5 reasons why people hesitate to invest in crypto and why you shouldn’t

Crypto has been the buzzword for years now. We can no longer imagine talking about investing without mentioning it. Crypto logos are everywhere: from famous sports arenas to super bowl commercials. Famous investors like Ray Dalio and Paul Tudor Jones are advocating investing in crypto.

Even the biggest financial institutions like BlackRock and Fidelity are offering cryptocurrencies to their clients. Celebrities are hooked too, with worldwide known artists like Snoop Dog, Jay Z and many more recommending their favorite coins and advertising and using cryptocurrencies.

There is no doubt that the crypto market is expanding faster than ever. So far, at least 100k people became millionaires only by investing in Bitcoin and this number gets even higher when we take other coins into account. But some people are still skeptical when it comes to crypto.

Why is that? Here are the 5 most common reasons why some people are hesitant to invest in crypto – and why you shouldn’t be.

1. Lack of knowledge

The first potential obstacle when it comes to crypto investing is a lack of knowledge. As with any new technology, it takes some time before it gets widely accepted and used. It’s completely rational to be careful with where you invest your money, but not investing in crypto simply because you don’t know much about it might turn out to be a bad choice in the long run. A much better solution would be to inform yourself on the topic and what opportunities crypto offers.

As with anything else, we would suggest you learn the basics and start learning by doing. This is why Veli focuses on educating future investors and making its app as user-friendly as possible. We strongly believe that crypto is the future of finance and that investing in crypto should be available to everyone.

To start investing you will need a crypto exchange platform where you can buy and sell cryptocurrencies and a crypto wallet where you can store them. The most convenient and easiest way to invest is by using broker applications like Veli, where you can buy, sell and store crypto, all in one place in a few simple steps.

2. High volatility

The cryptocurrency market is, without a doubt, one of the most volatile ones. This means that the price changes in the crypto market are more common and more extreme than in the other markets. It can be intimidating when your portfolio drops by 20% in one day. There are even more extreme scenarios, in which the price of a certain cryptocurrency changes by 90% in a short time period in either direction. High volatility could be perceived either as a risk or a great opportunity.

