal.

The ability to escape the volatility and stress of day trading is one of the main benefits of position trading. Namely, day traders must make quick choices based on market fluctuations while continuously monitoring their positions. This can be excruciating and lead to emotional decision-making. With a position trading strategy, traders can adopt a more lax strategy, occasionally reviewing their investments and making changes as necessary.

This strategy requires a great deal of patience and control. It’s important to maintain a clear investment strategy and stick to it, even when faced with short-term market fluctuations. Additionally, position traders must be prepared to endure periods of price volatility and possible dips if they are confident in the long-term potential of the cryptocurrency they have selected.

Another key aspect to keep in mind when position trading is risk management. By diversifying their portfolios across various cryptocurrencies and placing stop-loss orders to impose a cap on possible losses, position traders should carefully manage their risk. Additionally, it’s essential to monitor broad market patterns and to be prepared to modify one’s positions should the market take an unexpected turn.

Crypto position trading and swing trading are among the most common strategies cryptocurrency traders adopt. Each of these approaches comes with its own advantages and disadvantages, so it’s up to you to decide which one fits you best.

As already mentioned, position trading is a long-term strategy which involves holding onto an asset for a considerable amount of time, usually several months or years. The main goal of this trading strategy is to capitalize on significant price changes and market trends.

Position trading entails thoroughly examining and choosing high-quality assets with a strong likelihood of long-term development. Having chosen an asset, investors will keep it for a long time, enduring market ups and downs, in order to generate sizable returns in the long run.

The fact that the position trading strategy demands less of the trader’s active participation is one of its main advantages. Investors don’t need to constantly monitor and make adjustments. Instead, they can take a hands-off approach and watch their assets increase over time. In addition, since investors are less preoccupied with small price changes, position trading is less vulnerable to short-term market volatility.

Expectedly, position trading has some drawbacks as well. Long-term market trends can be challenging to forecast. Furthermore, there is always a chance that an asset won’t perform as well as anticipated over a longer period of time. Lastly, keeping assets for an extended period of time can tie up money that might be implemented in other investments.

Unlike crypto position trading, swing trading is a short-term strategy that involves purchasing and selling assets over a brief period of time, usually a few days to a few weeks. To find opportunities for quick gains, this approach requires examining market trends and technical indicators carefully. Swing trading enables investors to benefit from short-term oscillations in the market. Investors who purchase and sell assets quickly may be able to make significant returns in a short period of time. Swing trading also enables more active participation in the market since investors must continuously watch the market and modify their positions to profit from changing market circumstances. Swing doesn’t come without its drawbacks, much like its position trading counterpart. Investors must be highly skilled and experienced in order to make decisions in a fast-paced environment and recognize market trends rapidly. Also, swing trading is more vulnerable to short-term market volatility because even small price changes can have a considerable effect on profits.

There is no one method that works for everyone when it comes to investing in the cryptocurrency market. The best trading method for you will rely on your specific objectives and risk tolerance because swing trading and position trading each have their own distinct benefits and drawbacks.

Position trading might be the best option for you if you prefer a more hands-off approach and are willing to put up with short-term market fluctuations in exchange for the possibility of long-term growth potential. Swing trading, on the other hand, might be the best option if you’re prepared to take more risks and want to profit from short-term market fluctuations.

Regardless of the strategy you decide on, it’s critical to thoroughly investigate and assess the market, as well as to constantly check in on and modify your positions to benefit from shifting market conditions. Provided that they take the proper strategy, investors of all experience levels can benefit substantially from crypto trading.

Crypto position trading is a popular strategy among cryptocurrency traders for several reasons:

Compared to day trading, position trading is less stressful, as position traders don’t need to monitor the market constantly.

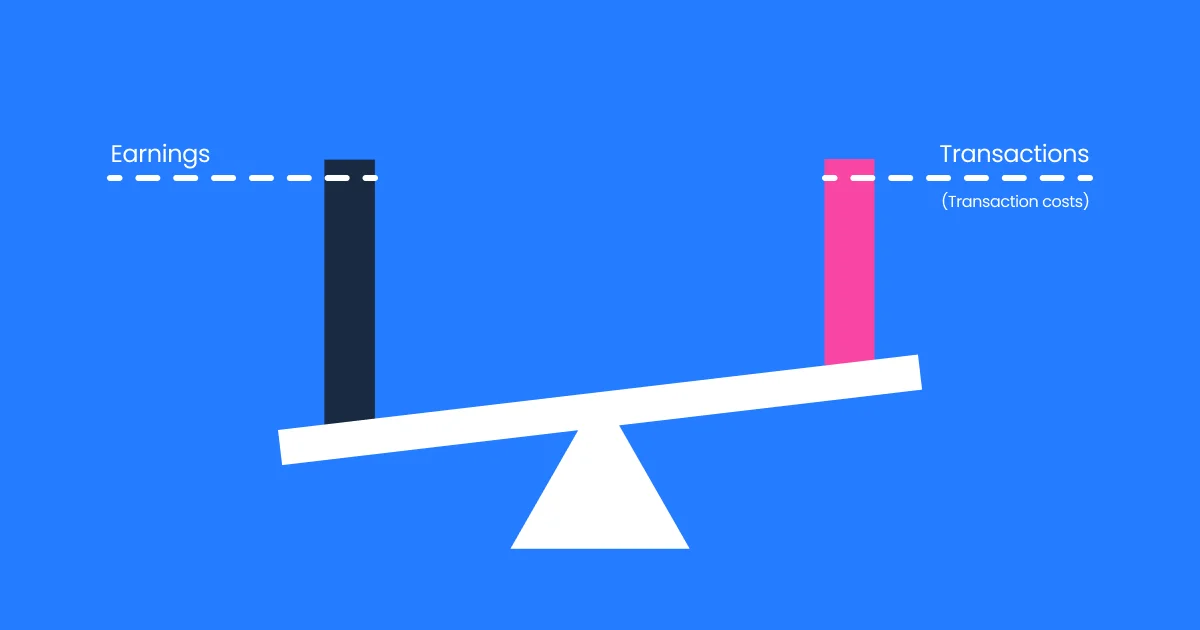

Frequent purchasing and selling are common in day trading, potentially leading to high transaction costs. These expenses may reduce earnings, making it harder for traders to meet their financial objectives. In contrast, the position trading strategy requires fewer transactions, resulting in reduced transaction costs.

Position trading enables traders to manage risks more effectively. By holding their positions for longer periods of time, position traders can withstand short-term market fluctuations. This strategy can lessen the possibility of frantic selling during market declines, which can lead to significant losses.

Compared to other strategies such as day trading, position trading has the ability to produce higher returns. Traders can profit from long-term market trends by holding positions for a long time. Over time, this strategy can produce significant gains, particularly in volatile markets such as the crypto market.

Position traders have more time to analyze the market and its trends. They can approach trading with greater caution as they are not continually monitoring the market. With better analyses, traders can make better-informed and prudent trading decisions.

If the position trading strategy seems to be your cup of tea, there are several tips and techniques you can implement to make the most of your investments.

Concentrate on the fundamentals. Focusing on the fundamentals of the assets you are investing in is one of the keys to effective position trading. This implies researching factors that could affect an asset’s performance, including its development team, availability, growth potential, etc. Investors can find cryptocurrencies with significant growth potential and develop long-term positions by adopting a long-term perspective and concentrating on fundamentals.

Diversify your portfolio. Portfolio diversification is a crucial tactic for all types of investing; however, it’s even more crucial when it comes to crypto position trading. By diversifying your portfolio across a number of different assets, you can manage risks better and lower the negative impact of a poor-performing asset on your overall portfolio. In the long run, this can aid in minimizing losses and maximizing profits.

Use technical analysis. While fundamental analysis is vital for finding possible investments, technical analysis can help you time your entry and exit points. It is the process of analyzing market charts to find trends and possible market turning points by using indicators such as moving averages, trend lines, and momentum indicators. By combining technical analysis and fundamental analysis, investors can advance their timing and increase their returns.

Set attainable objectives. Since cryptocurrency position trading is a long-term strategy, it’s critical to establish attainable objectives for your portfolio. This involves determining your investment goals and creating a timetable that will allow you to achieve them. In order to make sure that you are on track to achieve your objectives, it is a good practice to periodically evaluate your investments and change your strategy as necessary.

Patience is key. Position trading calls for both focus and patience. It’s critical to put your attention on the long-term potential of your investments rather than making emotional choices based on short-term market fluctuations. Investors can optimize their returns and accumulate wealth over time by keeping a long-term perspective and avoiding rash choices.

The crypto position trading strategy can yield substantial gains. However, it also has a number of risks and restrictions, which traders should take into account before implementing this trading strategy.

Market volatility is one of the main challenges of position trading in crypto marketplaces. Known for their extreme price volatility, cryptocurrencies can cause substantial losses if not properly managed.

Crypto position trading also poses the risk of market manipulation. The cryptocurrency industry’s lack of regulation increases the risk of market manipulation by major players who may influence prices in their favor. By meticulously choosing trading pairs and markets with greater liquidity, this risk can be reduced.

When weighing the disadvantages of position trading strategy in crypto marketplaces, liquidity is an additional important factor to take into account. Due to the low liquidity of cryptocurrencies, it can be difficult to enter or exit a position at a favorable price. Illiquid markets can lead to wider bid-ask spreads, further increasing trading costs and lowering total profitability.

Another limitation of the position trading strategy is its reliance on fundamental analysis. Fundamental analysis includes examining the underlying financial and economic factors which can impact the price of an asset. The lack of comparable financial data for cryptocurrencies compared to conventional assets makes it difficult to perform exhaustive fundamental analysis.

In addition to being dependent on fundamental analysis, crypto position trading also hinges on technical analysis. Traders analyze price charts and use technical indicators to make informed trading decisions. However, it’s difficult to accurately forecast future crypto price movements as they occasionally defy conventional technical analysis principles.

To conclude, despite the fact that cryptocurrency position trading has the potential to generate sizable profits, it is not without dangers and restrictions. To control their risk exposure, navigate market volatility and manipulation, and find profitable trading opportunities, traders must be prepared to do extensive study and analysis. Position trading can be a useful tool in a trader’s toolbox for profiting from long-term price movements in the cryptocurrency market with careful thought and a well-developed plan.

Latest Articles

Veli Won Best Startup Award by Plug and Play 🏆 Thanks to...

Veli Partners with DEC Institute to Equip Finance Professionals for the Future...

Inside the Mechanics of Crypto Indexes – How Are They Actually Constructed...