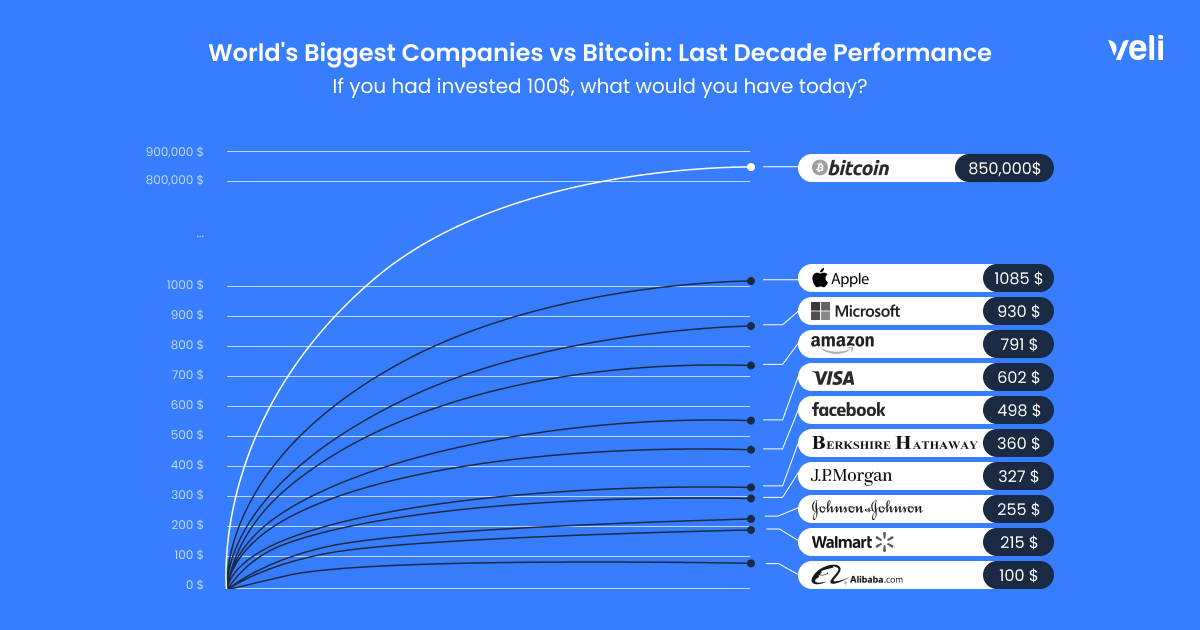

While we are on the topic of perception, having a short-term outlook on investing in crypto or any other asset, might lead to making impulsive decisions. On the other hand, having a long-term perspective would help us see the bigger picture. If we track the performance over the past decade, Bitcoin has in fact been the best-performing asset class. On the graph below, you can see how much you would earn if you had invested $100 in Bitcoin 10 years ago in comparison to investing in shares of the most popular companies on the stock market.

Investing $100 in Bitcoin ten years ago would result in a $850k gain. If you bought Apple’s shares, the second most profitable asset of the past decade, you would now have $1.085. That is why short-term volatility doesn’t have a great impact when you invest in high-quality assets which have solid fundamentals.

3. Lack of legal clarity

Many people do not know the legal status of cryptocurrencies or if they are legal to use at all. The truth is that crypto is still highly unregulated and laws about crypto are not fully defined yet. What is certain is that the acceptance of crypto is rising rapidly and the things that were unimaginable a few years ago are now happening. The same institutions that were once against crypto are now offering it to their clients.

Many countries are in the process of adopting laws on cryptocurrencies. El Salvador was the first country to declare Bitcoin an official means of payment. Many international companies also accept payments in crypto like Microsoft, PayPal, Starbucks, Tesla, etc. All of this suggests that crypto might be on the way to becoming a mainstream method of payment.

At the moment, however, cryptocurrencies are still a capital asset in most countries, which means that it is legal to invest and use them. It is important to mention that, as with any other capital asset, capital gains from cryptocurrencies are taxable. You should therefore check what are the tax regulations regarding crypto in your country or region and make informed decisions on where to invest. There are some countries that don’t tax crypto, like Portugal or Belarus

4. Not knowing in which cryptocurrency to invest

There are more than 21,000 different cryptocurrencies and new ones are being released almost every day. So how can you know which one to invest in? New products are coming and going in all industries and the same goes for the crypto industry. However, there are some proven assets and cryptocurrencies which have good fundamentals and which are therefore here to stay.

But how can you know which cryptocurrencies have good fundamentals? It’s a good idea to do some research before opting for a certain cryptocurrency. There are also some that have stood the test of time like Bitcoin or Ethereum. Investing in these proven assets is always safer, even when the whole market is shaken up.

Some good questions to ask while choosing which cryptocurrencies to invest in are: What is unique about this cryptocurrency? Which pain point does it aim to solve? What is the utility of that cryptocurrency? Who is the team behind it? Who else has invested in that cryptocurrency? After you have gathered all this information, it will be much easier to make an informed decision on which cryptocurrency to invest in.

If you don’t have the time to do thorough research, Veli has created a Coin Guide that analyzes the top 25 most established cryptocurrencies on the market. You can easily access and read it on our website.

5. Fear of being too late

We have already mentioned that many people made extraordinary returns by investing in crypto in the periods when the prices of crypto soared. Since the prices of major coins are now much higher than before, some people might think that the best time to invest in crypto is behind us.

One of the best things about crypto is that you don’t have to buy a whole coin. Instead, you can invest in a fraction of it for significantly less money. For example, one Bitcoin is currently trading at $22.7k , but you can easily invest as little as $100 or even $10.

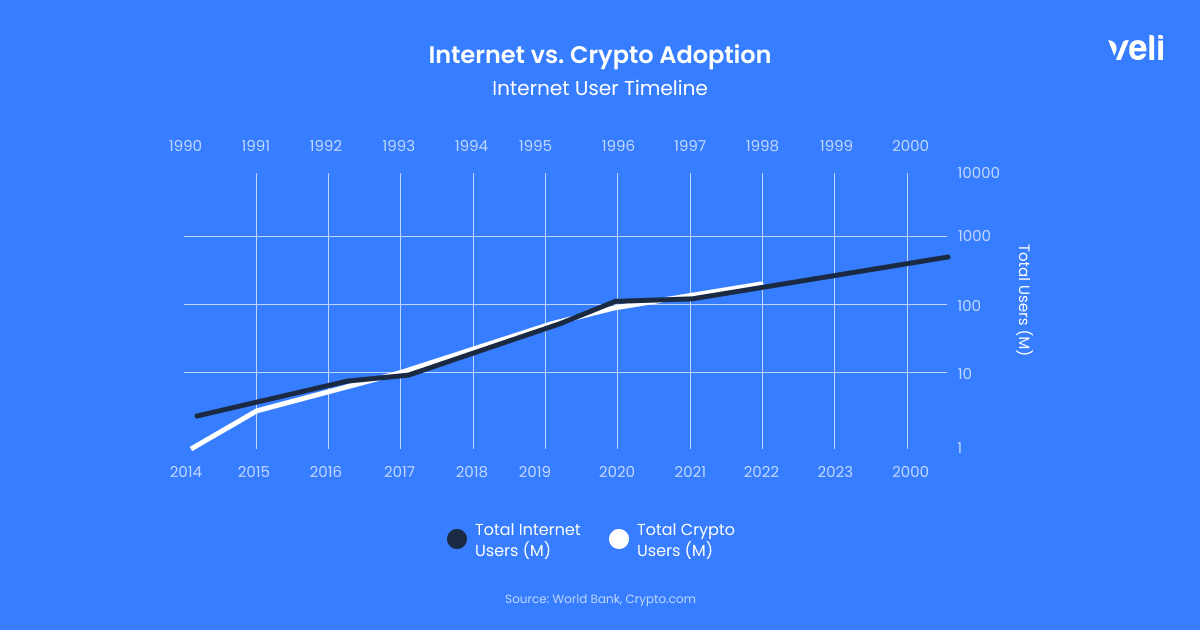

It might seem that the people who invested in crypto at the very beginning got lucky and that it’s not likely that the same scenario would repeat. However, the reality is that currently “only” 300 million people are investing in crypto today, which is less than 4% of the world population. In this sense, even if you started investing today, you would still be among the early majority. If we would compare the adoption of crypto with that of the Internet, we could see that we are still in the early stages.

Crypto is currently at the same point of adoption as the Internet in 1998, when it only had 300 million users. We consider that the Internet reached mass adoption in 2005 when it reached 1 billion users. Following the same curve, we could expect that crypto will reach 1b users by 2029, although the adoption rate for crypto is faster and crypto is projected to reach 1b users in 2025.

Why you shouldn’t hesitate

It always takes time for new revolutionary technologies to become widely accepted. On one hand, we are now at the stage when crypto has been around long enough for us to assume that it will be an important component of the future financial market. On the other hand, the crypto market is still at the early stage of development, so you can still enjoy the benefits of joining early.

The most successful investors have traditionally been people who own a lot of capital which they have used to create more wealth. Given the fact that the threshold for investing in crypto is usually much lower than for other major asset classes, it could be said that crypto is democratizing finances. Combined with the high returns, it is not difficult to imagine that someone who hasn’t been born rich can reach financial independence through smart investments.

The launch of our Veli crypto investment app is coming soon where we will offer personalized investment strategies which are created by the top experts in the industry. Join our waitlist and be among the first to get access to the Veli app which will help you make smart investments effortlessly.

Latest Articles

Veli Partners with DEC Institute to Equip Finance Professionals for the Future of Digital Assets

Veli Partners with DEC Institute to Equip Finance Professionals for the Future...

Veli Partners with EIMF to Bring MiCA and Compliance Education to Financial Advisors

Veli Partners with EIMF to Bring MiCA and Compliance Education to Financial...

Veli Partners with BCNL Foundation to Connect Financial Advisors with the Dutch Crypto Ecosystem

Veli Partners with BCNL Foundation to Connect Financial Advisors with the Dutch...